Ethereum, Sui, and Pepe Slide Toward Make-Or-Break Support as Bears Tighten Grip

Ethereum, Sui, and Pepe are at critical junctions as market dynamics shift and bearish forces tighten their grip. Ethereum’s plunge below key moving averages, Sui’s struggle to maintain resilience, and Pepe’s sharp reversal from its recent highs highlight a fragile state, leaving traders apprehensive. With each asset teetering on pivotal support levels, the looming question is whether buyers can muster a comeback or if further declines will ensue. Time to delve into the technical setups and assess the signals governing these moves.

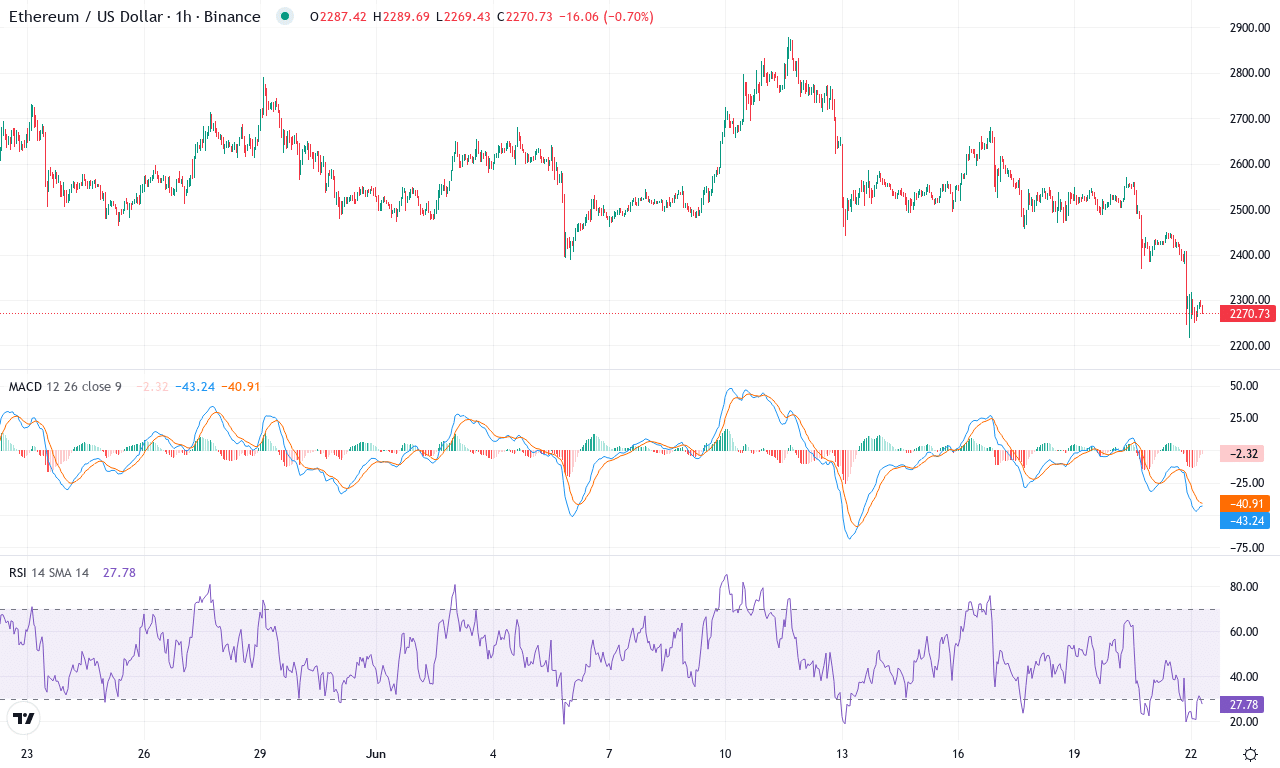

Ethereum (ETH) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | ETHEREUM(ETH) | $2272.80 | -10.25% | -14.68% | 35.2 | 17.0 | -30.20 | -201.09 |

|---|

After a bruising month that saw Ethereum tumble nearly 15% and break well below its 10- and 20-week moving averages, the second-largest crypto is nursing wounds near $2,270—uncomfortably close to its monthly low. Just a few weeks ago, bullish momentum had ETH pressing against major resistance above $2,800, but sellers have since flipped the script, pushing price action steadily into bearish territory. Six-month and yearly returns underscore the scale of this reversal, with Ethereum now down a staggering 33% from its local high and deep in negative territory for the trailing year. While crypto markets are no stranger to volatility, watching ETH slide through key support zones always triggers unease—especially when weekly performance shows another sharp dip. The technical outlook suggests that unless the bulls regroup quickly, ETH risks an extended fall, with little sign of institutional inflows or trader confidence at these levels.

Diving deeper into the chart, trend indicators reflect persistent bearish control: directional signals favor the sellers, and elevated ADX levels suggest this downtrend has teeth. Momentum oscillators—including MACD and Awesome Oscillator—continue to flash red, confirming acute downside pressure as recent histogram moves intensify. Crucially, ETH trades below all major short-term exponential averages, with the price languishing under the 50-, 100-, and even 200-day trends—never a comfortable setup for bulls. As for RSI, it’s falling into oversold territory, historically a precursor to potential relief rallies, but when both price and indicators align so firmly bearish, trying to “catch the knife” is always risky. Key psychological support hovers just above $2,200, and if bears break that barrier, a steep correction toward $1,900 could follow. On the flip side, any bounce-back will need to reclaim $2,500 to shift sentiment and target the next resistance near $2,800. Until the tide turns, my advice is to tread cautiously and respect the bears’ control—so you’re not in the red until you hit that sell button.

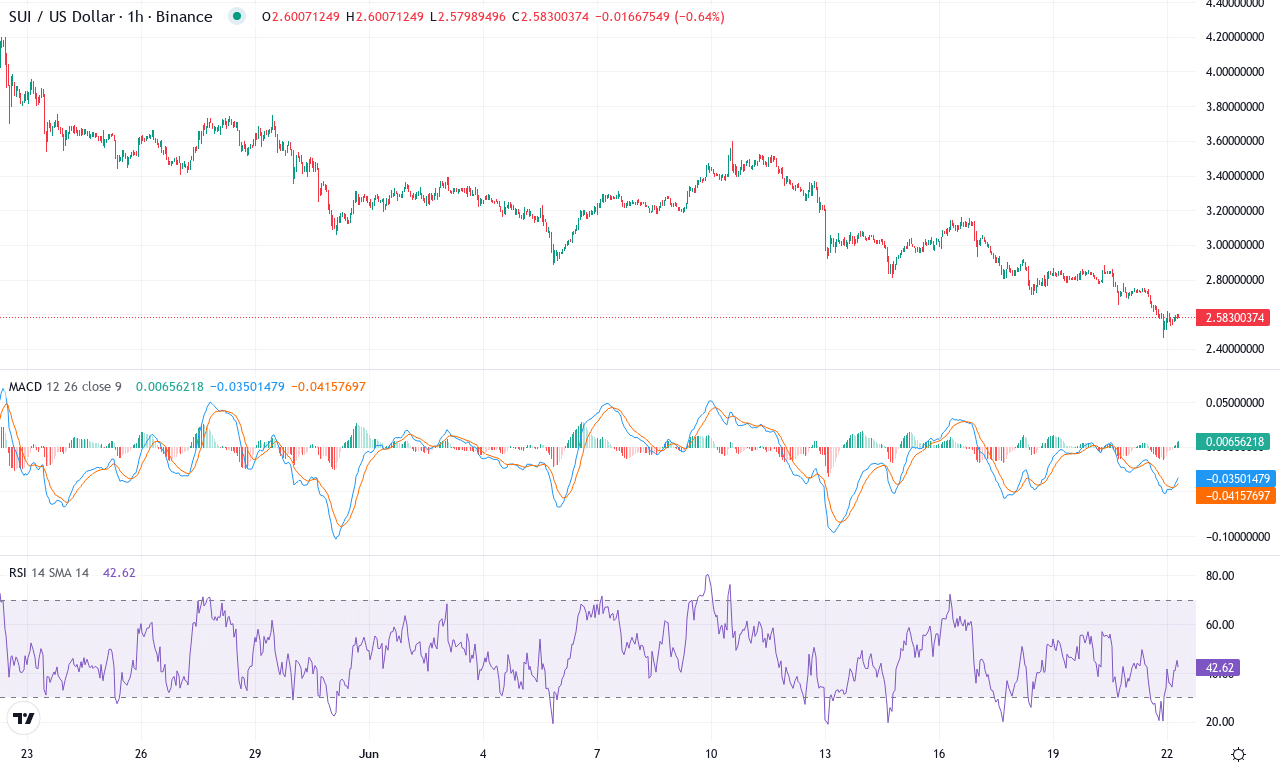

Sui (SUI) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | SUI(SUI) | $2.58 | -12.32% | -33.51% | 30.1 | 33.8 | -0.20 | -152.33 |

|---|

After a brutal month, Sui is staggering near the lower end of its recent range, notching a punishing 33% monthly decline. Bears seized control following a failed attempt to break past $3.75, hammering the price down to lows just above $2.45. Short-term sentiment remains battered, with a sharp 12% weekly tumble intensifying the sense of urgency among bulls. The broader performance context is a mixed bag: while the past three months saw double-digit gains, Sui remains vulnerable, shedding nearly half its value over six months. Traders may feel battered here, but that’s the nature of chasing these volatile layer-one plays—the fortunes can flip fast, especially when strong hands get tested near psychologically charged support.

Diving into the technicals, the trend indicators are showing a strong grip by sellers: the ADX reads robust trend strength, with bears firmly in command, and the weekly MACD just turned negative—a classic warning that downside momentum is swelling. Oscillators paint a similarly grim picture, with RSI slipping toward oversold territory and momentum oscillators flagging deep exhaustion. Price action is hovering below key short-term moving averages and sits precariously close to a major support band near $2.45; if this level gives way, risks extend toward a steep correction targeting the $2.00 round number. Yet, if buyers can stage a spirited defense and drive the price back above $3.00—a zone layered with moving average congestion and prior pivots—it could spark a reversal and squeeze short sellers, with upside targets back toward $3.53 and, with luck, a retest of $3.75. The next few sessions will be crucial; I’m watching for either a capitulation flush or a surprise comeback. Stay nimble—Sui’s volatility is unforgiving, but also ripe for those who can read the tape.

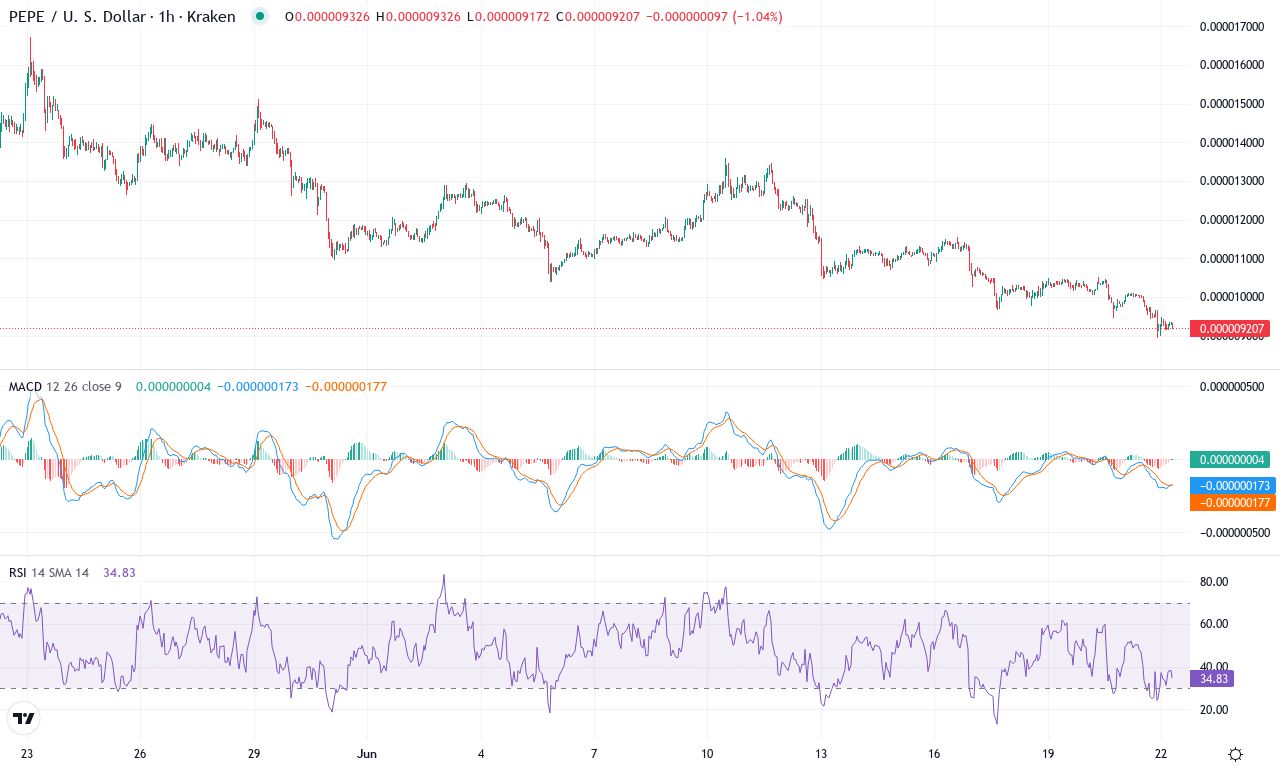

Pepe (PEPE) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | PEPE(PEPE) | $0.00 | -15.90% | -40.66% | 33.3 | 20.6 | 0.00 | -150.19 |

|---|

After a stunning early spring rally that saw Pepe log a monthly peak above $0.000015, the celebrated meme coin has capitulated sharply, dropping nearly 41% this month and closing precariously near $0.0000092—a level not seen in weeks. This punishing pullback has completely erased recent three-month gains and stoked fears of a steeper correction, especially as broader altcoin sentiment sours. While Pepe delivered a volatile but overall positive quarter, the sudden snap lower is shaking out weak hands. As a trader, I’ll admit: these deep dips can feel like a gut punch, but they also set the stage for outsized rebounds—if support holds. For now, the technical outlook suggests that sellers are firmly in control, with the coin continuing to probe the lower end of its recent range.

Diving into the technicals, trend indicators are flashing warnings: directional movement trackers show bearish momentum swelling, and the average directional index signals that this trend has teeth. The MACD is dipping further into the red, foreshadowing continued downside pressure, while most oscillators—including momentum gauges and the RSI—are softening, confirming vulnerability. Pepe is now pressing hard against the $0.0000090 support zone; if this psychological level cracks, risks extend dramatically, exposing the coin to a potential cascade down toward the next pivot near $0.0000072. On the flip side, only a convincing bounce back above $0.0000119—the historical midpoint of this month’s trading—would threaten to invalidate the bearish thesis and open the door to a relief rally. Until buyers regain initiative, I’d brace for more whipsaw volatility and keep stops tight; sometimes the best trade is simply staying nimble on the sidelines.

Is a Rebound in Sight?

Ethereum hovers near crucial support, while Sui faces mounting pressure at its current levels, and Pepe attempts to stabilize after recent losses. A break below these supports could usher in further declines, but a defense could trigger a recovery. Traders are closely watching for signs of renewed buyer interest, with upcoming sessions pivotal in determining direction.