Aave, Maker, OKB, and Monero Bulls Wrestle with Resistance as Breakout Tension Mounts

Aave, Maker, OKB, and Monero have each captured the spotlight with notable rallies, shaking loose from recent market lethargy. While Aave soared more than 47% in a flurry of bullish action, Maker snapped a 22% downslide with a robust 12% monthly gain. Yet, at critical resistance levels, these assets now face a pivotal crossroads that could dictate near-term direction. Is the rally poised to stretch further, or is a market cooldown lurking around the corner? Let’s take a closer look at the signals behind the move.

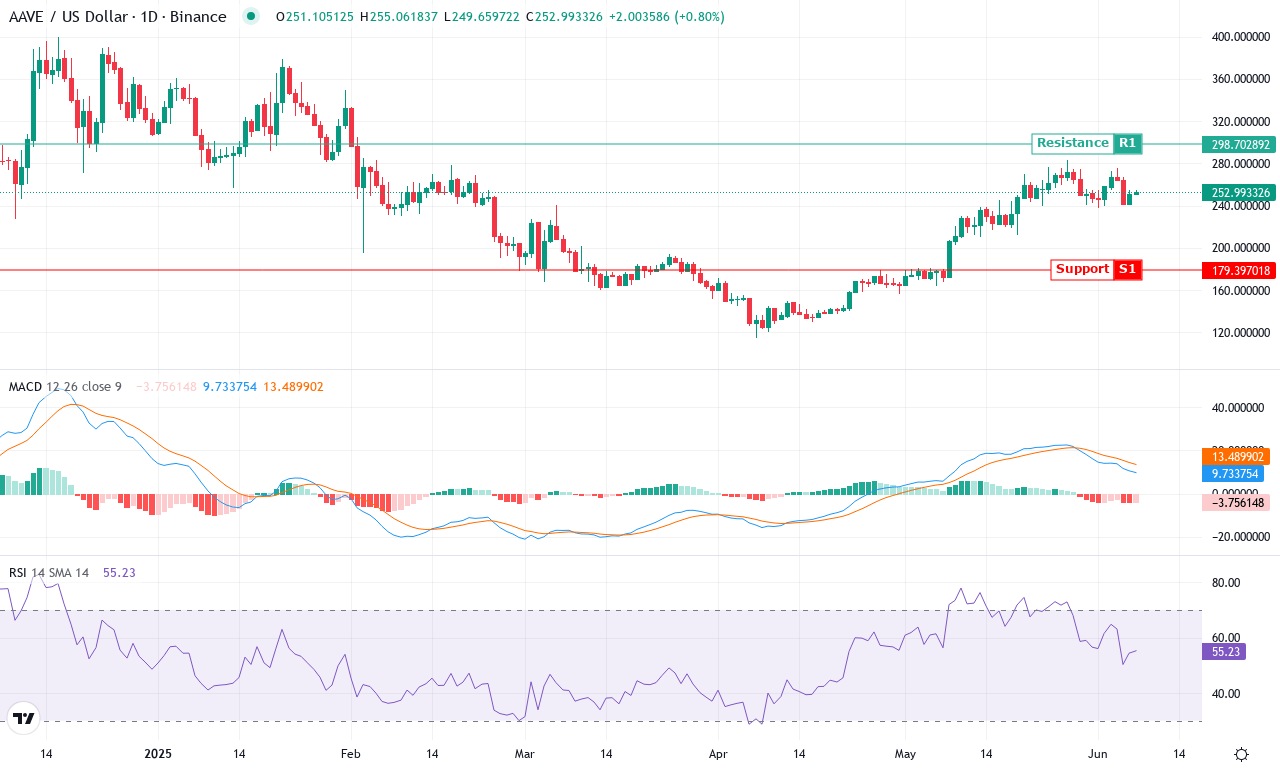

Aave (AAVE) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| AAVE (AAVE) | $253.63 | 0.84% | 47.21% | 55.5 | 28.2 | 9.81 | -30.42 |

After a torrid month in which Aave charged more than 47% higher and flirted with a multi-month high above $280, the DeFi lending pioneer is now grappling with consolidation near $254. That massive run was overdue after a difficult six-month stretch, and though bulls have every reason to celebrate, recent price action hints that the easy money might be off the table in the short term. Even as Aave outperformed most peers, hitting the top of its monthly range, cracks are emerging: weekly gains have slowed to under 1%, and altcoin momentum is ebbing as profit-taking sets in. With macro headwinds lingering across the broader crypto market and volatility pulsing, the technical outlook suggests Aave has entered a fork-in-the-road phase—neither outright exhaustion nor fresh breakout, but a moment where patience could pay for both determined bulls and lurking bears.

Diving into the chart, Aave’s trend indicators tell a story of strength but also caution. The ADX signals a robust and established uptrend, with positive directional movement firmly ahead of bears; however, the MACD—while still in bullish territory on the weekly—shows early signs of flattening, a classic precursor to momentum stalls. Oscillators including the RSI hover in the mid-50s, hinting that overbought fever has cooled somewhat, but buyers haven’t yet lost control. The price sits above all major moving averages, with the 10-day EMA near $254 and longer-term averages stacked well below, reinforcing ongoing bullish structure. Key psychological support remains at $230–$226, while resistance looms at the recent $283 high—if buyers ignite fresh momentum above this level, a breakout surge toward $300 or even $350 (major pivot) isn’t out of the question. On the flipside, a drop below $226 risks an extended fall back to the $200 zone, especially if bearish reversal signals gain traction. I’m watching closely—if bulls seize $283, the chase could resume, but discipline is key after such a vertical rally.

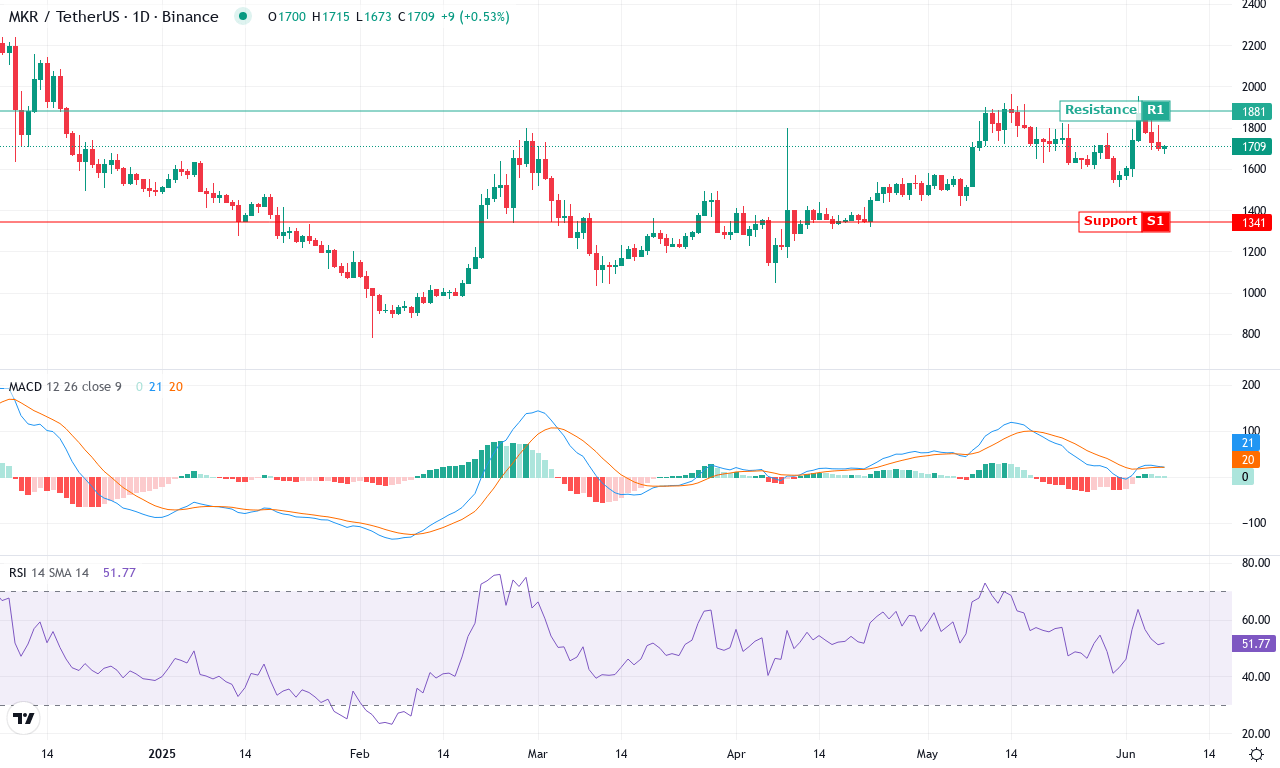

Maker (MKR) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| MAKER (MKR) | $1701.00 | 9.81% | 12.28% | 51.2 | 20.6 | 20.23 | 0.36 |

After weeks of turbulent swings, Maker (MKR) has surged back into the limelight, notching a robust 12% gain this month and breaking out of the doldrums that dogged its six-month decline. The coin rallied from a monthly low near $1,511 to tap a high at $1,962, before closing out the week at $1,701—a move that hints at newfound bullish momentum. While the broader DeFi narrative remains volatile, Maker’s sharp recovery over the past month stands in stark contrast to its bruising 22% six-month slide and a sobering 35% decline year-on-year. For those who weathered the storm, this bounce feels like relief—and maybe even a whiff of hope that a deeper turnaround is brewing.

Diving into the technicals, trend indicators are showing renewed conviction: the average directional index points to strong trend strength, while positive directional movement remains firmly above its bearish counterpart. The MACD is accelerating on both daily and weekly timeframes, signaling that momentum is shifting in favor of the bulls. Meanwhile, oscillators like the RSI hover in the low-50s—still far from overbought territory—suggesting there’s room to run before conditions become stretched. Maker is back above short- and medium-term moving averages, reinforcing the case for continued upside, but faces stiff resistance around the $1,880–$1,960 zone. If bulls can clear that ceiling, the next target lies near the psychological $2,200 level, as outlined by classic pivot analysis. On the flip side, a loss of momentum could see Maker retest support at $1,650 or even slide toward $1,540 if broader profit-taking sets in. For now, technical outlook suggests breakout momentum is building, but as always—keep an eye out for sudden reversals, especially in this market.

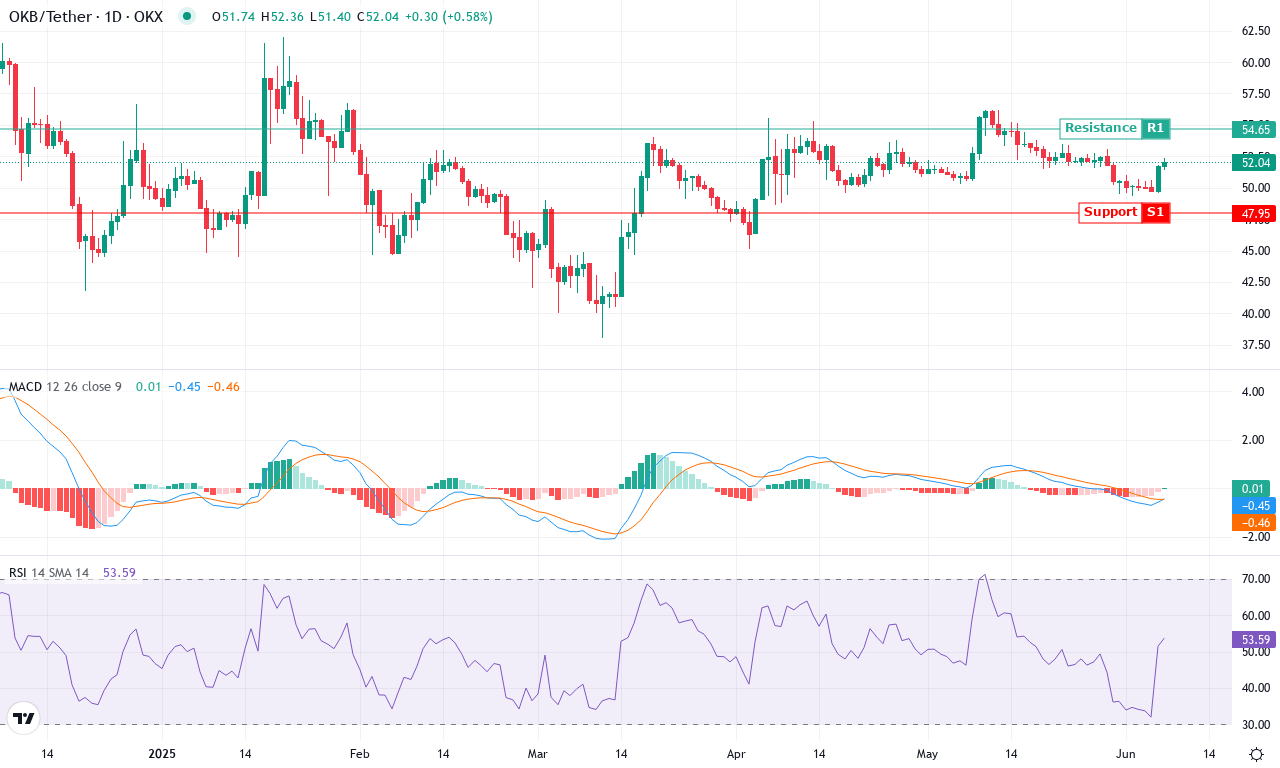

OKB (OKB) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| OKB (OKB) | $52.05 | 3.09% | 2.54% | 53.7 | 13.8 | -0.45 | 30.40 |

After a volatile few weeks, OKB is beginning to flex its strength, brushing aside recent weakness with a decisive upward push. The token managed a solid 3% gain over the past week and is now trading at $52.05—comfortably above its monthly low. This rebound comes hot on the heels of a nearly 13% six-month slide, making the latest rally feel like a fresh breath of bullish momentum. The technical backdrop has improved markedly: trend indicators, particularly the ADX, are registering strong trend strength, suggesting that OKB’s directional bias is turning positive again. While longer-term investors may still feel the sting of the recent pullback, the rapid turnaround at the $49.34 support level signals that buyers aren’t ready to give up yet.

Diving deeper into the charts, momentum oscillators are catching a bid, with the weekly MACD ticking higher and the Awesome Oscillator swinging back into bullish territory. The RSI hovers solidly in the mid-50s and refuses to show any overbought alarms, hinting that this uptrend could have room to run. OKB has also reclaimed and held above key moving averages, including the 10-day EMA, which is now providing a bullish tailwind near current price levels. Short-term resistance looms at the $56 zone—the month’s high and a psychologically significant barrier. If buyers can break through this ceiling, the next technical target lies near $58.80, just shy of the pivot R2. On the other hand, failure to sustain momentum could see the price tumble back to key support around $51 or, in a more severe scenario, a retest of $49. I’ll be watching closely—this pivot could define OKB’s next big move.

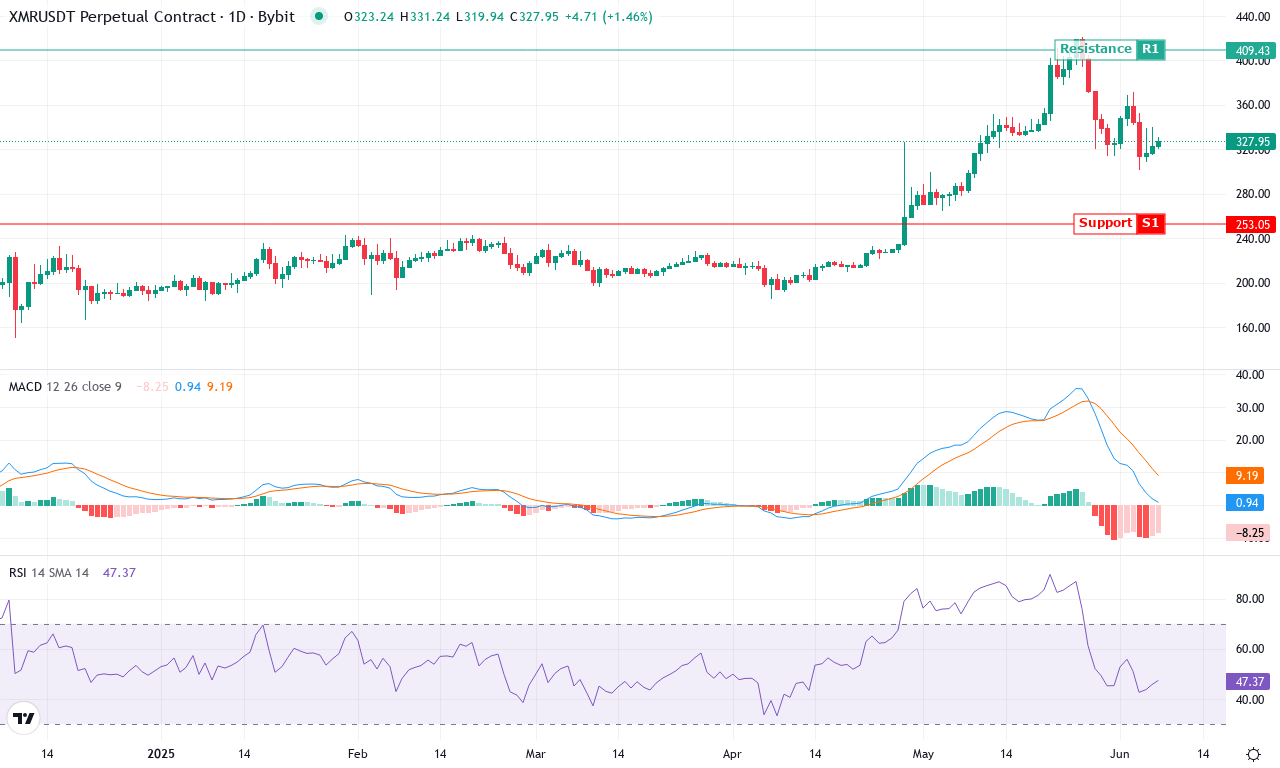

Monero (XMR) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| MONERO (XMR) | $330.08 | 1.49% | 16.57% | 48.1 | 34.6 | 1.10 | -75.63 |

After an explosive month that saw Monero surge over 16%, traders can’t ignore the renewed vigor in this privacy coin. The technical outlook suggests bullish momentum is back in the driver’s seat, fueled by a robust 3-month performance near 50% and an eye-catching yearly gain just north of 100%. The latest week was tame by comparison, with XMR essentially flat—perhaps a sign of well-deserved consolidation after a brisk climb from last month’s lows around $295 to a recent high of $421. As price now hovers near $330—comfortably above all short-term moving averages—the broader trend appears intact, and those banking on privacy narratives may get another shot at upside if sentiment holds. Personally, with legacy privacy coins stirring, I’m always on alert for abrupt volatility spikes; XMR is notorious for catching both longs and shorts off-guard.

Diving into Monero’s technicals, the blend of trend and momentum signals is hard to ignore. Trend indicators still point higher: the ADX sits at healthy levels, with the key directional lines tilted favorably—positive momentum is outweighing any hint of bearish reversal. The MACD, meanwhile, shows the weekly line surging well above its signal, confirming long-term buyers still have control. Oscillators echo this view; while the RSI is elevated, it hasn’t breached classic overbought thresholds, leaving room for further gains before profit-taking erupts. Currently, XMR is trading above its critical support at $315, with the next big resistance looming near the $410–420 zone—a psychological and technical ceiling tested several times this year. If bulls manage to crack that level with volume, a run at the $490 pivot isn’t out of the question; but should sentiment sour, traders should eye the $280–290 support band, which previously acted as a launchpad for the recent leg up. As always, be nimble around inflection points—Monero’s next act could come with little warning.

Will Resistance Break or Hold?

Aave has met strong resistance after its impressive 47% climb, and Maker hovers near its critical levels following a 12% gain. OKB shows signs of fatigue, and Monero approaches a key barrier. If these coins breach their respective resistances, the rally could extend, but any failure to do so may signal consolidation or retracement. Traders should watch for volume and momentum shifts to gauge the next move.