TAO And MKR Coil At Pivotal Levels As Bulls And Bears Brace For An Explosive Break

After a remarkable period of volatility, both Bittensor (TAO) and Maker (MKR) are coiling around pivotal levels, setting the stage for an explosive move. TAO’s quarterly performance remains an impressive 78% gain, but the recent monthly drop of 6.8% has traders braced for a critical market shift as it hovers around $401. Meanwhile, MKR has enjoyed a 62% surge over the past three months, stabilizing at $1,814 amidst volatile trading patterns. With both assets poised at technical crossroads, will this lead to breakout rallies or steep corrections? Let’s dive into the technical signals to see where the momentum could swing next.

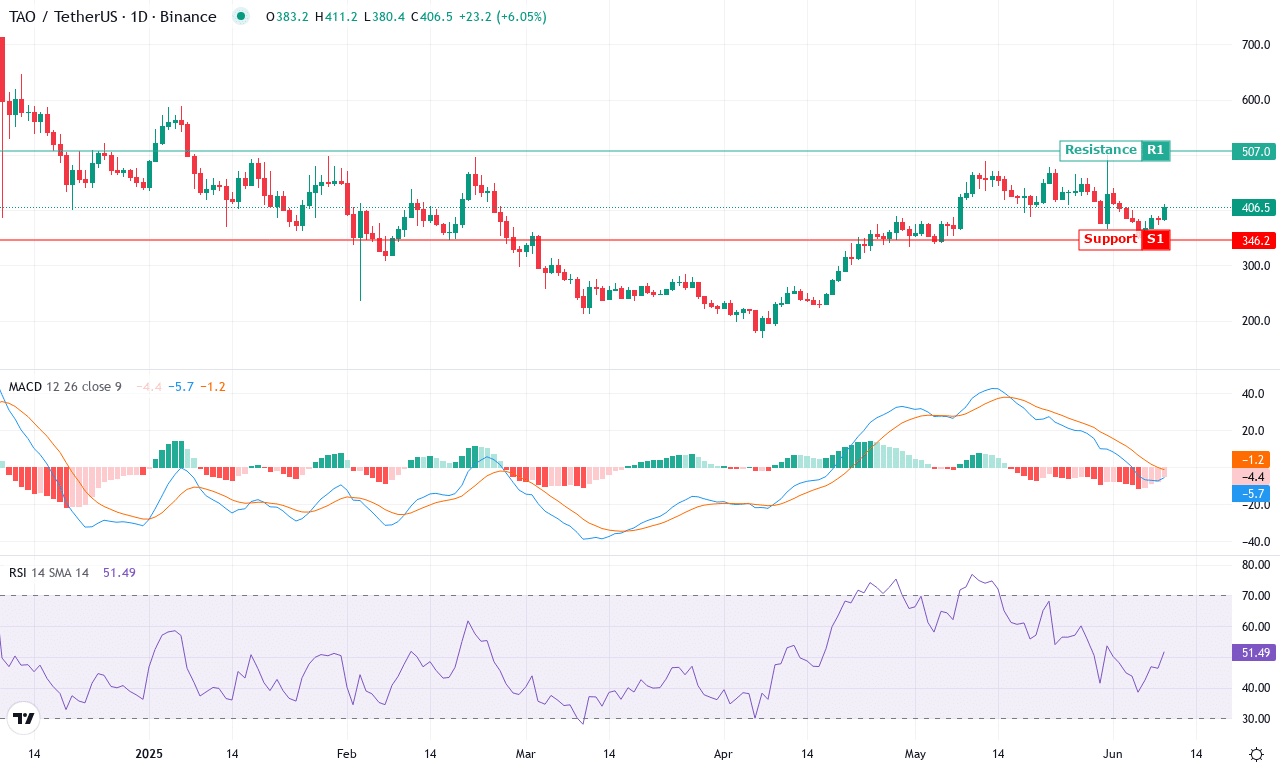

Bittensor (TAO) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| BITTENSOR (TAO) | $401.30 | -3.02% | -6.78% | 50.4 | 17.1 | -6.10 | -46.81 |

After a period of remarkable volatility, Bittensor (TAO) is testing traders’ resolve. Following a sharp 6.8% retreat over the last month—punctuated by a high at $500 and a swing low to $347—TAO sits at $401, virtually flat for the week and compressing within an increasingly tense range. Despite the recent pullback, the quarterly performance remains a staggering 78% in the green, a testament to persistent institutional interest and periodic speculative fervor. This month’s whipsaw trading has created a situation where both bulls and bears remain on edge, awaiting a decisive move that could set the tone for TAO’s next directional surge. With price currently orbiting key technical territory, the stage is set for either a volatility surge or an unsettling bout of drift—my gut says the next play will be big.

Technically, TAO’s backdrop is fascinating and fraught with crosscurrents. Trend indicators, led by a robust Average Directional Index reading, confirm that the asset still sits within a strong long-term trend—yet the positive trend differential is narrowing as oscillators flash mixed signals. Weekly MACD readings show loss of upside acceleration, and a falling Awesome Oscillator suggests waning bullish momentum. Momentum indicators hint at buyer exhaustion, while the RSI hovers in the low 50s—neither overbought nor oversold, but far from the euphoria that usually triggers a steep correction. Crucially, TAO is sandwiched between the 50- and 200-day moving averages, showing a technical standoff right near the $400 psychological level and the all-important pivot at $423. If bulls reclaim the $423 resistance zone, the path to $507 and even $583 opens quickly; but if sellers seize momentum, eyes should shift to support near $346—and risks of an extended fall toward $262 intensify. I’ll be watching for a breakout candle with heavy volume before acting; until then, patience and tight stops are my watchwords.

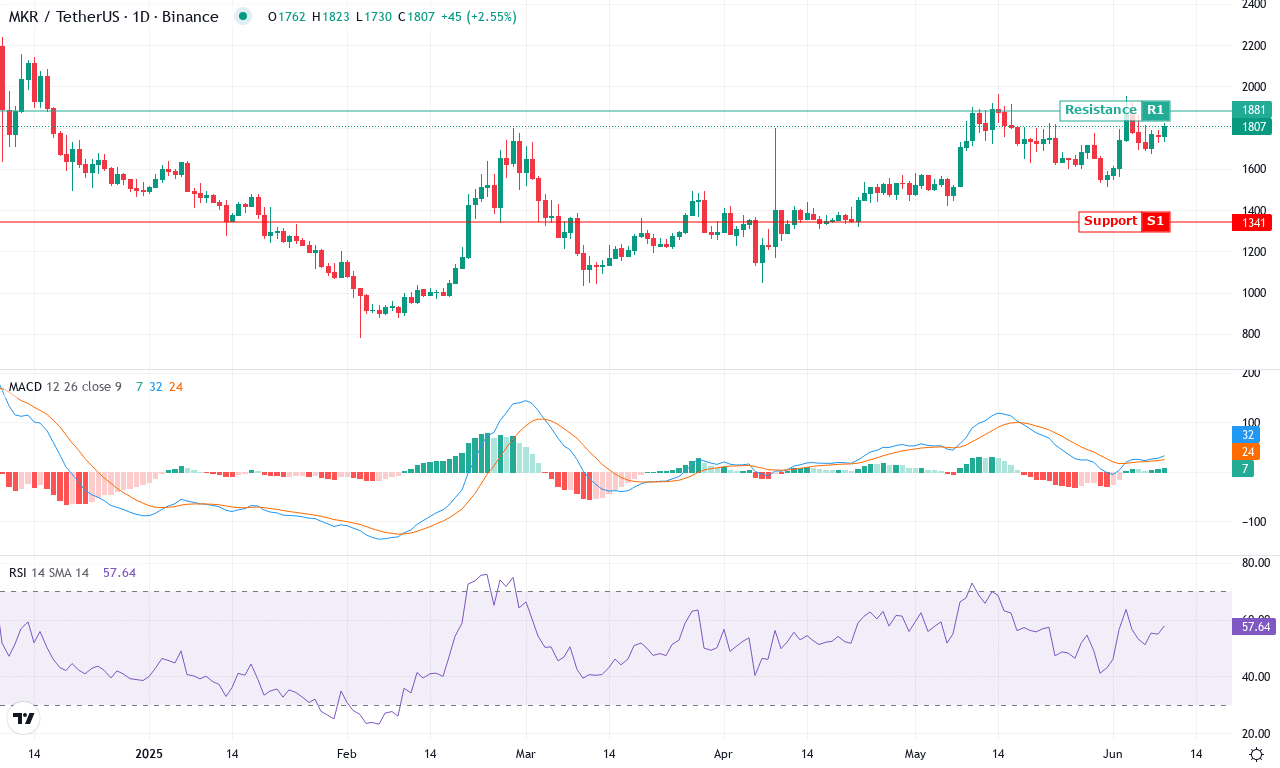

Maker (MKR) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| MAKER (MKR) | $1814.00 | 13.09% | 4.37% | 58.1 | 20.8 | 32.49 | 87.31 |

Maker (MKR) has delivered a robust performance lately, surging over 62% across the past three months and eking out another 4.4% gain over the last month. After a period of pronounced volatility marked by a recent monthly high near $1,962 and a dip to $1,511, the token has stabilized around $1,814. This rebound occurs even as the broader market wavers, hinting at underlying resilience—perhaps a result of renewed institutional inflows or speculative momentum. With trend indicators heating up, volatility surging, and the year-to-date picture still deep in the red, Maker looks poised at a technical crossroads. Traders should pay close attention as the current setup could lead to either a breakout rally or sharp mean reversion; frankly, I’m on the edge of my seat here.

Drilling into the technical outlook, trend strength is formidable—trend indicators remain elevated, and the MACD shows strong upward acceleration, suggesting bulls are regaining control. The weekly momentum supports this view, with oscillators highlighting positive divergences across the RSI, Stochastics, and the Awesome Oscillator. Maker’s price is pushing well above its key exponential moving averages, reinforcing the bullish momentum, though the RSI hovers just below overbought territory—so do watch for a profit-taking surge. Immediate resistance is clustered near $1,962; if buyers can clear that level decisively, a rally toward the next major psychological zone above $2,000 isn’t out of the question. Alternatively, a failure to push higher—especially if bears step in near $1,900—risks an extended fall back toward strong support at $1,650. For now, MKR’s momentum and technicals tip the scales upward, but volatility levels warn: stay nimble, or risk getting caught in a steep correction.

Watching for Breakouts or Corrections

TAO is encircling the $401 level, indicating potential for a decisive move if buyers return or bears take over. MKR remains stable near $1,814, suggesting a tight battle between bulls and bears that could tip the scale quickly. Both coins are at a crossroads where either breakout rallies or corrections are possible, with traders closely analyzing volume and momentum for clues on the next big move.