DEXE And OFFICIAL TRUMP Face Escalating Sell Pressure As Bulls Scramble To Defend Make-Or-Break Support Levels

After a brutal month, DEXE and OFFICIAL TRUMP tokens are in a precarious position, both facing pressure to defend crucial support levels. DEXE’s staggering -38% drawdown from recent highs places it near make-or-break points, with bearish momentum intensifying. Meanwhile, OFFICIAL TRUMP’s momentum, following a meteoric six-month rise, has sharply reversed, slicing through support levels and presenting a critical test at $10.50. Will the bulls muster a defense, or is further downside inevitable? Let’s take a closer look at the signals behind the move.

DeXe (DEXE) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| DEXE (DEXE) | $8.90 | -37.45% | -38.62% | 31.4 | 30.9 | -0.99 | -115.54 |

After a brutal month marked by a staggering -38% drawdown and a sharp -37% weekly drop, DeXe (DEXE) is in the spotlight for all the wrong reasons. The token has collapsed from its recent high above $15 to close near $8.90, erasing nearly half its value in three months—a steeper correction than most of its peers. The broader six-month performance remains less dire, hinting that long-term holders are sitting on more moderate losses, but the technical outlook suggests headwinds are mounting. With the price teetering precariously above April’s lows and now scraping the lower end of its monthly range, the pressure is unmistakable—sellers are getting emboldened, and the threat of forced liquidations or capitulation lingers.

Diving deeper, trend indicators reflect a market in distress: a high ADX reading underscores strong bearish momentum, with negative directional signals overwhelming any glimmer of a bullish response. The weekly MACD has deepened into negative territory again, while oscillators and momentum gauges show persistent downside traction. DeXe is now pinned below its 10- to 200-day exponential moving averages, notably failing to find support at its $12–$13 zone—now a significant barrier for any relief rally. Bulls need to reclaim at least the $13.70 pivot to slow the bleeding, but resistance looms at $15 and $17.60. If sellers press the advantage and $8.30 cracks, risks extend toward the pivotal $6 level, where the market could see panic-driven volatility surge. As a trader, these moments are nerve-racking—remember: you’re not really in the red until you sell, but discipline is critical. Any close above $13 could invalidate the immediate bearish thesis, but unless momentum flips, skepticism remains warranted.

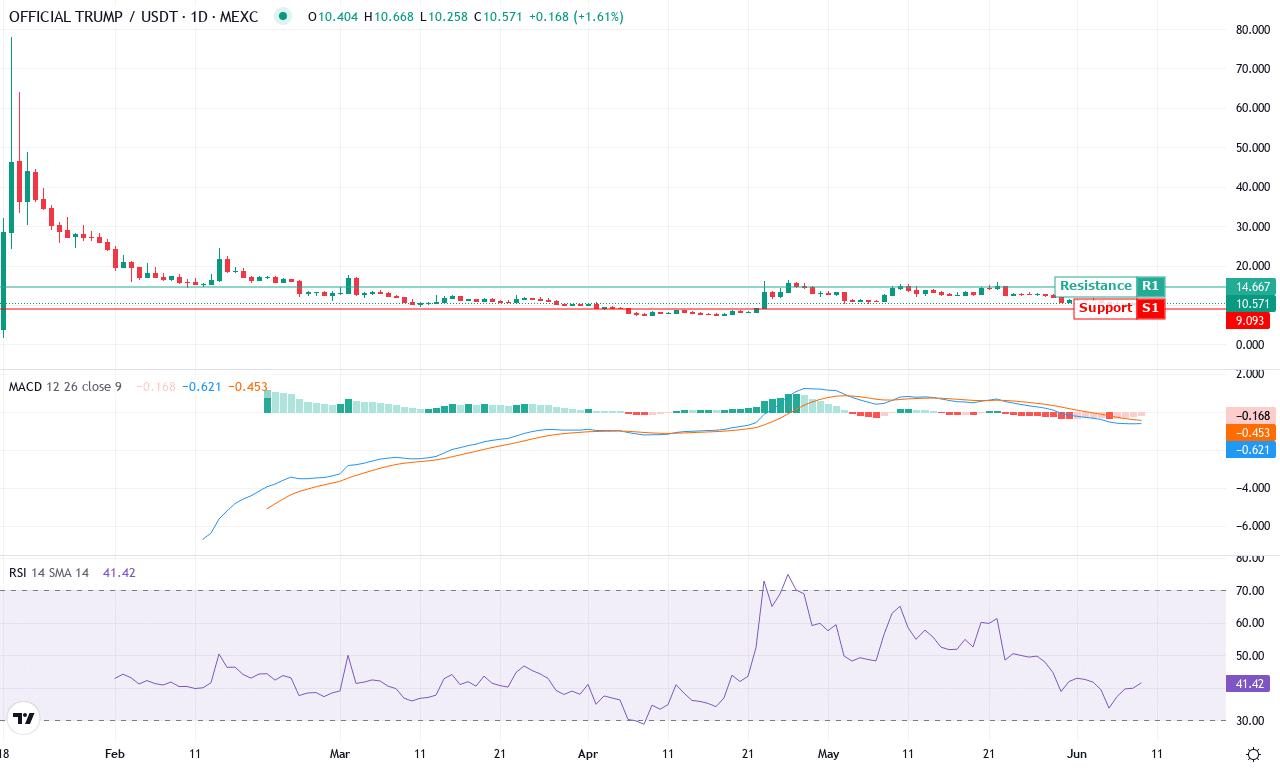

OFFICIAL TRUMP (TRUMP) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| OFFICIAL TRUMP (TRUMP) | $10.55 | -7.35% | -26.07% | 41.2 | 20.2 | -0.62 | -78.20 |

After a blistering six-month rally that saw OFFICIAL TRUMP soar over 175%, the token is now grappling with a dramatic shift in momentum. The last month delivered a sharp -26% correction, slicing through recent support buffers and leaving traders wondering if euphoria has finally given way to exhaustion. This week’s continued 7% slide underscores mounting bearish pressure, as buyers retreat and sellers rush to lock in profits. With price consolidating near $10.50—well off recent monthly highs—the technical outlook suggests OFFICIAL TRUMP is teetering near a critical juncture. I’ll admit, I’m watching this level with trepidation; too much further weakness and those gains could unravel fast.

Digging deeper into the chart, trend indicators confirm a loss of bullish momentum. While the ADX still points to a strong trend environment, the growing gap between positive and negative DI lines signals that sellers now have the upper hand. Momentum oscillators are rolling over—RSI has cooled to the low 40s, drifting far from recent overbought zones, and the MACD line runs beneath its signal, hinting at the risk of a further slide. The token is now trading below its short- and medium-term moving averages, which often precedes deeper corrections, and price action is clustered uncomfortably close to support in the $10–$12 zone; if that breaks, eyes will turn to psychological support at $9. If bulls manage to reclaim and close above $15, we could see a fresh wave of buying—otherwise, risks of an extended fall remain real. For now, savvy traders should stay nimble and keep stops tight; volatility is likely far from over for OFFICIAL TRUMP.

Can Bulls Stabilize the Sell-Off?

DEXE hovers precariously above critical support, after a significant downturn, as bearish sentiment grows. OFFICIAL TRUMP faces a vital test at $10.50, amid a sharp reversal from its recent highs. For both tokens, maintaining these levels is crucial for bulls aiming to prevent further losses; upcoming sessions will determine if they can anchor their defenses and initiate a recovery.