Gnosis Bears Tighten Grip As GNO Teeters Near Major Breakdown Zones

Gnosis (GNO) has faced persistent bearish pressure, retreating from its recent high amidst a broader downtrend. As it hovers around $120 with key moving averages overhead, the question for traders becomes critical: Can this support hold, or are deeper levels imminent? The technical landscape is littered with mixed signals, teasing potential upside if bulls can muster a turnaround. Let’s take a closer look at the signals behind the move.

Gnosis (GNO) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| GNOSIS (GNO) | $120.44 | -7.96% | -8.70% | 40.7 | 19.7 | -1.68 | -158.39 |

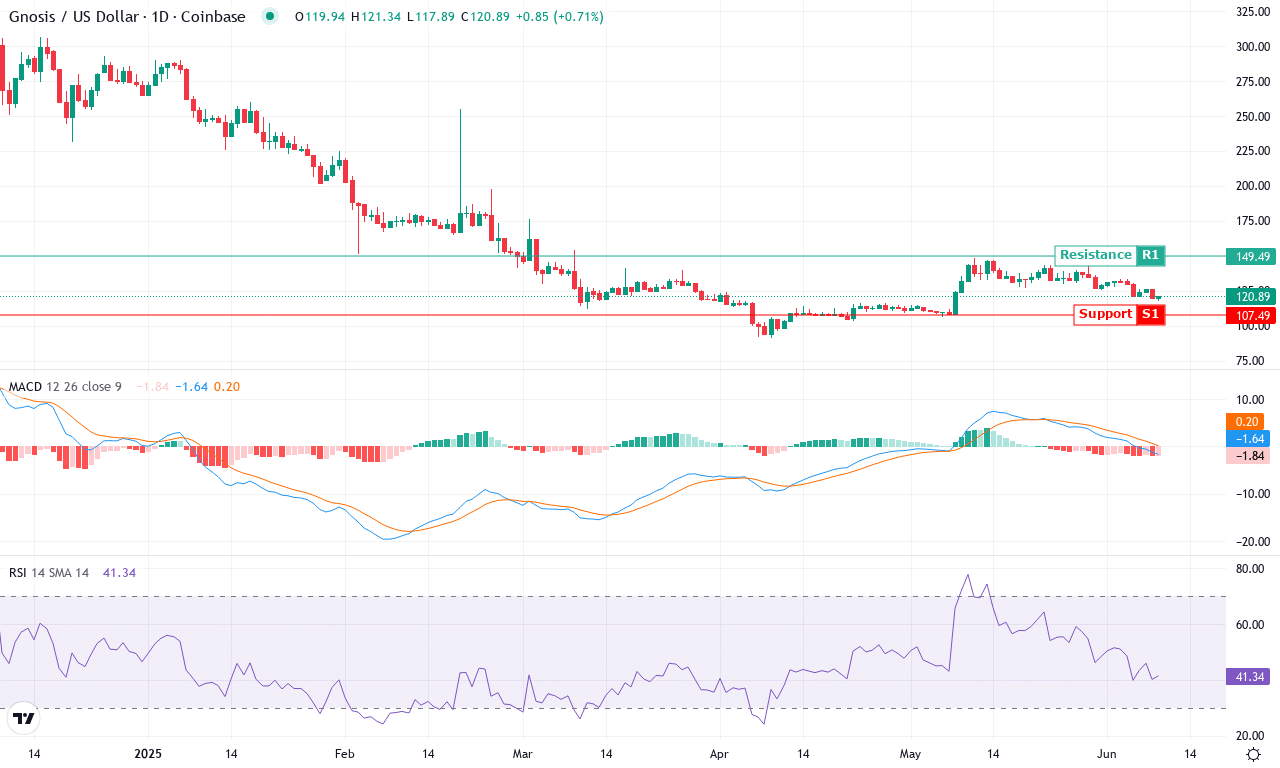

After a month marred by bearish sentiment, Gnosis (GNO) finds itself recoiling from a monthly high of $148.45 to close at $120.44—an 8.7% retreat for the month. This turbulence comes on the back of a sharp six-month downtrend, with GNO plunging over 53%—a sobering reminder of how volatility can swiftly erase prior gains. While short-term traders hoped for a bounce after the latest 2.5% three-month uptick, recent price action smacks of disappointment, as Gnosis failed to sustain momentum and remains anchored below several key resistance thresholds. If you’re like me, watching this kind of persistent seller control stirs unease—especially with GNO hovering so far beneath its yearly averages, hinting that the bears are still steering.

Technically, the outlook suggests downside risks persist unless bulls can reclaim lost ground. Trend indicators paint a cautious picture: the ADX signals strong directional movement, but with negative directional lines overpowering the positive, the path of least resistance leans downward. The weekly MACD continues to print deep in bearish territory, reinforcing ongoing momentum decay—a classic prelude to further correction. Oscillators press the case for caution, showing negative momentum and a relative strength index that, while not oversold, reflects mounting exhaustion. The price now sits beneath its major moving averages, amplifying the threat of a steep correction if the $120 support buckles. Immediate resistance looms near $128 and $149, with a psychological wall waiting at $150. Should Gnosis break below last month’s low at $117.89, risks extend toward the $107 and even $86 support zones. Until buyers flip the narrative with a decisive breakout, the technical picture warns: stay nimble, guard your capital, and watch for signals of a bullish reversal—because in this market, you’re never out until you capitulate.

Will $120 Be the Decisive Pivot?

Gnosis sits precariously near the $120 support level, struggling to break through overhead moving averages. Although bears have dominated recently, a hold above $120 could offer bulls a chance to reclaim control. Traders should watch for either sustained support or a breach below that signals a deeper retreat; the next sessions are crucial for direction clarity.