Solana Litecoin and Monero Teeter as Bulls Plot Comeback or Capitulation Move

Solana, Litecoin, and Monero are caught in a delicate dance with critical market levels after a volatile month riddled with price corrections. The question now is simple yet profound: will bulls seize the reins to vault these cryptos past pressing resistance, or is a deeper dive imminent? With Solana hovering near the pivotal $150 mark, Litecoin grappling with stubborn lows, and Monero retracing after an exuberant rally, the technical crossroads is here. Let’s break down the signals behind the move to uncover what lies ahead.

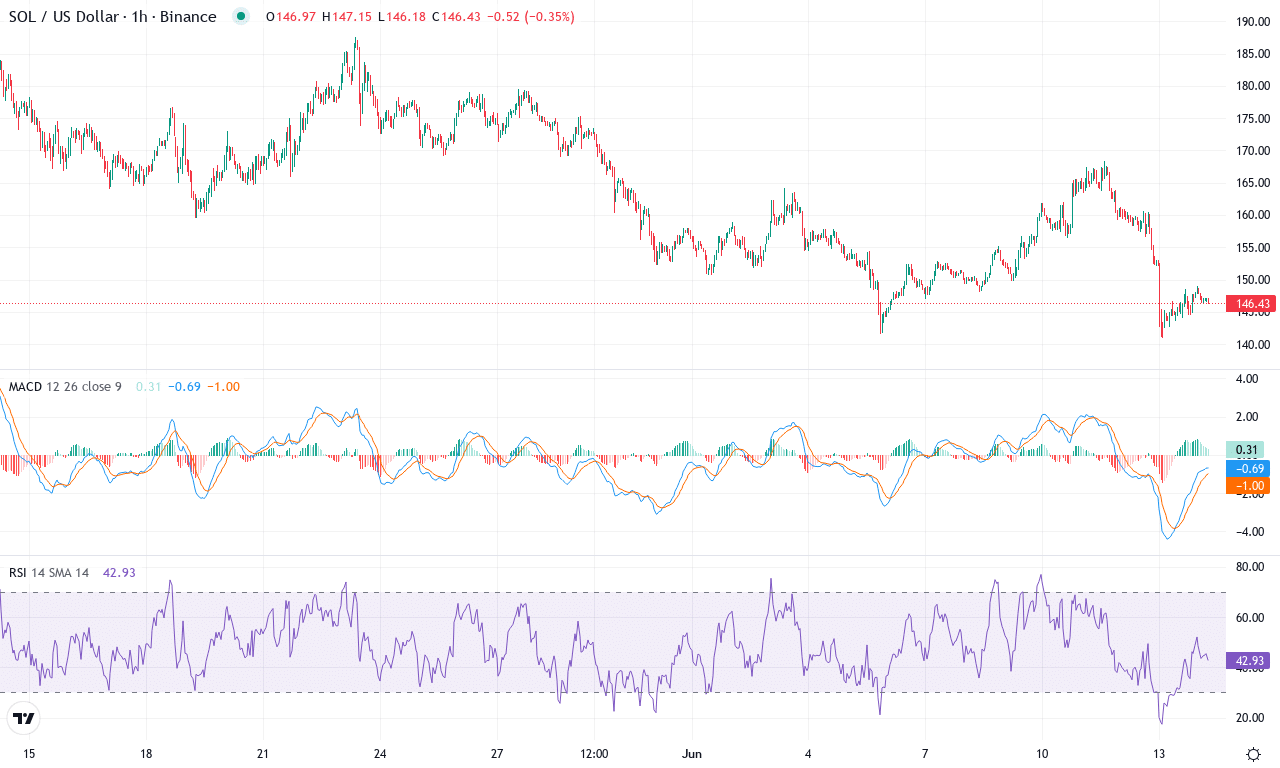

Solana (SOL) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | SOLANA(SOL) | $146.95 | -0.67% | -16.84% | 39.7 | 18.9 | -3.10 | -99.92 |

|---|

After a month marked by a sharp 16% correction and heavy volatility, Solana is battling to claw back lost ground, trading just below $147 after sliding from a monthly high near $188. The mood across the Solana market has shifted; bullish conviction is on the ropes following six months of choppy, negative price action. Despite a slight 1-week dip, Solana remains a favorite among altcoin traders for its historical resilience and explosive upside—as long as it can regain technical footing. With current trading clustering near the psychological $150 level and momentum indicators stuck in the red, the stakes couldn’t be higher: a decisive reversal here could revive Solana’s reputation as a comeback king, but another slip spells extended pain. Like many watching this chart, I’m eyeing these inflection points with both excitement and a tinge of worry—Solana’s next move will be telling.

The technical outlook suggests bears are pushing their advantage: trend indicators reflect a clear loss of bullish momentum, and momentum oscillators are mired in negative territory. The MACD line remains underwater with histograms showing little sign of reversal energy—typically, a MACD crossover would signal the kind of turnaround bulls are craving, but for now, buyers seem hesitant. Solana is perched below all key moving averages—from the 10-day up to the 200-day—reinforcing a picture of sustained weakness, while the ADX hovers at elevated levels, confirming that recent downside had real conviction behind it. Immediate resistance lies at $162—a break above could unleash breakout momentum up toward the $182–$188 range, where substantial overhead supply waits. If sellers maintain control, however, support clusters near $137, with a further slide risking a steeper correction into the low $120s. For now, price action analysis points to a market at a crossroads: all eyes on whether fresh institutional inflows or a profit-taking surge decide Solana’s fate in the weeks ahead.

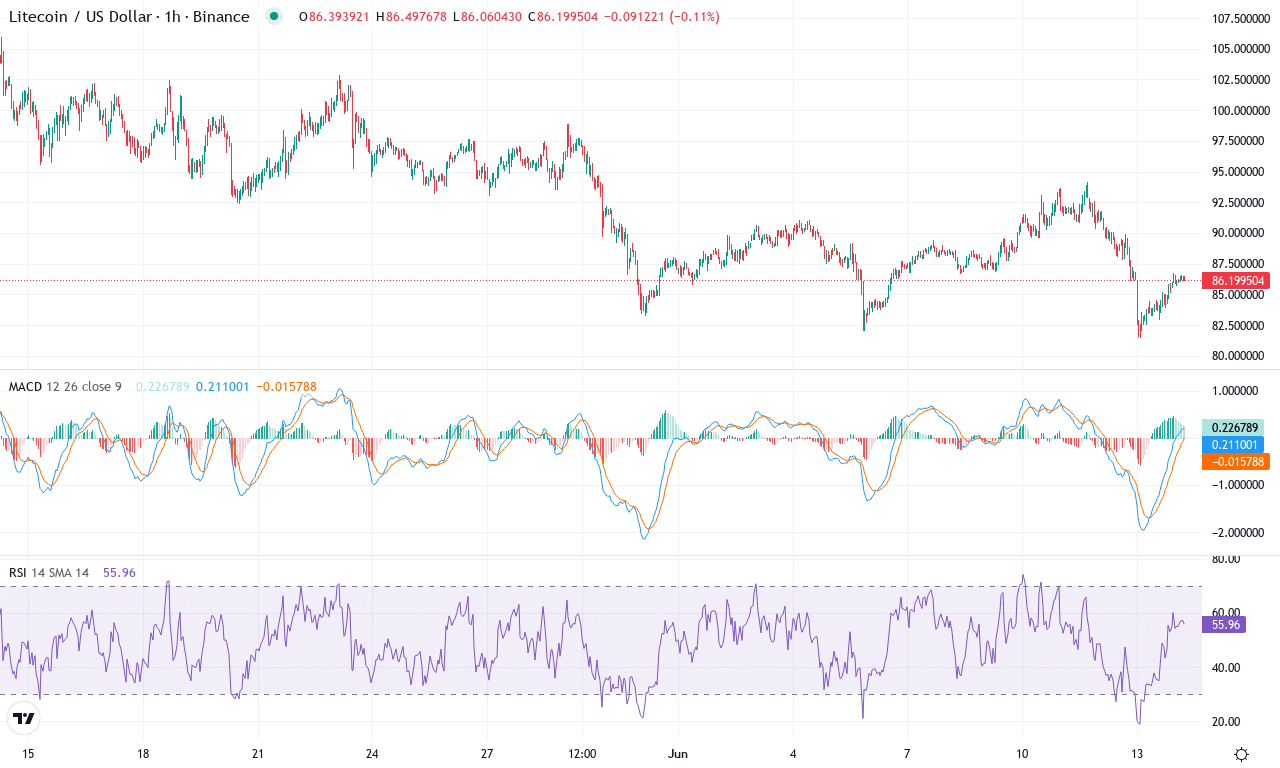

Litecoin (LTC) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | LITECOIN(LTC) | $86.41 | -1.01% | -14.34% | 43.3 | 18.9 | -1.43 | -77.02 |

|---|

After tumbling out of a multi-week sideways range, Litecoin is currently licking its wounds near $86 following a bruising monthly drop of over 14%. The coin has shed almost 30% over the past six months, dramatically underperforming peers and giving traders a rough ride. That persistent undercurrent of bearish momentum continues to weigh on the technical outlook, especially with price unable to reclaim critical moving averages and now resting near the lower quartile of its recent trading channel. I’ll admit, it feels like the market is daring traders to catch the proverbial falling knife here—but milder velocity on recent declines may soon set the stage for a volatile reversal, should bulls muster the nerve.

Technically, trend indicators paint a cautious picture: the backbone trend signal is still pointed lower, with momentum oscillators carving out negative territory and the MACD line stubbornly beneath its signal. That’s textbook bearish for now. Meanwhile, RSI is drifting around the mid-40s, neither oversold nor primed for a breakout—suggesting directionless churn is brewing underneath. Litecoin is currently wedged under all major exponential moving averages, with the 10- and 20-day lines effectively capping upside attempts. Immediate resistance is stacked up near $92, a level that also overlaps with the 50-day EMA and a psychological round number. If bulls can reclaim $92 on decisive volume, I’d be looking for a first major target around $102, with a chance for momentum to fully flip. Failure here, however, risks an extended fall toward sturdy support at $81—the recent monthly low. Bears are still leaning on the throttle, but a volatility surge feels inevitable; my eyes are peeled for a shakeout, long liquidations, or that adrenaline-pumping reversal that tends to catch the majority off guard.

Monero (XMR) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | MONERO(XMR) | $311.70 | -3.57% | -8.34% | 42.0 | 24.3 | -4.27 | -108.78 |

|---|

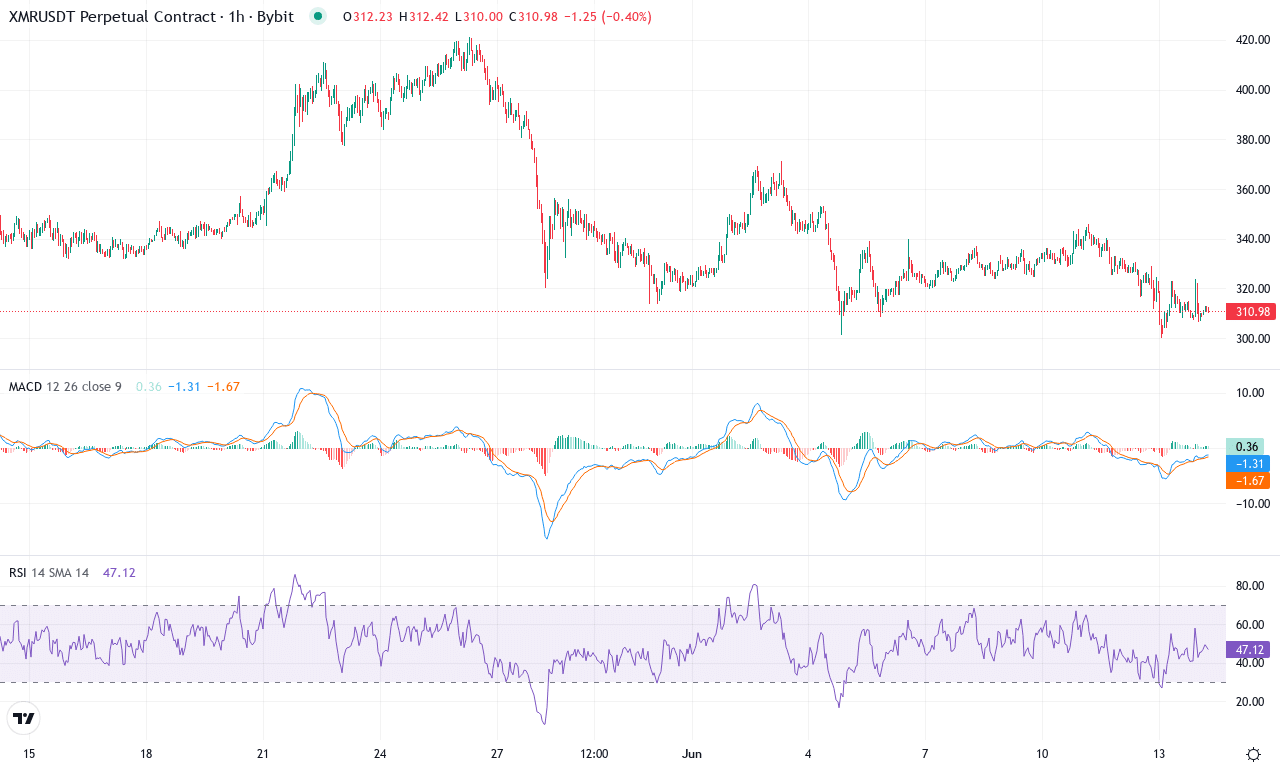

After a sharp run-up in recent months, Monero (XMR) has shifted into reverse, dropping over 8% on the month as sellers press their advantage. The privacy-focused coin reached a high above $420 but has since been battered back to the $311 zone, erasing short-term bullish momentum and raising the stakes for both bulls and bears. Notably, the one-week performance shows further declines, hinting that buyers are stepping back as volatility surges. While the longer-term trend is still positive—yearly performance is up over 80%—recent price action feels like a dramatic reset after the euphoric rally from the March lows. If you loaded up near last month’s top, I feel your pain—patience is key here.

Diving into Monero’s technicals, the trend indicators have begun to flicker warning signals. The ADX is elevated, confirming strong directional movement, but the balance of power is tilting toward the bears as negative directional lines outpace the positive, and the MACD has flipped to the downside on weekly timeframes. Oscillators paint a mixed picture: RSI languishes below the typical mid-range, suggesting persistent weakness, while momentum readings and the commodity channel index both imply ongoing downward pressure. Price has also fallen beneath key short-term moving averages, losing grip on former support near $330—a spot now acting as resistance. Eyes should be on support around $290; if Monero slides through there, risks of a steep correction grow. A decisive bounce from current levels could spark a recovery up toward $337, but failing that, further profit-taking and long liquidations could drag XMR back to retest the $250 region. For now, the technical outlook suggests caution—until the bulls reclaim lost ground, the bears are in control.

Turning Point or Tipping Point?

Solana steadies near $150, awaiting a volume surge to reclaim upward traction, while Litecoin’s struggle at recent lows could either herald a bounce or deeper correction. Monero’s retreat post-rally signals a possible consolidation unless bulls muster fresh strength. As the market holds its breath, traders keenly watch for breakout signals or a decisive downside move.