GNO And XCH Fight For Survival As Bearish Momentum Threatens Critical Support

With both Bitcoin and Ethereum recently posting solid gains, altcoins like Gnosis (GNO) and Chia (XCH) are facing an uphill battle amidst note-worthy bearish momentum. GNO’s sharp 9% dip and XCH’s relentless downtrend have pushed these tokens to precarious support levels. The question is whether these critical zones will hold firm or crumble beneath selling pressure. Let’s break down the technical setup to uncover what might come next for these beleaguered assets.

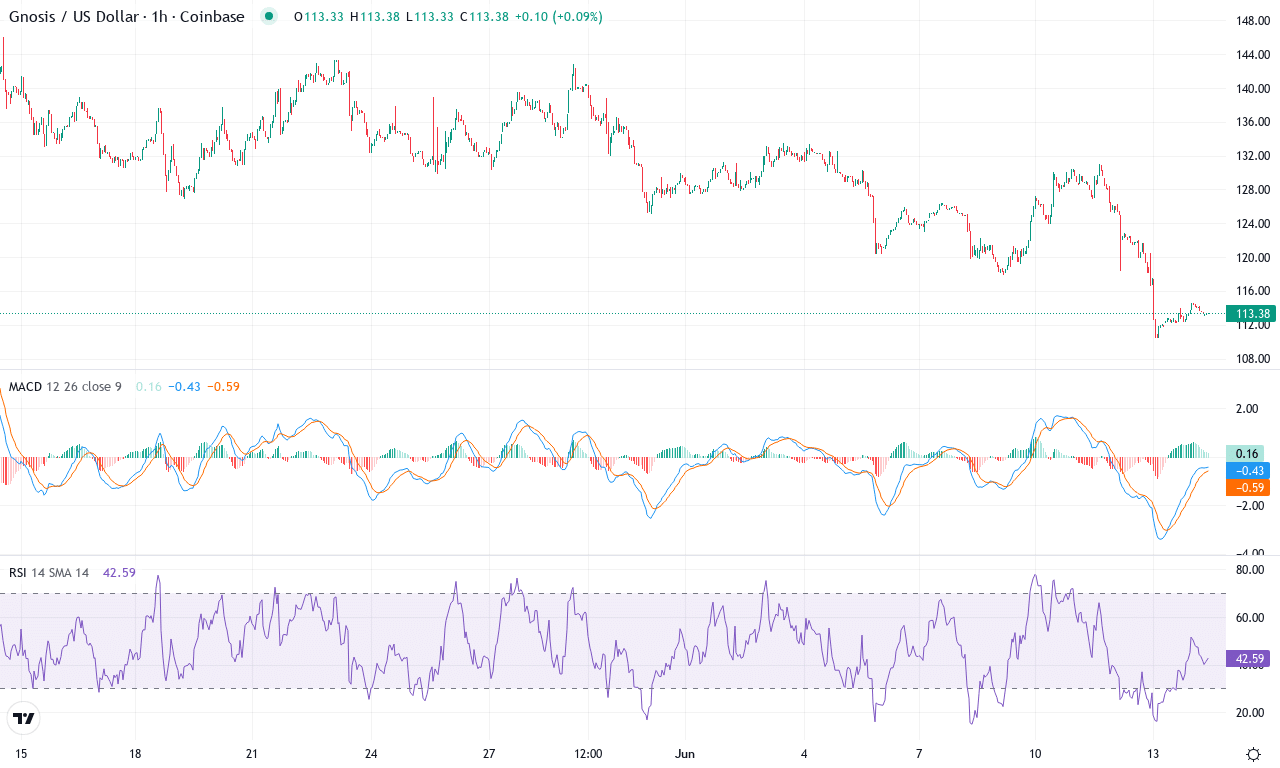

Gnosis (GNO) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | GNOSIS(GNO) | $113.18 | -8.60% | -18.98% | 37.2 | 22.1 | -3.15 | -171.61 |

|---|

After a notable period of underperformance, Gnosis (GNO) finds itself in a precarious position this week, sliding nearly 9% to close at $113.18—a level not far above its monthly bottom. Price action has been gripped by a steep correction, with monthly returns down almost 19% and an ugly 62% decline over the past six months. This free-fall has dragged the token through multiple support levels, exposing pronounced bearish momentum and calling into question the sustainability of Gnosis’s longer-term trend. Personally, these sorts of sharp drawdowns always make me raise an eyebrow—nothing tests conviction like an extended fall, but volatility can also breed opportunity for those watching key zones.

The technical outlook suggests bears remain in clear control. Trend indicators are flashing red: the average directional index is elevated and the negative trend component far outpaces the positive, underscoring the strength of this downtrend. Momentum oscillators register deeply negative readings, and the weekly MACD shows little sign of a reversal—still diverging lower, signaling the risk of further declines. Price is cemented under all major moving averages—the 10, 50, even the 200-day—painting a classic bearish portrait. Immediate support sits around $110, barely protecting GNO from another selloff, while resistance looms near $128–$130. If sellers break current support, I’d brace for a test of the psychological $100 level or even lower. However, a decisive close back above $130 could force a round of profit-taking from late shorts and spark a short-covering rally toward $150. Until then, the threat of a further bearish reversal lingers. Stay nimble here; patience is as valuable as capital in markets like this.

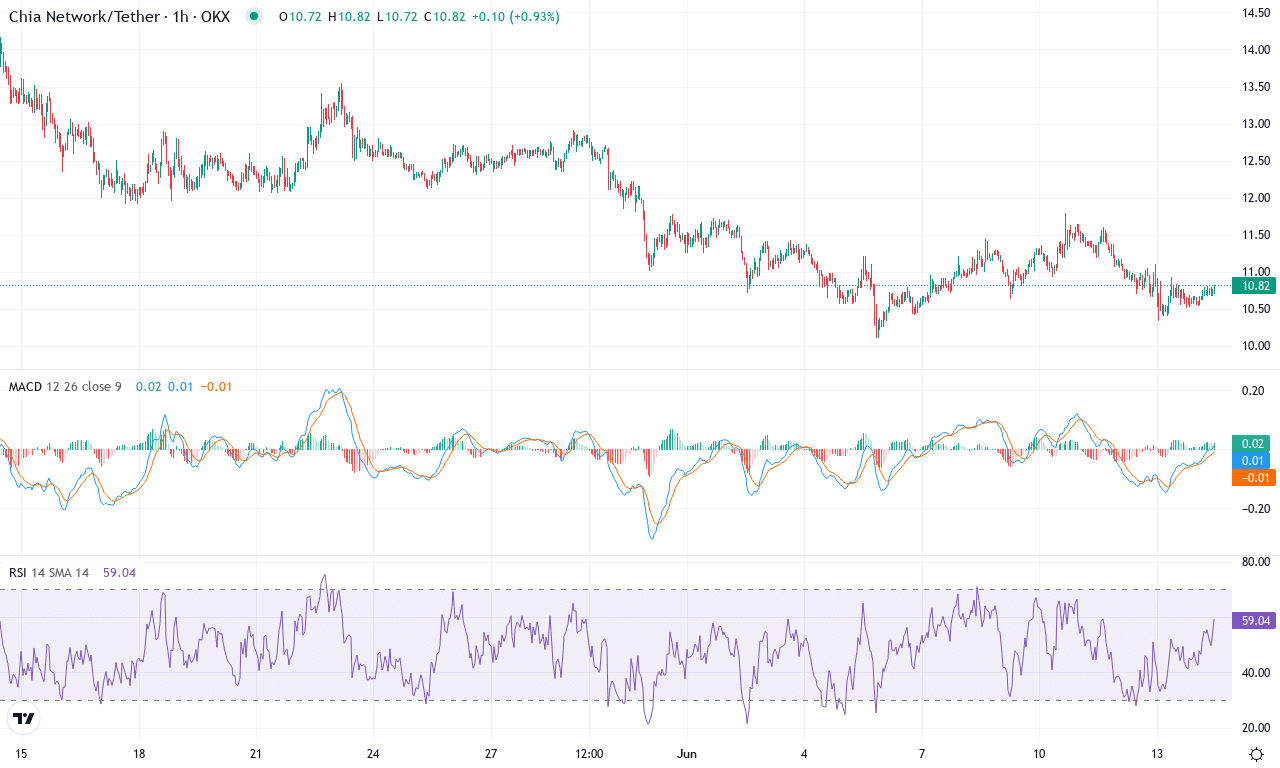

Chia (XCH) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | CHIA(XCH) | $10.73 | 1.23% | -19.93% | 41.0 | 21.6 | -0.36 | -83.54 |

|---|

After a brutal monthly slide of nearly 20%, Chia (XCH) remains trapped in a punishing downtrend, battered by steep losses that have intensified over the past quarter. Sellers have been relentless, driving price down to a monthly low of $10.10 before a modest recovery to $10.73. While the broader crypto market has flirted with recovery, Chia’s technical outlook suggests that the coin is still struggling to locate a reliable support base. As I watch the tape, I sense real fatigue among the bulls—Chia’s six-month and yearly performance reads like a cautionary tale, with price more than halved and negative momentum stacking up. If there’s a silver lining, it’s that persistent selling does tend to bring opportunity to the patient, but right now, Chia’s chart is a case study in downside pressure.

The technical indicators paint a cautious picture: trend strength remains dominant on the bearish side, with directionals still tilted in favor of the sellers and the MACD hovering in negative territory. Even as short-term oscillators hint at oversold territory, there’s no decisive reversal yet. Chia’s price action is camped under every meaningful moving average I track, clearly signaling that sellers still have the upper hand. The next immediate support zone sits just above $10—a psychological battleground that, if lost, risks an extended fall toward new lows. On the flip side, reclaiming the $12.50–$13.00 area would be a compelling sign that buyers are regaining control, potentially catalyzing a short-squeeze rally. Until we see confirmation of bullish momentum, I’m on guard: sideways chop or a deeper flush remain live scenarios. My advice here—respect the trend, but prepare for volatility; we could see fireworks when this coil finally unwinds.

Will Support Levels Preserve GNO and XCH?

GNO clings to its critical support, with a recovery contingent on bullish resurgence, while XCH struggles at its last line of defense. Both assets could face further declines if current levels fail, but any bullish signals here might prompt rebounds. As the market watches, traders remain cautious, prepared for either scenario.