Ethereum And Monero Teeter At Pivotal Levels As Bulls And Bears Plot Their Next Move

Ethereum and Monero are both balancing at critical junctures, having enjoyed significant gains recently. Ethereum surged 34% over the last quarter but now hovers just under $2,600, while Monero’s prior powerful rally appears to be cooling off below $325 after an impressive 55% climb. These assets are at technical crossroads, with indicators showing diverging futures—will fresh buying interest ignite another rally, or has selling pressure set the stage for a pullback? Let’s break down the technical setup across the board.

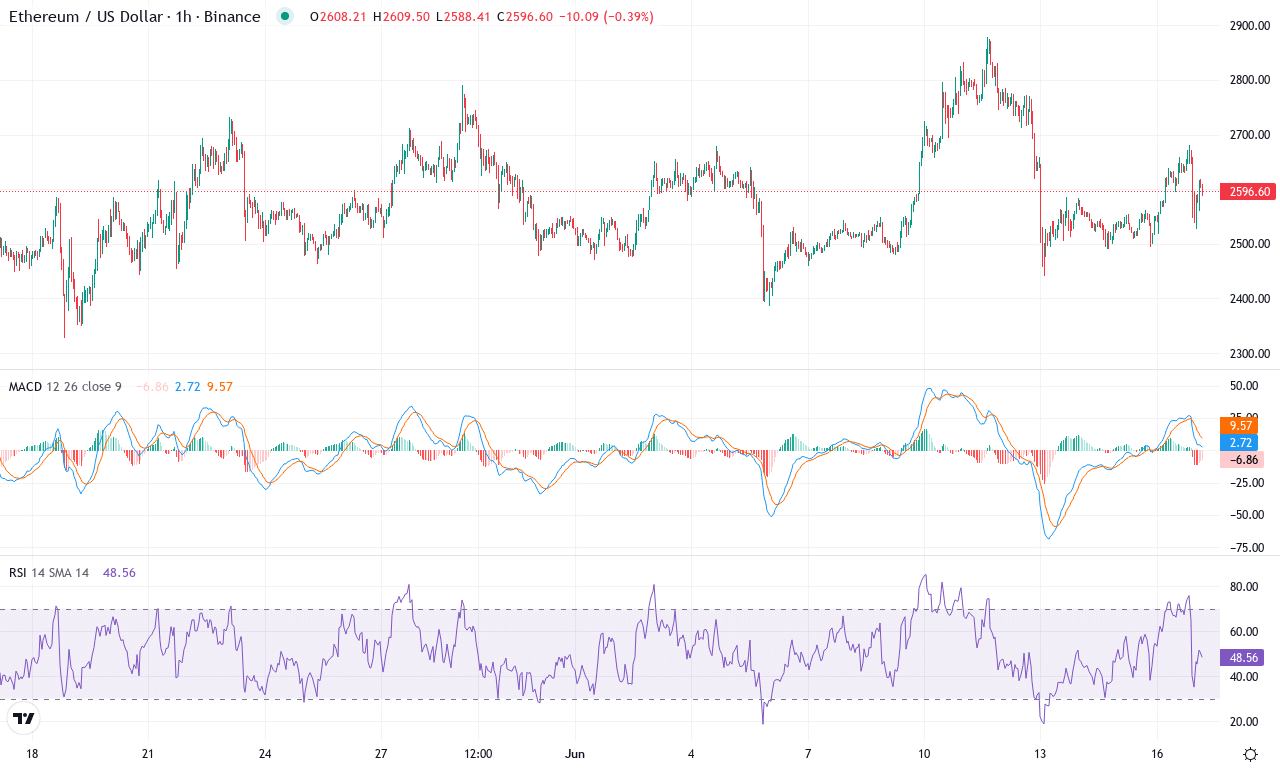

Ethereum (ETH) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | ETHEREUM(ETH) | $2596.63 | -3.12% | 4.89% | 53.2 | 18.9 | 39.41 | -4.94 |

|---|

After a strong quarter, Ethereum is pausing just below $2,600, showing signs of fatigue after a robust 34% surge over the last three months. The 4.8% monthly gain was hard-fought, but last week’s modest drop underscores how traders are locking in recent profits while the broader digital asset space churns with volatility. Momentum has cooled considerably compared to that earlier breakout, and for those of us who’ve seen ETH waver at key levels before, the stage is set for high drama as ETH navigates formidable range boundaries. The technical outlook suggests that Ethereum is caught between bullish momentum waning on higher timeframes and potential fresh energy just below the surface—so it’s tough not to feel both excited and wary as an inflection point nears.

Trend indicators hint at underlying strength, with the average directional index elevated and positive directional momentum outpacing negative—but the gap is narrowing. The MACD on the weekly timeframe, while recently negative, is attempting to curl back up, and oscillators like RSI hover near neutral zones, neither flashing exhaustion nor screaming for a reversal. ETH is trading right around its cluster of short- and medium-term moving averages, suggesting a coiled-spring setup: a decisive move could trigger a fresh wave of volatility. Major support sits near the $2,350 monthly low, while resistance overhead remains stubborn at the $2,880 high and the psychologically charged $3,000 level. If buyers manage to reclaim $2,900 with conviction, next targets lie at $3,400 and beyond—the bulls might just regain control. However, if sellers push ETH below $2,350, risks of a steep correction emerge, potentially dragging the price back to $1,900. All eyes are on whether this consolidation resolves higher; personally, if ETH reclaims $3,000, we’ll know the bulls are truly back.

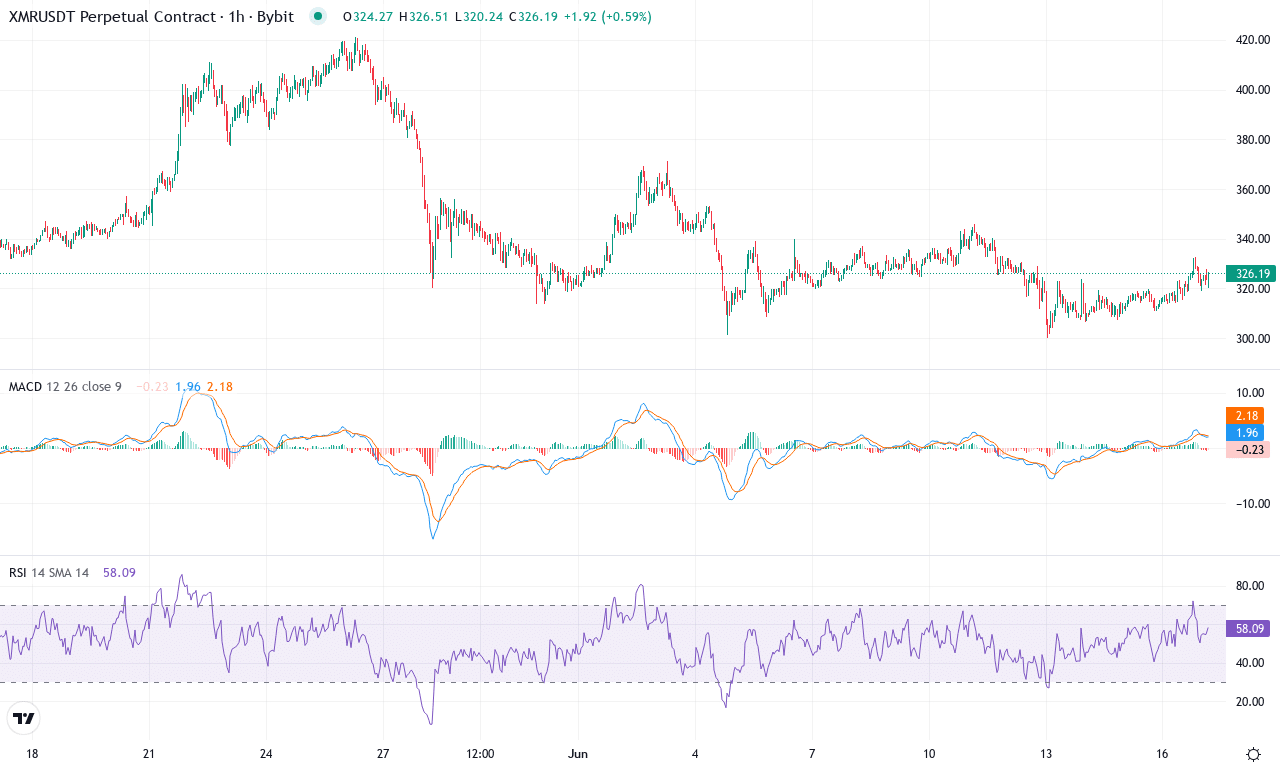

Monero (XMR) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | MONERO(XMR) | $324.05 | -2.82% | -3.75% | 47.7 | 21.3 | -4.50 | -37.39 |

|---|

After a blistering multi-month rally, Monero (XMR) is cooling off just below $325, nursing a modest 3.7% monthly pullback after vaulting over 55% in the prior quarter. The privacy coin’s bullish macro trend remains intact, with year-on-year gains still dazzling at nearly 83%. Yet, recent price action signals bulls may be overdue for a breather; a long tail of profit-taking has left XMR struggling under this month’s $421 high. As broad crypto markets sway, XMR finds itself sandwiched between intense selling into strength and speculative bids near its major moving averages. I’m watching for signs: are the bears mounting a true reversal here, or is this just a garden-variety shakeout before another leg higher?

Zooming into the technicals, the trend isn’t as bulletproof as it was last month. Key oscillators have softened, with the weekly MACD rolling over and trend strength indicators hinting at a waning bullish grip—always a mood-shifter for momentum traders like me. RSI is perched above 61, not yet stretched but definitely losing upward thrust, while Monero now battles to stay above its tight EMA10-EMA30 cluster, which has started to flatten. Volatility looks poised to surge should XMR break decisively from the $320-$330 support zone; if sellers crack this area, a correction back toward the psychological $300 threshold or even the next major support around $253 comes into play. However, if the bulls can reclaim $360, all signs point to an attempt toward the monthly high near $421, resetting the breakout narrative. My bias? Stay nimble and alert—Monero is rarely dull at inflection points like these, and a sharp move feels imminent.

Decision Time at Key Levels

Ethereum’s steady perch near $2,600 awaits new catalysts, potentially signaling either a breakout or a downturn back to support around $2,400. Monero’s current stall calls for patience; its trajectory could shift sharply with any uptick or loss of buying interest. Traders should watch for decisive moves, as this balances at support could dictate the near-term trend.