HYPE, Fartcoin, and INJ Jockey for Direction as Bulls Battle Deepening Volatility Storm

The crypto market’s recent volatility has been nothing short of electrifying, with HYPE grabbing headlines for a stellar run now showing signs of fatigue, while Fartcoin’s wavering rally tests trader nerves amid wild swings. As these digital assets dance on the edge of further gains or imminent pullbacks, the underlying dynamics provide a fertile ground for tactical plays. Will the resilience of continued bullish trends overcome the stirrings of sell-offs, or are we at the brink of deeper corrections? Let’s break down the technical setup across the board.

Hyperliquid (HYPE) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | HYPERLIQUID(HYPE) | $38.11 | -8.81% | 43.70% | 54.3 | 37.6 | 2.50 | 13.85 |

|---|

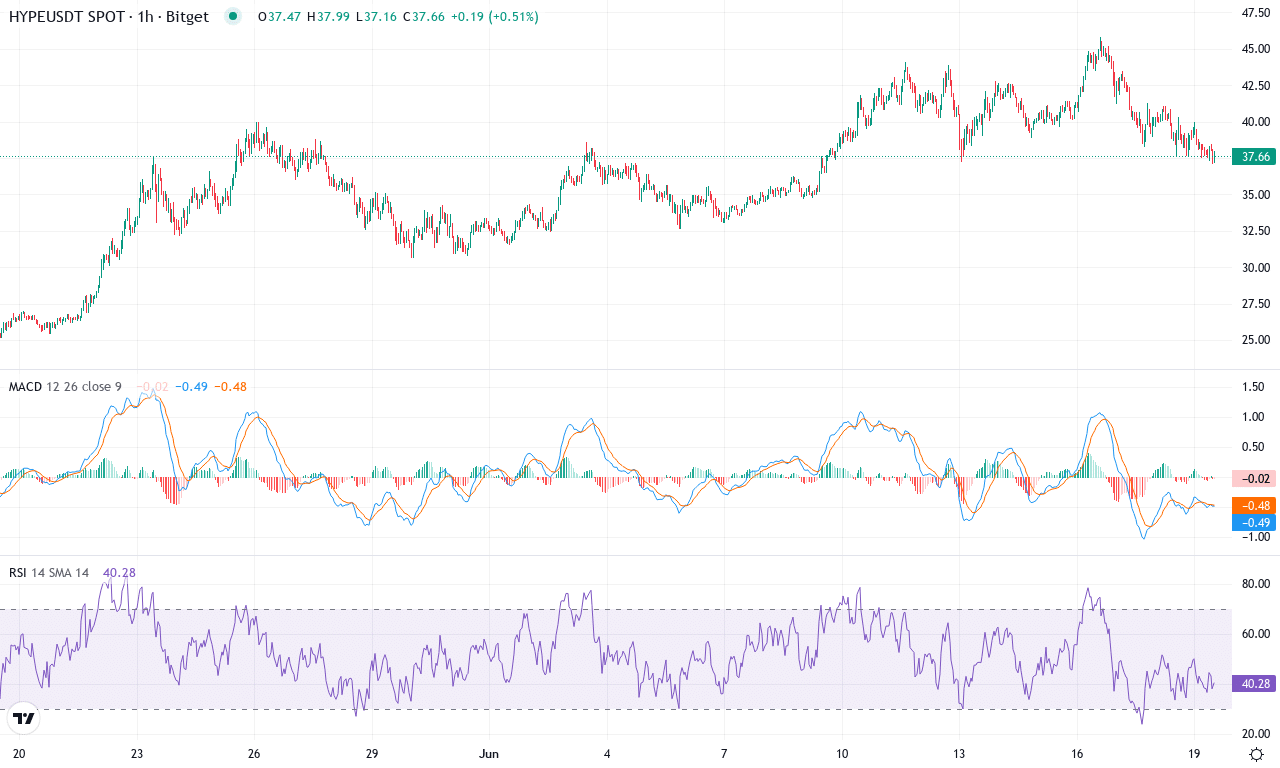

After a blistering ascent over the past quarter, Hyperliquid (HYPE) finally seems to be cooling off, with a sharp -8.8% decline this week after an eye-popping 43% monthly rally and a staggering 169% three-month gain. That kind of price action tends to draw both hype and anxiety, and rightfully so—parabolic moves inevitably test the nerves of even seasoned traders. With HYPE closing the week near $38, the token now sits well off its monthly highs at $45.82 but remains firmly within an established uptrend when zoomed out. The technical outlook suggests bullish momentum is taking a breather; while the long-term rally is very much alive, volatility is surging and the risk of further profit-taking is front and center. If bulls can reclaim control, we could see another leg up, but after such a dramatic run, I wouldn’t be surprised to see some deeper mean reversion in the short term. Strap in—these are the spots that separate pros from tourists.

On the technical front, trend indicators point higher overall, though are flashing mixed signals in the near term. The weekly MACD remains comfortably above its signal line, hinting at persistent bullish momentum, but the gap is narrowing, and the histogram’s pace is slowing—a classic warning that momentum could be stalling. Oscillators, including RSI, have retreated from overheated territory but still hover above neutral, implying that while HYPE isn’t wildly overbought, the balance of power could shift fast if sellers step in. Price is consolidating just above all major exponential moving averages (EMA10 through EMA100), reinforcing an underlying uptrend, but a decisive breach below $38 would open the door for a steeper pullback—potentially down toward the strong support zone around $32. On the upside, the first hurdle is that psychological $40 round number, then the monthly high at $45. If bulls break through resistance at $45, look for speculative blow-off moves; if sellers force a breakdown below $38, risks of an extended fall surge. I’m watching these levels closely—momentum moves quickly in both directions here, and whipsaws are brutal for the unprepared. Stay sharp.

Fartcoin (FARTCOIN) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | FARTCOIN(FARTCOIN) | $1.10 | -19.29% | -9.34% | 45.5 | 15.8 | -0.02 | -21.70 |

|---|

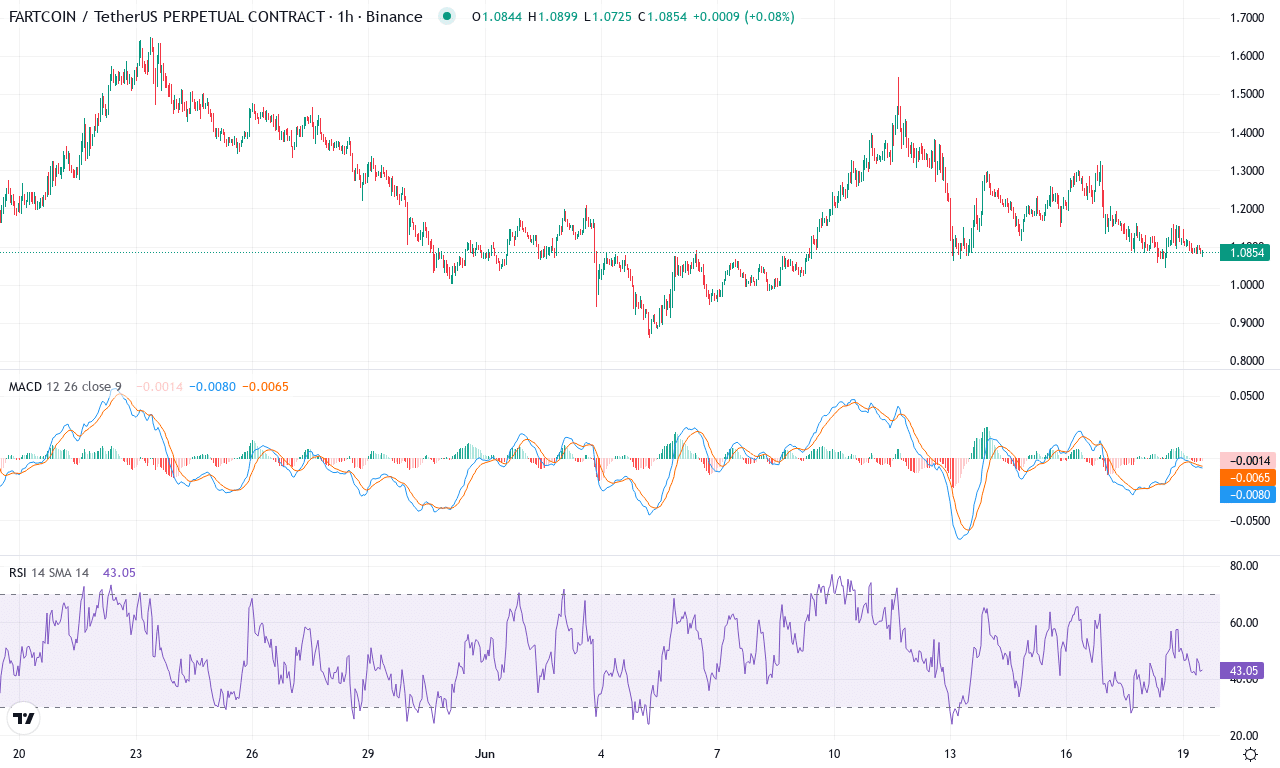

After a meteoric run over the past quarter, Fartcoin’s rally has finally hit turbulence—posting a sharp 19% drop this week and leaving the market questioning whether we’re witnessing a healthy correction or the start of something more sinister. Even with a monthly performance still in the red, those triple-digit three-month gains (+204%) are hard to ignore, suggesting Fartcoin’s macro trend remains overwhelmingly bullish. However, the latest price action has dragged the coin to the lower end of its monthly range, stalling just above $1.09, and traders are now eyeing key levels as volatility surges. In this kind of environment, emotions can swing as wildly as price—you’re not really underwater until you capitulate, but I won’t pretend this drawdown doesn’t sting.

The technical outlook suggests the tide may be shifting, at least in the short term. Trend indicators are flashing early warnings: the Average Directional Index (ADX) remains elevated, confirming trend strength, but the negative directional component has overtaken the positive—bearish momentum is now pressuring bulls. Adding to the tension, the MACD has turned south; a fresh weekly bearish crossover signals the momentum has reversed, and the histogram keeps sinking. Oscillators echo this bearish tone: a softening RSI and a Commodity Channel Index deeply in negative territory both point to oversold, but not yet exhausted, conditions. Price is holding right near the cluster of short- and medium-term moving averages, and below this, the $0.86-$0.90 area stands out as crucial support; a decisive break could spark a steep correction toward monthly lows. On the flip side, if Fartcoin can regain its footing and push above resistance at $1.20, recovering the rising pivot zone, there’s potential for bulls to reassert control. For now, all eyes are on whether bulls can defend this line in the sand or if sellers will trigger a deeper shakeout—keep stops tight, as volatility shows no sign of easing.

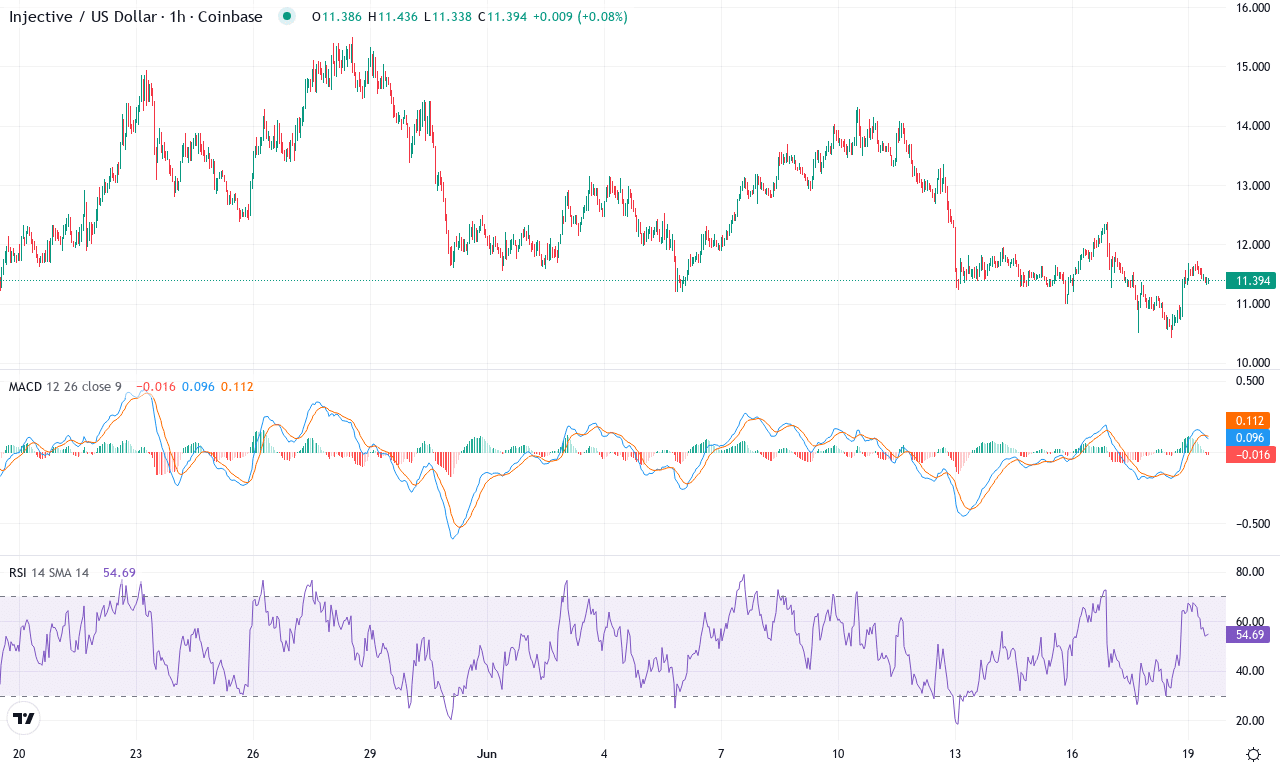

Injective (INJ) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | INJECTIVE(INJ) | $11.40 | -14.09% | -3.63% | 43.9 | 16.5 | -0.28 | -72.04 |

|---|

After a punishing 6-month stretch that saw Injective plunge nearly 50%, bulls appear battered but not broken. Over the past week, sellers struck again, knocking INJ down over 14% and dragging price back toward the monthly lows near $10.40. That said, monthly losses have started to decelerate, and with the token still above key psychological support at $10, a potential bottoming scenario is on the table. Market mood, however, remains fragile—momentum indicators are struggling, and price action continues to whipsaw between fading optimism and sudden dumps. It’s been a rough ride lately, but all eyes are now on whether demand will step in to shield INJ from a steeper correction or let the bears claim new ground.

Technically, trend signals remain weak, with the average directional index failing to confirm any sustained bullish push. Negative momentum from oscillators suggests sellers are still dictating the pace, while the weekly MACD shows deepening bearish divergence. Short-term moving averages stack just above spot price, reinforcing the drag and casting doubt on immediate bounce-back hopes. Should bulls mount a breakout and push through resistance at $12.20, the path to $13.50 opens up, but right now, the more likely scenario is a retest of major support at $10.40 or even a tumble toward the psychological anchor at $10. I’m concerned by the persistent loss of altitude—if buyers show up in force, I’d be relieved, but until then, risks of further long liquidations and volatility surges linger on. Stay nimble: unless there’s a clear invalidation of the bearish thesis, caution is warranted while INJ navigates this stormy range.

Navigating the Volatility

HYPE is precariously near a potential retracement if bullish momentum wavers, while Fartcoin’s erratic moves keep traders on edge, ready for either direction. INJ, meanwhile, shows resilience, hinting at bullish potential if it clears nearby resistance. Navigating these choppy waters calls for vigilance; traders should watch for confirmed breakouts or signs of emerging stability before committing to positions.