Bittensor And Aave Perched At Crucial Levels As Bulls Battle Fading Momentum

Bittensor and Aave have entered a phase of crucial price action as bulls try to regain their footing amidst recent losses. Bittensor, after a 40% surge, is now grappling with a 14% retreat, testing key support levels as enthusiasm wanes. Aave, too, has hit a wall, with a 15% drop reflecting fading bullish momentum despite an earlier quarter of robust gains. As market forces pull in opposite directions, the question remains: can buyers rally and renew momentum, or will the pressure mount further? Let’s break down the technical setup across the board.

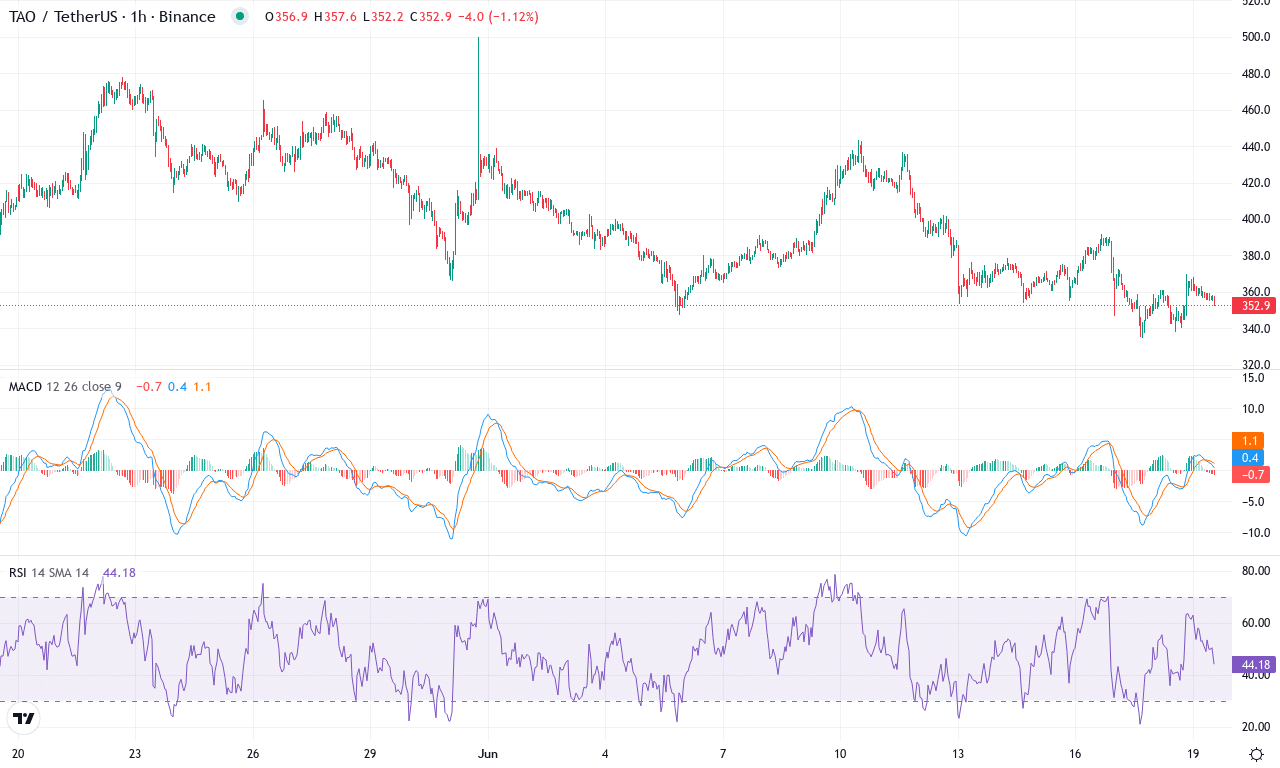

Bittensor (TAO) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | BITTENSOR(TAO) | $352.40 | -13.59% | -14.24% | 41.2 | 13.7 | -12.52 | -89.42 |

|---|

After a blistering three-month run that saw Bittensor surge more than 40%, the token has stumbled hard over the past month, with price action retreating nearly 14%. Volatility is unmistakable: from a monthly high of $500 down to a low near $334, bulls and bears have been locked in a fierce struggle. As it stands, Bittensor is hovering around $352, right above key support but well off its recent peak. Despite the deep pullback, the longer-term picture remains ambiguous; the six-month trend is still underwater, buoyed only slightly by double-digit annual gains. With this kind of whipsaw action, it’s easy to feel both hope and fear—especially if you’ve been caught on the wrong side of the recent reversal. The drama is far from over: TAO is now perched at a make-or-break level, and traders are watching for a defining move.

Technically, the setup is tense. Trend indicators show that bullish momentum is fading: the weekly MACD has slipped deeper into negative territory, and short-term oscillators suggest sellers are regaining control. Momentum readings are soft, and the RSI sits comfortably mid-range—nowhere near oversold, but a far cry from its former overbought glory. What’s worrying is that Bittensor has lost its grip on the key 10- and 20-day exponential moving averages, signaling the potential for further downside unless buyers step up quickly. Support sits ominously at the $346 zone—a psychological level that, if lost, could trigger a steep correction toward the $262 region. However, if bulls can muster a recovery and push price decisively above $423 resistance, the outlook could flip bullish in a hurry, putting $507 and even $584 back on the map. For now, the technical outlook suggests heightened caution; I’m watching order flow at these levels closely—because whichever side cracks first is likely to set Bittensor’s next big move in motion.

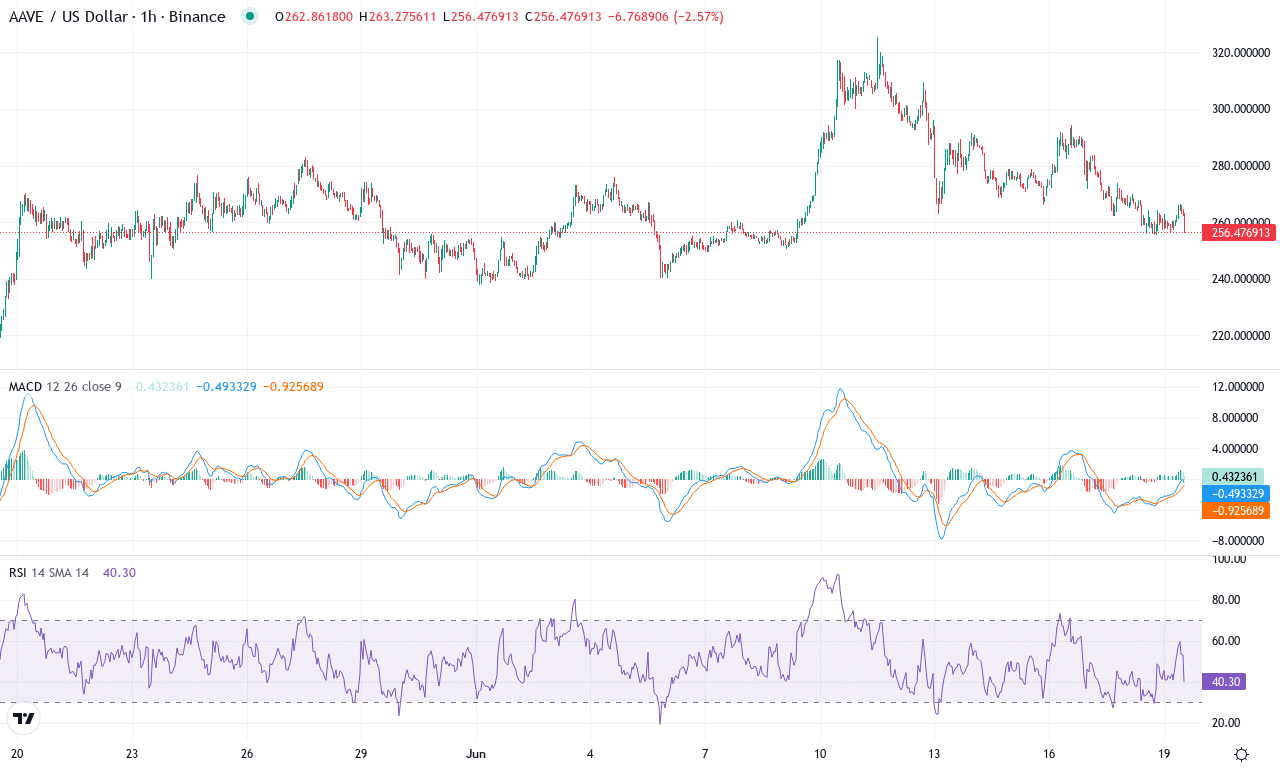

Aave (AAVE) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | AAVE(AAVE) | $258.53 | -14.95% | 4.42% | 48.0 | 23.6 | 7.07 | -37.61 |

|---|

After a month of grinding higher, Aave has finally run into resistance, and last week’s nearly 15% slump underscores that the bulls are losing their grip—at least for now. Despite a resilient showing earlier this quarter, with an impressive 44% rally over three months, markets have cooled, settling into a period of higher volatility and shifting sentiment. Short-term performance looks bruised, reflecting a wave of profit booking as Aave rejected its recent monthly high near $325. On the macro view, though, the broader uptrend isn’t fully broken; the technical outlook suggests that buyers are regrouping, even as traders brace for further swings between support around $230 and the overhead barrier near $300. As institutional demand ebbs and flows, I’m cautiously optimistic but ready for whipsaw action—no shame in waiting for a clearer signal.

Digging into the technicals, the trend indicators still point higher overall, with the ADX suggesting strong trend strength—though the positive directional line has slipped, showing that bullish momentum is taking a breather. The weekly MACD is losing altitude, hinting at possible trend exhaustion, but daily oscillators, including RSI and ultimate oscillator, hover in neutral territory, leaving the door open for a renewed push in either direction. It’s notable that Aave is hugging several key moving averages; it ended the week just above both its 20- and 30-day EMAs, but remains vulnerable if sellers force a close below $245—a potential trigger for a steep correction down toward the $230 support zone. Conversely, if bulls recapture momentum and clear resistance near $300, a fast move toward the $325–$350 zone wouldn’t surprise me. For now, with momentum waning and no textbook oversold readings, I’m watching closely—this is one of those pivotal moments where patience pays dividends.

Can Buyers Find Their Strength?

Bittensor clings to support after its sharp retreat, while Aave attempts to stabilize its recent drop. A decisive bullish push is needed to counteract mounting pressure and reverse the recent bearish undertone. The next sessions are pivotal as traders watch for any sign of renewed buying interest to restore directional confidence.