Chainlink And Avalanche Teeter On Cliff Edge As Oversold Bears Threaten Fresh Volatility

Chainlink and Avalanche are finding themselves at critical junctures amid recent turmoil in the altcoin space. Chainlink faces a harsh sell-off, with a nearly 13% drop last week, probing vital support levels. Meanwhile, Avalanche has plummeted 20% this month, sitting precariously atop a crucial support zone. The question is, can these assets muster enough demand to trigger a meaningful rebound, or will the downward spiral deepen? Let’s take a closer look at the signals behind the move.

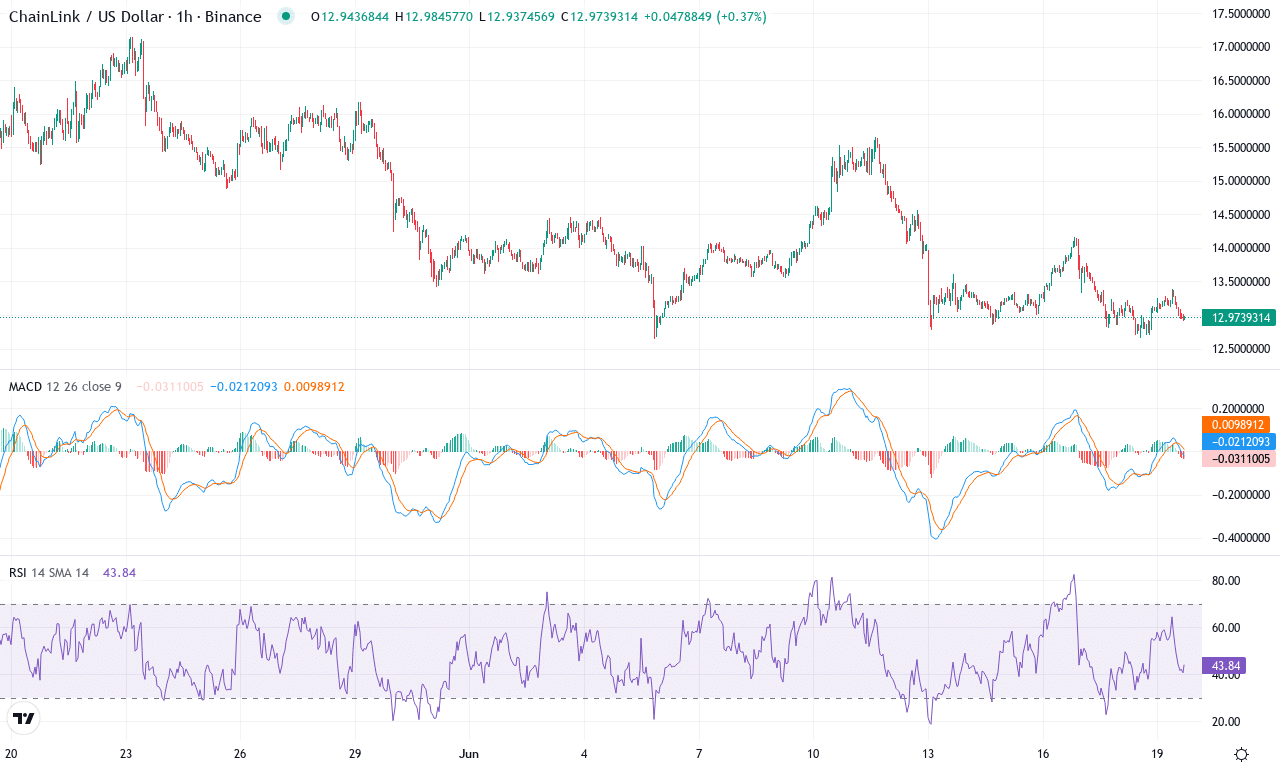

Chainlink (LINK) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | CHAINLINK(LINK) | $12.98 | -12.86% | -17.78% | 40.0 | 18.0 | -0.47 | -95.36 |

|---|

After a relentless stretch of weakness, Chainlink is trying to steady itself, though the last week didn’t offer much respite—prices slid nearly 13%, capping off a bruising month down over 17%. The technical outlook paints a challenging picture: sellers have been in control, dragging LINK from its monthly high above $17 to current levels near $13. The macro trend remains firmly bearish, especially with a daunting 44% loss over six months and a negative yearly trajectory. Yet, as Chainlink hovers just above monthly lows, I can’t help but feel a trace of cautious optimism; the market is notorious for rebounding when sentiment is at its bleakest.

Technically, the trend remains heavy: ADX reads robust trend strength, with trend indicators and oscillators skewed sharply in favor of the bears. The MACD refuses to signal upside hope just yet—its lines are crossed well below the neutral axis, and the histogram remains negative, underscoring persistent bearish momentum. RSI lingers just beneath the 40 mark, indicating bears are in the driver’s seat, but some short-term oscillators hint at exhaustion as price approaches oversold territory. LINK trades beneath its short- and medium-term moving averages, showing bulls have their work cut out. Immediate resistance looms at $15, a psychological level reinforced by both the 50-day average and monthly pivot. Should buyers reclaim this threshold, a push toward the $17 region could ignite further short covering. On the downside, if bears maintain pressure and LINK breaks below $12.65, risks extend toward the psychological $12 handle and possibly a volatility surge lower. Personally, if Chainlink reclaims strength above $15, I’ll be watching for swift momentum; otherwise, patience may be the name of the game as price action teeters at the edge of deeper correction or long-awaited reversal.

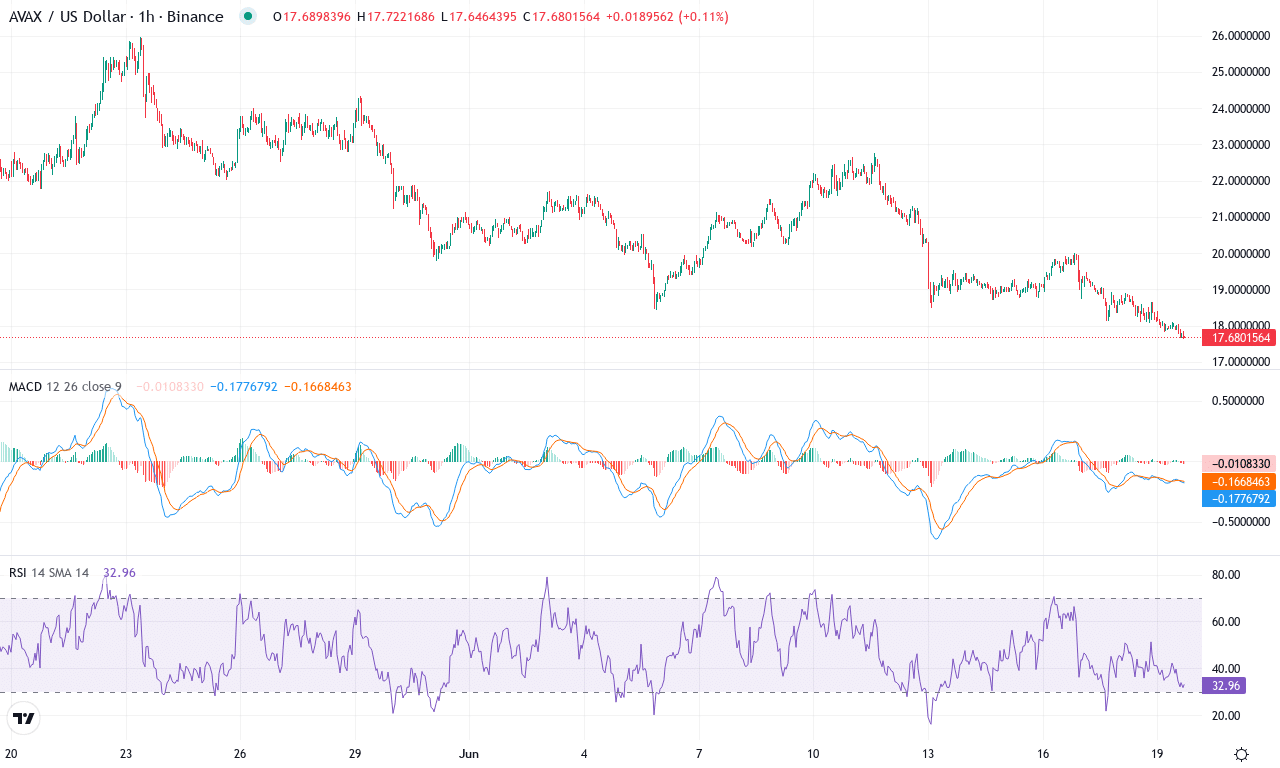

Avalanche (AVAX) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | AVALANCHE(AVAX) | $17.77 | -17.58% | -20.19% | 34.2 | 17.3 | -0.97 | -138.39 |

|---|

After a relentless bleed in the altcoin space, Avalanche (AVAX) is now trading close to $17.77, battered by a staggering 20% retreat this month alone and eye-watering 55% losses in the last six months. The selloff has pushed AVAX back toward the monthly low near $17.67, hovering dangerously above a pivotal support zone. Short-term traders have seen little relief, with last week’s performance down another 17%. While the macro trend remains firmly bearish, the sheer steepness of the correction suggests that volatility could quickly swing both ways. AVAX is now deep in oversold territory—markets like these can snap back sharply when sentiment shifts, so I’m watching closely for signs that bears are running out of steam.

The technical outlook suggests sellers remain in control, with trend indicators signaling persistent downside pressure. The average directional index is elevated, underscoring strong trend momentum, and negative directional readings far outweigh positives—classic signs of bearish momentum still at work. The weekly MACD shows lingering acceleration to the downside, and the histogram offers little hint of reversal just yet. Oscillators, including the RSI, have sunk well below typical mid-range levels, signaling overstretched conditions but not yet flashing a confirmed bounce. Price action is pinned under all key moving averages, including the 10, 20, and 50-day EMAs, reflecting ongoing supply. As AVAX sits just above the crucial $17.70 support, a clean break below raises risks of an extended fall toward psychological round-number support at $15. If bulls can muster a reversal here and reclaim resistance at $22, the doors open for a rebound toward $25. For now, the pressure is on—any relief will only come once buyers prove they can flip momentum in their favor.

Can Support Zones Hold?

Chainlink is testing significant support, and Avalanche hovers at critical levels after sharp declines. For a rebound, renewed demand is essential; otherwise, breaches of these supports could accelerate losses. Traders should watch for volume increases as a sign of stabilization or another descent into volatility.