AeroDrome Finance Blasts Toward $0.97 Ceiling as Bulls Tighten Grip—Breakout or Bull Trap Ahead

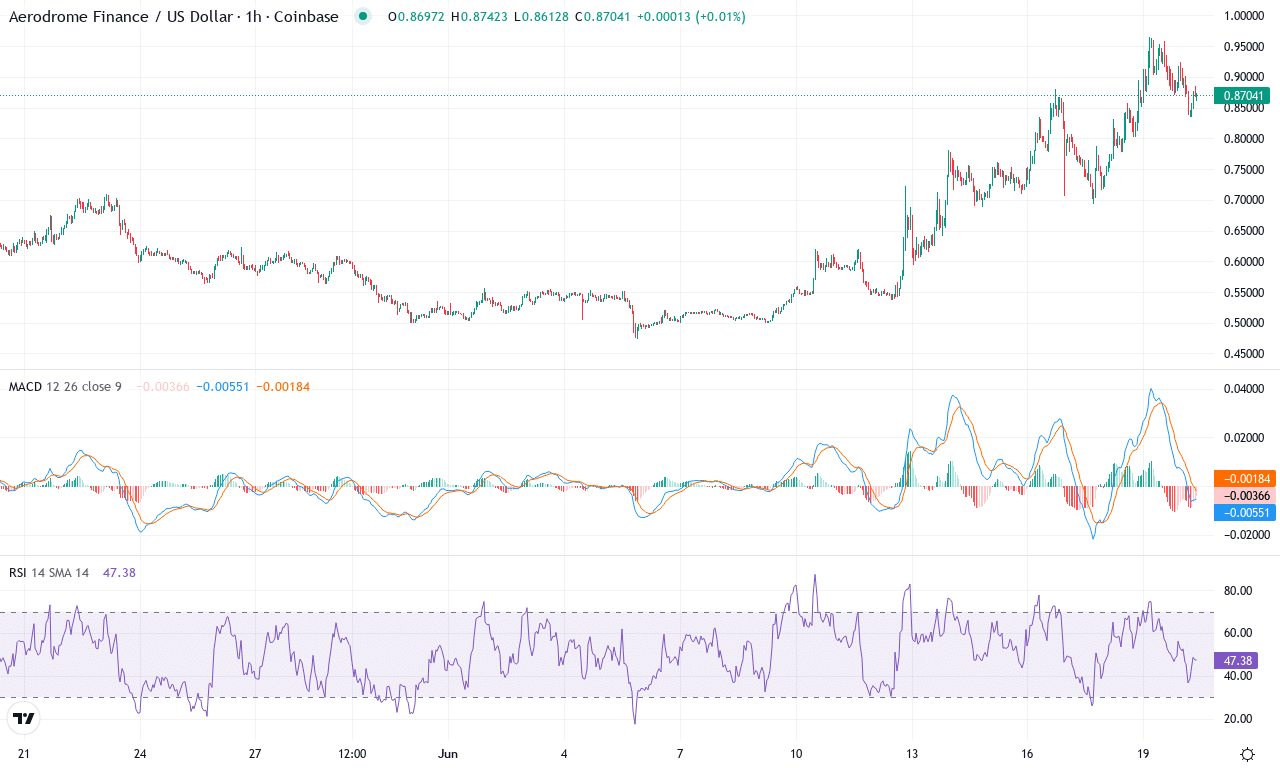

Aerodrome Finance has caught the market’s attention with its impressive rebound, nearly 29% up this week alone, defying a six-month downtrend. As it approaches the $0.97 resistance, the stage is set for potential fireworks. Will this be the start of a true breakout or a deceptive bull trap? Let’s break down the technical setup across the board.

Aerodrome Finance (AERO) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | AERODROME FINANCE(AERO) | $0.87 | 28.85% | 37.18% | 65.9 | 36.4 | 0.07 | 129.81 |

|---|

After a volatile stretch marked by whipsaw price action, Aerodrome Finance (AERO) is turning heads with a return of nearly 29% this week and a staggering 37% gain for the month. The coin has erupted out of its recent lows, snapping a six-month downtrend that saw heavy losses, and now approaches its monthly high of $0.965 with renewed momentum. This recovery unfolds amid robust buying interest—AERO has surged over 72% in the past three months—hinting at a healthy influx of fresh buyers and the possibility of trend reversal. I’m watching this bounce closely; the sharp ascent from oversold territory to current levels always injects a sense of drama—are we at the start of a true breakout, or is a corrective pullback looming?

Technically, the trend indicators are lighting up: AERO’s strong ADX reading underscores a powerful directional move, while the bullish shift in the MACD on both weekly and daily timeframes signals strengthening upside momentum. Oscillators paint a similar picture—RSI is climbing, yet not flashing overbought just yet, suggesting bullish momentum has room to run. Price is now consolidating above its short-term exponential moving averages, a classic sign of buyers regaining control, and sits within striking distance of resistance at $0.97. If bulls can punch through this ceiling, the next major target emerges at the psychological $1.21 mark. However, a failure to hold support around $0.71 risks a steep correction; in that scenario, the rally may fizzle just as quickly as it began. The technical outlook suggests breakout momentum, but after such dramatic gains, I’m keeping my stop losses tight—never hurts to lock in profit when the market’s this hot.

Approaching Resistance: Decision Time

Aerodrome Finance is hovering at critical resistance, with bulls showing strength but facing a formidable ceiling at $0.97. A sustained push beyond this level could spark further gains, whereas failure to break through might signal a consolidation phase. Traders should remain vigilant, as the next move will define the trend’s credibility.