Aave And Maker Bulls Charge Into Resistance As Breakout Momentum Builds

Aave and Maker are at a critical juncture, with both showing impressive gains amidst a turbulent market backdrop. Aave has surged over 7% this week alone, enticing bulls as it approaches the pivotal $325 resistance level. Meanwhile, Maker rides high after a solid 14% climb, brushing up against the crucial $2,190 mark. As these assets hover near key psychological thresholds, one must ask: will the bullish momentum break through, or are we on the cusp of a pullback? Let’s dissect the technical signals that may hold the answers.

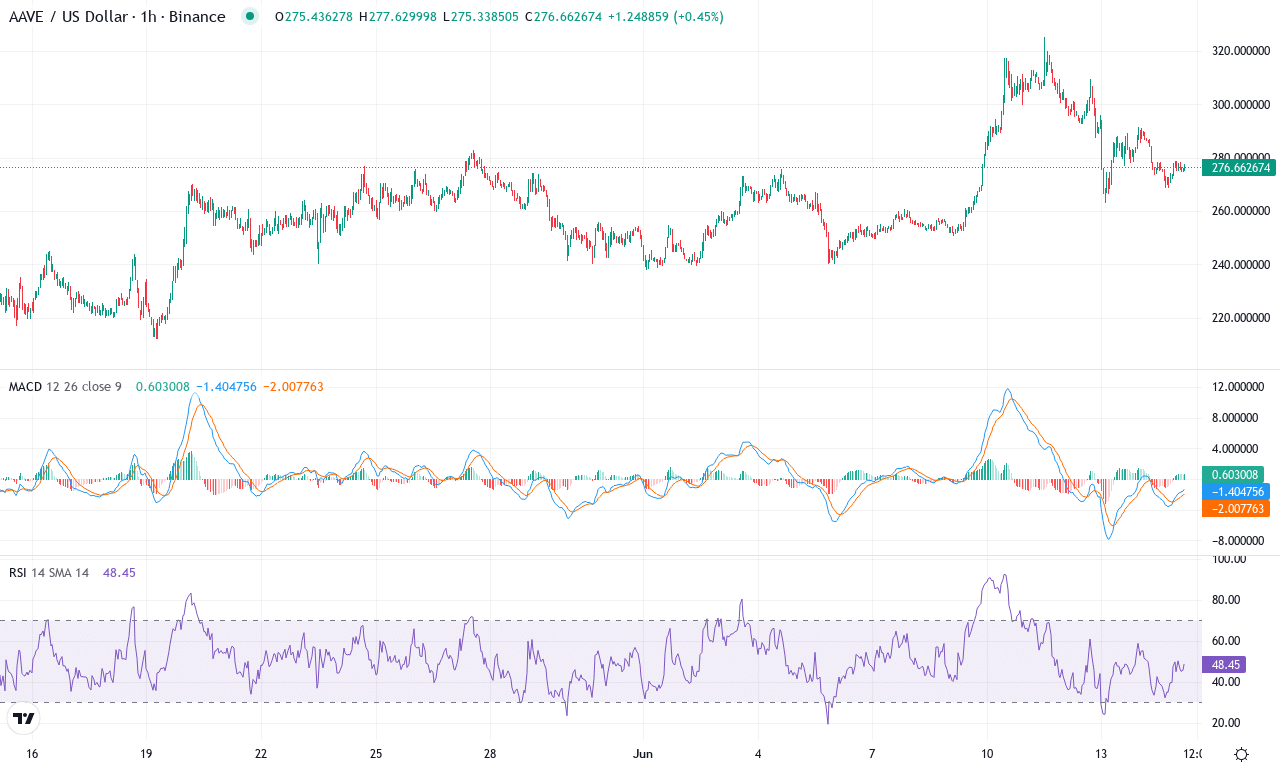

Aave (AAVE) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | AAVE(AAVE) | $277.16 | 7.57% | 24.32% | 56.2 | 27.5 | 14.09 | 39.51 |

|---|

After a month punctuated by strong swings, Aave is grabbing the spotlight with a decisive move higher. This week alone, AAVE surged over 7%, capping off an impressive one-month rally approaching 25%. The broader context tells a dramatic tale—three-month gains exceeded 68% before a recent cooldown, but the coin remains substantially below its recent highs. With price now sitting just under $280, Aave is trading well above every major moving average, underscoring the strength of its current uptrend. A cluster of short-term momentum and trend signals points firmly upward, and as volumes rise, it feels like bulls have retaken control. If Aave breaks above the $325 monthly high, we could see another powerful leg higher, especially if institutional appetite continues to build. I have to admit, seeing buyers step in so forcefully after last quarter’s volatility is invigorating.

Technically, the stage is set for a pivotal showdown. Trend indicators are firmly in the bulls’ camp, with the average directional index hovering at elevated levels—this confirms robust trend intensity. Aave’s MACD lines are aligned bullishly and still accelerating, signaling that breakout momentum isn’t spent just yet. Oscillators also flash strength, while the weekly RSI sits above 60 but not yet in overbought territory; there’s room for this run to extend further before the risk of a steep correction looms large. The price is comfortably above all key exponential moving averages, with the 10-period EMA leading the pack upward—a classic signal of trend continuation. Watch the $325 resistance zone closely; a clean break could open up blue-sky territory, with $350 and $470 as logical upside targets. However, if sellers regroup and push Aave below the $270 region, expect a pullback toward $242 support. For now, the technical outlook suggests the path of least resistance remains higher—don’t let your guard down, but this rally looks anything but fragile.

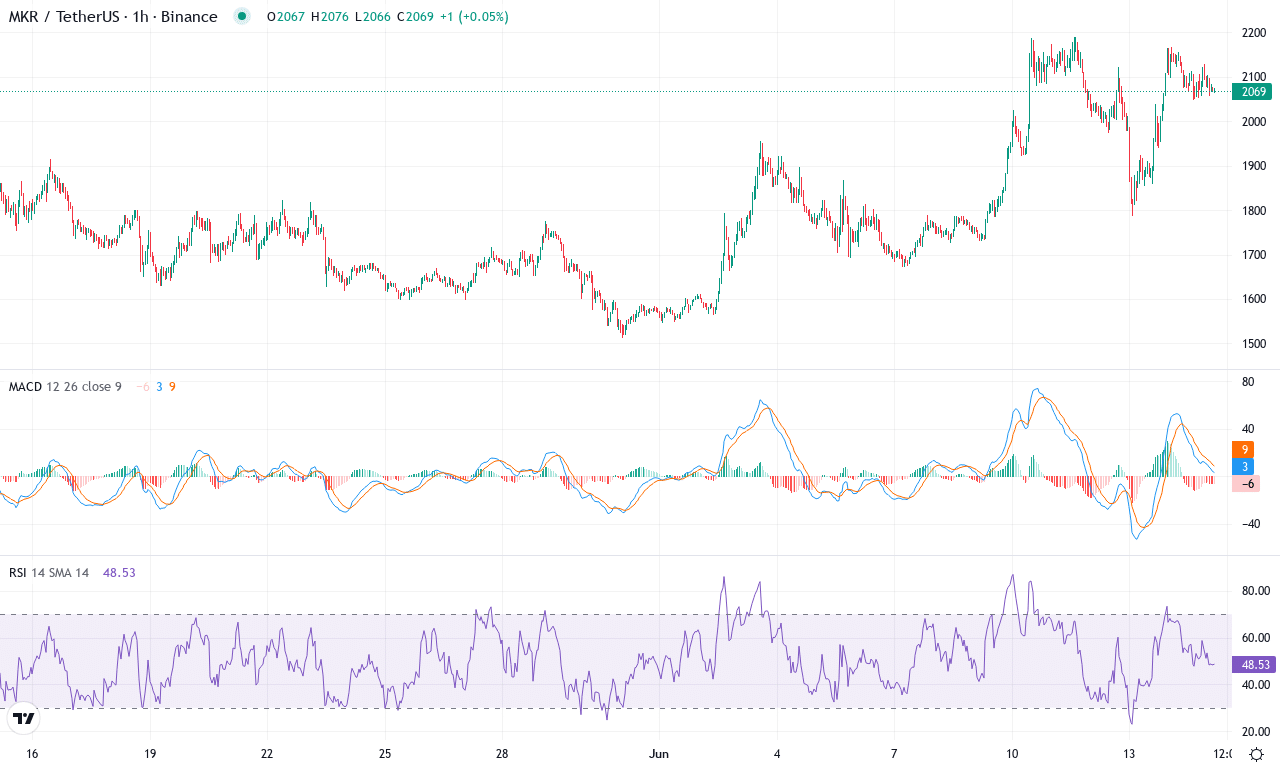

Maker (MKR) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | MAKER(MKR) | $2072.00 | 17.33% | 14.22% | 61.5 | 25.0 | 112.35 | 108.46 |

|---|

After a fierce month marked by double-digit gains, Maker (MKR) is flexing its muscles well above $2,000, notching a robust 14% monthly climb and a head-turning 76% rally over the past three months. This surge has propelled MKR straight into the upper end of its range, testing resistance near $2,190 while bulls celebrate a nearly 17% leap just this past week. The technical outlook suggests breakout momentum, fueled by both fresh institutional interest and persistent momentum from DeFi narratives. The broader trend is undeniably bullish, though traders should be mindful—a run this steep rarely goes unchallenged. If Maker clears its next psychological barrier at $2,200, I’d be genuinely excited to see just how far the rally can extend before profit-taking sets in.

Digging into the technicals, the trend indicators are on fire: the ADX reveals a dominant and strengthening trend, with buyers overwhelming sellers as bulls regain control. The weekly MACD is accelerating upward, showing wide divergence between signal lines—often a precursor to major upside follow-through. Oscillators back the bullish narrative, as Maker is riding elevated momentum, and the RSI sits just shy of classic overbought zones, hinting there’s still some gas left in the tank. Crucially, price is holding well above all its key moving averages, underscoring how much sellers are getting squeezed at every dip. Immediate support rests around $1,880 (where recent pullbacks have bounced), while the next major resistance zone looms at $2,190–$2,200; if bulls break above that, $2,730 isn’t out of reach. Caution, though: a failure at resistance could trigger a sharp correction down towards $1,650. For now, all signs point to bullish continuation, but as always—manage your risk and keep an eye on the tape for any signs of reversal.

Will Bulls Conquer Resistance?

Aave and Maker are testing their resistance levels, with Aave eyeing $325 and Maker grappling with $2,190. Sustained bullish momentum could drive a breakout, but failure at these barriers may lead to a strategic pullback. Traders should monitor volume and price action closely, as the coming days will reveal whether bulls have the stamina to push through or if a consolidation phase is imminent.