Aave And Maker Ignite As Breakout Bulls Target Fresh Highs But Will Overheated Momentum Hold

Aave and Maker’s recent explosive surges are sparking interest across the crypto sphere, with Aave climbing an impressive 36% in the past month and Maker posting a 23% weekly gain. Yet, as these DeFi giants flirt with fresh highs, traders find themselves at a crucial juncture. Will the current bullish momentum hold strong, or are signs of exhaustion signaling a possible cooldown? Let’s break down the technical setup and see what the charts have to say.

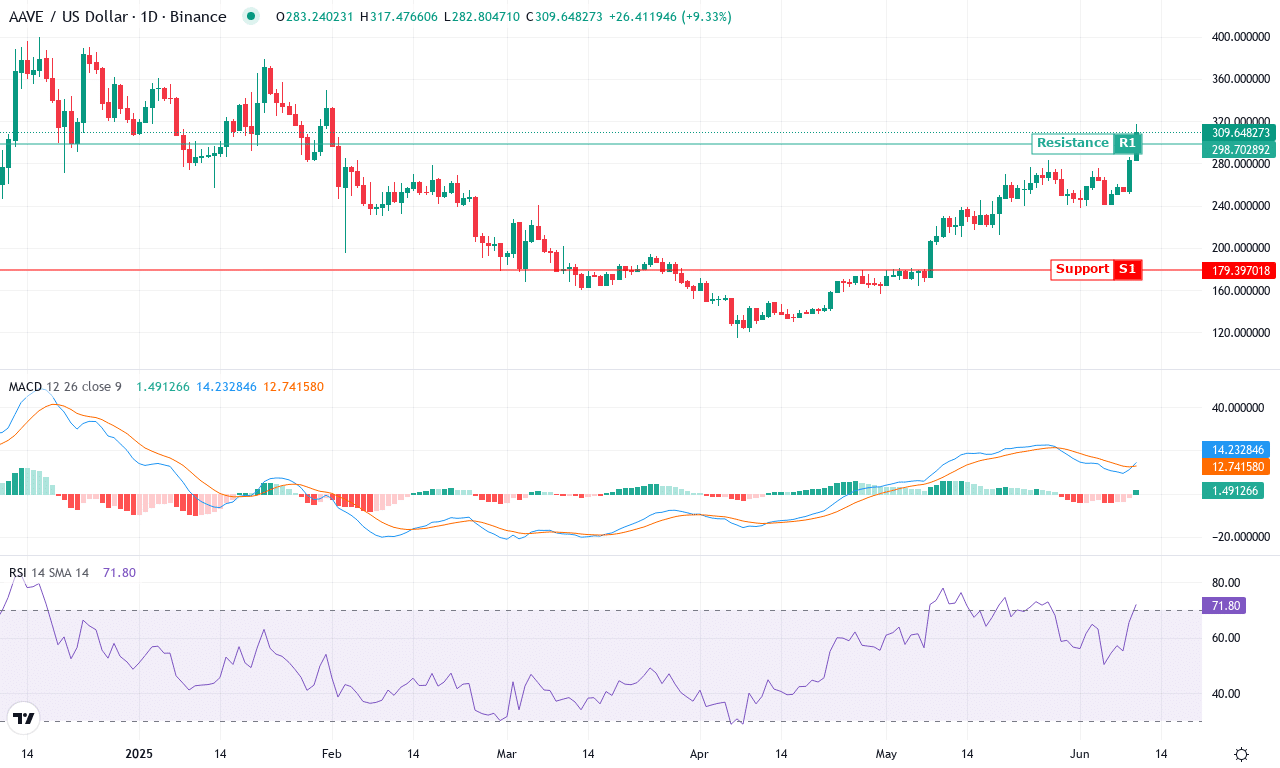

Aave (AAVE) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| AAVE (AAVE) | $311.81 | 20.86% | 36.62% | 72.3 | 28.9 | 14.39 | 294.42 |

After weeks of coiling near yearly highs, Aave is finally grabbing traders’ attention with a blistering 36% monthly surge and a powerful 21% rally over the past week. The protocol is clawing back market share following a subdued six-month stretch, breaking out of its sideways range as DeFi sentiment brightens. Currently trading near $311 and pressing close to its recent $317 monthly top, Aave’s price action is bolstered by strong inflows and heightened open interest—hallmarks of a volatility surge often seen when momentum traders pile in. The exuberance is hard to miss: after a tepid first half, Aave now looks determined to regain its reputation as a market leader in the lending space.

Technically, all signs point to breakout momentum. Trend indicators show robust strength—trend intensity is rising, and the gap between the directional lines continues to widen, underscoring bullish control. The weekly MACD is accelerating higher above its signal, while oscillators and momentum gauges remain positive, supporting the move. With price holding well above its major moving averages and the nearest support layered at the psychologically charged $300 level, a confident close above $317 clears the runway toward intermediate resistance at $350, where I suspect some profit booking could emerge. If sellers wrestle back control, watch for a potential retest of the zone between $291 and $280, coinciding with the short-term moving averages. Volatility is back on the menu. As a trader, watching Aave catch fire after months of dormancy is exactly why I stay nimble—there’s real potential for trend acceleration, as long as the bulls don’t get trapped at the highs.

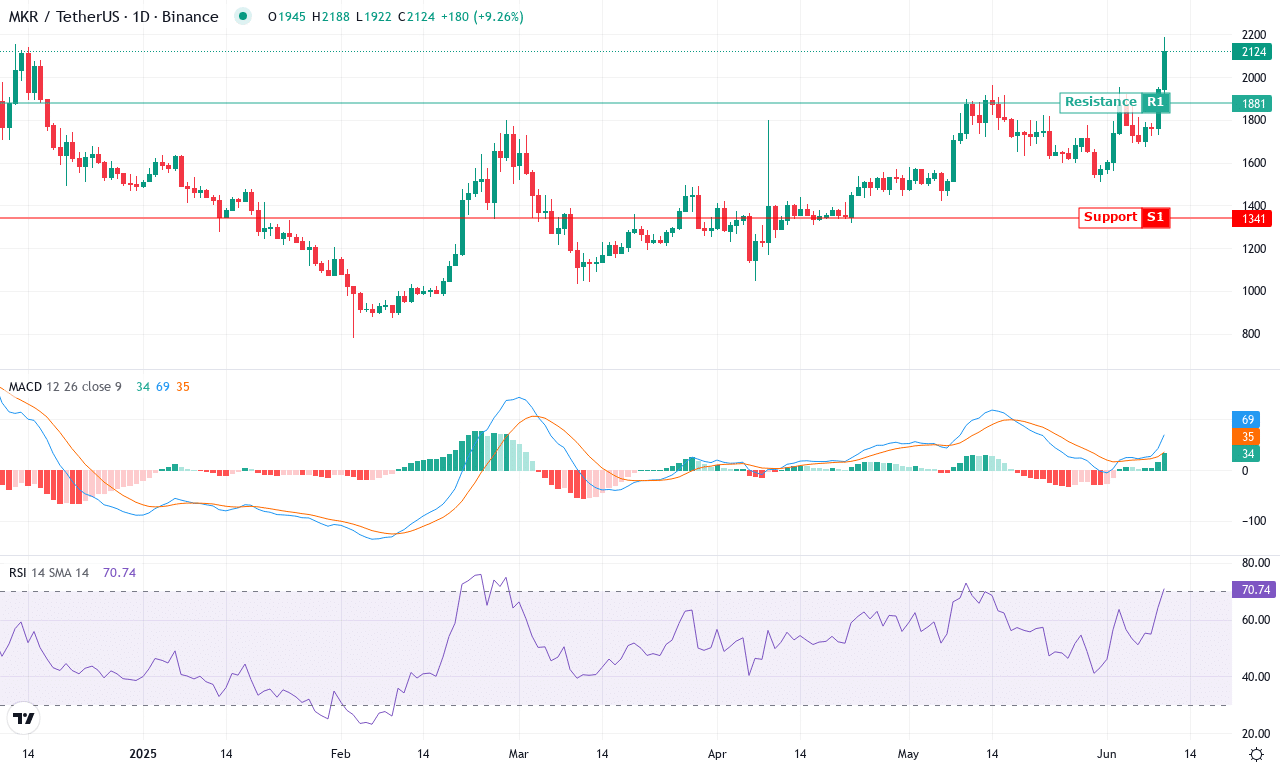

Maker (MKR) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| MAKER (MKR) | $2144.00 | 23.22% | 14.53% | 71.4 | 23.9 | 70.45 | 272.71 |

After a stellar month capped by a surge to $2,188, Maker (MKR) is catching traders’ attention with a 23% gain on the week and nearly 15% on the month. The broader context is compelling: despite a rough year overall (down almost 14%), the last three months have delivered a stratospheric 89% gain, hinting at resurgent bullish momentum. As institutional demand kicks in and volatility accelerates, sentiment is shifting decisively away from the slow grind seen earlier this year. Maker’s price action is now hovering just below the monthly high and notably above most key moving averages—another bullish omen that has me watching for further fireworks. If bulls can defend $2,000 and punch through $2,200, we could be on the cusp of a major breakout. And honestly, if MKR crosses $2,200 decisively, I wouldn’t want to be on the sidelines.

Digging deeper, the technical landscape is loaded with promise—but there are hints of a tug-of-war playing out. Trend indicators register robust strength, with the ADX north of 23 and the positive DI comfortably above its negative counterpart, suggesting bulls still hold the reins. The MACD line is streaking higher above its signal, and the oscillators (especially the Awesome Oscillator and CCI) are flashing green, underlining swelling momentum. RSI is pressing into overbought territory, which usually warns of a potential pause or profit booking, but I see little evidence yet of bearish reversal momentum—short-term exhaustion could lead to a shallow pullback before any steep correction. Multiple moving averages—spanning the 10 to 200-day EMAs—all line up below the current price, reinforcing a solid support zone near $1,800–$2,000. Major resistance looms at $2,200 and then $2,300; if sellers show up in force, expect a retreat to the $1,900–$2,000 support band before the bulls likely reload. In sum, the technical outlook suggests breakout momentum—just carve out your risk, because if this rally runs hot, sidelined shorts will get squeezed hard.

Can Aave and Maker Sustain Their Breakout?

Aave is approaching key resistance, while Maker navigates closely around its recent highs. The persistence of their rallies hinges on maintaining this upward momentum and overcoming any immediate resistance. While the potential for further gains is tangible, any dip could rapidly shift focus to supporting levels. Traders should remain cautious as the next few sessions will be pivotal in determining the continuity of this bullish trend.