Aave Plunges Below $250 as Bulls Retreat While COMP Eyes Breakout Above $50

As Aave struggles after shedding 16% in a week, its recent uptrend faces a crucial test at the $250 psychological battleground. This DeFi giant has stumbled, slipping into a shaky technical structure that raises questions about its short-term future. Meanwhile, Compound hints at a potential breakout, with its price closing in on the $50 mark, standing at a pivotal juncture. Could Aave’s fall be an ominous warning for the broader DeFi market, or does Compound’s rally suggest resilience? Let’s unearth what the technical signals reveal about these contrasting narratives.

Aave (AAVE) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | AAVE(AAVE) | $244.05 | -15.87% | -1.32% | 42.0 | 20.4 | 2.40 | -103.07 |

|---|

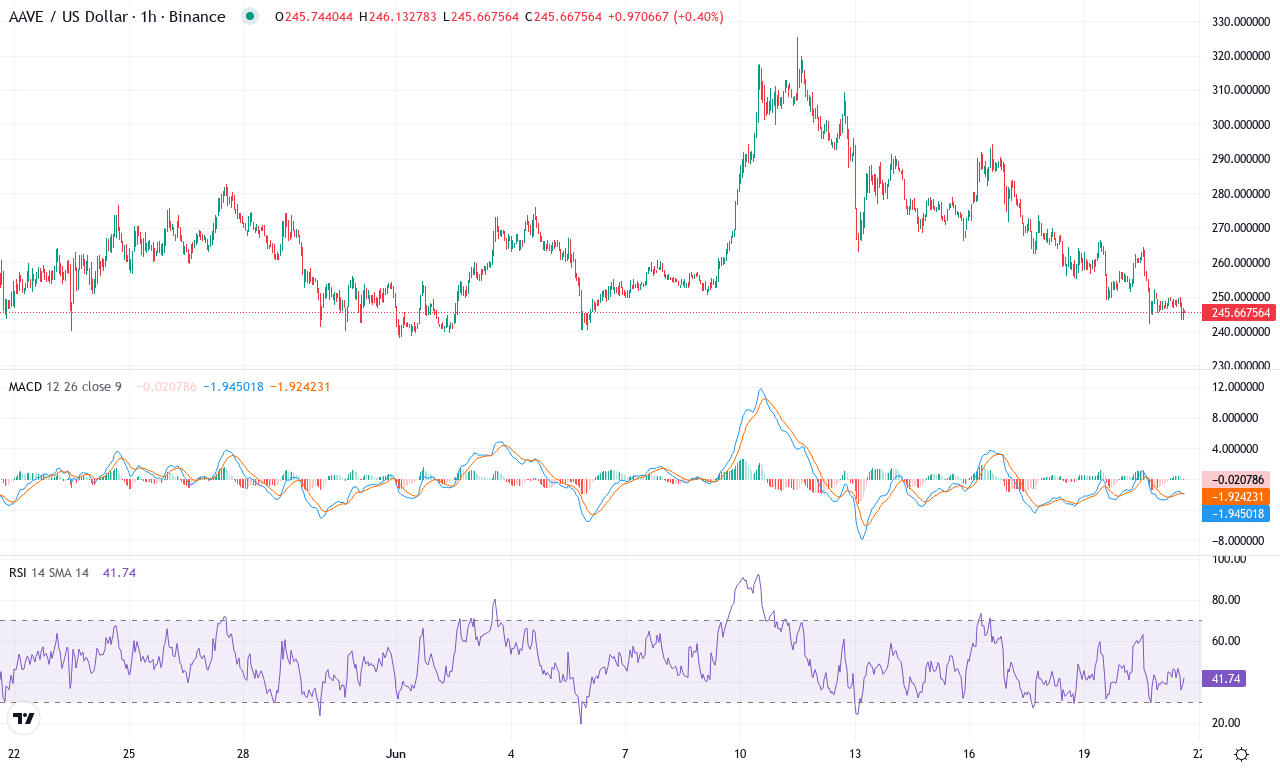

After a sharp 16% weekly drawdown, Aave is reeling from a significant volatility surge that wiped out most of its recent momentum. The DeFi stalwart has lost its grip at the $260–$270 range, retreating to $244 and erasing almost all of its hard-earned monthly gains. Contextually, the short-term reversal is dramatic: Aave had posted a bullish three-month rally, but the technical outlook now suggests bulls are on the defensive. With price action slicing through key moving averages and failing to defend the $250 psychological level, traders are left weighing whether this is a healthy correction or the prelude to a steeper slide. Honestly, I’m wary—when market structure buckles this quickly, caution trumps bravado.

Delving into the technicals, trend indicators are flashing warning signals. The average directional index is running hot, which confirms strong trend strength—but with sellers in control, that spells risk of an extended fall. The MACD is rolling over, with its lines converging lower and the histogram bleeding red—classic early signs of bearish momentum gathering force. Oscillators including the RSI are drifting away from overbought territory and toward middling ground, reflecting waning buy pressure. Aave trades below its 10-day and 20-day EMAs, putting immediate resistance at $263—if bulls can muster a bounce back above this zone, watch for renewed bids up to $280. However, a continued move lower opens up a clear path to major support near $230, a level I’d mark for potential accumulation—assuming sellers don’t trigger a full-fledged breakdown. For now, the dominant technicals err on the side of downside risk; if you’re already long, buckle up and keep stops tight.

Compound (COMP) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | COMPOUND(COMP) | $47.44 | -14.93% | 7.83% | 47.4 | 28.0 | 1.53 | -35.39 |

|---|

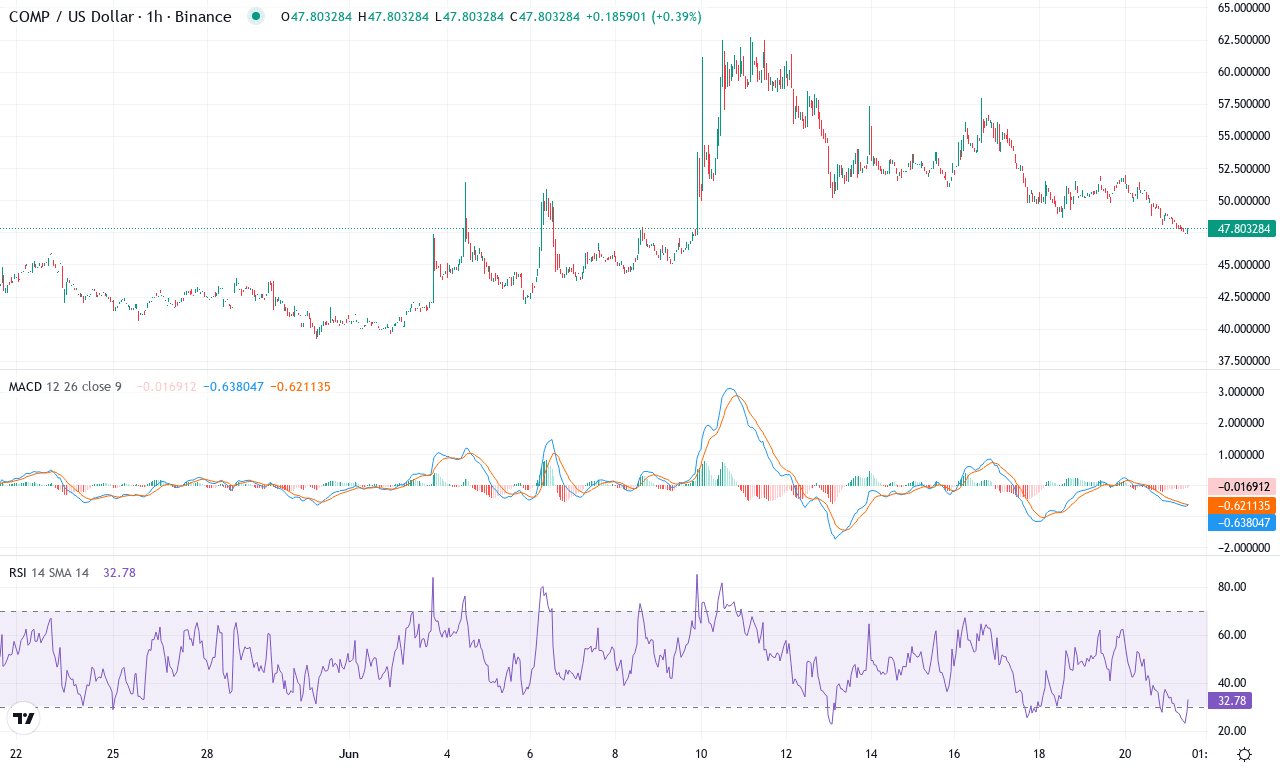

After a punishing six months that erased over 40% of value, Compound (COMP) finally found some footing this month, bouncing more than 7% off its recent lows near $39 to close around $47. Short-term price action feels turbulent—last week’s pullback of nearly 15% left nerves frayed—but with three-month and monthly performance turning positive, there’s hope that COMP may be carving out a durable base. What catches my eye is the sharp rally from the monthly low, especially as price action swirled close to a cluster of major support levels around $42–$45; that battle zone is where sellers previously overwhelmed buyers, making the current stabilization significant. For anyone watching the macro trend, the past year’s deep slide is hard to ignore, but signs of renewed accumulation and aggressive price defense set the stage for a potential bullish turnaround.

Technically, oscillators are lighting up with mixed signals, but the tide may be shifting. The average directional index is pushing north of 27, suggesting a trend is gaining traction, while the uptick in the positive directional indicator also hints at strengthening bullish momentum. The weekly MACD, though still negative, is showing signs of bottoming out, while the daily chart is flirting with a bullish crossover—a classic precursor to reversal rallies. Momentum indicators, including the RSI, are stuck in no man’s land, neither overbought nor oversold, giving COMP ample room to move if buyers burst in. On the moving averages front, price is clawing above short-term and intermediate EMAs—always a welcome sign after months under water—and the volume-weighted MA is narrowly supportive just below current levels. Watch the $50 psychological barrier: if bulls can decisively clear it, a quick run to resistance near $55 is on the cards; failure there could invite a retest of those sticky support zones in the low $40s. I’m watching this one closely—a decisive move is brewing, and the next 48 hours could set the tone for Compound’s summer.

Aave’s Challenge and Compound’s Opportunity

Aave’s drop below $250 highlights a critical juncture, as its trend weakness puts bearish pressure on any immediate recovery efforts. In contrast, Compound’s approach to the $50 resistance level suggests potential upside, contingent on fresh buying volumes. These divergent paths underscore the mixed sentiment within DeFi, where decisive moves will dictate each coin’s trajectory.