Aave Quant And Maker Flash Breakout Signals As Bulls Eye Untapped Highs

Aave, Quant, and Maker are currently in the spotlight, each brandishing robust monthly gains that signal a potential shifting of tides among DeFi heavyweights. This week, Aave surged beyond $300, challenging critical resistance levels as bullish forces muster strength. Meanwhile, Quant has broken away from its consolidation pattern, and Maker’s explosive rise hints at a renewed bull rally. Will momentum persist, or is a correction looming on the horizon? Let’s break down the technical setup across the board.

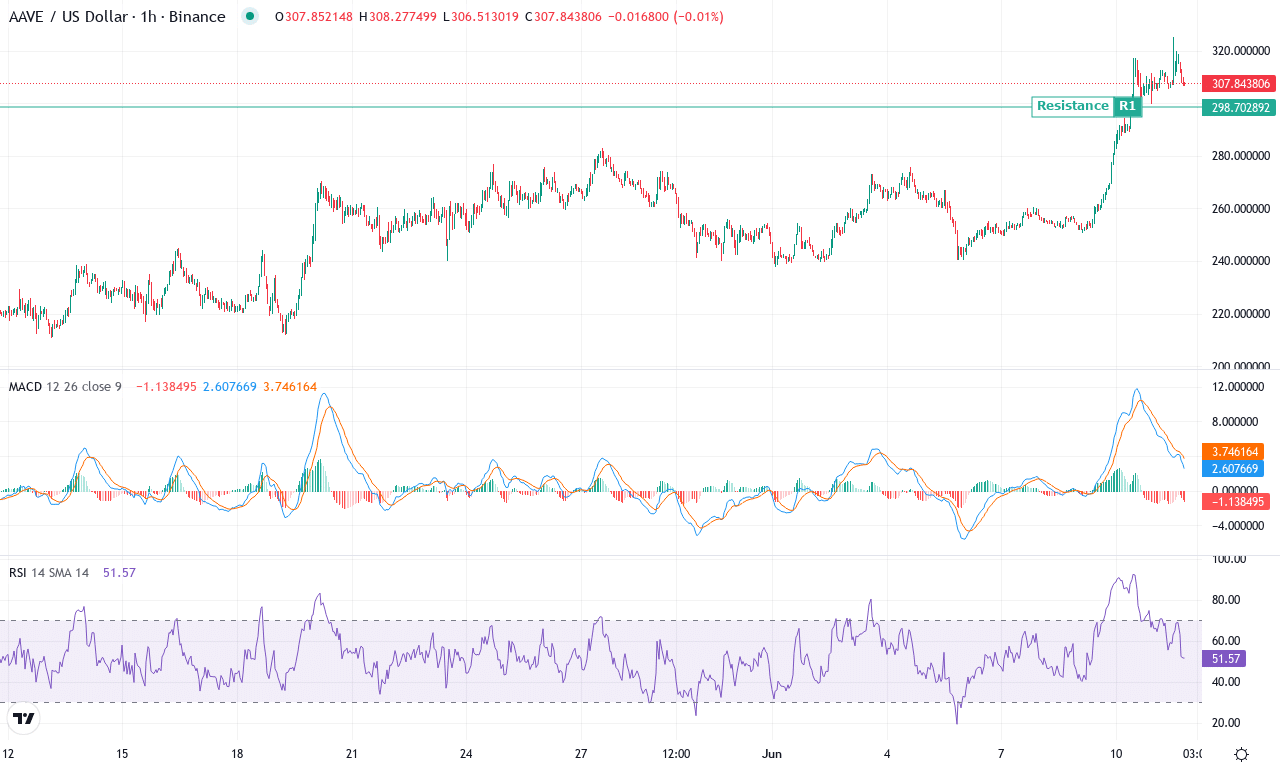

Aave (AAVE) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| AAVE(AAVE) | $307.98 | 15.47% | 39.43% | 71.4 | 30.4 | 16.40 | 270.60 |

After a month of surging momentum, Aave is firmly back on traders’ radars—up over 39% for the month and flexing one of the top returns across DeFi majors. The asset is climbing after a bruising six-month slide, showing it still commands deep interest in the sector. Bullish sentiment has translated into a fast move beyond the $300 psychological barrier, with price currently consolidating near monthly highs and threatening a potential breakout. Aave’s powerful recovery from its $210 monthly low stands out as both a technical rebound and a signal that the DeFi narrative isn’t dead—sometimes, all it takes is a spark for dormant bulls to stampede.

Digging into the technicals, trend indicators confirm the move: the ADX is well above thresholds that typically define a strong trend, with directional lines skewed positively—clearly, bullish control is reasserting itself. The weekly MACD shows accelerating momentum, and the daily Moving Averages have all aligned decisively beneath spot price, stacking up for upward continuation. Oscillator readings like RSI have heated up, but without flashing clear-cut overbought warnings—yet. I’m watching resistance at $325, where sellers have reappeared in previous rallies; a clean break opens a run toward the $350–$370 zone, especially if wider DeFi appetite returns. But caution never hurts: any loss of $275 support could drag Aave back for a retest of $235, especially if profit-taking kicks in or broader market headwinds flare. Big picture, all signs point to breakout momentum, but as always—stay nimble, and let price action be your guide.

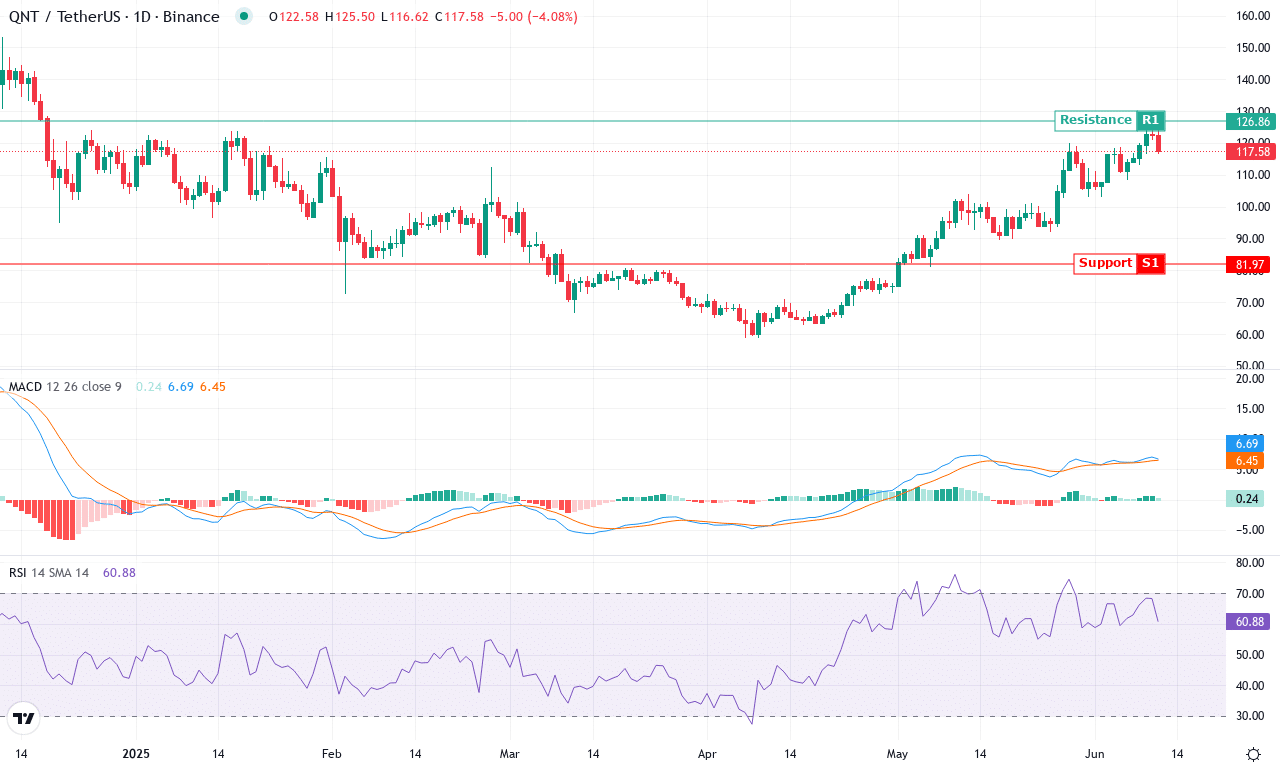

Quant (QNT) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| QUANT(QNT) | $117.77 | 1.18% | 19.08% | 61.1 | 33.4 | 6.70 | 92.75 |

After a volatile month marked by a robust 19% surge, Quant (QNT) is capturing renewed attention as its price action breaks out of lingering consolidation. Fresh off a monthly high of $125.56 and closing at $117.77, QNT has rallied nearly 54% over the past three months—no small feat considering the steep -15% drawdown it suffered six months ago. The narrative now turns: as Quant claws its way above key moving averages, bullish momentum is returning. That energy, combined with the coin’s ability to hold above $116 near-term, puts the focus squarely on whether buyers have the stamina to launch another leg higher. I’ll admit, these dynamics have me eyeing the next resistance with anxious optimism.

Digging into the technicals, trend indicators are emphatically tilting bullish. The ADX reading implies a robust trend; positive directional signals outpace negative ones, while the MACD line accelerates above its signal, reinforcing sustained breakout momentum. Oscillators also tell a bullish tale—RSI hovers in strong territory but hasn’t reached the classic overbought signal, hinting that there’s still gas in the tank. Price remains stacked well above the 10-, 20-, and 30-period exponential moving averages, all aligned in an upward slope, underscoring bullish conviction. The challenge comes at resistance near $126.86—a breach here could ignite a move toward $145.87, the next technical and psychological battleground. Conversely, if profit-taking drags QNT below the $111 pivot zone, look for a test of firmer support closer to $101. All signs point to a trend in Quant’s favor, but if sellers regain control, risks of a steeper correction mount quickly. I’m watching this breakout closely—it’s got all the makings of a decisive move.

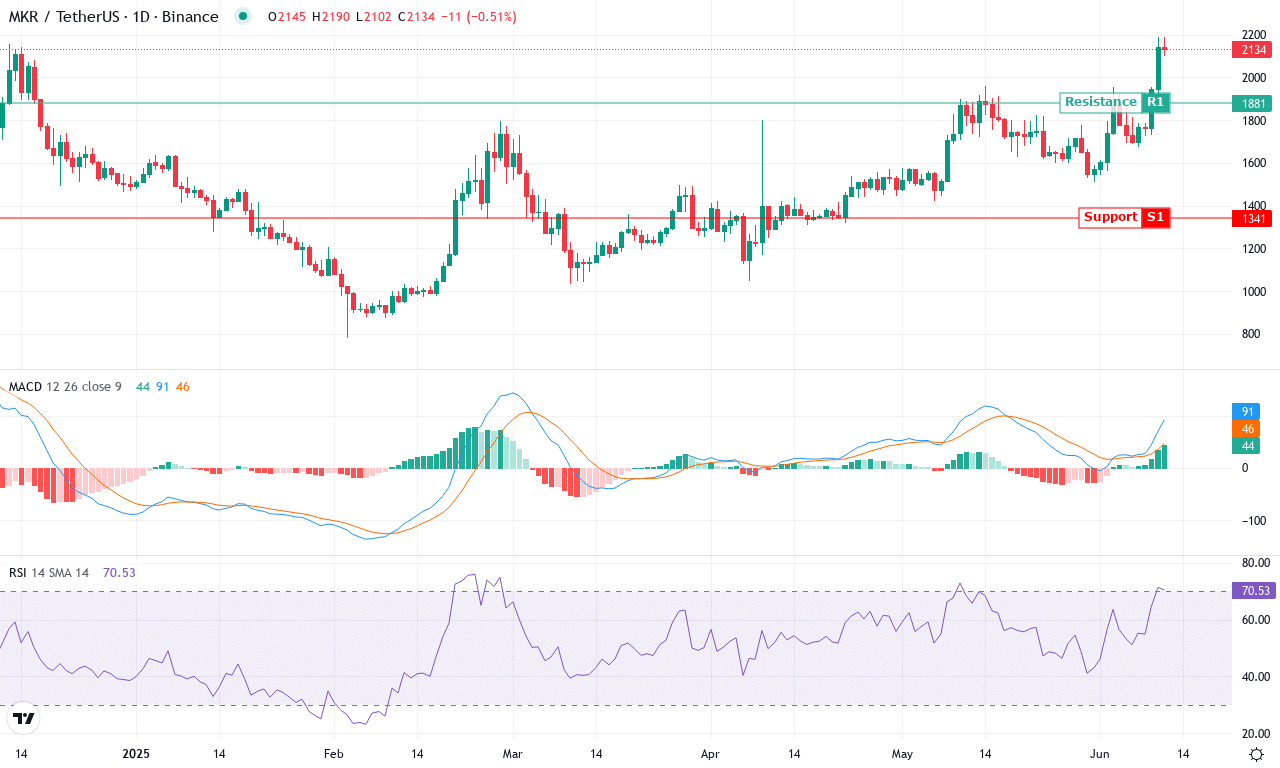

Maker (MKR) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| MAKER(MKR) | $2140.00 | 14.44% | 17.45% | 71.0 | 26.0 | 91.06 | 242.81 |

After a wild month marked by sharp volatility, Maker (MKR) has exploded higher, boasting a 17% monthly surge and nearly 90% gains over the last quarter. Short-term sentiment remains electric—MKR’s weekly rally has cut through layers of prior resistance, and price action now flirts with the upper bounds of the monthly range near $2,190. This kind of momentum doesn’t come out of nowhere. The technical outlook suggests a classic bull run in play: all major moving averages are stacked bullishly beneath the spot price, and the token is carving out new local highs, despite a shaky 6-month performance. Frankly, after watching Maker’s year-to-date rollercoaster, seeing bulls regain control here is a rush.

Diving into the technicals, trend indicators are on fire. The ADX is blazing above the “strong trend” threshold, and positive directional signals firmly outpace negative—textbook signs of breakout momentum. The weekly MACD is accelerating away from its signal line, while the awesome oscillator shows a healthy uptick, reinforcing that buyers have seized the wheel. Oscillators, including RSI, are overheated but not yet blowing into extreme overbought territory—a caution flag, not a stop sign. Maker is pressing well above its short- and medium-term moving averages, and has left key support levels at $2,100 and $1,900 in its slipstream. The next psychological hurdle sits at $2,200, followed by an ambitious stretch target up at $2,730. If sellers manage a reversal, expect a retracement toward $1,880 or even $1,685, where moving average and pivot confluence could catch the fall. All signs point to continued upside but beware: if this run fails to clear $2,200 decisively, a profit-taking surge could trigger a steep correction. For now, I’m watching with excitement—bulls have the momentum, but these are the moments when discipline matters most.

Can Bulls Sustain the Charge?

Aave’s leap past $300 sets a new bullish tone, though traders must watch for any fading momentum at resistance. Quant’s breakout from consolidation suggests bullish continuity, provided it maintains newfound support. Maker’s rapid ascent signals potential continuation if uptrend support holds firm. Each coin’s next steps hinge on sustaining buyer interest — the coming days will reveal if these advances are the beginning of a larger upswing or merely fleeting gains.