Aave Rockets While TAO and BCH Teeter as Bulls and Bears Jockey for Control at Critical Levels

Bittensor (TAO), Bitcoin Cash (BCH), and Aave (AAVE) are each navigating critical junctures amid contrasting market currents. TAO’s struggled attempt to stabilize following a steep correction and BCH’s balancing act above key levels are underscored by shifting bullish and bearish dynamics. Meanwhile, Aave’s meteoric rise hints at a larger trend reversal. As these tokens flirt with pivotal thresholds, traders face pivotal questions: will TAO and BCH overcome current resistance, and can Aave sustain its breakout momentum? Let’s take a closer look at the signals behind the move.

Bittensor (TAO)

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| BITTENSOR (TAO) | $372.10 | -10.64% | -0.51% | 43.6 | 20.8 | -6.39 | -156.00 |

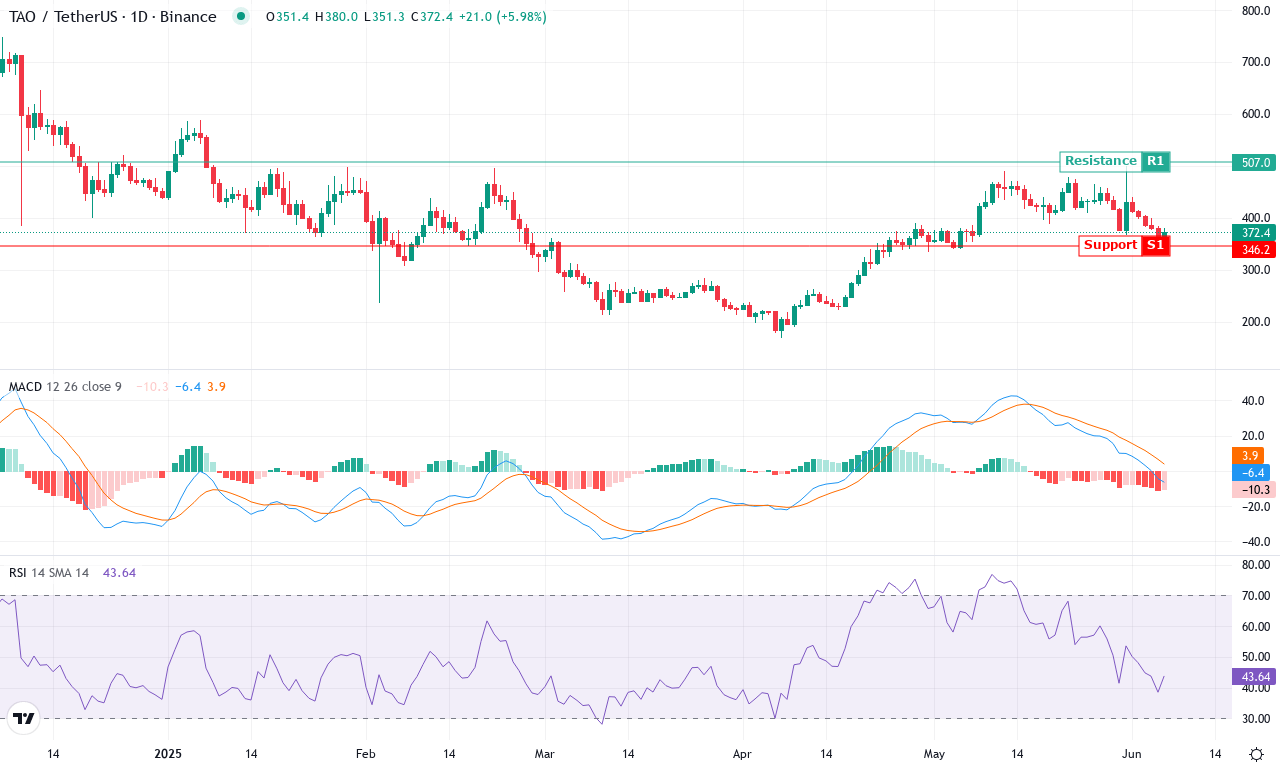

After a volatile month marked by a steep correction from highs near $500 down to $347, Bittensor (TAO) finds itself trying to stabilize. The coin’s one-week slide of over 11% underscores the waning bullish momentum, and the overall monthly decline hints at persistent profit-booking and lackluster demand. Despite this, Bittensor remains up over 34% in the last three months—a stark reminder of its explosive potential during risk-on phases. Currently, TAO is coiling just below $375, pivoting near its 100-day exponential moving average, suggesting traders are reassessing direction amid rapidly shifting sentiment. As the token flickers at these crossroads, my nerves are on edge—one decisive move could set the tone for the coming weeks.

From a technical perspective, trend indicators are signaling caution; the average directional index remains elevated, reflecting persistent volatility, but the positive direction index is fading while the negative index is climbing—clear signs that bears are regaining control. The weekly MACD has flipped negative, aligning with a slide in the awesome oscillator, both hinting at a deepening bearish reversal. Momentum oscillators have plunged, with RSI and Stochastic readings both teetering near the lower boundary, but not yet screaming oversold—there’s risk of an extended fall if buyers don’t step in soon. TAO’s support band sits around $346; losing this level invites a sharp drop toward the psychological $300 mark. On the upside, resistance looms heavy near $425; a breakthrough here would invalidate the bearish thesis and could ignite a scramble back to $500. For now, all signs suggest caution—sideline capital may be wise until volatility resolves, but don’t blink: when TAO moves, it rarely tiptoes.

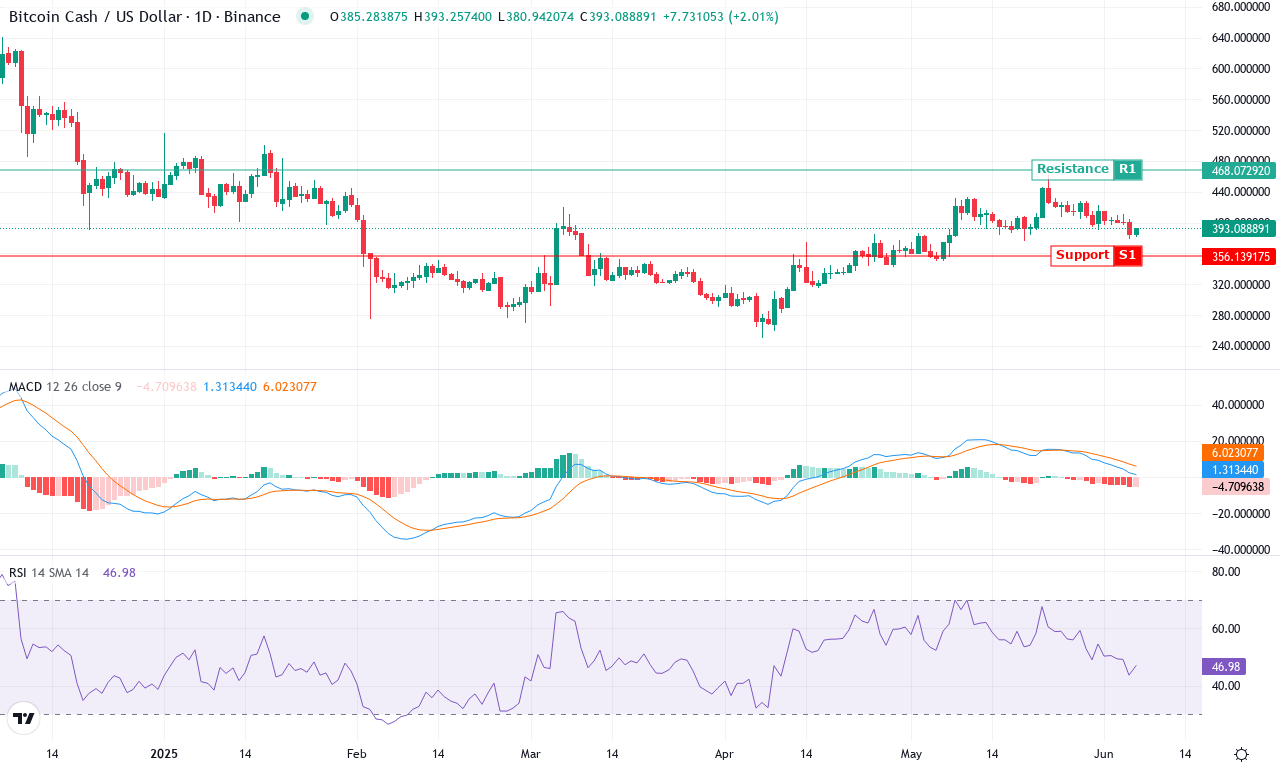

Bitcoin Cash (BCH)

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| BITCOIN CASH (BCH) | $392.33 | -4.40% | 4.69% | 46.6 | 21.4 | 1.28 | -119.77 |

After a turbulent month characterized by sharp swings between $376 and $461, Bitcoin Cash appears to be at an inflection point. Despite posting a modest 4.4% monthly gain, a weekly dip of nearly 5% betrays underlying volatility and lingering uncertainty—a far cry from the bullish surges seen in larger caps. The technical outlook suggests bearish momentum has cooled after a relentless six-month slide of -35%, as BCH now consolidates just above $390, where buyers and sellers are fiercely negotiating control. As trend indicators begin to steady, we’re seeing early signs of potential accumulation, though conviction remains tepid. If BCH can hold current levels and push through nearby overhead resistance near $400, it may well spark a short squeeze—frankly, I wouldn’t mind seeing the bears run for cover after such sustained pressure.

Digging deeper into the charts, the trend strength is still notable; directional indicators reveal bulls are battling back, but bear influence persists—no clear winner yet. The weekly MACD just flipped positive, suggesting a possible momentum shift, while oscillators hint at rising underlying strength despite the price hovering near critical technical thresholds. BCH is now testing a cluster of exponential moving averages between $388 and $400—a technical battleground that often decides immediate trend direction. Resistance zones loom overhead at $420 and $470, while reliable support sits at $375; a breakdown below this level risks extended falls toward $357. Momentum and RSI are ticking higher but remain far from overbought territory, leaving room for a push higher if volume and conviction return. If buyers can reclaim $400 decisively, the door opens for a rapid move toward $470; fail there, and profit-taking could trigger a steep correction. I’m eyeing this range closely—expect fireworks if BCH finally chooses a direction.

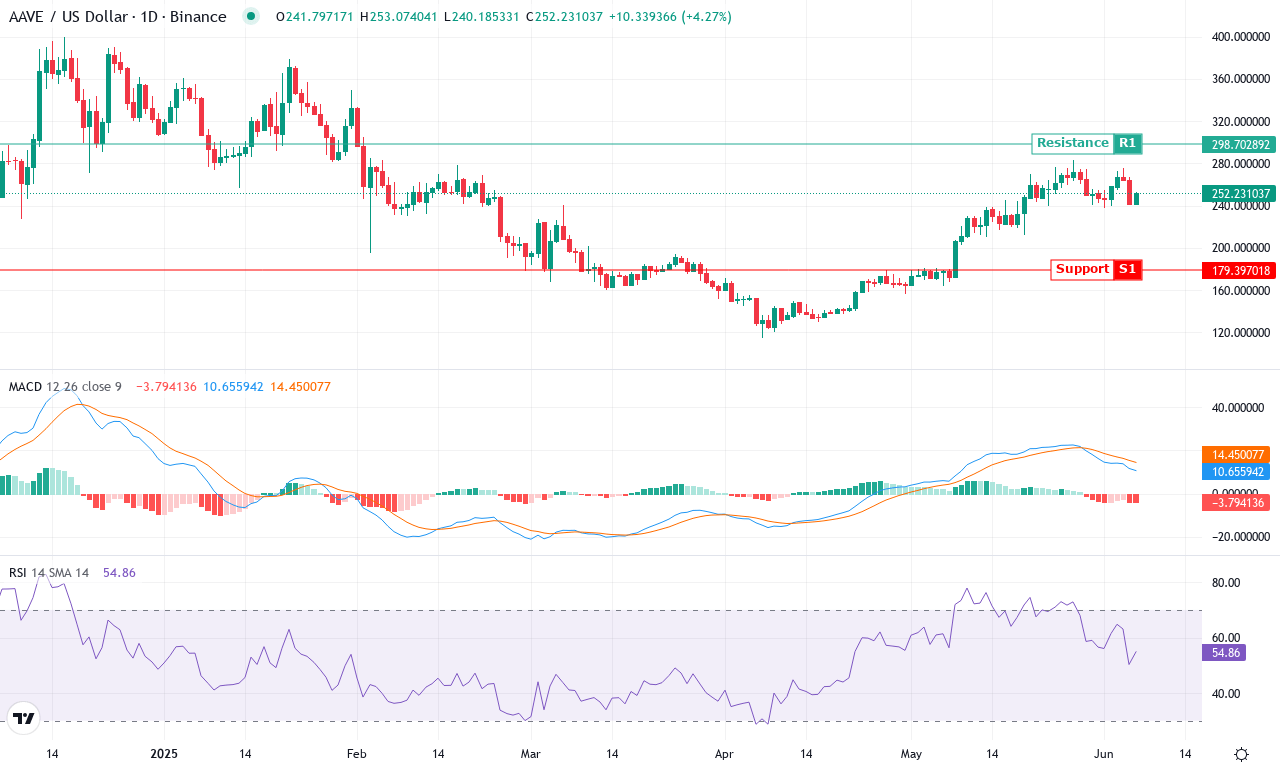

Aave (AAVE)

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| AAVE (AAVE) | $252.37 | 0.96% | 41.83% | 54.9 | 30.2 | 10.71 | -51.46 |

After a month of choppy trading, Aave (AAVE) is stealing the spotlight with a dramatic surge—up over 40% this month and wiping out several months of underperformance in one swift move. Price is now hovering around $250, which sits just below this month’s high at $282—a level that’s quickly emerging as the next battleground for bulls and bears. In just the past week, Aave’s ascent has been relentless, a rally powered by a resurgence in DeFi interest and broader optimism across risk assets. The long-term trend, while still recovering from earlier drawdowns, appears to be staging a comeback. If Aave can clear the $282 zone and maintain momentum, a break toward $300 could be in the cards—a move that would certainly get the market buzzing.

Under the hood, the technical outlook for AAVE is firming up. Trend indicators—especially a robust ADX reading north of 30—confirm that the ongoing rally has teeth, not just froth. The weekly MACD line continues to push higher, signaling sustained bullish momentum, while positive movement in the oscillators is spelling out a renewed sense of conviction. Notably, Aave’s price is anchored well above major moving averages, including the 20-day and 200-day EMAs—always a good sign when hunting for confirmation of trend. RSI has climbed into the 50s, but isn’t flashing warning signs yet; in fact, there’s room for upside before overbought conditions set in. Psychological support has shifted upward to the $224–$230 range, lining up with previous congestion and moving average clusters. If sellers manage to halt this rally, look for buyers to regroup in that zone. But if bulls manage to slice through $282, momentum-driven traders could quickly target the next resistance at $300—or even a retracement-extension just above. All signs point to an inflection; personally, I’m watching closely—if Aave punches through resistance, the resulting breakout could turn heads across the market.

Navigating Market Crossroads

Aave continues its upward trajectory, suggesting potential for a sustained uptrend if support holds firm. Meanwhile, TAO remains under pressure, and BCH must maintain its footing above current levels to stave off a reversal. The market is at a critical juncture, and traders will be closely watching for the next wave of indicators to decide the direction.