Aave Teeters at Crossroads as Compound Bulls Roar—Will Volatility Ignite a Breakout or Trap Traders?

While Aave struggles with recent market volatility after an impressive start to 2024, Compound is displaying fresh vigor, rallying 22% over the past month. As Aave hovers near $271, drifting from resistance levels, Compound enjoys renewed bullish momentum with positive sentiment driving its climb past $52. Bulls face crucial tests on both fronts: will Aave overcome its downturn, or will Compound sustain its rally? Let’s break down what the indicators reveal.

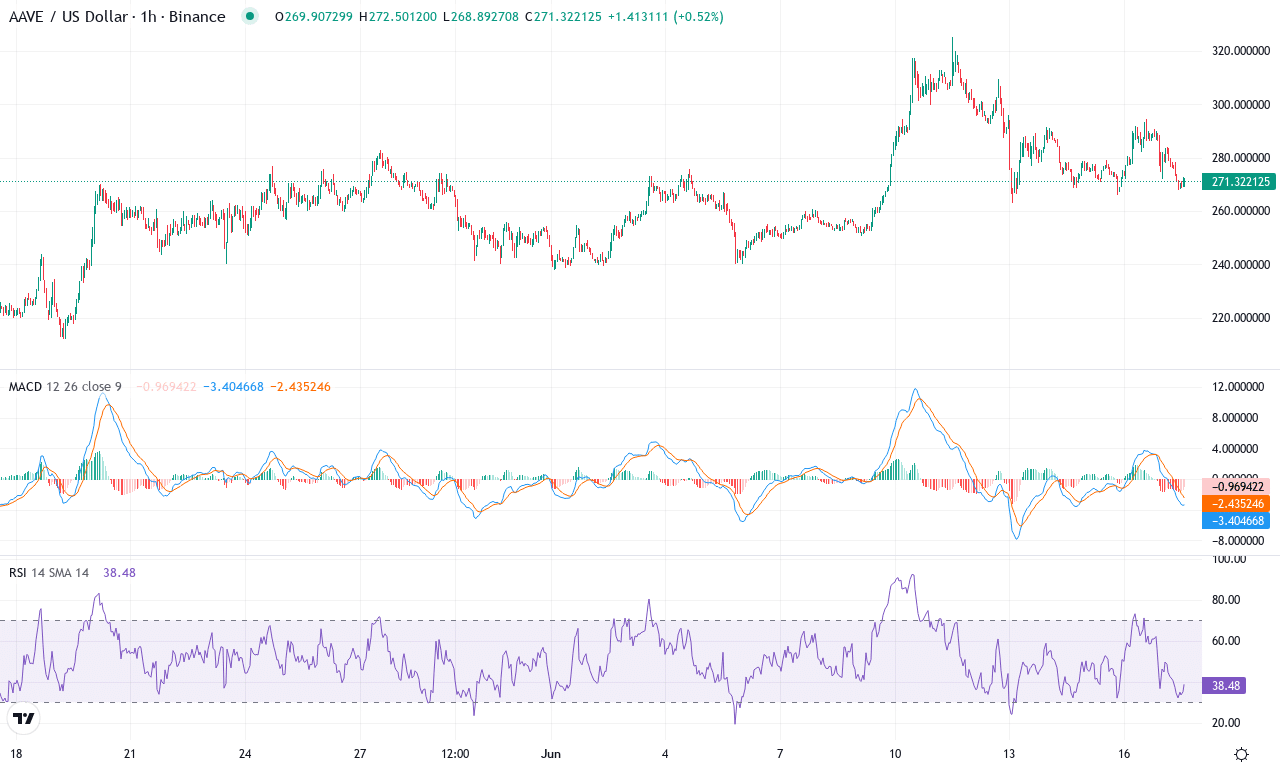

Aave (AAVE) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | AAVE(AAVE) | $271.29 | -4.18% | 22.04% | 53.6 | 26.4 | 11.30 | 25.32 |

|---|

After a stellar run in the first half of 2024, Aave has transitioned into a period of volatility, with last week’s action underscoring increasing uncertainty. Despite notching a robust 22% monthly gain and over 59% in the past three months, AAVE’s recent -4% week raises questions about whether bullish momentum is ebbing or merely pausing before a fresh leg up. The price currently hovers at $271, retreating from its monthly peak near $325, as sellers try to regain control. I’m feeling cautious here—these sudden swings tend to flush out weak hands, yet underneath the noise, trend signals remain constructive.

Diving into the technicals, the weekly MACD remains positive, but its narrowing gap versus the signal line hints at waning upside momentum; oscillators reflect some cooling off, while trend indicators still point upward—albeit less emphatically. The fact that AAVE is holding above its short-term and longer-term exponential moving averages speaks to underlying strength, and the ADX remains elevated enough to suggest that the trend is by no means exhausted. Key support sits around $244, just above the confluence of major moving averages, while the first resistance looms at $298, with $325 as the critical breakout level. If bulls can reclaim and close above $298, a run to $350 isn’t out of reach. But failure to do so could open the door to a steeper correction—perhaps down to that $230–$244 zone. For now, the technical outlook suggests staying nimble as AAVE’s next move will likely be decisive; I’ll be on edge watching for either a volatility surge higher or the bears finally staging a reversal.

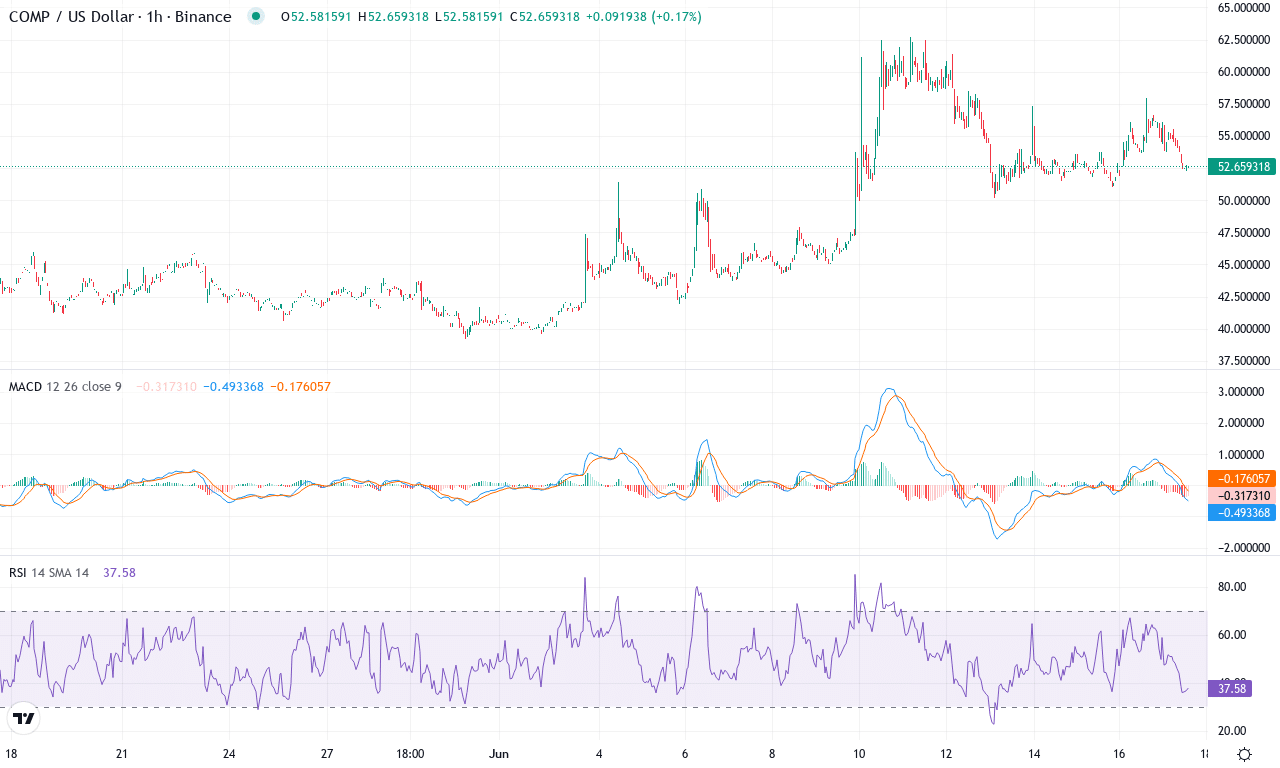

Compound (COMP) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | COMPOUND(COMP) | $52.59 | 2.57% | 21.87% | 56.6 | 31.6 | 3.03 | 60.27 |

|---|

After weeks of drifting in a lackluster sideways range, Compound (COMP) is showing newfound energy, closing at $52.58—an impressive 22% surge over the past month. Short-term sentiment has turned more upbeat, with the token notching another 2.5% gain this past week and decisively leaving its monthly lows behind. This reversal comes as COMP claws its way out from a long, grinding 6-month downtrend, hinting at a potential shift in macro momentum. With accumulators lurking below $40 and a high of $62.70 still fresh in traders’ minds, Compound’s technical outlook now suggests that bullish momentum is gaining traction—especially as oscillators and moving averages start to align in the bulls’ favor. If you’ve been waiting for signs of real conviction, this might just be it.

Digging deeper into the chart, trend indicators show healthy acceleration: the ADX is robust, while positive directional movement swells far above the negative, a classic sign that bulls are regaining control. The weekly MACD line has crossed over its signal and is turning higher, supporting the case for sustained breakout momentum. Meanwhile, the recently surging RSI remains well under overbought territory, reflecting an upward push with room to run before stretched conditions set in. COMP is consolidating above all major moving averages, including its 10- through 200-period EMAs—a clear vote of technical confidence. The token is pressing toward a resistance zone near $55, and if buyers overcome this barrier, the path to $62—and possibly a retest of the quarterly highs—opens wide. Should sellers defend this area, expect a profit-taking pullback toward support at $47. If Compound breaks above $62, I’d be thrilled—this could ignite a new momentum wave. But if the rally fizzles, keep your stops close; risks of an extended fall are real in this volatile landscape.

Volatility’s Next Move

Aave remains precarious, teetering near key supports around $271 amid heightened uncertainty. In contrast, Compound’s recent surge past $52 sets the stage for continued bullish action, contingent on market sentiment holding firm. While traders eye these pivotal levels, the coming sessions are crucial — the unfolding volatility could ignite significant moves for both assets.