AB And AERO Eye Breakout Highs As Momentum Peaks But Overbought Fears Linger

AB and Aerodrome Finance (AERO) have both soared to new monthly highs, captivating traders with their rapid recoveries amid broader market shifts. AB’s staggering 36% weekly climb and AERO’s blistering 35% surge highlight fresh momentum, yet both now hover near critical resistance levels. As traders revel in recent gains, the question arises: Will these assets break through to even higher ground, or are we poised for a cooldown? Let’s delve into the technical landscape to see what’s next for these momentum-packed plays.

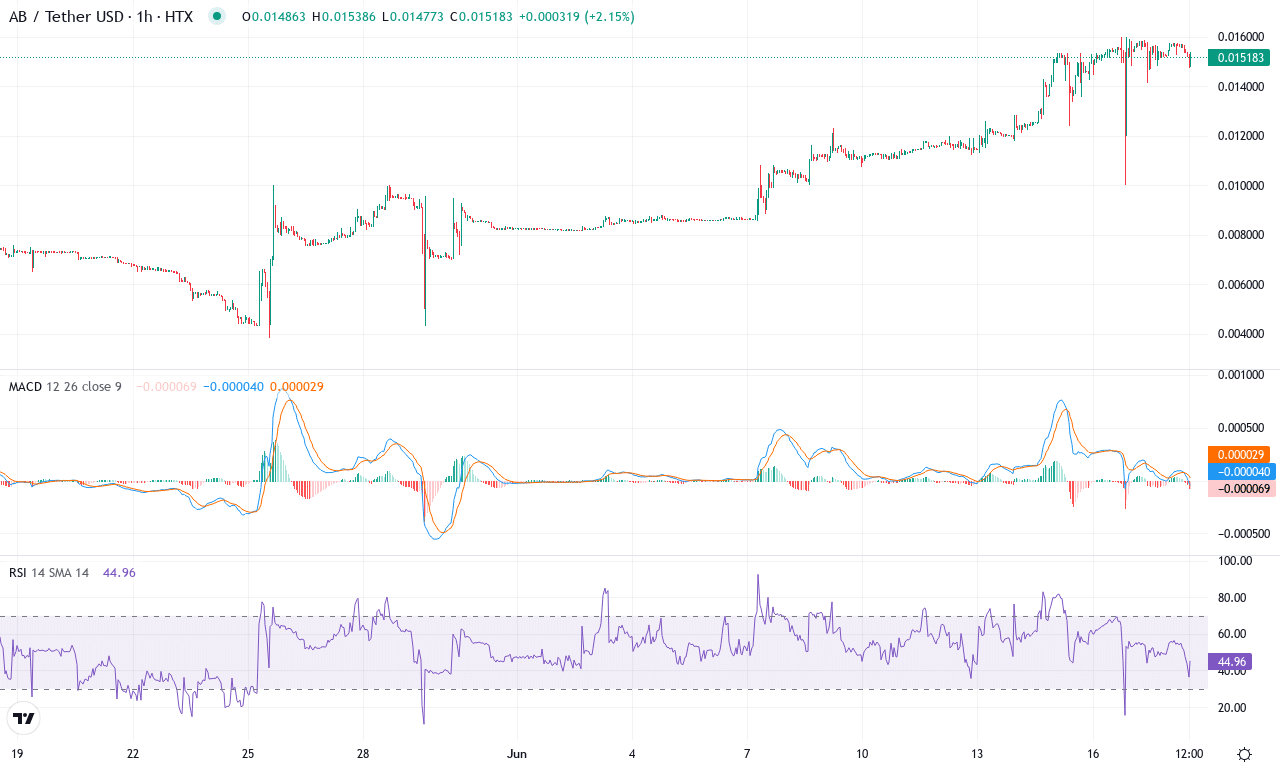

AB (AB) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | AB(AB) | $0.02 | 36.42% | 103.20% | 76.7 | 29.5 | 0.00 | 145.19 |

|---|

After weeks of relative uncertainty and sharp price swings, AB has taken many by surprise by rocketing over 100% higher this month and posting a stunning 36% gain in just the last week. This explosive rally has not only reversed lingering bearish sentiment from earlier in the quarter but has catapulted the price into striking distance of its monthly high at $0.016. The rebound comes on the back of an astronomical six-month performance, suggesting institutional demand or a major catalyst is at play. Yet with price now consolidating just below that recent peak, the market is on edge—are we looking at a prelude to further upside, or will profit-taking trigger a steep correction? This is one of those moments when you sit up straight: big moves breed bigger opportunities, and the technical setup is nothing short of electric.

Diving deeper into the chart, trend indicators are signaling robust bullish momentum—ADX is elevated, with positive directional movement reinforcing that buyers are still in control. The weekly MACD continues to edge higher and maintains a bullish cross above signal lines, while supporting oscillators and momentum gauges—Momentum, Commodity Channel Index, and the Ultimate Oscillator—remain strong but hint at overheating. RSI is pushing into the overbought zone; this often precedes a pullback, so I’m watching closely for any stalling price action near the immediate resistance at $0.016. Above this, a convincing breach could trigger a short squeeze, targeting psychological levels near $0.023. However, if bulls lose steam and sellers exploit these stretched conditions, look for an initial slide towards $0.012, with further support resting at the monthly low of $0.0038. All signs favor the breakout scenario, but let’s not forget—in crypto, reversals can be just as violent as rallies.

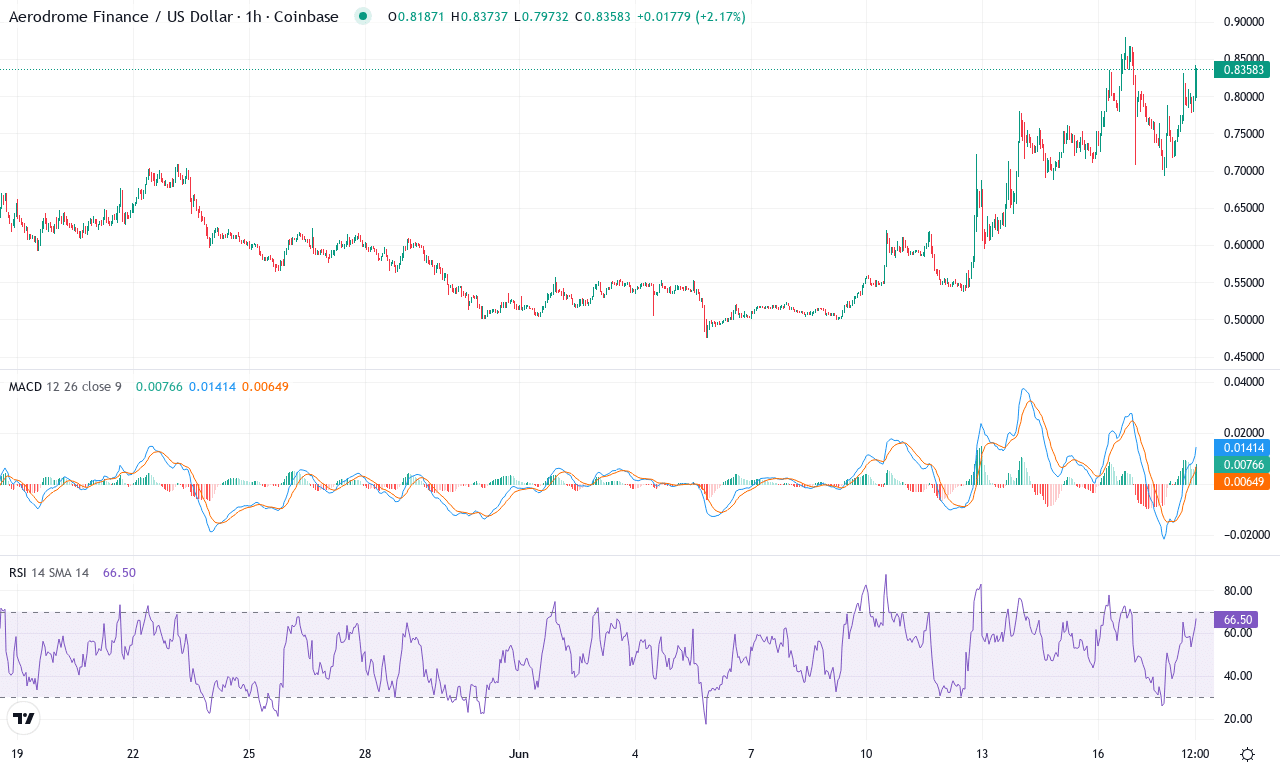

Aerodrome Finance (AERO) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | AERODROME FINANCE(AERO) | $0.82 | 35.83% | 25.72% | 65.2 | 31.5 | 0.05 | 137.77 |

|---|

After languishing for months in a downward spiral, Aerodrome Finance (AERO) has delivered a blistering rebound, notching a remarkable 35% weekly surge and over 25% gains for the month. With price currently hovering near the monthly high at $0.82, momentum has decisively swung back in favor of the bulls. It’s a dramatic turnaround after a six-month rout, and while the yearly figure still shows losses, the past quarter’s 50% rally cannot be ignored. This fresh burst of energy coincides with a broader DeFi revival that’s fueling renewed optimism across the sector. Volatility is elevated, and AERO’s technical posture suggests breakout momentum could extend if buyers maintain control—a scenario that has me leaning bullish if current trends hold.

Technical analysis reveals a convincing shift in trend. The average directional index indicates strong trend strength, with positive directional movement cemented well above its bearish counterpart. The weekly MACD is accelerating, and both traditional oscillators and the RSI are advancing with purpose—RSI readings are approaching levels that hint at overbought conditions, but history shows AERO can run hot during sharp upswings. Price action is firmly above all key moving averages, a classic sign of bullish momentum regaining control, and support has now moved up to the $0.60–$0.65 zone. The next resistance sits around $0.88, close to the monthly high; if bulls can push through, a stretch to the psychological $1.00 mark comes into view. On the flip side, a failure to hold above $0.76 could trigger much-needed profit booking and open the door to a swift correction. Right now, with so many indicators lining up, all signs point to further upside—just be ready for volatility as the market digests these explosive moves.

Can The Rally Sustain?

AB is testing a crucial resistance, while AERO’s momentum faces its first major test as it nears its monthly peak. A decisive breakout above these levels could signal continued upward momentum, but caution is warranted as overbought signals flash. The next sessions will be pivotal in determining whether these cryptos will extend their rally or retreat into consolidation.