Avalanche And Injective On The Brink As Key Supports Face Bearish Onslaught

Avalanche and Injective are both teetering on the brink as bearish forces threaten to push them past crucial support zones. Following a month marked by relentless downturns in both tokens—AVAX taking a 15% dive and INJ close to its low at $10.99—traders are tensely eyeing whether these levels will hold or succumb to further declines. Key indicators continue to signal pressure, raising the question: are we on the verge of a bearish breakdown, or is a rebound in sight for these struggling assets? Let’s take a closer look at the signals behind the move.

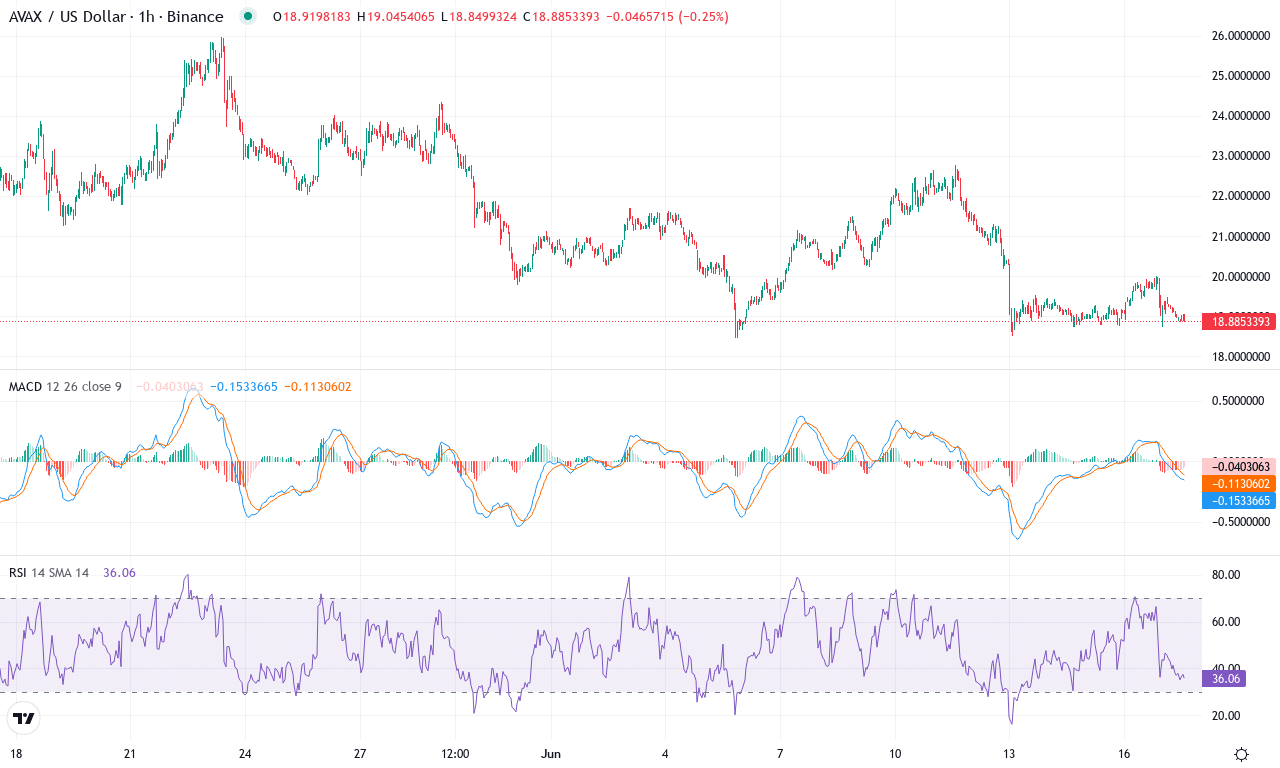

Avalanche (AVAX) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | AVALANCHE(AVAX) | $18.95 | -13.69% | -14.61% | 39.0 | 16.1 | -0.77 | -107.43 |

|---|

After a brutal six-month slide, Avalanche (AVAX) is hanging onto support by a thread following another sharp double-digit drop this week. The token’s monthly performance is down nearly 15%, capping a relentless string of lower highs and profit-taking surges. With price action retreating toward $18.45—the monthly low—and trading well beneath the 6-month and yearly averages, traders are on edge, eyeing any glimmer of bullish reversal. The technical outlook suggests sellers are still in control, and with AVAX sitting near crucial long-term moving averages, risks of an extended fall aren’t off the table. If Avalanche can’t reclaim momentum soon, we could witness further capitulation as bears tighten their grip.

Digging into the technical setup, trend indicators show persistent bearish momentum: the positive directional index is fading while the negative side remains dominant, and oscillators are still pointing lower, leaving little room for relief. The MACD line reflects a deepening downtrend, sitting firmly below its signal—momentum remains negative both on daily and weekly frames. RSI isn’t yet in oversold territory but continues to decline, and with the ultimate oscillator steady but uninspiring, there’s no strong case for an immediate bounce back. AVAX is hovering just below key exponential moving averages and hugging the lower bounds of its weekly range, with the next major support clustered around $17.65. If buyers manage to engineer a close above $22.20, that would be the first sign of serious bottom-fishing—until then, any rally attempts should be viewed with skepticism. If sellers push through $18.45, the door is open for a steep correction toward deeper lows. I’m watching closely—capitulation can be a nightmare, but it can also signal the birth of a new trend if the weak hands are flushed out.

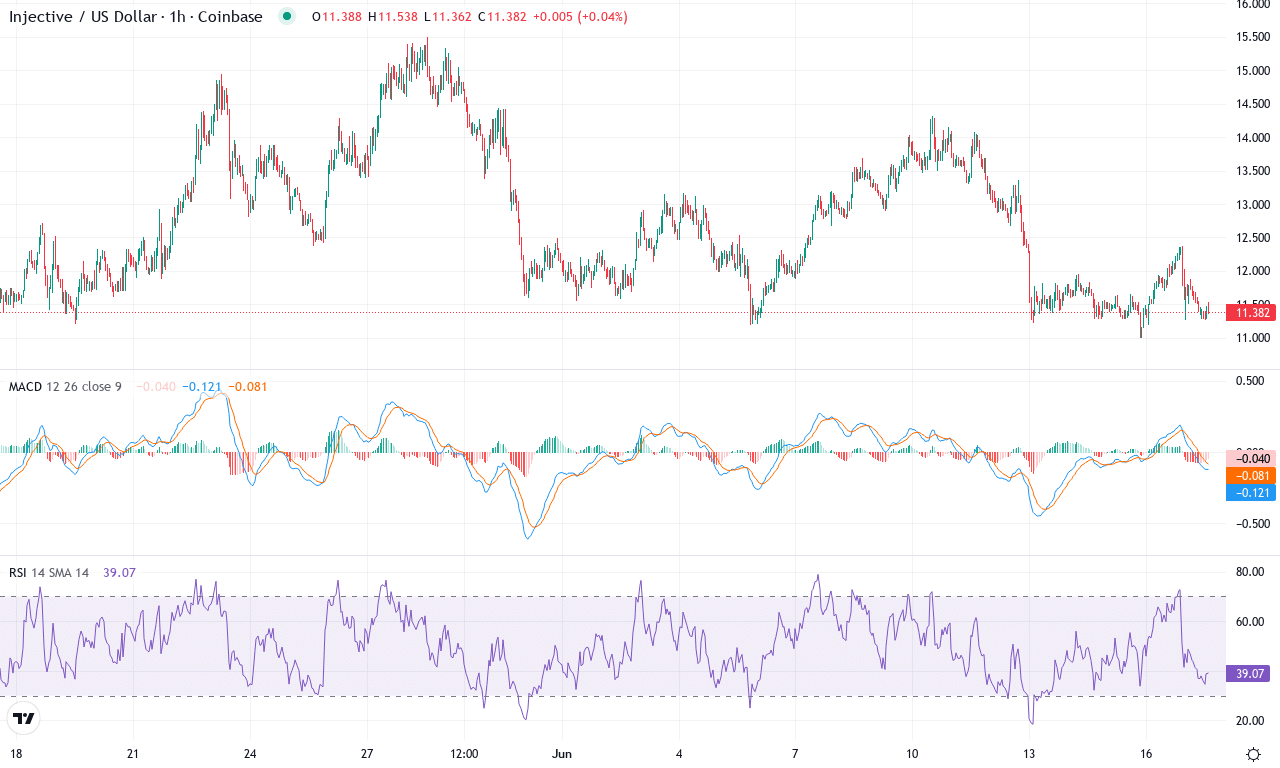

Injective (INJ) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | INJECTIVE(INJ) | $11.36 | -17.50% | -2.25% | 42.5 | 16.8 | -0.18 | -90.58 |

|---|

After a punishing few weeks, Injective (INJ) is struggling to regain its bullish footing. Following a sharp -17% drop over the last week and a softer -2% monthly decline, INJ now sits well off its recent highs. The macro trend has clearly shifted from its explosive Q1 run: six-month returns are now down a staggering -53%, and yearly performance is deep in the red. Despite fleeting attempts by bulls to defend the $12 zone, sellers have kept the pressure on, driving price dangerously close to its monthly low at $10.99. If buyers can’t muster momentum soon, Injective could risk another extended fall, especially with current sentiment still rattled. As a trader, seeing so many chase the bounce prematurely always makes me wince—patience is key in this kind of market turmoil.

Technically, the outlook remains fraught. Trend indicators reveal growing bearish momentum; directional gauges are elevated and negative, reflecting persistent selling pressure, while the weekly MACD is languishing in negative territory with little sign of a reversal. Oscillators reinforce this caution: RSI sits near 44, safely out of oversold, but nowhere near suggesting a bullish resurgence, and momentum indicators are still stuck in negative ranges. Price action has sliced beneath the short- and medium-term exponential moving averages, reinforcing that sellers are in control for now. Immediate support sits near $11, and a breakdown here could open the door for a deeper move toward $8.80—coincidentally, a psychologically charged round number where bargain hunters might step in. On the upside, bulls have a lot of work to do: only a sustained push above resistance at $15.50 would signal invalidation of the bearish thesis and hint at a new leg higher. All signs point to caution—if you’re still holding out hope for a turnaround, I’d treat any snapback as a relief rally, not a trend reversal… at least, not yet.

Is a Rebound Possible?

Avalanche hovers near a critical support area around $9, while Injective seeks stability just above $10. If these levels falter, a swift bearish continuation could ensue, but any hold might trigger a relief rally. Traders should watch closely for shifts in momentum — the next few days hold the answer.