AVAX And Litecoin On Edge As Key Support Levels Test Nerves—Will Sellers Trigger The Next Breakdown

Avalanche (AVAX) and Litecoin (LTC) are walking a tightrope, with both assets testing the patience of traders at key support levels. AVAX has trailed off nearly 20% over the last month, teetering near a critical $18.45 zone, while Litecoin sits precariously above its $86 floor after failing to reclaim the $100 mark. Market forces are set to challenge the nerve of bulls and bears alike—will the tables turn, or is another bearish wave imminent? Time to assess what the key technical indicators are hinting at.

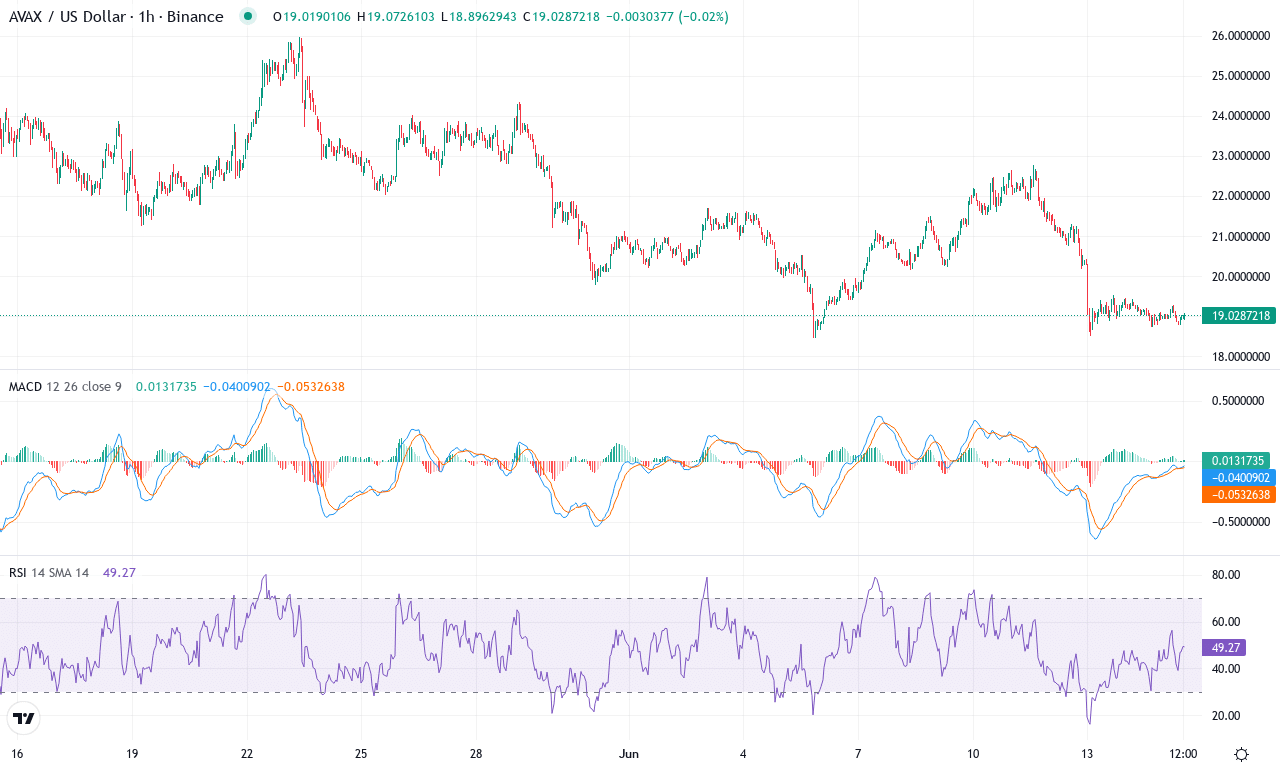

Avalanche (AVAX) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | AVALANCHE(AVAX) | $19.01 | -8.07% | -19.17% | 39.1 | 16.6 | -0.68 | -125.31 |

|---|

After a turbulent month, Avalanche (AVAX) finds itself under pressure, with price action slipping nearly 20% over the past four weeks and failing to recapture any bullish momentum after a bruising 61% drawdown in the past half year. Despite some short-lived optimism earlier in the quarter, bears have regained control, driving AVAX down toward the lower end of its monthly range and testing the critical $18.45 support zone. Volatility has surged, and recent attempts at a rebound have faltered below resistance, leaving short-term sentiment shaky. If sellers keep pressing, there’s a real risk of a steeper correction unfolding—traders should brace for a wild ride if these support levels give way.

The technical outlook suggests momentum remains pointed south: trend indicators like ADX are firm, signaling robust downside pressure, while a negative crossover in the weekly MACD hints that bearish momentum could persist longer. The current price hovers just above key exponential moving averages and pivots, though a real rally needs a decisive close above $22 to flip the script. Oscillators echo uncertainty—RSI has slipped into neutral territory after an earlier overbought stretch, and other momentum measures flash waning enthusiasm. For now, the $18.45 support zone is the last line of defense; if that breaks, look for downside targets near $17.65 or even $14.50. But if bulls stage a reversal and reclaim $22, AVAX could target $25 and beyond. Personally, I’m watching this standoff with caution—when assets coil up at make-or-break levels, the next move can be explosive either way. Stay nimble: Invalidating the bearish thesis with a swift rebound remains possible, but the bears rule the tape for now.

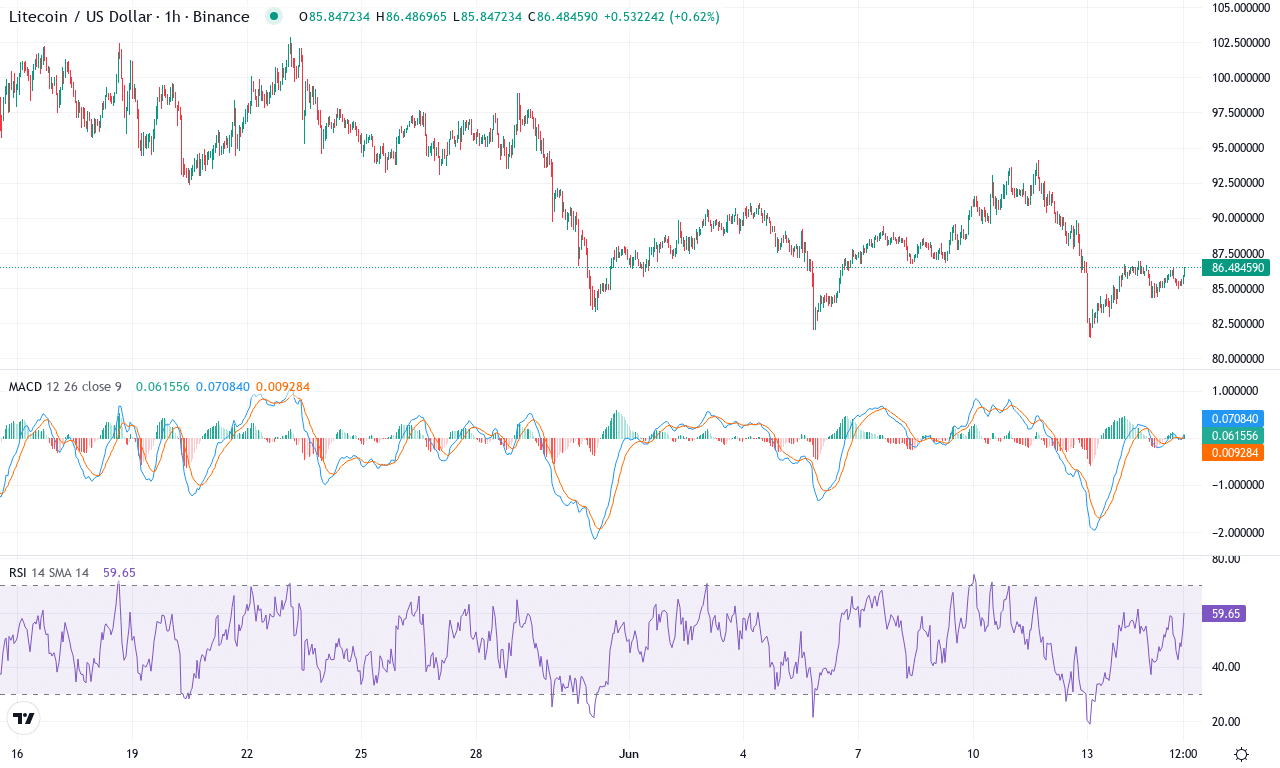

Litecoin (LTC) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | LITECOIN(LTC) | $86.37 | -2.31% | -13.02% | 43.9 | 19.6 | -1.58 | -78.08 |

|---|

After a brutal month marked by a sharp 13% drop and a failed attempt to reclaim the $100 zone, Litecoin is firmly in the spotlight for all the wrong reasons. Recent price action shows LTC hovering near $86, teetering just above its monthly low and casting a shadow over any bullish aspirations as it approaches critical support. Short-term performance is lackluster—last week saw a further 2% slide, highlighting how downward momentum is gathering steam while buyers appear hesitant at pivotal levels. With year-to-date gains practically erased and traders licking their wounds after a steep 6-month decline, there’s an unmistakable air of caution hanging over the chart. The technical outlook suggests sellers remain in control, and unless bulls can spark a meaningful reversal, risks of an extended fall are rising fast.

Digging into the technicals, trend indicators are flashing bearish signals. The ADX is perched at relatively high levels, with negative directional movement outpacing positive, reinforcing the strength and persistence of the current downtrend. The weekly MACD continues to drift deeper into negative territory—clear evidence of sustained bearish momentum and increasing downside pressure. Oscillators like RSI are hovering in mid-range territory, nowhere near oversold, which means there’s room for further losses before any potential bounce back. Price has not only slipped below its 50- and 100-period exponential moving averages but is also struggling to hold above the 200-day baseline, a classic setup for deeper correction. Immediate support sits near $82—if this cracks, Litecoin could quickly tumble towards $76 or even the psychological $70 level. Should buyers mount a comeback and LTC climb back above $90, the first real resistance emerges around $102, coinciding with last month’s high and a cluster of technical pivots. Frankly, unless sellers get exhausted soon, the path of least resistance looks lower—I’m worried here; remember, you’re not in the red until you sell.

Will Traders Hold the Line?

AVAX rests at its $18.45 support, and LTC flirts with its $86 level as both cryptos face a pivotal juncture. A breakdown below these areas could accelerate selling pressure, while a bounce could offer a respite or reversal. Traders should brace for volatility as market dynamics test current support.