Bitcoin And Monero Face Showdown As Bears Tighten Grip Near Pivotal Support

Amidst shifting tides, both Bitcoin and Monero are encountering unexpected challenges, highlighting a pivotal moment for cryptocurrency investors. After Bitcoin’s impressive gains earlier, it now finds itself down by 8% this month as it falters at a significant support level. Meanwhile, Monero’s steep 20% downturn from its recent highs indicates potential over-exhaustion as traders reassess its prospects. With technical indicators painting a cautionary tale, market participants are on edge, gearing up for what’s next. Let’s take a closer look at the signals behind the move.

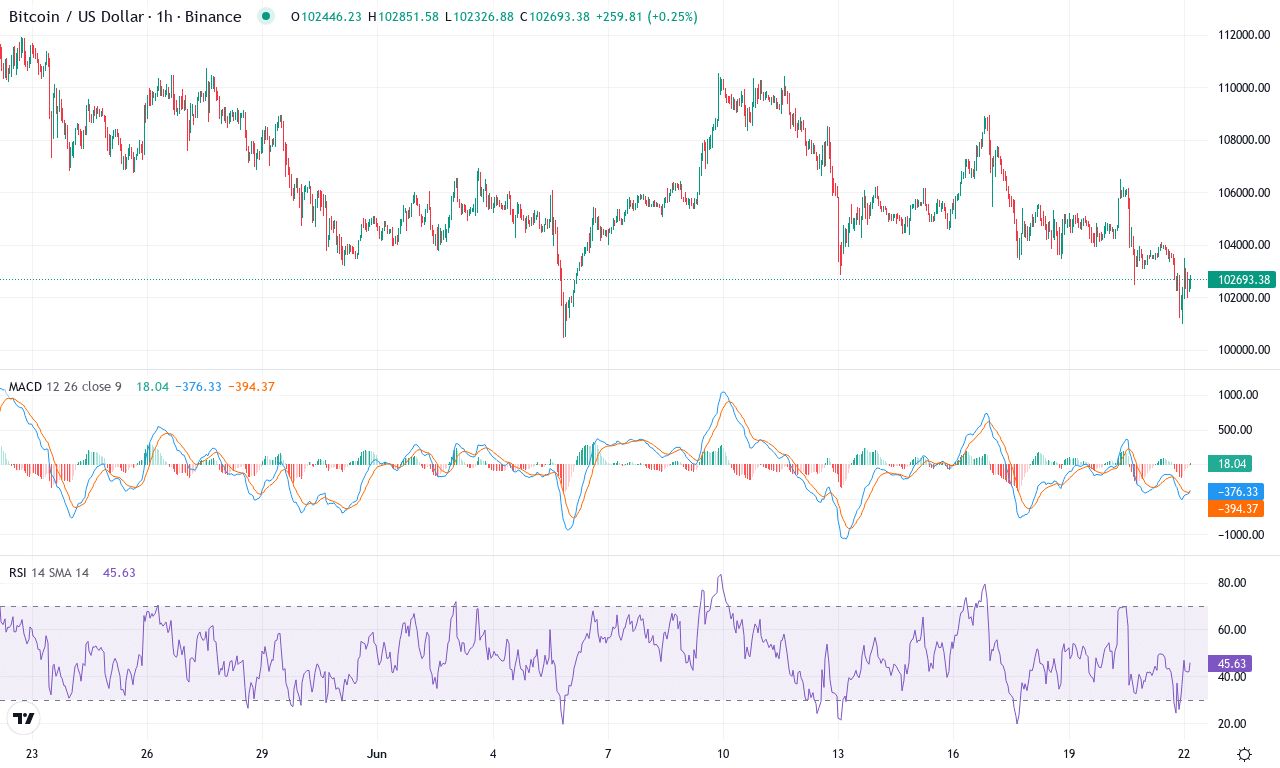

Bitcoin (BTC) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | BITCOIN(BTC) | $102619.32 | -2.73% | -8.04% | 42.5 | 17.0 | -378.87 | -125.88 |

|---|

After an impressive run over the past quarter, Bitcoin is now grappling with renewed volatility, registering an 8% monthly pullback and sliding roughly 2.7% for the week. This loss of momentum comes after a multi-month advance of nearly 19% as bulls earlier drove prices to a new monthly high above $110,700. But the mood has shifted—Bitcoin is now hovering near $102,600, unable to decisively reclaim ground as profit-takers seize the upper hand. The technical outlook suggests the market is at an inflection point; traders are watching for direction with bated breath. If Bitcoin breaks back above $105,000 and flips that level into support, a retest of the $110,000 region is on the table. But with sellers growing bolder, the recovery faces an uphill battle.

Diving into the technicals, trend indicators are signaling caution. The average directional index flags a strong trend, but it’s skewing negative as downside pressure outpaces bullish attempts. The weekly MACD line, previously surging, now rolls over—momentum is not just stalling, it’s reversing. Oscillators underline this loss in confidence; the RSI has retreated from overbought conditions, while other readings warn of waning bullishness. Price action sits below short-term moving averages, suggesting bears are regaining control—never an easy pill to swallow for committed bulls. Key support looms near $94,800; a weekly close beneath that could trigger a steep correction toward $84,800, where long liquidations might accelerate. But if buyers regroup and reclaim $105,000, we could see those sidelined institutions pounce, fueling a sharp rally. My own nerves are on edge here—Bitcoin sits at a crossroads, and whichever side breaks first could ignite fireworks across the market.

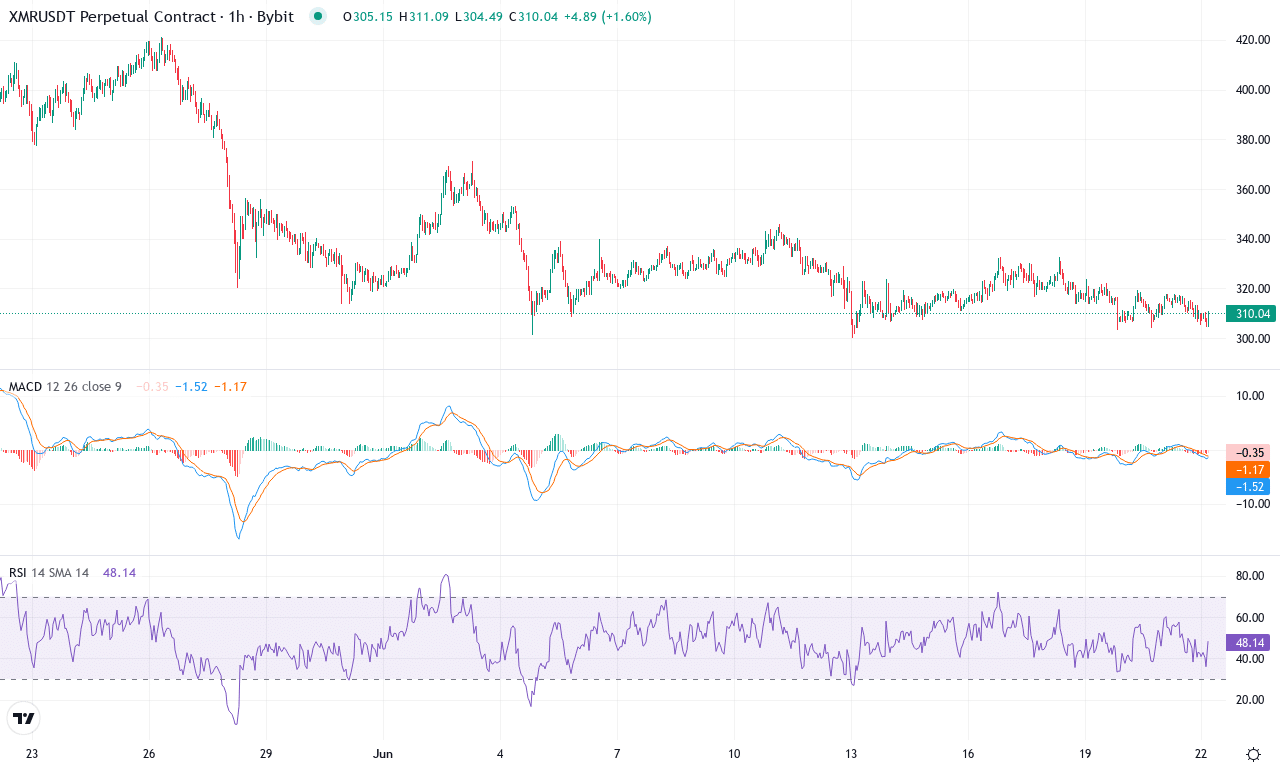

Monero (XMR) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | MONERO(XMR) | $310.24 | -0.73% | -19.70% | 42.1 | 19.5 | -6.56 | -117.33 |

|---|

After a sensational three-month surge that saw Monero (XMR) gain over 43%, the privacy coin is now under notable pressure. The past month’s performance is decisively bearish, with XMR sliding nearly 20% from its highs near $420 to current levels around $310—a move that’s shaking out weak hands and leaving traders wondering if bullish momentum has run its course. Oscillators and trend indicators reveal a market searching for fresh direction: the recent dip wiped out the exuberance of XMR’s six-month rally, and even traders like me who admire Monero’s resilience need to admit the technical outlook suggests cooling sentiment in the short term. If you rode the rally, a little caution is prudent here—remember, parabolic runs rarely last forever.

Diving deeper, trend indicators such as the ADX show firm trend strength, but with negative directional cues starting to dominate—hinting at accelerating bearish momentum. Oscillators reflect mounting downside pressure: the MACD is firmly in negative territory, signaling that sellers are regaining control for the first time since the early spring melt-up. The RSI languishes in the mid-20s, pointing toward oversold territory but not yet signaling a definitive bounce. XMR now trades well below its key moving averages, and the plunge below the $337-$340 support zone is a cause for concern; the next important cushion sits near $290, with a steeper correction looming should that level give way. On the upside, a recovery above $337 could reignite bullish hopes and challenge resistance around $370, but unless buyers come back in force, risks of an extended fall remain elevated. I’m keeping a wary eye on Monero—if the coin claws back above its 20-day EMA, I’ll get optimistic, but until then, it’s a trader’s market, not a HODLer’s paradise.

Bracing for a Critical Test

Bitcoin hovers near a crucial support zone, where a failure to hold could invite further bearish pressure. Monero also faces headwinds, its decline underscoring the importance of stabilizing above interim levels. Market watchers now await confirmation on price direction, mindful of any break that might redefine the current trend.