Bitcoin, Monero, and Aave Hang on Key Supports as Bulls and Sellers Plot Their Next Move

Bitcoin, Monero, and Aave are all at crucial junctures, with each coin wrestling with its own unique technical battles amid broader market fluctuations. Bitcoin has taken a breather, shedding over 5% this week, yet it clings persistently above the psychological $100,000 support, locking bulls and sellers in a stalemate. Monero, after a stellar run, grapples with newfound resistance while trying to defend its recent gains around the $320—$330 zone, where the tempo of the next move hinges. Aave has displayed impressive resilience yet now balances on the edge, as a recent 15% drop unveils hidden vulnerabilities amidst otherwise strong support levels. Will the bulls muster the strength to push forward, or are we facing an impending shift that could redefine the current trajectory? Let’s break down what the indicators reveal.

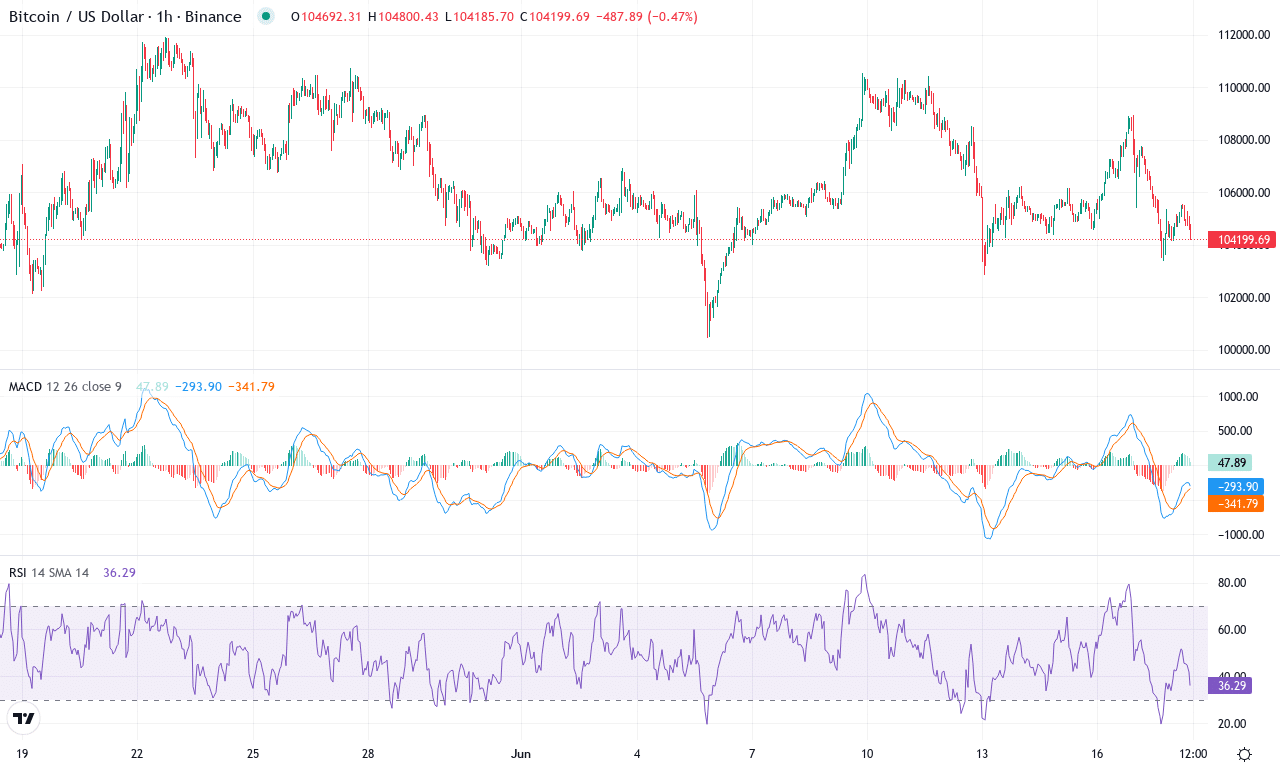

Bitcoin (BTC) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | BITCOIN(BTC) | $104393.41 | -5.31% | -1.96% | 46.8 | 15.9 | 346.92 | -51.74 |

|---|

After weeks of nervous anticipation, Bitcoin has taken a step back, shedding just over 5% this week and slipping nearly 2% for the month. Even with this pause, the king of crypto remains up an impressive 20% over three months and over 56% on the year—a testament to how strong this macro bull cycle really is. Right now, Bitcoin is hovering near $104,400, locked in a classic push-pull between patient bulls and profit-hungry sellers. Notably, the price continues to find its footing well above the crucial $100,000 psychological level, reinforcing how pivotal this support is for sentiment. If you’re like me, watching these dips with both concern and anticipation, you’ll know that volatility may only be sleeping, not gone.

The technical outlook suggests that, while trend indicators remain strong—a high average directional index alongside dominant positive directional momentum—the recent loss of steam in some oscillators hints at growing uncertainty. The weekly MACD is decelerating after months of bullish acceleration, while RSI hovers in neutral territory, making it clear that neither buyers nor sellers are fully in control. Price action analysis shows Bitcoin still trading well above its 10, 20, and 50-day exponential moving averages, keeping the longer-term bullish thesis intact, but the sharp intramonth spike and subsequent rejection above $111,900 have sparked a wave of profit-taking. If bulls can reclaim and hold ground above $106,000, the door reopens to test resistance at the $112,000 area; failing that, risks of an extended fall increase, and all eyes turn to the $100,000 support—break it, and we could see a steep correction toward $95,000. As ever, the fate of the next major move hangs in the balance, and I’ll be watching this zone like a hawk.

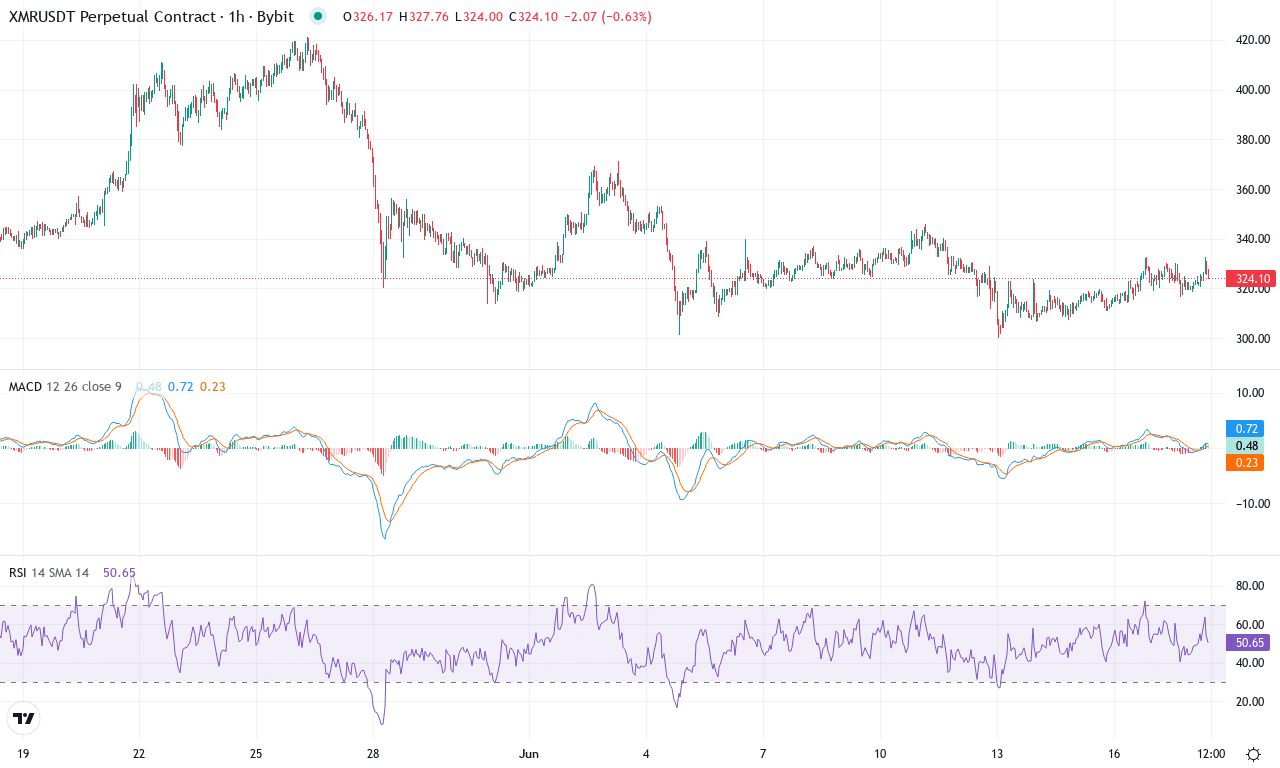

Monero (XMR) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | MONERO(XMR) | $325.54 | -3.99% | -3.54% | 48.6 | 20.0 | -4.35 | -18.31 |

|---|

After an explosive first half of the year, Monero (XMR) has cooled off, surrendering nearly 4% over the past week and extending its monthly drop to just over 3%. Despite this pullback, XMR remains one of the better performers among large-cap cryptocurrencies with a staggering 87% rally over the past twelve months and a robust 57% gain in the last three months. The technical outlook paints a complex picture: after reaching this month’s high at $421, XMR encountered heavy resistance and failed to hold above key psychological and technical milestones, triggering a round of profit-taking. With price closing at $325.54, bulls are now eyeing the previous support in the $320–$330 zone, hoping to prevent a more severe breakdown. If you’re like me, seeing XMR tread this crucial juncture gets the adrenaline going—clear resolution here could set the tone for the rest of the quarter.

Digging deeper, trend indicators show Monero is still in a longer-term uptrend; however, recent bearish momentum shouldn’t be ignored. The average directional index remains elevated, signaling solid trend strength, but short-term signals are waning—the MACD line has crossed below the signal line on the daily chart, reflecting bearish momentum building. Oscillators like RSI have retreated to the low 60s, dialing down the overbought risk but raising caution on momentum loss. Price is testing its 20-day and 30-day moving averages, both converging near $328, as an immediate battleground; a decisive bounce from here could revive bullish momentum, while a breakdown may trigger a steep correction toward deeper support at $290 or even $254. Resistance looms at $337 and $361, with $421 as the upside objective if buyers regain control. If bulls charge through $337, the path to a new rally opens up; otherwise, brace for heightened volatility and be nimble. With volatility surging, Monero is at a technical crossroads—trade with conviction, but don’t forget your stop-loss.

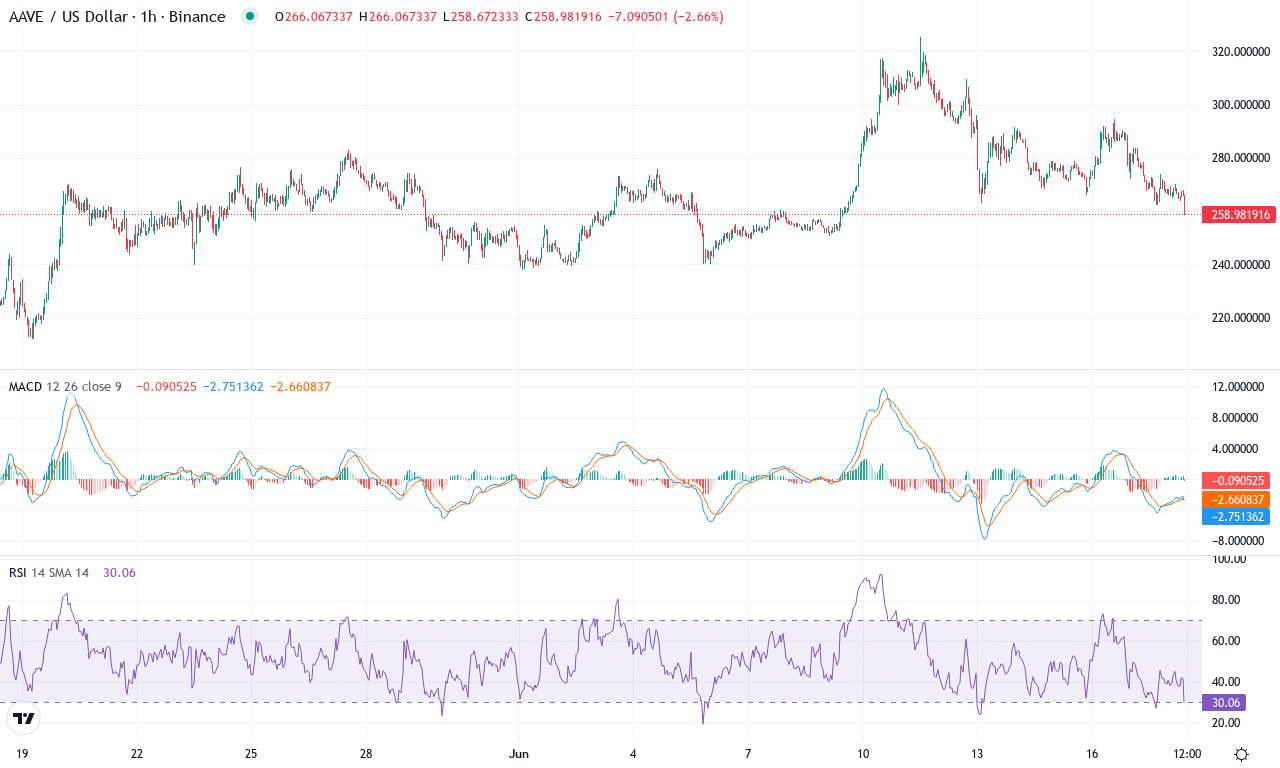

Aave (AAVE) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | AAVE(AAVE) | $262.37 | -14.85% | 12.82% | 49.6 | 25.2 | 9.11 | -15.72 |

|---|

After a sharp run-up over the last three months, Aave is finally catching its breath, posting a modest 12% monthly gain but a stinging 15% drop this week. The token’s yearly showing remains impressive, but this latest pullback is a jolting reminder that high-flyers aren’t immune to volatility. The technical outlook reveals a tug-of-war: on one side, medium-term strength is visible with price still hovering comfortably above all major moving averages and clear institutional demand at recent lows; on the other, the abrupt reversal from this month’s $325 high down to the $262 zone signals an emerging profit-taking surge and a market forcing leveraged bulls to hit the exits—never a peaceful sight for those riding late momentum. If Aave finds footing here, expect renewed speculation, but for now, the stage is set for fireworks—either way.

Technical indicators are painting a nuanced, even suspenseful picture. The ADX points to a robust trend backdrop, but there’s a sense that bullish momentum is declining: the MACD line, while still in positive territory, shows a narrowing gap versus its signal, underscoring waning acceleration and a possible bearish crossover on the horizon. Oscillators such as the RSI are cooling off sharply after flirting with overbought levels, and momentum measures have swung lower, adding urgency for bulls to defend the $245–$250 support region. Price remains above the 10- to 50-day EMAs—typically a bullish formation—but cracks are showing as sell-offs test these averages and the all-important pivot near $231. If buyers can reclaim control and push Aave back above $300, the next challenge lies near the $350 resistance zone; fail to hold this support, and a steep correction toward $230 or even the sub-$200 psychological round number is firmly in play. As a trader, my nerves kick in near inflection points like this—so stay nimble, and size your risk accordingly.

Key Levels to Watch

Bitcoin remains above the vital $100,000 level, keeping bulls slightly ahead, though a dip below could open the door for sellers. Monero’s resistance challenge around $320-$330 hints at potential consolidation unless fresh buying pressure emerges. Aave’s support test highlights the risks of a deeper correction but a hold here may restore bullish confidence. Traders should eye these levels closely, as they hold the key to the next directional move.