BNB And Monero Coil For Major Move As Bulls And Bears Clash Near Pivotal Levels

BNB and Monero have both experienced explosive growth recently, setting the stage for a thrilling clash between bulls and bears at critical junctures. After BNB’s strong three-month rally of over 23%, the energy seems to be cooling as the token consolidates beneath pressing resistance levels around $700. Similarly, Monero’s impressive run has been halted below $340, as it waits to either rebound or contract further. Will these pivotal levels succumb to bullish pressure or uphold bearish restraint? Let’s break down the technical setup across the board.

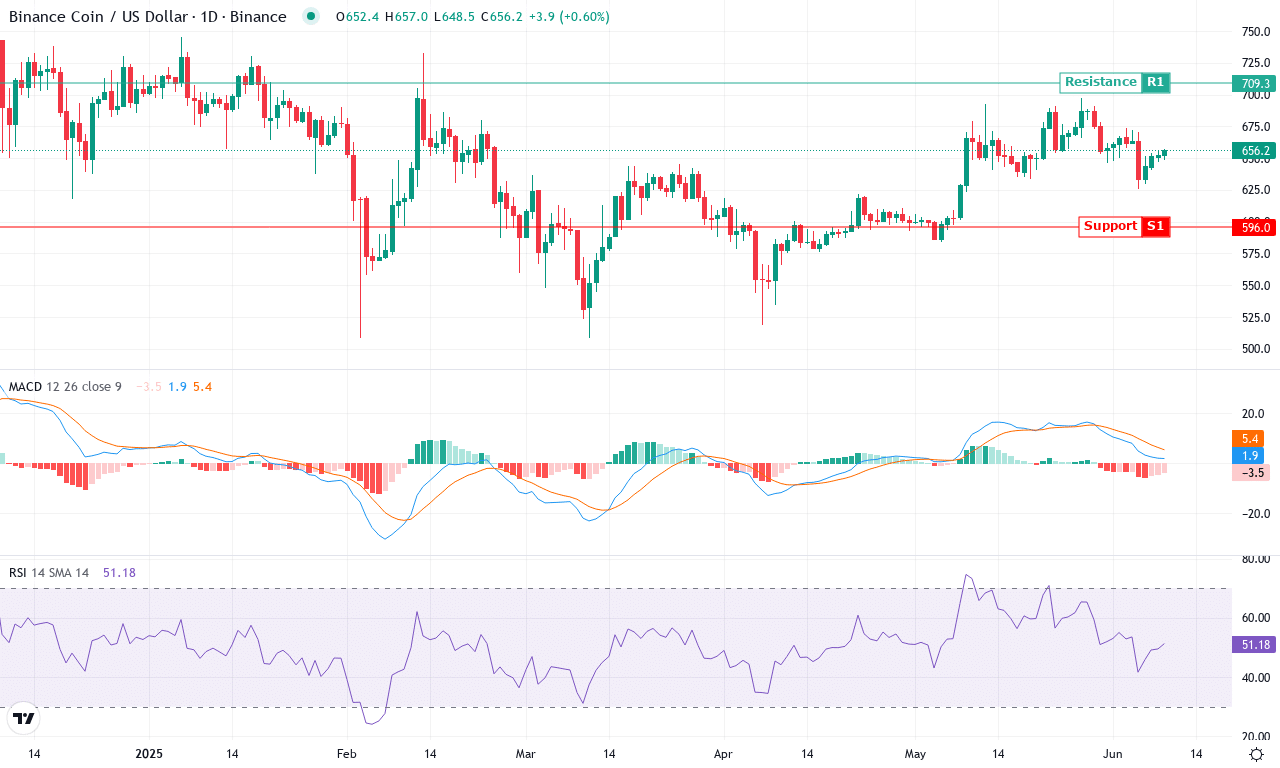

BNB (BNB) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| BNB (BNB) | $655.60 | -0.82% | -1.61% | 50.9 | 22.9 | 1.81 | -68.90 |

After a remarkable three-month surge that sent BNB soaring over 23%, the past week has delivered a sobering pause, with the token slipping just under 1% and posting a minor loss for the month. This cooling off comes after repeated tests of the $700 region, where overhead supply has capped further upside—yet, the wide distance between the monthly high near $698 and recent lows around $626 points to persistent volatility. The technical outlook suggests BNB is sandwiched between profit-taking by short-term traders and strategic positioning by institutional participants. I’m watching this stalemate unfold with a mix of anticipation and caution; a decisive move could set the tempo for the next multi-week leg.

Drilling into the technicals, trend indicators still point higher: the average directional index sits above 20, and positive directional movement remains robust, underlining BNB’s underlying strength. However, momentum signals hint at waning bullish conviction; the MACD is losing altitude after a strong run, and the awesome oscillator has tipped negative, flashing a mild caution. Critically, BNB is straddling all its short- and long-term exponential moving averages—a rare sign of thinning directional conviction. If bulls can push through resistance at $700, the next logical magnet is the psychological $760 barrier; otherwise, failure to reclaim momentum could see BNB test support in the $635–$620 range. All signs point to an imminent volatility surge. No red until you sell, but I’m bracing for fireworks if BNB breaks out of this coil.

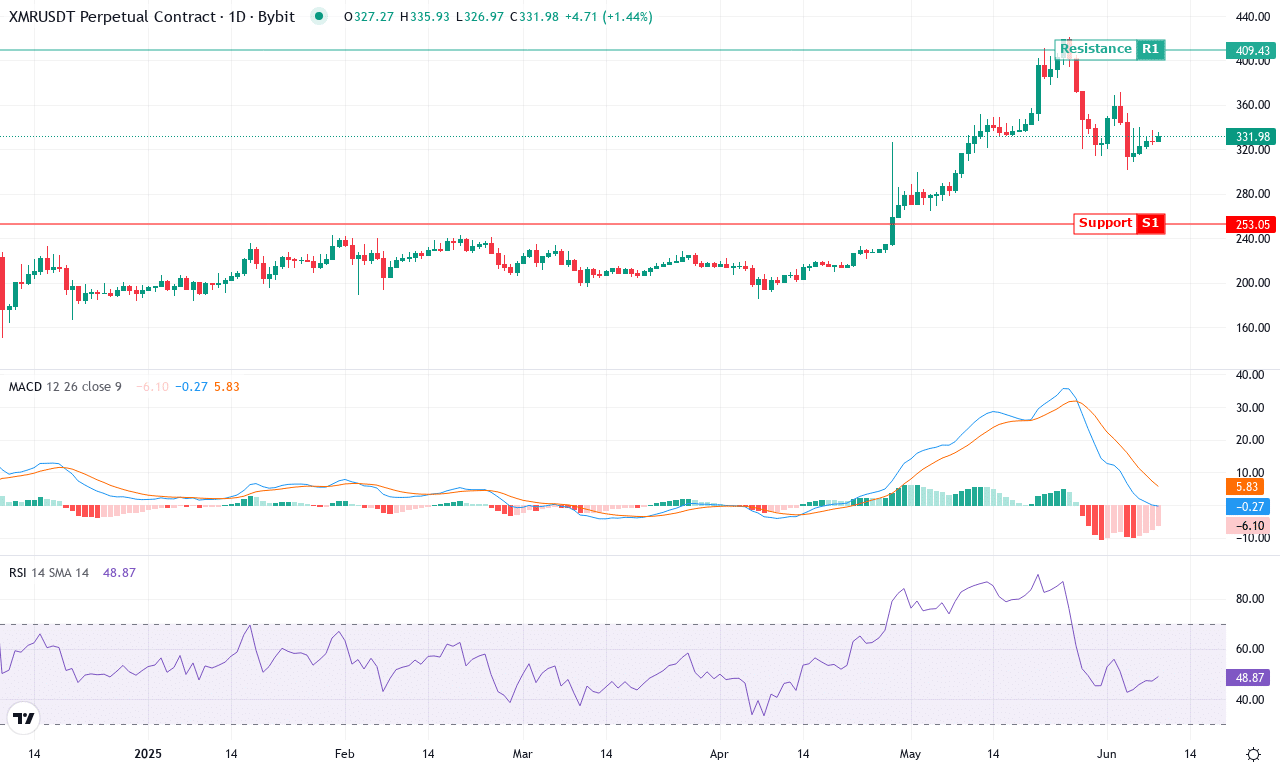

Monero (XMR) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| MONERO (XMR) | $335.30 | -3.65% | 5.86% | 50.0 | 30.3 | -0.02 | -54.94 |

After an explosive run this spring, Monero (XMR) finds itself cooling off just below $340, having notched a monthly high above $420 before retracing amid broader market volatility. Despite a slight dip of around 3.6% over the last week, the coin remains up nearly 6% for the month, with jaw-dropping 3- and 6-month gains over 65% and 87% respectively. The uptrend is impossible to ignore—yearly performance sits right around 98%. Still, after this kind of ascent, the market’s pausing for breath feels more like tactical consolidation than a bearish reversal. The technical outlook suggests bullish momentum has moderated, but those longer-term moving averages and price structure offer little comfort for the bears. If Monero breaks back above the $360–$370 zone, we could see the bulls press for the $410–$420 range once again.

Diving deeper, trend indicators still point higher although their strength is fading. The ADX hovers around 30, consistent with ongoing but less feverish trend energy, and DI lines remain supportive of bullish direction. However, momentum gauges are mixed: the weekly MACD is holding positive but flattening, echoing a shift from breakout momentum to possible range-trading. Oscillators like the RSI are in bullish territory but short of overbought—not quite flashing red lights, but not screaming “undervalued” either. Price action is maintaining support above key moving averages (with the 10, 20, and 50 EMA clustered beneath current levels around $334–$338), reinforcing the notion that buyers remain in control for now. Watch immediate resistance near $360: a close above it could set the stage for another attack on the April highs. On the downside, if sellers push XMR below $320, risks of a steeper correction toward $300 or even $284 emerge. Personally, I’d be keeping stops tight—profit-taking surges often accelerate once a long rally pauses like this. The next few sessions could define whether this is consolidation before new highs or the start of something more dramatic.

Will Resistance Be Defeated?

BNB is consolidating below the $700 mark, indicating a potential standoff as bulls await a breakthrough. Monero remains at a crossroads under $340, poised for a decisive move as market forces converge. The outcome at these levels will set the tone for either a continued rally or a retracement, with traders ready for swift action based on which way the wind blows.