HNT and AVAX Hover at Make-or-Break Support as Bears Test Patience and Nerves

After a month of pronounced declines, HNT and AVAX are now teetering on critical support levels that could dictate their next directional moves. With Helium hovering just above $2.00 amid a harsh 41% drop and Avalanche clinging near $17.55 after a 24% slide, markets are bracing for potential reversals or further pitfalls. As key psychological zones loom further ahead, the question remains: will current bear pressure capitulate to renewed bullish resolve, or will it deepen the downturn? Let’s break down the technical setup across the board.

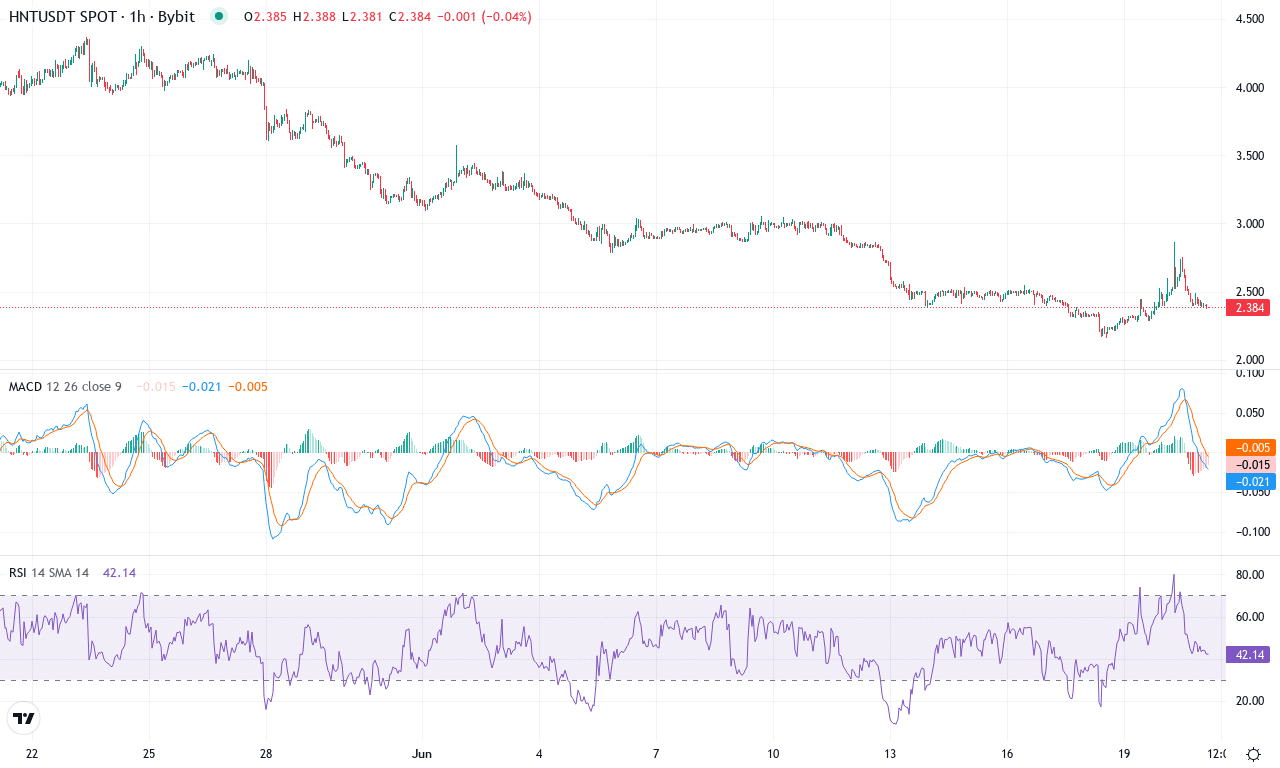

Helium (HNT) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | HELIUM(HNT) | $2.39 | -1.08% | -40.76% | 31.5 | 34.2 | -0.31 | -83.85 |

|---|

After a brutal month that saw Helium (HNT) tumble nearly 41%, the token is showing tentative signs of stabilization just above the psychologically pivotal $2.00 level. This extended correction wiped out a large chunk of its multi-month gains, dragging HNT to make fresh lows and shaking out weaker hands in the process. Even last week’s performance lacked spark, as bears continued pressing their advantage. Yet, with volatility peaking and early signs of exhaustion in the selloff, there’s a hint that panic may be giving way to patience. If HNT can firm up and reclaim momentum, traders could see a sharp bounce back—but risk controls remain paramount in this environment.

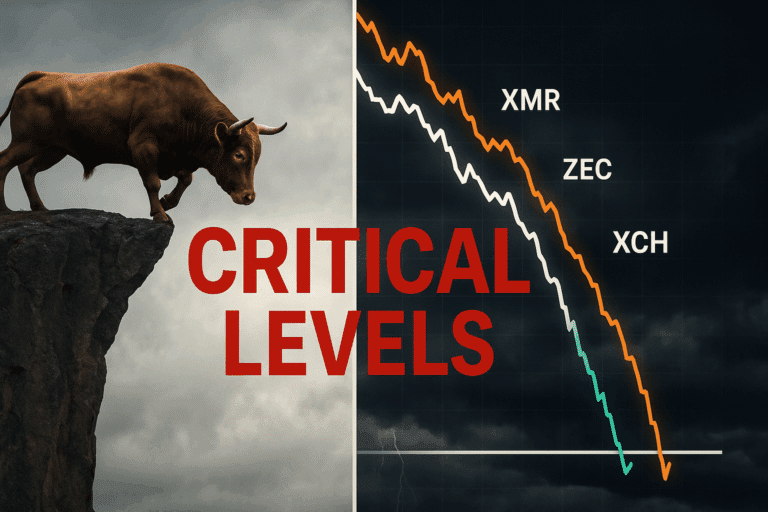

Technically, the outlook reveals a high-stakes battleground: Strong trend indicators reflect the lingering intensity of the downtrend, but short-term oscillators are hinting at an oversold bounce. The weekly MACD continues to drift in negative territory, but the flattening signal line suggests selling pressure might be running out of steam. Meanwhile, the RSI is pressing into deeply oversold territory, historically a prelude to sharp relief rallies—though catching the bottom is rarely so simple. With price hovering at a confluence of the 200-day average and major support near $2.30, the stakes couldn’t be higher. If bulls manage to reclaim the $2.70–$2.90 zone, explosive upside toward $3.50 isn’t out of the question. But if sellers regain control and push HNT below $2.10, risks extend toward a further steep correction. Personally, I’m watching that $2.10 level like a hawk—capitulation or reversal, we’ll have an answer soon enough.

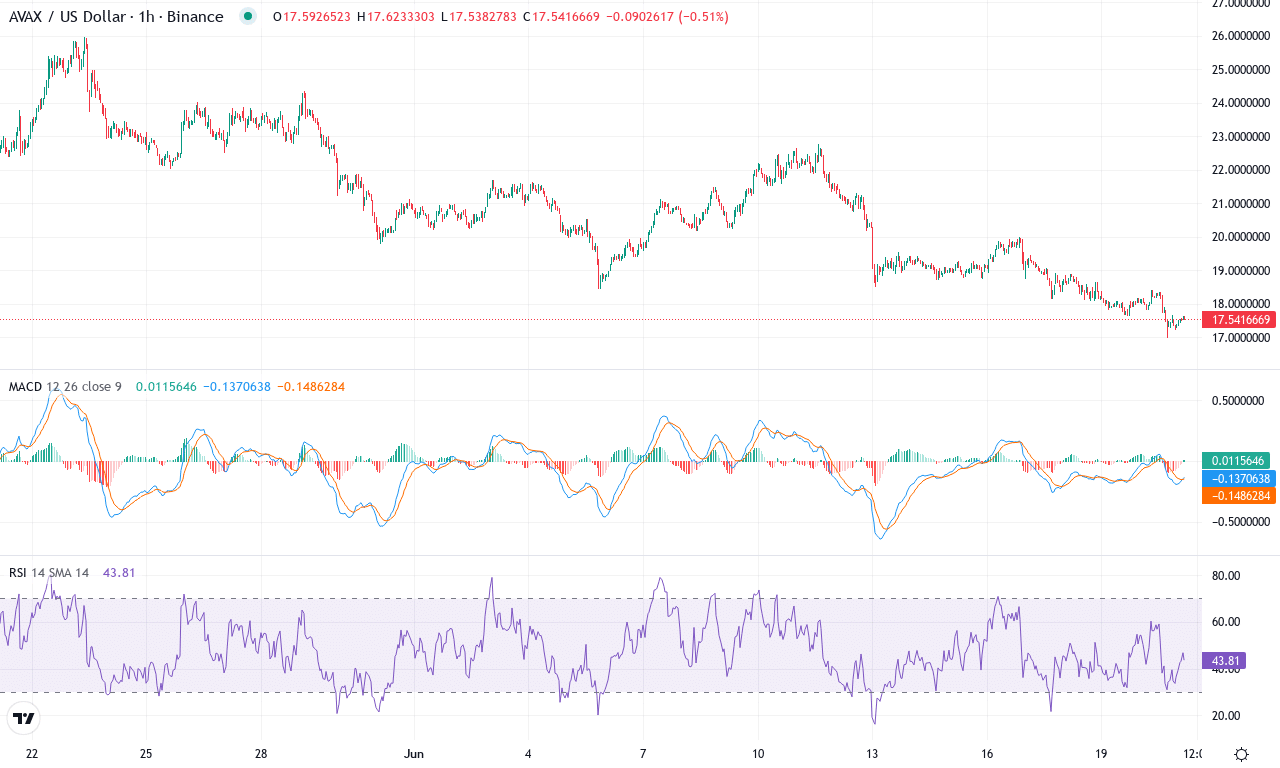

Avalanche (AVAX) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | AVALANCHE(AVAX) | $17.55 | -9.61% | -24.34% | 34.0 | 19.2 | -1.08 | -125.74 |

|---|

After a brutal month for Avalanche, traders are seeing the aftermath of an aggressive correction, with the token sinking nearly 24% in the past 30 days. The latest weekly slide, just under 10%, has left the price hovering around $17.55—dangerously close to its local lows and well below this month’s high above $25. Confidence remains shaky as the broader crypto market pulls back, and Avalanche’s year-to-date losses now stretch past 36%. While volatility has cooled after the initial capitulation, the technical outlook still suggests that bearish momentum is in play and buyers remain on the defensive. For those of us who’ve ridden AVAX through both euphoria and despair, the temptation to capitulate is real—but seasoned traders know relief rallies can appear right when hope fades.

Diving into the chart, trend indicators stay firm on the bearish side. The ADX shows a solid trend presence, while negative momentum dominates: Avalanche is trading beneath all notable moving averages, and price action sits uncomfortably near the monthly support zone at $17. Should sellers break this level, risks of an extended fall toward $15 or even $13 increase sharply. The weekly MACD trend continues to deteriorate, reflecting deepening downside conviction, while oscillators like RSI and the ultimate oscillator languish well below overbought thresholds—no signal of exhaustion from the bears yet. If bulls somehow manage to reclaim $22, Avalanche would set its sights on recovering the psychological $25 barrier; but failure here favors another leg down. As a trader, I’m keeping stops tight—because when volatility surges around support like this, things can unravel fast.

Critical Junction: Bounce or Break?

HNT hovers precariously above $2.00, while AVAX tries to hold the line at $17.55. If these levels fail, deeper declines may unfold, but resilient holds could invite bullish re-engagement. Traders should watch for definitive moves at these supports, as the market looks to regain balance amid intensified pressure.