HYPE And AAVE Soar Into Overbought Territory As Bulls Threaten Parabolic Surge

HYPE and AAVE have displayed outstanding monthly performance, surging into overbought territories. With both digital assets flirting with parabolic moves, the momentum has hit pivotal levels that could dictate short-term direction. Are the bulls poised for an extended rally, or is a retracement on the horizon? Let’s dive into the details and examine the key indicators.

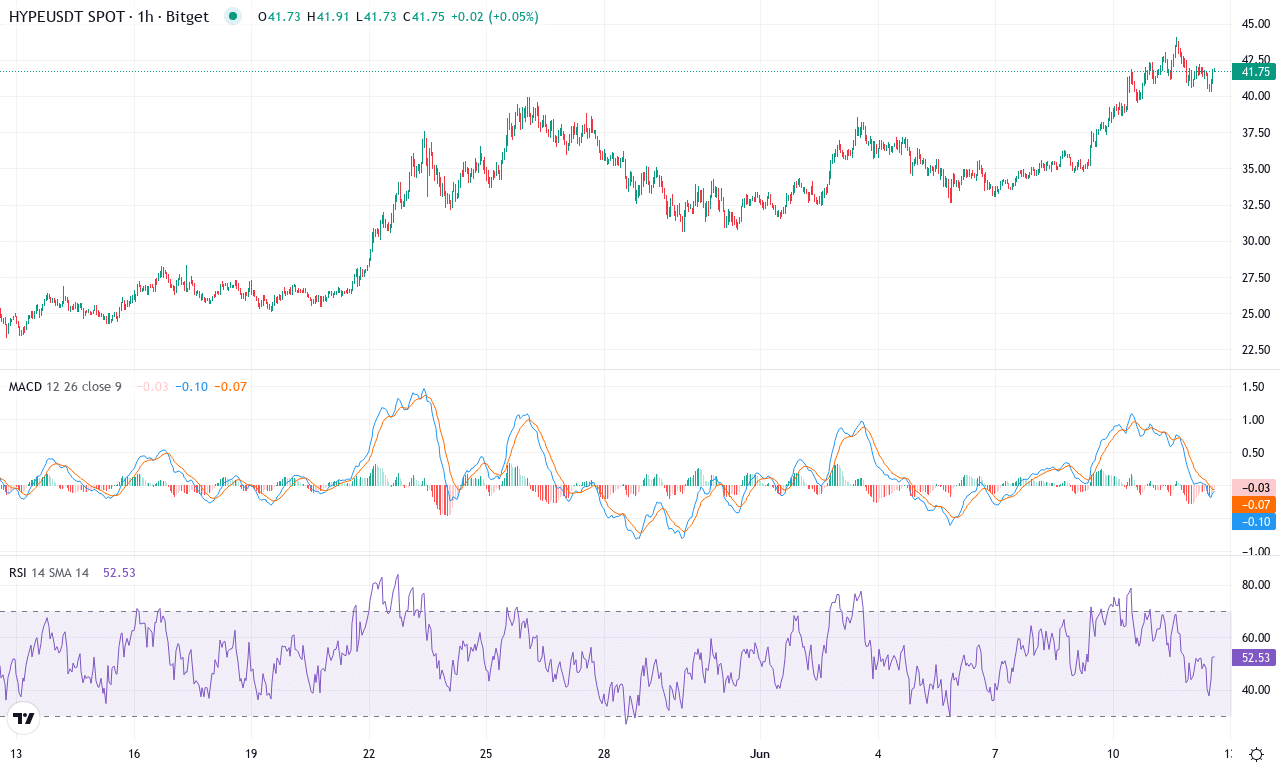

Hyperliquid (HYPE) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| HYPERLIQUID(HYPE) | $41.64 | 16.93% | 67.90% | 71.1 | 43.8 | 3.30 | 155.77 |

After a blistering month, Hyperliquid (HYPE) is catching every trader’s attention. The token’s 68% surge over the past 30 days is no fluke—especially coming on the heels of a staggering 238% gain in the last three months and a mind-blowing 1,565% advance year-to-date. Trading near $41.64, just below this month’s high at $44.08, HYPE is pushing the upper edge of its recent range, testing fresh territory and stirring up real FOMO. The technical outlook suggests buyers remain firmly in control, with bullish momentum pulsing through the price action and institutional demand showing no signs of fading. At these levels, volatility is both an opportunity and a risk; but as long as bulls keep their foot on the gas, the path higher remains open.

Diving deeper into the technicals, trend indicators are signaling an unrelenting uptrend. The weekly MACD shows continued acceleration above its signal, while upward-sloping moving averages—from the short-term 10-period EMA through to the longer 200—confirm bulls are dominating every timeframe. Oscillators remain firmly in bullish territory, with the RSI well above 70, hinting that HYPE is in overbought territory—yet there’s no clear sign of bearish divergence. If buyers break through the $44 resistance, the next upside target could easily stretch toward $72, the nearest major pivot. On the other hand, failure to hold above $42 may invite profit-taking and a pullback, with initial support around $35 and stronger backup at $31. Frankly, with momentum this strong, I wouldn’t dare short HYPE until price action actually confirms reversal—up here, fortune still favors the bold.

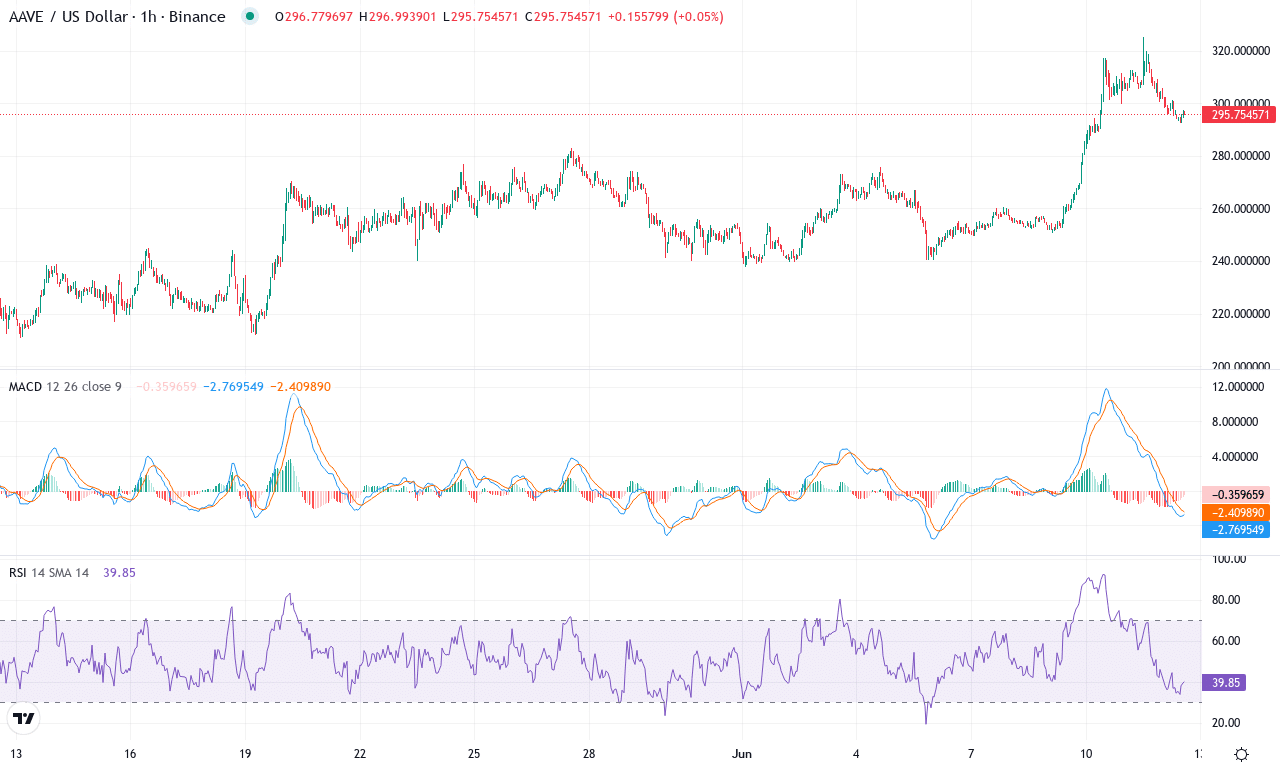

Aave (AAVE) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| AAVE(AAVE) | $296.31 | 12.20% | 33.61% | 65.3 | 31.2 | 16.83 | 162.91 |

After a turbocharged month, Aave is throwing off some real fireworks—up over 33% in the past 30 days with a three-month performance scorching the charts at nearly 82%. That’s a breakout worth celebrating if you’ve been patiently holding through recent crypto sector churn. After weeks of choppy action, AAVE has punched up toward $300, putting short-term bears on notice and drawing bullish attention back to a token with a history of violent moves. The technical outlook suggests that momentum is not just present, but swelling—Aave is currently trading near the upper end of its recent range, risk appetite is clearly back, and you can feel the anxiety building as price action creeps into the shadow of the $325 high.

Diving into the technicals, trend indicators reflect formidable bullish momentum. The ADX is surging above 30, confirming that trend strength is real, while a decisive weekly MACD acceleration signals buyers are in control. Even as the MACD line glides away from its signal, oscillators—from a charged RSI in the mid-60s to a firing Commodity Channel Index—rule out immediate overbought peril. Price is perched neatly atop all major moving averages, with the 10 and 20-period EMAs clustered just beneath spot as support. A decisive close above $300 could set the stage for another advance toward the formidable $325 resistance zone. If bulls drive through, $350–$360 snaps into focus as the next psychological target—my heart would be pounding if we see a volume rush there. On the downside, failure to hold $280 risks a steep correction toward $255, where buyers need to defend or risk a deeper unwind. For now, the setup is aligned in the bulls’ favor, but as always, stay nimble—profit-taking surges have blindsided many in fast markets like this.

Will the Bull Run Sustain?

HYPE continues its upward trajectory, brushing against overbought levels that signal caution for a potential pullback. AAVE, similarly extended, will need sustained buying pressure to maintain its ascent. While bulls maintain the upper hand, a watchful eye on volume and RSI indicators will be crucial to confirm whether this bullish momentum evolves into a lasting surge or reverts to consolidation.