INJ, AAVE, and COMP Bulls on the Brink as Critical Support Strains Under Bearish Pressure

INJ, AAVE, and COMP have each faced their own battles amid recent market turbulence, with prices hovering near make-or-break levels. INJ has seen a sharp downturn from its highs, while AAVE and COMP grapple with critical support amid fading momentum. Investors are now staring down crucial tests of strength as these coins flirt with psychological barriers, and potential reversals hang in the balance. Could this be a turning point or merely a pause before further declines? Let’s take a closer look at the signals behind the move.

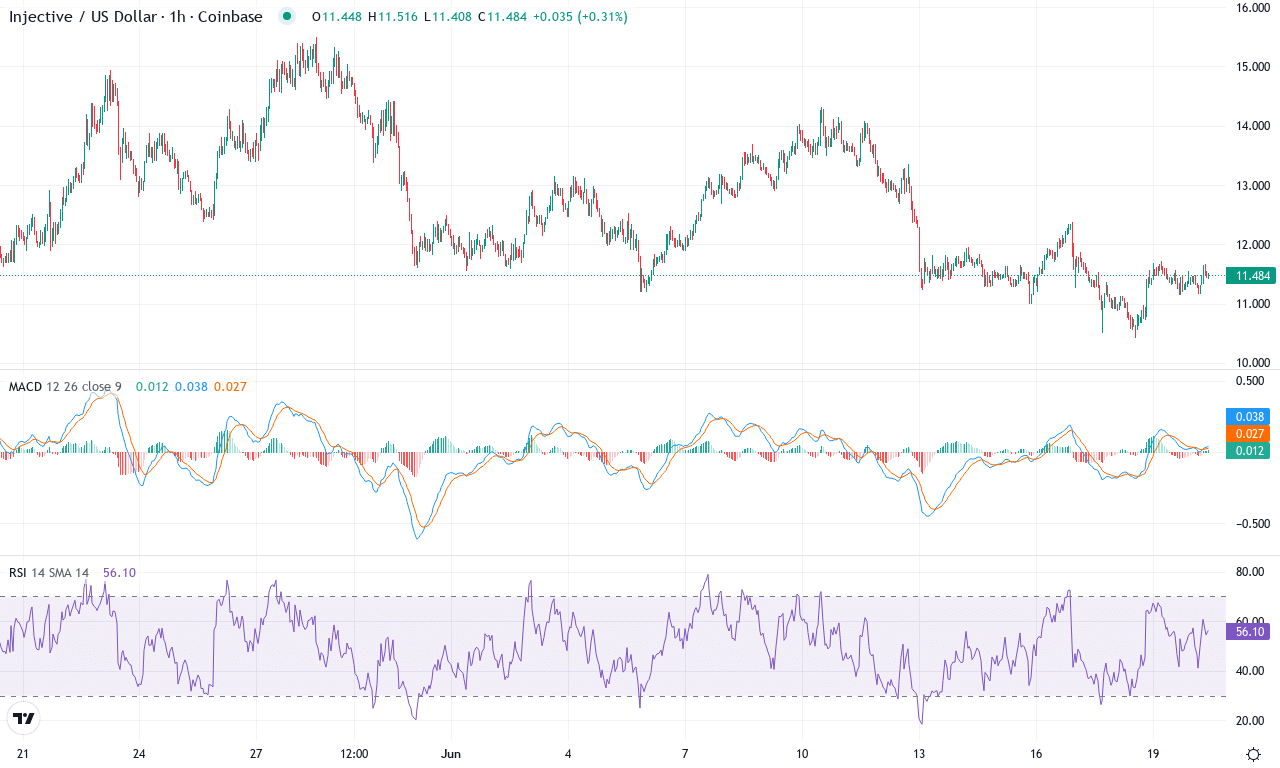

Injective (INJ) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | INJECTIVE(INJ) | $11.50 | -6.30% | -5.28% | 44.7 | 15.9 | -0.28 | -70.17 |

|---|

After a wild three-month upswing, Injective (INJ) has sharply reversed course, losing over 5% in the past month and sliding another 6% this week. Bulls are clearly on the ropes, with the price stuck well below this month’s high, grinding along near $11.50. That’s far from the $15.50 peak we saw, and there’s little question that INJ is caught in the throes of a macro downtrend—yearly performance is deep in the red, and the ugly 44% six-month slide still looms overhead. Still, with the token camped right above a familiar support zone and several momentum gauges flashing oversold hints, I’m watching closely; if buyers start getting traction, the risk-reward here could shift fast. But right now, caution rules the field.

Technically, bears are controlling the narrative: trend indicators remain firm to the downside, with the ADX confirming a stout trend and directional indices skewed negative. The weekly MACD continues to show acceleration toward bearish momentum, backed by the Awesome Oscillator and other oscillators decisively underwater. What’s more, INJ is clinging just above major moving averages, threatening a cross beneath the 50-day and 100-day EMAs—a classic signal that risks extended fall if confirmed. The primary battleground lies at support near $11; if this floor gives way, a steep correction toward the $9 zone could accelerate as long liquidations and profit-taking intensify. However, should bulls manage to retake resistance around $13, we could see a textbook bounce back targeting $15 or higher. I have to admit, it’s tense at these levels—sometimes, surviving is the real victory. Stay nimble, because any sharp move will catch traders off guard.

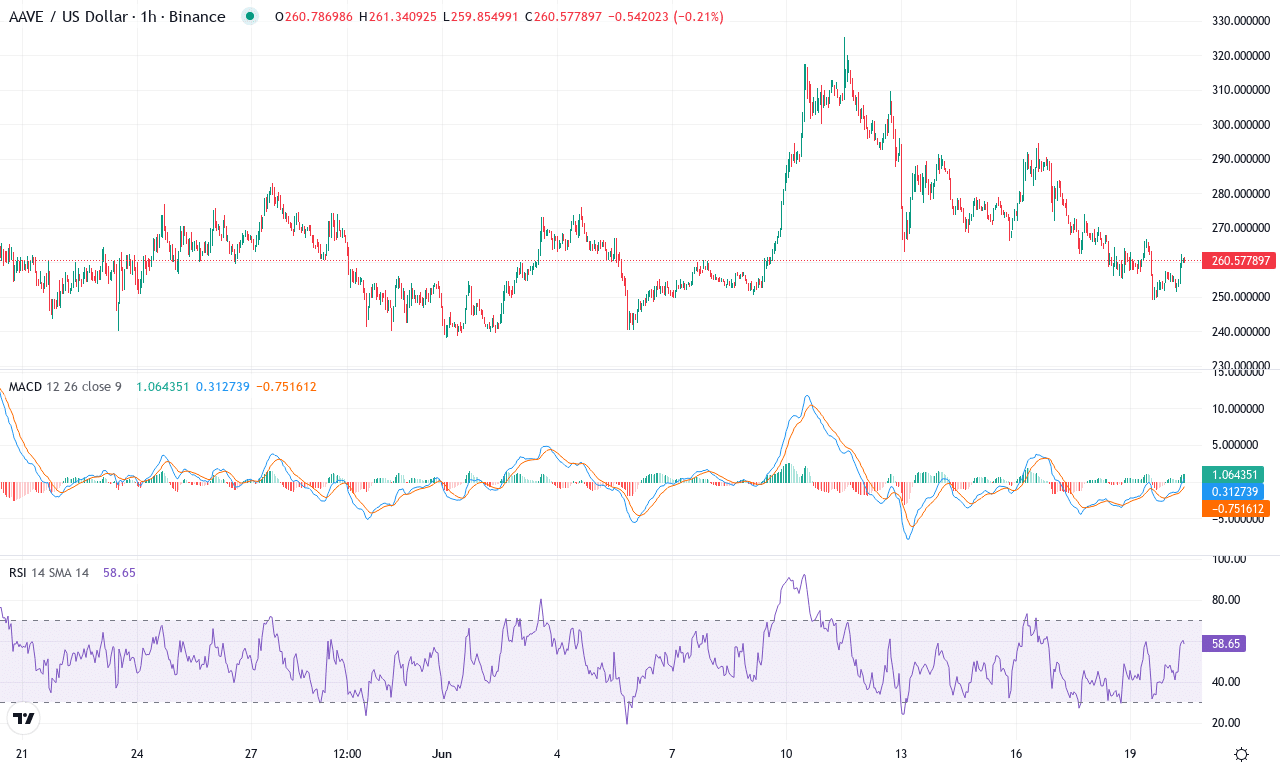

Aave (AAVE) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | AAVE(AAVE) | $260.31 | -11.39% | 0.34% | 49.0 | 21.7 | 5.57 | -51.64 |

|---|

After a month marked by intense volatility and very little net progress, Aave is struggling to regain its bullish footing. The token’s monthly range—stretching from a high near $325 to a low at $237—speaks volumes about the ongoing battle between bulls and bears. Last week, AAVE was hit by a sharp 11% pullback, erasing most of its previous month’s gains and dropping it back toward its longer-term base around $260. Despite that stumble, the broader three-month trend remains impressive, with a near 46% gain reminding us that momentum can come roaring back if macro sentiment aligns. From a trader’s seat, the action feels a bit jittery; there’s palpable suspense as AAVE clings to its critical support zone, with both sides looking to seize control. Unless the bulls retake the initiative soon, risks of a steeper correction will continue to mount.

Technical outlook suggests AAVE’s directional strength is still robust, but momentum has flagged in recent sessions. Trend indicators hold steady in bullish territory, though there’s clear evidence of deceleration—weekly oscillators like the MACD are still above their signal line but losing altitude, hinting at weakening upside drive. The RSI has fallen dramatically, now threatening the midpoint—often an early sign that sellers may gather strength for another push lower. Meanwhile, the price is clinging just above its short-term and long-term moving averages, but the failure to hold above $270–$280, combined with some bearish pivots on the daily chart, keeps traders on edge. If Aave can reclaim and sustain above the $280 resistance level, a bounce toward $325 isn’t out of the question—I know I’ll be watching that zone with anticipation. But if sellers keep pressing and support at $246 breaks down, brace for a volatility surge down toward $230 or even $180, where stronger hands might step in. Every move at these levels feels high stakes: for now, caution and nimble position sizing are paramount.

Compound (COMP) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | COMPOUND(COMP) | $50.57 | -6.55% | 18.46% | 52.7 | 29.5 | 2.11 | 14.00 |

|---|

After a turbulent month marked by wild volatility, Compound (COMP) has managed an impressive 18% surge from its monthly low, recovering to trade near $50.50 as June closes. The short-term momentum, however, has softened with COMP slipping over 6% in the past week—an abrupt pause after a strong three-month uptrend of over 21%. Bears recently tried to force a steep correction, but the coin found solid footing above its psychological support near $40. I won’t pretend this bounce was easy; at multiple points this month, the market’s nerves were shot, especially when year-to-date performance swung deep into the red. Still, the overall technical outlook points to a maturing reversal rather than outright exhaustion.

Looking under the hood, trend indicators are tilting bullish: the Average Directional Index remains elevated, confirming that bears are losing their grip even as recent price action runs into congestion. The MACD is flattening on the weekly chart, signaling a standoff rather than a reversal; momentum oscillators show a tug-of-war, with the RSI hovering around neutral and neither side showing runaway conviction. COMP is trading right above key exponential moving averages (10-, 20-, and 30-day), which are flattening—a classic sign that price action is coiling for its next big move. If the bulls can recapture and hold above resistance at $55, a retest of the $62 monthly high is firmly in view; a break there could stoke breakout momentum toward $68. Meanwhile, if sellers push COMP below the $47–$45 region, risks of a deeper slide back to $40 could materialize fast—I’d keep that level on the radar. At this crossroads, conviction counts: if institutional demand shows up, all signs point to a fast ascent, but complacency could see profit-taking return with a vengeance.

Approaching the Point of No Return

As INJ rebounds modestly, AAVE and COMP teeter near their critical support levels, poised for potential breakdowns. Sustained pressure may push these coins further down, but a decisive bounce could mark a significant reversal. Traders should keep a keen eye on volume changes and rapid directional shifts to gauge the next move.