INJ Clings to Support as DEEP Teeters—Will Bulls Flip the Script or Cede Control

Injective (INJ) clings precariously to its support line after shedding nearly 7% in thirty days, a stark reminder of its 59% decline over the past six months. This struggle against mounting bearish pressure poses a critical question: will the bulls flip the script as momentum shifts or concede to further losses? Similarly, DeepBook Protocol (DEEP) faces its own crossroads, having retraced almost entirely from its exuberant highs amid a recent volatility surge. With both assets teetering on the edge, the next moves could set the tone for their respective paths. Let’s break down the technical setup across the board.

Injective (INJ) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | INJECTIVE(INJ) | $11.44 | -12.55% | -6.75% | 42.8 | 19.0 | -0.06 | -103.95 |

|---|

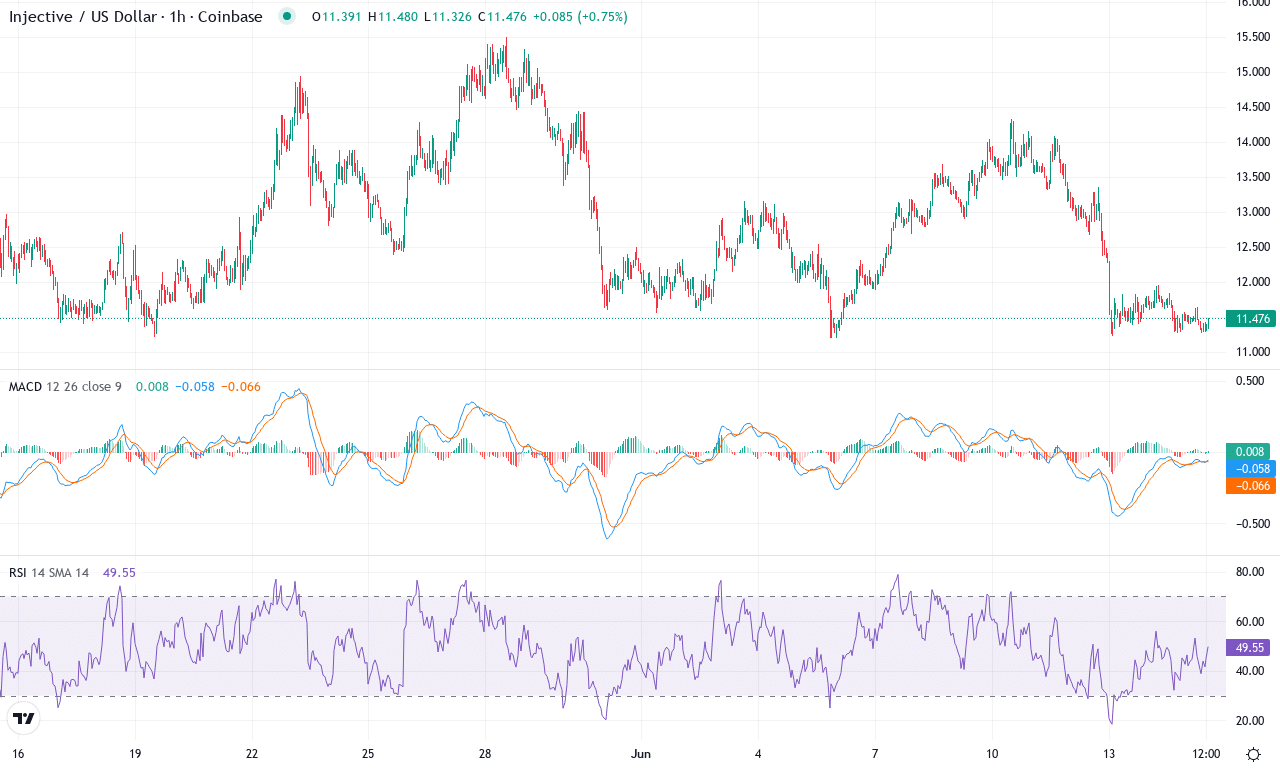

After a turbulent month, Injective (INJ) is struggling to regain its footing, having shed nearly 7% over the last thirty days and facing a sharp 12% drop just this past week. The broader narrative here is one of confrontation: INJ bulls are battling to hold the line after a punishing 59% six-month decline—a dramatic pivot from the impressive gains clocked in prior quarters. With the token hovering just above $11.40 after tagging a monthly low near $11.19, sentiment remains tense. Injective’s technical backdrop flashes mixed signals: after a spirited Q1, the past week’s sell-off has tipped momentum to the downside, and with volatility swelling, traders are bracing themselves for either a swift recovery bounce or deeper losses. Frankly, it’s the kind of price action that stirs both nerves and greed; volatility cuts both ways, and the coming sessions should define which narrative wins out.

The technical outlook suggests caution: trend indicators are still pointing modestly higher, but bullish conviction is clearly eroding. The ADX remains elevated—signaling that this downtrend has teeth—while a widening gap between positive and negative directional indicators underscores mounting bearish momentum. Even the weekly MACD, which had been set for a bullish turn earlier in Q2, is rolling over into negative territory, and oscillators like RSI have pulled back from overbought territory to hover in the neutral zone. INJ is currently clinging to support near $12.15 (also coinciding with the 50-day EMA), with the next major floor down at the psychological $10 round number—a level that, if lost, risks extended fall and possible capitulation selling. Resistance looms at $15.50, and unless buyers show up in force, any rally may be met with swift profit-taking. If bulls manage to claw back control above $15.50, the path to $18.80 opens up; however, failure to defend $12 could see bears regaining control. Watch for decisive closes at these pivots—if a reversal doesn’t emerge soon, sellers may press their advantage. I’m worried here; remember, you’re not in the red until you sell.

DeepBook Protocol (DEEP) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | DEEPBOOK PROTOCOL(DEEP) | $0.14 | -8.64% | -26.28% | 39.4 | 19.6 | -0.01 | -109.87 |

|---|

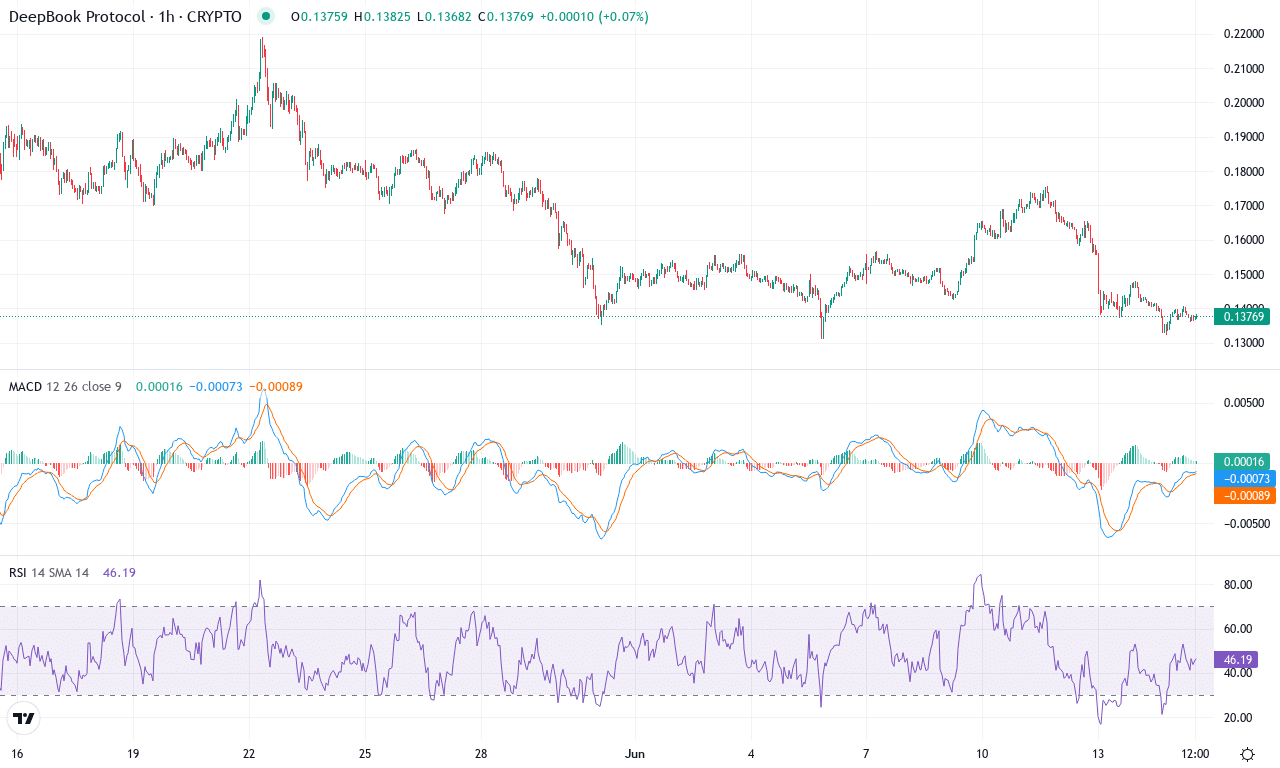

After a stunning multi-month rally that catapulted DeepBook Protocol to extraordinary yearly gains above 2,600%, the tides have turned sharply. The past month delivered a harsh wake-up call: DEEP shed more than a quarter of its value, slumping to a monthly low near $0.13—almost a complete retrace of the prior breakout. This volatility surge comes on the heels of a euphoric run, and the mood has noticeably shifted from euphoria to caution as short-term holders rush to the exits. Yet, even amid this bloodletting, I’m not ready to call a top just yet—momentum-driven tokens like this often find their feet just when conviction fades.

Technically, we’re at an inflection point. Trend indicators still show underlying strength, with directional signals barely positive, though the ADX hints that trend power could be waning. The weekly MACD just flipped negative, signaling momentum is now tipping toward sellers, while most oscillators—like the RSI hovering in neutral territory—reflect a market desperate for direction. Price action analysis shows DEEP trading slightly below its key short-term moving averages, and hanging dangerously close to a major support level near $0.13. If bulls manage to defend this floor and push above the nearby resistance at $0.17, we could see a rapid bounce toward the $0.20 area. However, failure to hold the line here risks an extended fall and profit-taking surge, potentially dragging DEEP back toward deeper support zones. Strap in—the next few sessions could define the next chapter for this high-flyer.

Bulls at a Crossroads

INJ remains anchored at its support, awaiting either a rebound or further decline if bears gain traction. DEEP, grappling with volatility, seeks a foothold to recapture upward momentum. Should bullish forces reassert themselves, a short-term climb is possible; however, a lack of buyer initiative could signify further capitulation. Traders are closely watching to gauge the prevailing market sentiment.