KAIA WAL And SPX Jockey For Next Breakout As Bulls Battle Volatility At Key Highs

In the ongoing market dance, KAIA is back in the limelight with a 55% monthly surge, pressing against key highs amidst growing trader attention. Yet, while Ethereum basked in similar gains, the moment of truth here lies in whether KAIA can rally past the pivotal $0.20 resistance or stall under renewed volatility. As for Walrus (WAL), the past month’s steep decline casts a shadow over its earlier explosive ascent, leaving the question—will this retracement turn into a full-on reversal? With SPX also hovering close to its peak after an impressive rally, the stage is set for intriguing shifts. Let’s break down the signals behind these moves.

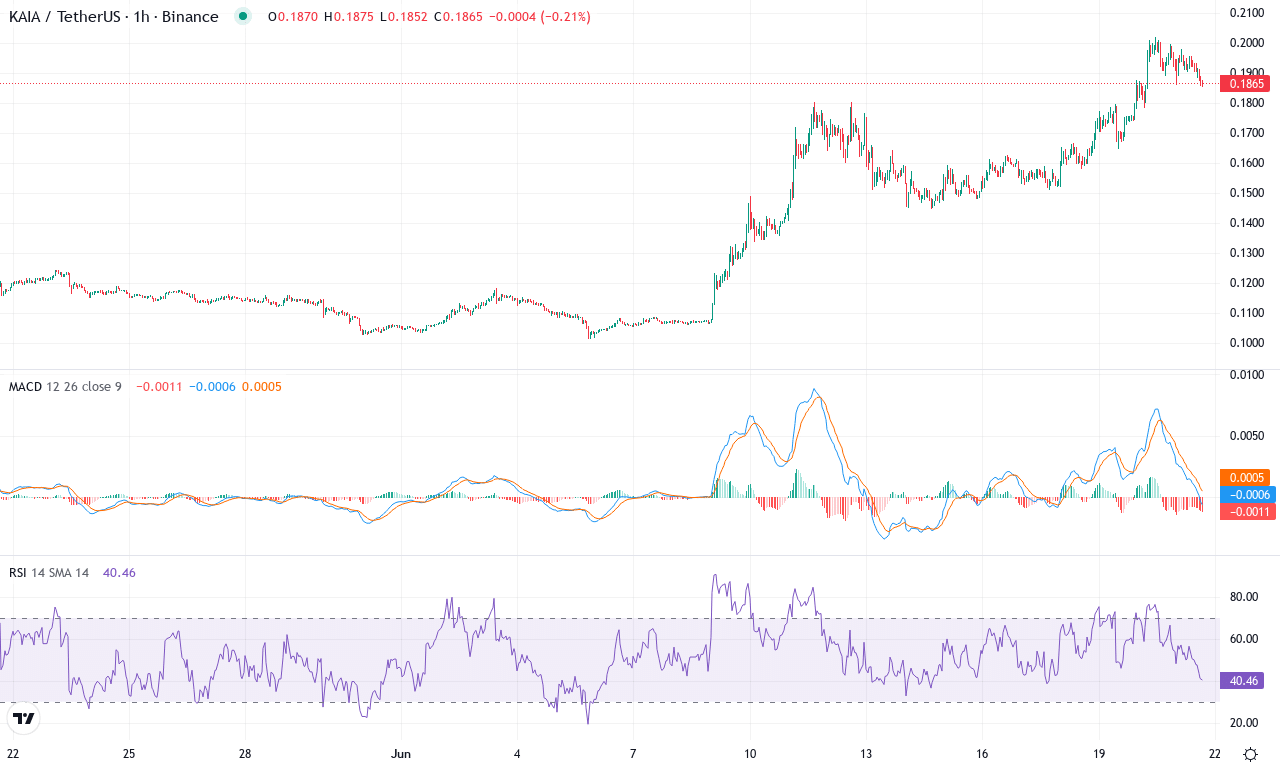

Kaia (KAIA) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | KAIA(KAIA) | $0.19 | 16.73% | 55.70% | 69.5 | 38.5 | 0.02 | 118.79 |

|---|

After several months of volatility and an impressive 55% monthly surge, Kaia (KAIA) is back in the spotlight, catching traders’ attention with its renewed upside push. The token is transitioning out of a period of prolonged weakness—year-to-date performance still carries a scar from a steep 16% six-month pullback, but the tide appears to be turning fast. KAIA’s explosive 16% rally over the past week signals a reawakening, especially as the price presses up toward recent monthly highs near $0.20 and decisively holds above all major moving averages. With market breadth improving and macro sentiment supportive, it feels like the bulls are regaining control—and, honestly, if momentum keeps up, I wouldn’t be surprised to see a full trend reversal play out before the quarter’s end.

A closer look at the technicals reveals that trend indicators are now pointing higher, with the average directional index (ADX) well above 30 and the positive trend component firmly outpacing the negative. The MACD shows early signs of bullish convergence, steadily rising from recent lows, while short-term oscillators like RSI hover in the mid-60s—suggesting solid momentum but not yet overbought conditions. The price holds convincingly above the 10- and 20-day EMAs, and the next key resistance is circled at the monthly high near $0.20; a decisive break above this zone could trigger breakout momentum toward $0.22. However, with the recent vertical climb, I’m watching for potential profit-taking or a temporary cooldown—if sellers regain traction, look for a retest of strong support around $0.15. Until then, the technical outlook suggests bullish momentum is building, and all signs point to higher prices if KAIA can sustain this pace. The coming sessions are shaping up to be pivotal—stay sharp!

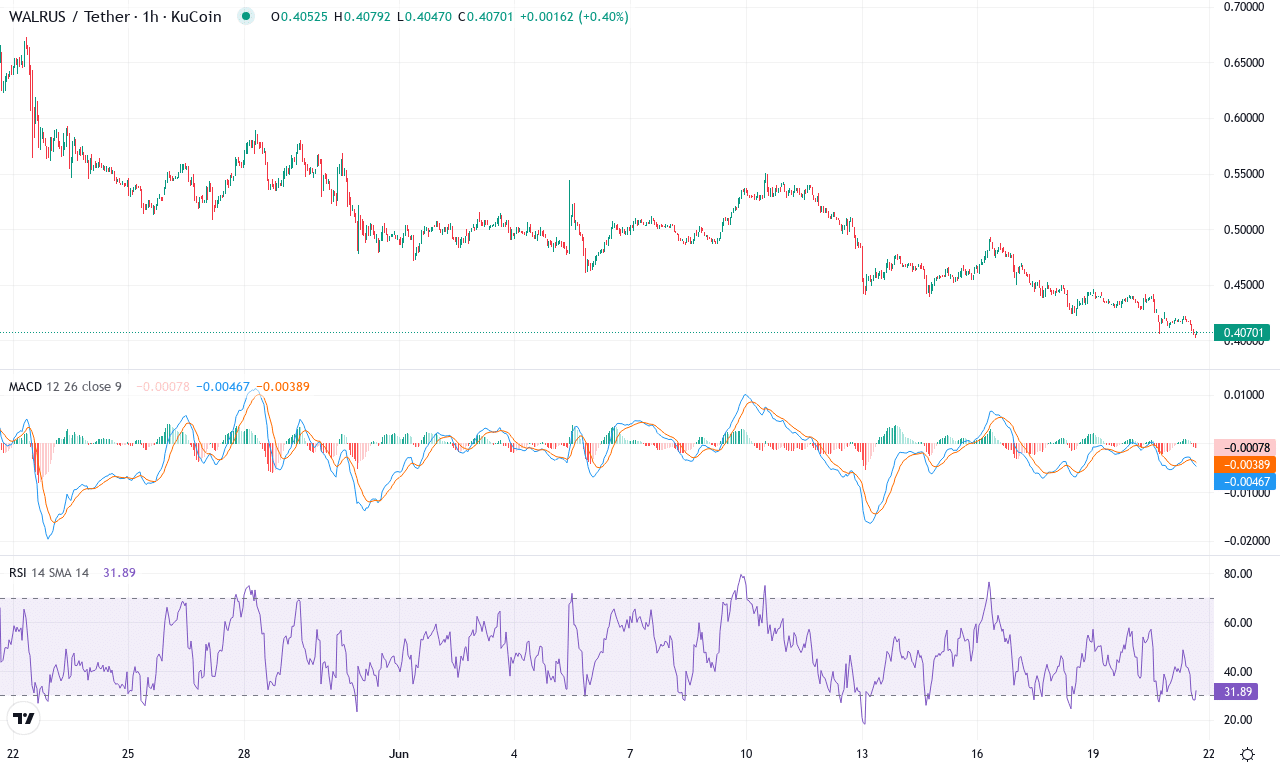

Walrus (WAL) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | WALRUS(WAL) | $0.41 | -14.75% | -36.62% | 31.2 | 16.7 | -0.03 | -157.05 |

|---|

After an explosive three-month rally that catapulted Walrus (WAL) over 300% higher, the mood has shifted dramatically. In the past month, WAL suffered a bruising 36% slide, with a harsh 15% drop just last week—the steepest pullback since the breakout began. The bears are clearly attempting a comeback, hammering prices down to monthly lows near $0.40. Despite the short-term bleeding, the longer-term trend remains notable—WAL is still up threefold in six months and riding above many key moving averages. It’s a classic whiplash scenario: breakneck gains have left late bulls exposed, and now, volatility is surging as profit-takers scramble out. The big question gripping traders—has the music stopped, or is this just a violent shakeout before the next leg up?

Diving into the technical outlook, the picture is cautionary. Trend indicators are still signaling underlying strength—average directional readings remain elevated, a typical sign of robust trends—but bears have rapidly closed the gap, with negative directional forces now outweighing positive ones. The weekly MACD has rolled over into negative territory, while momentum oscillators swing sharply lower, echoing a shift in sentiment. WAL’s price now hovers just above its 20- and 30-day moving averages, but any decisive break lower could usher in a steep correction toward the next support band at $0.38. Resistance sits overhead near $0.50, a level bulls will need to reclaim to restore confidence. If buyers can absorb this bout of volatility and push WAL convincingly above that psychological barrier, a run back toward the highs is possible. For now, it’s a knife’s edge—watch for further long liquidations and choppy price action, and don’t be surprised if we see one last flush before a sustained rebound emerges. Personally, I’d keep stops tight: when the volatility storm hits, prudence is your best friend.

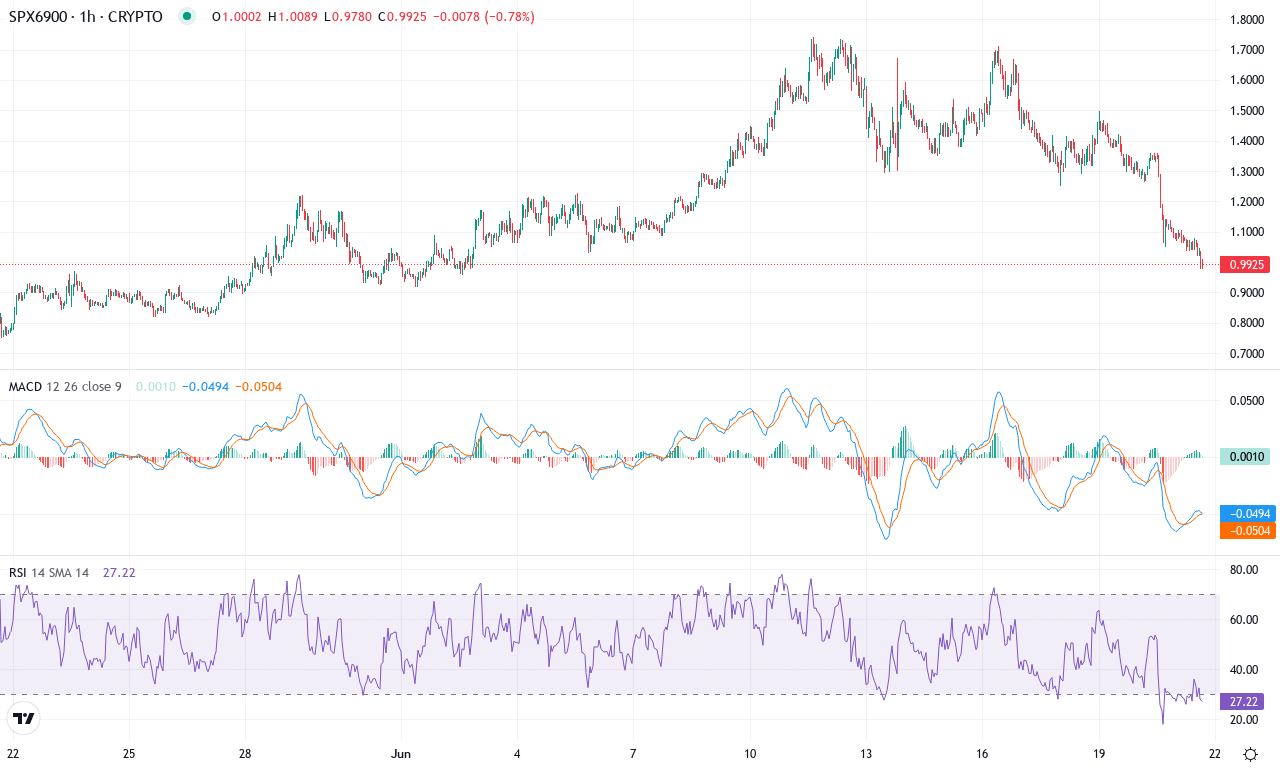

SPX6900 (SPX) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | SPX6900(SPX) | $0.99 | -36.15% | 27.00% | 41.1 | 40.7 | 0.07 | -111.13 |

|---|

After a blistering 27% surge this month and an eye-popping 102% gain over the past quarter, SPX is capturing traders’ attention as it hovers just shy of its monthly high, closing near $0.99. Despite last week’s dramatic 36% short-term drop—a sharp reminder of crypto’s inherent volatility—the broad trend remains decisively bullish, with the year-to-date rally standing tall at over 1,200%. The technical landscape is alive with energy: trend indicators continue to flash strong uptrend signals and institutional inflows seem to be fueling persistent upside momentum. But make no mistake, the sideways chop from last week reminds us: even in roaring bull markets, profit-taking and shakeouts arrive when you least expect them.

Diving deeper, the dominant uptrend is unmissable. Directional indexes and oscillators both confirm strong bull control, with the average directional index registering elevated trend strength and positive, aggressive buyer activity. The weekly MACD line is still ascending, echoing recent acceleration, and momentum oscillators are reinforcing the bullish stance, even as RSI approaches traditionally overbought territory—a classic sign of swelling optimism, but also a reason for level-headedness. Price is running well above key exponential moving averages, underscoring the risk of a steep correction if sellers regain control. Looking ahead, if bulls shatter resistance near $1.74, breakout momentum could catapult SPX toward uncharted highs; fail to do so, and we could see a profit-booking surge, with major support anchored around the $0.90 level. Personally, I’m on alert—if SPX can clear that top, it’ll be a breakout worth chasing, but don’t lose sight of risk: extended falls can come quick when euphoria runs hot.

Can KAIA and SPX Deliver on Breakout Potential?

KAIA is confronting a critical $0.20 resistance level as traders watch for either a breakout or another bout of volatility-induced stalling. WAL’s notable downtrend raises the question of whether recovery is possible or if bearish pressure will persist. SPX, meanwhile, teeters near highs, setting the scene for potential continuation or correction. The coming sessions will illuminate whether these assets can capitalize on current dynamics or face setbacks, keeping market participants poised for rapid responses.