Litecoin Teeters on Fragile Support While Monero Bulls Eye Breakout Zone

Litecoin and Monero are at pivotal crossroads, each facing their own unique technical challenges and opportunities. Litecoin struggles under mounting pressure after a month-long slide, teetering on fragile support amid lasting bearish sentiment. Can it hold its ground, or will further decline dominate? Meanwhile, Monero embarks on a bullish quest, with recent gains steering it closer to a formidable breakout zone. Will Monero maintain its upward momentum, or will resistance levels prove too tough to crack? Let’s break down the technical setup across the board.

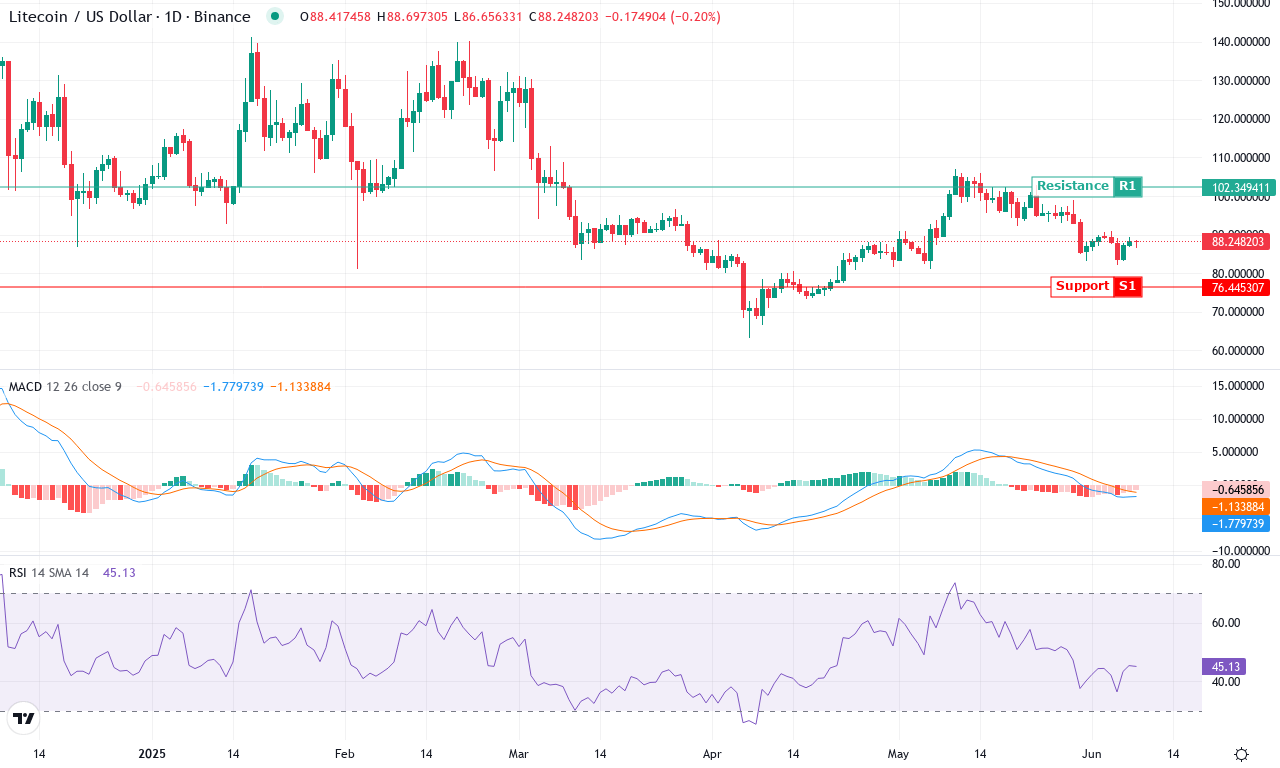

Litecoin (LTC) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| LITECOIN (LTC) | $88.12 | 1.17% | -7.18% | 44.9 | 19.5 | -1.78 | -63.83 |

After a disappointing performance over the past month—down more than 7%—Litecoin is facing a critical test amid lingering bearish sentiment. The crypto has been stuck in a grinding downtrend since April’s failed breakout, only just avoiding a full-scale rout after touching lows near $82. While a slight uptick this week hints at stabilization, sellers still hold the reins, as evidenced by persistent underperformance and fading attempts at a bullish reversal. From a high-level view, the technical outlook remains fragile: trend indicators are skewed negative, and the inability to retake the $90 level leaves Litecoin vulnerable to renewed downside—especially with long-term moving averages beginning to curve lower. There’s a palpable sense of fatigue among buyers; if this support zone breaks, risks of an extended fall toward previous multi-month lows intensify.

Digging deeper, trend strength oscillators confirm that bears have the upper hand. The Average Directional Index signals pronounced trend momentum, with negative trend indicators overshadowing positives. The weekly MACD continues to drift lower, clearly showing bearish momentum while the histogram expands into negative territory; meanwhile, oscillators like RSI and stochastic readings linger in no-man’s-land, failing to spark hope of an imminent bounce. Litecoin is currently wedged below the 10-, 20-, and 30-day exponential moving averages, signaling that short- and medium-term sellers are firmly entrenched. The near-term setup is straightforward: if bulls somehow reclaim $90 and drive price above $95, breakout momentum could revive a push back to the $100–$107 resistance cluster. However, a close below support at $82 would reinforce the bearish thesis, opening the door for a steep correction toward the $76 handle or worse. Right now, it’s a trader’s market—nimble entries and swift exits rule the day. Personally, I’m watching for exhaustion among sellers; if Litecoin can spark a clean reversal, it could surprise everyone. Until then, tight stops and caution are key.

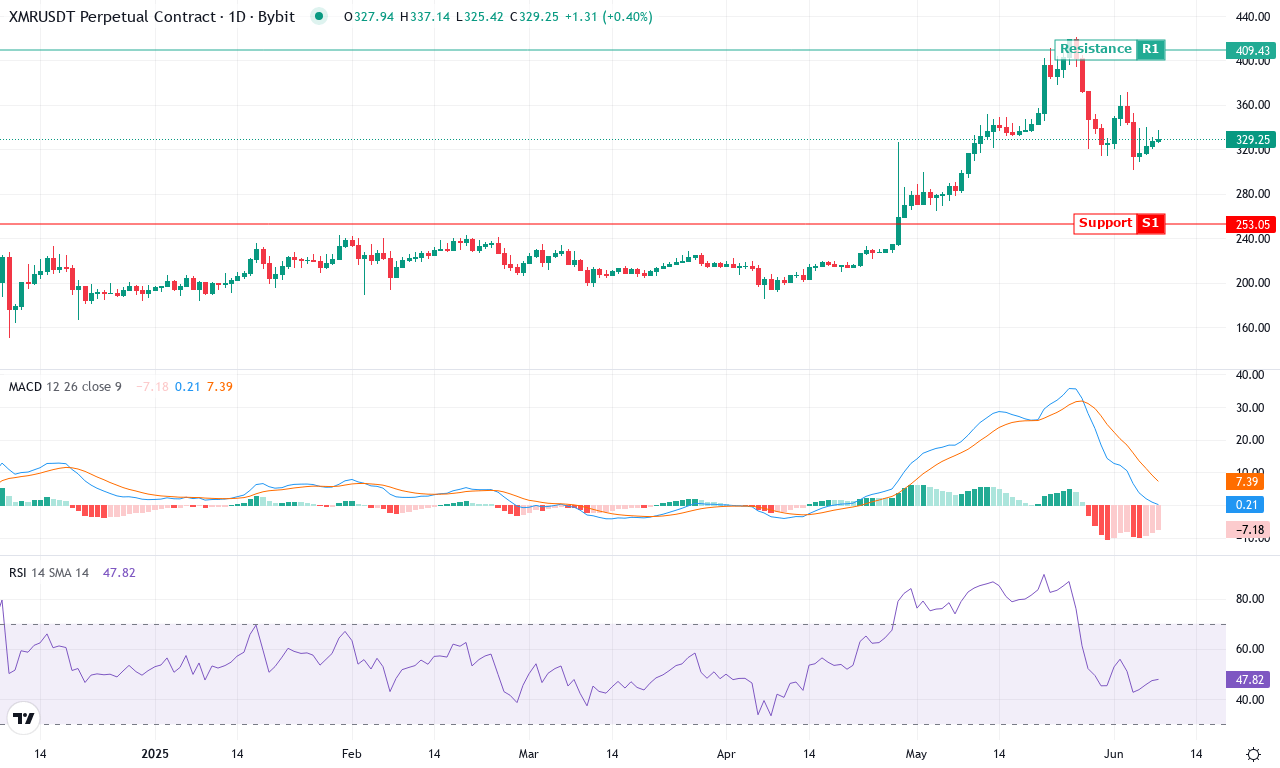

Monero (XMR) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| MONERO (XMR) | $329.67 | 1.33% | 10.19% | 48.0 | 32.4 | 0.24 | -63.89 |

After a dynamic climb over the past three months, Monero (XMR) is making headlines with a 10% monthly rally and a staggering 56% gain over the quarter—a sign that bulls are exerting real pressure after a period of relative obscurity. The steady run up from last month’s low of $301 has now brought Monero within striking distance of the $340–$350 resistance band, an area that has historically drawn seller interest and triggered profit-taking surges. With the yearly performance up an eye-watering 113%, it’s clear institutional demand and persistent buying have been the primary drivers. Yet, I can’t help but eye that cluster of round numbers and major pivots near $340–$360—the breaking point could ignite further momentum or snap the recent uptrend.

Digging deeper into the technicals, the trend indicators are painting a mixed picture. The ADX sits above 30, confirming a strong prevailing trend, but with positive and negative directional lines tightly matched, there’s a brewing tug-of-war between buyers and sellers. The weekly MACD has just crossed above its signal line, a classically bullish cue, while oscillators like RSI hover in the low-60s—strong but not yet overbought—implying there’s fuel left for a final burst. Monero’s price is riding well above its stacked moving averages, emphasizing bullish momentum, yet it is brushing up against critical resistance at $337 and $350. If the bulls can clear $350 with conviction, the next leg targets the psychological $400 level. Otherwise, failure to hold above $320 risks a sharp correction down to $300 or even $282, where the longer-term uptrend would be severely tested. All signs point to battle stations; whichever side wins, expect volatility to explode. I’m bracing for fireworks—this is where moves that define the quarter are made.

What Lies Ahead for Litecoin and Monero?

Litecoin sits precariously on its support, with any breach potentially triggering further decline. In contrast, Monero inches closer to a key resistance zone, encouraging bulls with its recent momentum. Future price action will clarify whether Litecoin can stabilize and if Monero’s rally can breach its barrier for further gains.