Maker, Compound, Monero, Litecoin, and Gnosis Test Critical Supports as Volatility Reaches Fever Pitch

In a market where volatility is king, Maker, Compound, Monero, Litecoin, and Gnosis are now grappling with critical support levels after recent downtrends tested bullish resolve. Maker’s 6.5% pullback last week is emblematic of the broader tension, surfacing just as these assets navigated below key psychological points. As each token stands at a crossroads, the technical indicators are painting diverging paths—will these assets find their footing or plunge deeper into correction territory? Let’s take a closer look at the signals behind the move.

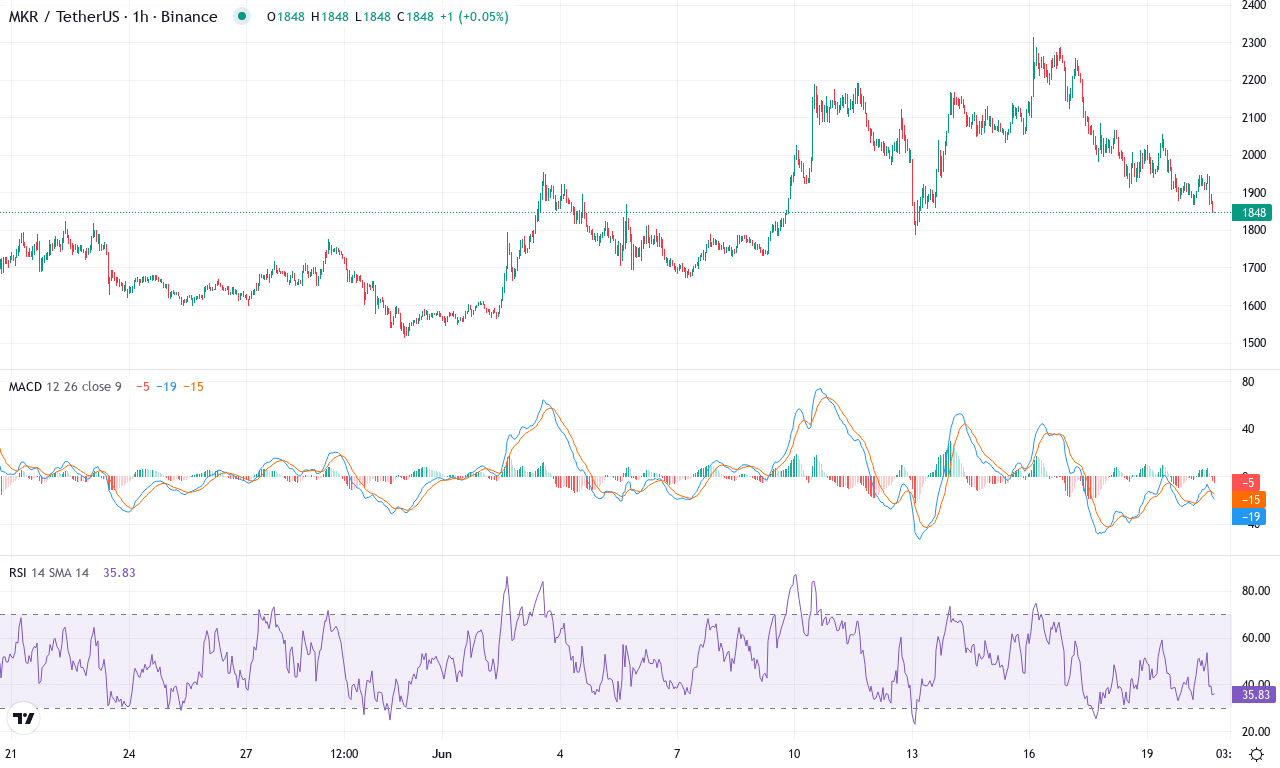

Maker (MKR) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | MAKER(MKR) | $1856.00 | -6.50% | 7.47% | 48.2 | 20.2 | 74.54 | -16.12 |

|---|

After a spectacular three-month run where Maker surged over 50%, the last week has thrown a curveball—pulling back nearly 6.5%. The monthly high at $2,314 now stands firm as bulls pause for breath, with current prices consolidating near $1,856, midway through this month’s volatile range. The trendline over six months still points higher, but year-to-date losses hover around 25%, underlining just how turbulent the Maker landscape is. With such sharp swings, nerves are fraying at the edges—these are the moments when conviction is tested, and latecomers risk getting whipsawed out of the trade unless they watch levels closely.

Diving into the technicals, trend indicators remain robust: a surging ADX above 20 and persistent positive directional bias show bulls haven’t been fully dislodged, even after this week’s sharp pullback. The weekly MACD momentum is cooling from earlier strength, hinting at waning bullish momentum—yet a spike in the Awesome Oscillator suggests sellers haven’t seized lasting control just yet. Maker trades just under short-term exponential moving averages, dancing on a knife’s edge near the pivotal $1,880 level. Key support sits around $1,650; lose that and risks of a steep correction toward $1,340 quickly climb. But if buyers regroup and punch through resistance at $2,190, the door opens for another run at those monthly highs. If price slices above $2,315, I’d be watching for breakneck acceleration as sidelined bulls scramble to re-enter. For now, the stakes are high and the setup fraught with tension—keep your stops tight and watch those pivots.

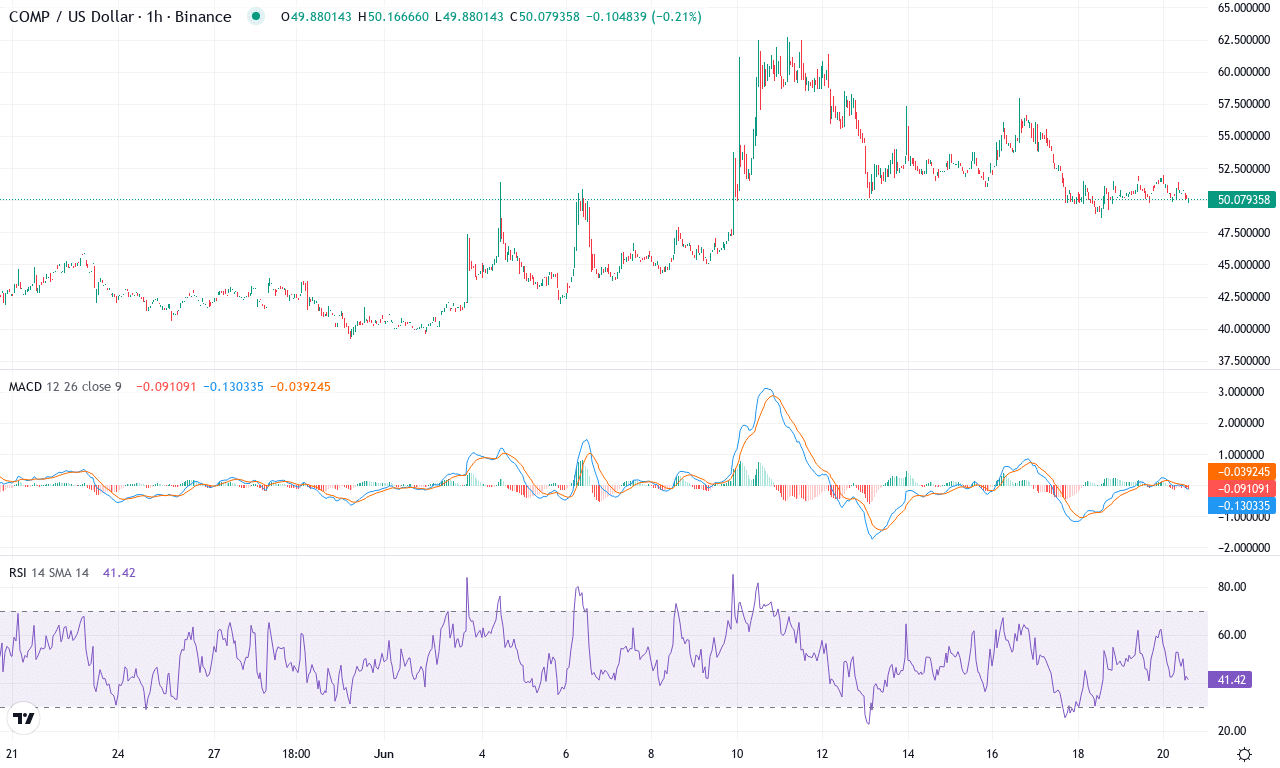

Compound (COMP) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | COMPOUND(COMP) | $49.99 | -7.61% | 17.11% | 51.7 | 29.5 | 2.07 | 11.38 |

|---|

After an impressive 17% climb this month and nearly 20% gains for the quarter, Compound (COMP) finds itself in the spotlight again. The token’s journey from a sharp six-month decline to its recent recovery suggests volatility is far from over. This week’s pullback—down over 7%—signals profit-taking and hesitation near the recent $62 monthly high, as sellers momentarily regain control. Still, the broader trend tells a story of resilience: while COMP is off its peak, oscillators maintain a constructive bias, and the price is consolidating just below key resistance rather than tumbling straight back down. Momentum is building for a decisive move, and I’m watching closely: if COMP can sustain this base above $50, that reversal could accelerate in dramatic fashion.

The technical outlook suggests a battle brewing between bulls and bears. Trend indicators, including a robust ADX, reveal that upward momentum is still alive, bolstered by the weekly MACD beginning to turn upward and the commodity channel index hinting at renewed buying interest. COMP continues to trade above its cluster of short-term EMAs and pivots, with the $50–$52 zone acting as solid support—if sellers force a break beneath this, risks of an extended fall toward the mid-$40s are real. On the flip side, a push through resistance around $62 would likely trigger breakout momentum, with $68 and $75 shaping up as logical price targets. The RSI sits comfortably below overbought territory, so there’s still room to run if sentiment heats back up. I’ll admit, the suspense at these levels is palpable—with COMP coiling for an explosive move, patience and conviction are going to be rewarded, whichever way the breakout lands.

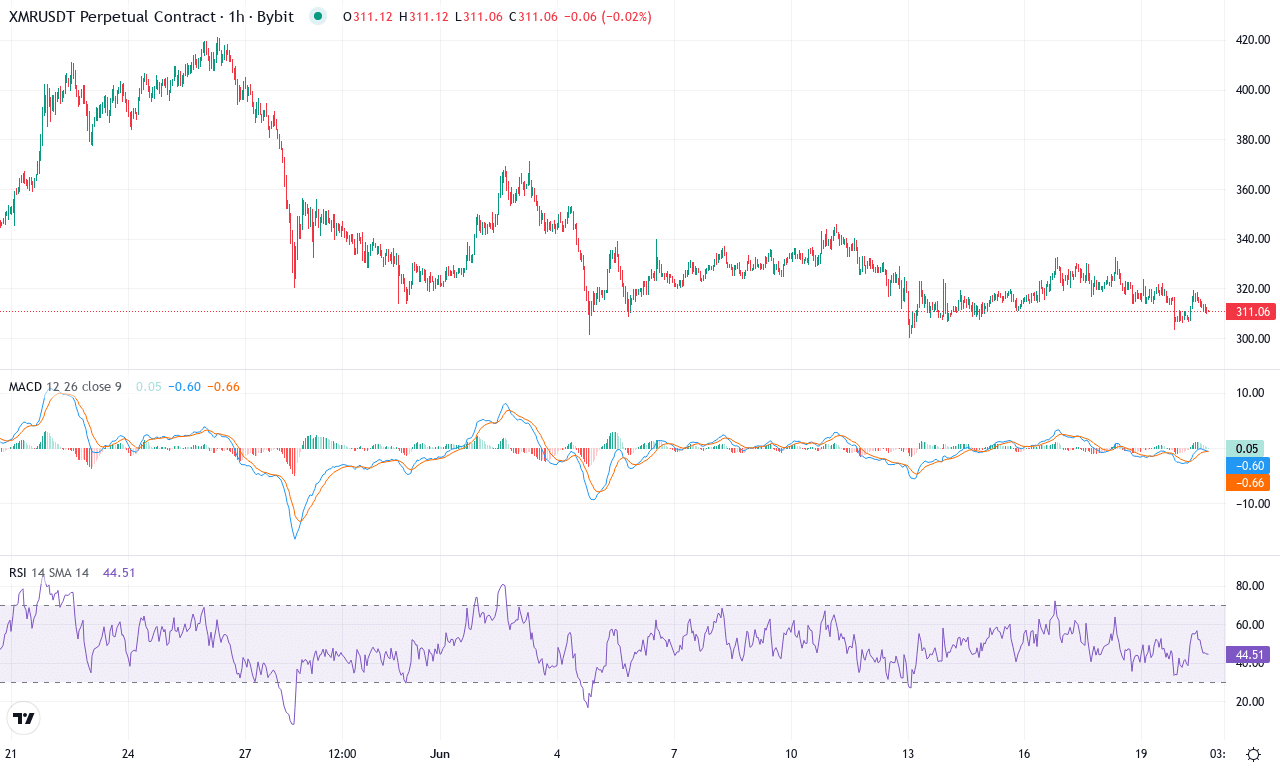

Monero (XMR) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | MONERO(XMR) | $311.10 | -2.33% | -11.74% | 42.2 | 19.9 | -6.02 | -99.18 |

|---|

Monero has finally taken a breather after an impressive multi-month rally, slipping roughly 12% over the last 30 days and closing the week near $311. Despite the recent pullback, the privacy coin still boasts 46% gains over three months and an eye-catching 85% year-to-date surge—a run I certainly wouldn’t have wanted to miss out on. This volatility is more cooling-off than crisis, as price action is consolidating above the psychological $300 level, a region that has repeatedly attracted both dip-buyers and profit-takers. The big question now: Is this merely a pause before the next breakout, or are sellers gaining the upper hand?

Diving into the technical outlook, trend indicators remain elevated but are showing some signs of fatigue. The ADX is perched near 20, while negative directional movement is edging above the positive, hinting that bullish momentum is declining—at least for now. The weekly MACD, after a strong upward push, is beginning to flatten, signaling that the upside impulse is losing steam. Short-term oscillators point to a reset: RSI has cooled into the 59 area, well off its overbought peak, while several oscillators have retreated from extremes, leaving Monero neither technically stretched nor screaming for immediate reversal. Price is now hovering around the 20- and 30-day moving averages, which are converging near $324—acting as resistance for any attempted bounce back. If bulls can reclaim ground above $340, a move toward $410 and the recent monthly highs is in the cards. On the downside, a break below $290 sets up risk for a steeper correction, with $255 as the key support to watch. Personally, I’m eager to see if buyers step up once more—Monero’s history shows that periods of quiet often precede explosive swings. Stay nimble here; the next big move could catch traders off guard.

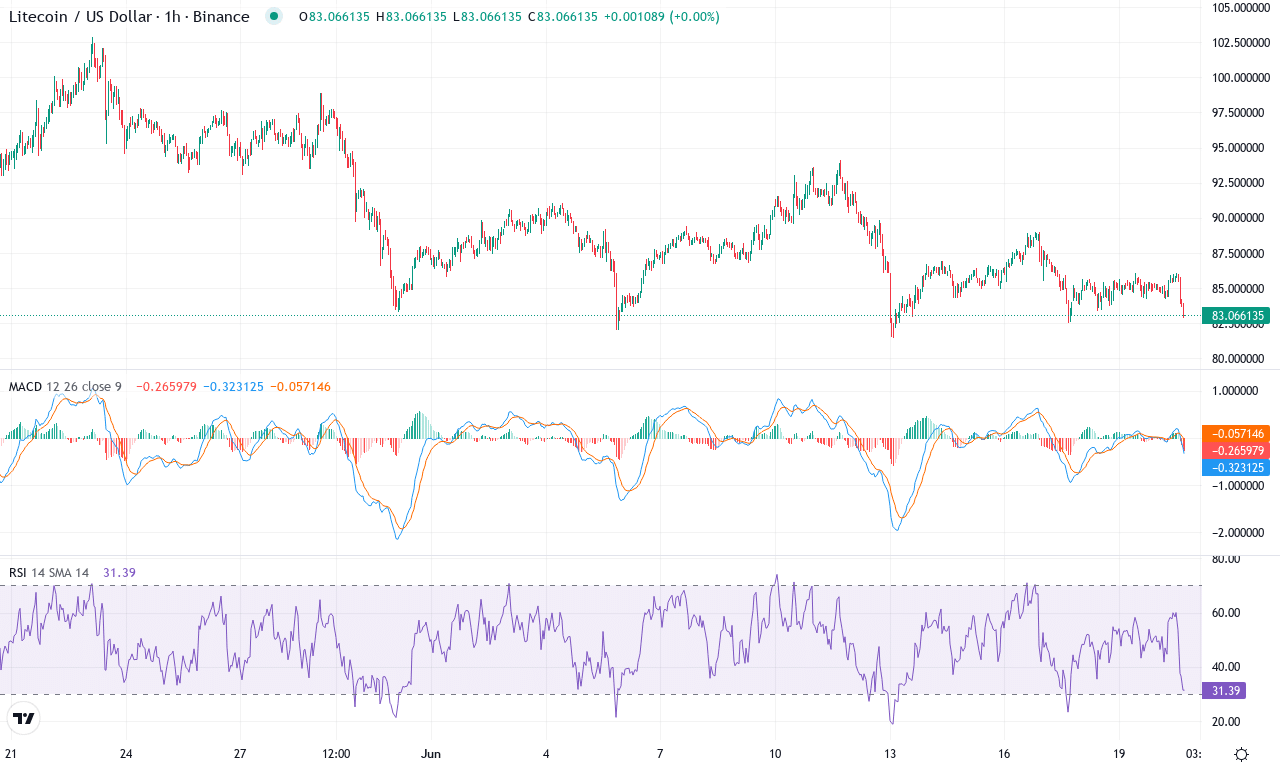

Litecoin (LTC) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | LITECOIN(LTC) | $82.98 | -3.61% | -11.94% | 39.2 | 21.4 | -1.99 | -112.80 |

|---|

After a sharp downturn this month, Litecoin is testing traders’ nerves at the $83 level, having shed nearly 12% in the past 30 days and continuing a six-month slide of over 18%. Despite last year’s double-digit rally, the recent negative momentum is unmistakable, with sellers regaining control and driving LTC toward the lower end of its recent range between $81 and $103. The broader short-term picture is weighed down by persistent volatility—Litecoin failed to mount a bounce during the past week, slipping another 3.6%. With descending price action and sustained weakness, the technical outlook suggests an extended correction is underway unless bulls regain lost territory soon.

Digging into the technicals, trend indicators remain starkly bearish: the weekly MACD is firmly in negative territory and drifting lower, while oscillators confirm building downside pressure. The ADX signals a potent trend, with negative directional indicators firmly above the positives—momentum is clearly favoring the bears. Meanwhile, LTC now trades beneath all major short-term moving averages, with the 10, 20, and 50-day EMAs clustered well above current prices and pushing resistance down to the $88–$90 area. Immediate support sits at the monthly low near $81; if that zone breaks, risks extend toward $76 and even the psychological $70 handle—a level that, frankly, would trigger wider panic selling. Conversely, any bounce faces heavy resistance into $92 and again near $103, where failed recoveries have repeatedly attracted profit-taking. Unless buyers reclaim the $90–$92 region with conviction, sellers are likely to dictate price action. Myself, I’m cautious here—best to wait for confirmation before calling a reversal, as all signs continue to point lower for now.

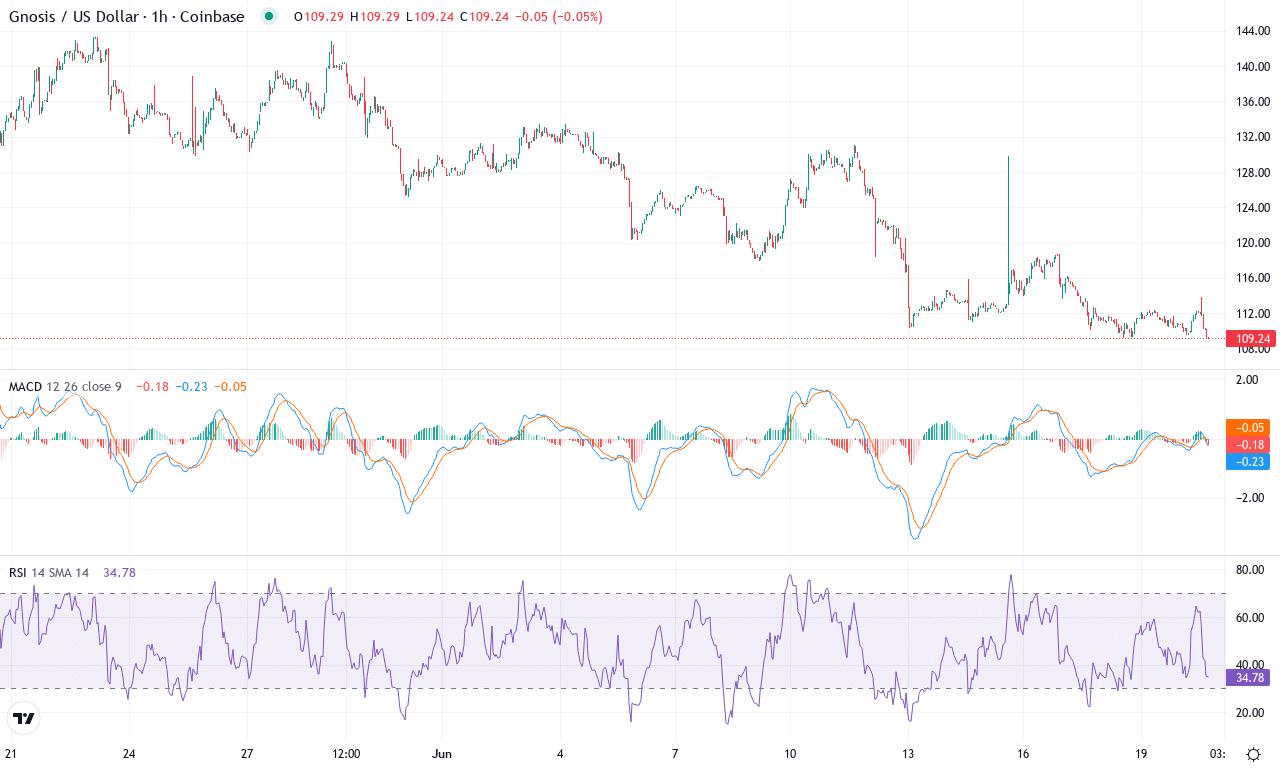

Compound (COMP) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | GNOSIS(GNO) | $109.29 | -6.94% | -18.86% | 34.8 | 17.0 | -4.97 | -109.64 |

|---|

After an agonizing month of relentless sell pressure, Gnosis (GNO) has found itself battered near the lower end of its range, closing just above $109 and shedding nearly 19% over the last 30 days. One glance at the recent price action reveals little mercy for bulls—performance over the past quarter remains deep in the red, while the six-month and yearly returns tell the story of a prolonged downtrend. With the token oscillating alongside major support around $107, anxiety among holders is palpable; a sustained breakdown here risks an extended fall that could challenge even deeper psychological levels.

Digging into the technicals, the setup is undeniably precarious. Trend indicators display clear bearish momentum: ADX remains elevated, confirming the strength of this dominant trend, while negative directional readings have overtaken positive ones. The MACD continues to signal pronounced downward momentum, its lines diverging as the histogram swells further into negative territory—no hints of a reversal just yet. Oscillators paint a similarly grim picture, with RSI stuck in the mid-thirties and both the CCI and momentum readings mired in oversold conditions. Price is hovering beneath all key moving averages; notably, the 10 EMA and 20 EMA, amplify the overhead pressure, and failure to reclaim those levels in the coming days could embolden sellers. Immediate support looms at $107—lose that, and GNO is exposed to a steep correction toward the psychological $100 mark or even lower. A rare glimmer of hope: should bulls muster enough strength to reclaim resistance at $128, the tide could turn quickly—potentially igniting a sharp bounce back toward the $150 zone. Until then, caution is warranted; catching a falling knife in thin liquidity is rarely forgiving.

Navigating the Crossroads

Maker holds near support, while Compound shows signs of stabilizing after its slide. Monero aims to rebound, contingent on buying interest, as Litecoin tests its longstanding floor. Gnosis attempts to avert further decline as volatility swells. Each asset now faces a pivotal moment—whether they secure support or dive deeper will be closely watched in the coming sessions.