Maker Soars Past BNB As Bullish Momentum Accelerates But Can The Run Last

Maker has surged past BNB with a notable 14.01% gain this week, positioning itself as a standout performer in an otherwise steady market landscape. Both Maker and BNB are navigating pivotal zones, yet Maker’s bullish momentum appears considerably more pronounced. Can this rapid ascent sustain itself, or is a potential cooldown on the horizon? Let’s take a closer look at the signals behind the move.

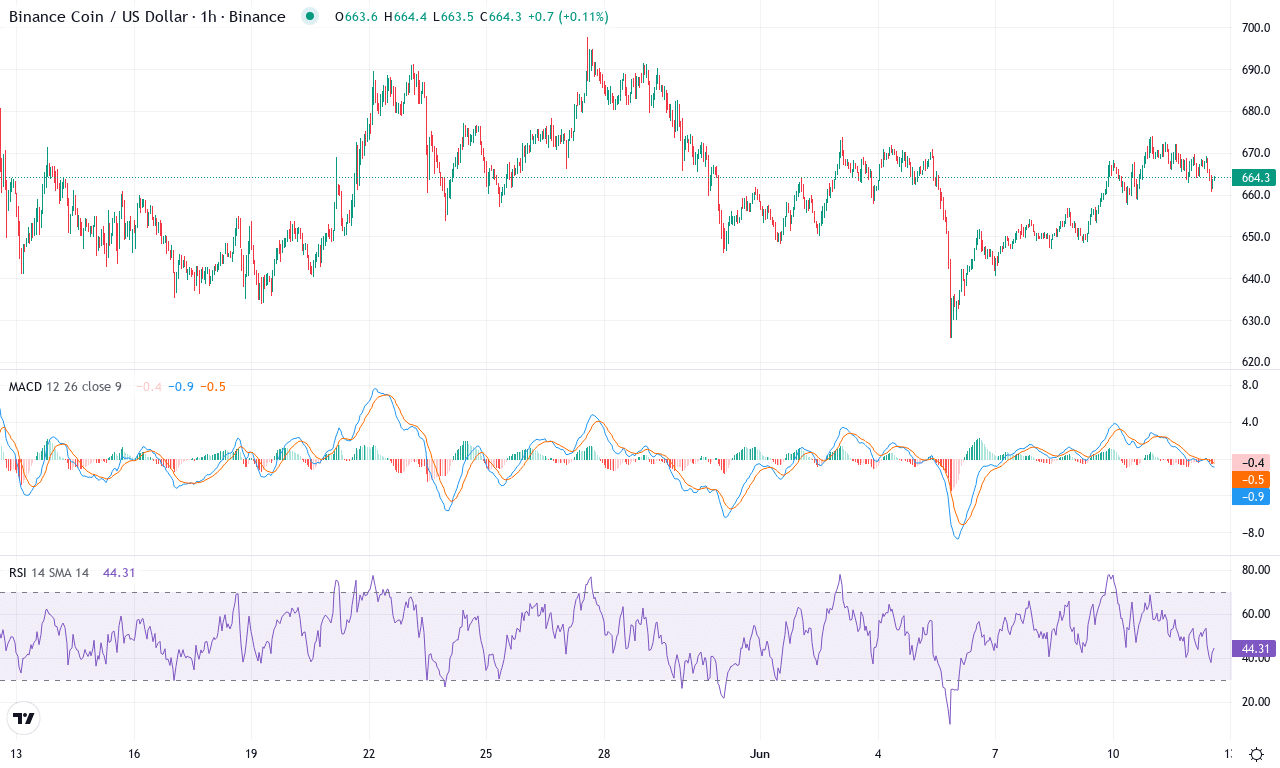

BNB (BNB) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| BNB(BNB) | $663.30 | -0.02% | 0.44% | 52.9 | 18.9 | 3.94 | 8.76 |

After a spectacular surge this month, BNB is drawing eyes with an outsized 44% gain—no small feat in a largely choppy market. The token is now hovering near $663, just off its monthly high of $697, and the current price action suggests bullish momentum is only just beginning to ebb. While bears momentarily pushed for a short-lived selloff (down 1.5% over the past week), buyers quickly defended key retracement zones, hinting at robust underlying demand. From a macro perspective, the 6-month dip now looks like a distant memory, replaced by a convincing 14% jump in the last quarter and renewed institutional interest as BNB outpaces its major moving averages and rides atop rising sentiment. As volatility surges, I can’t help but feel the stage is set—BNB is at a crossroads, and fireworks may not be far away.

Technically, trend indicators are screaming strength: the ADX hovers near 19, pointing to a powerful directional move, while a strongly bullish MACD crossover has fueled buy-side enthusiasm for weeks. Oscillators also confirm positive momentum, with the RSI marching up toward 70—a region that sometimes signals frothy, overbought conditions but also precedes explosive run-ups in trending markets. BNB’s price is consistently beating all its major exponential moving averages, with short-term averages aggressively sloping upward and providing dynamic support. The next battleground sits at the psychological $700 resistance; if bulls break through, the path opens toward the $760–$870 region. Should sellers push back, keep an eye on support near $646, around the monthly pivot and a cluster of moving average confluences. All the technicals suggest buyers remain firmly in control—unless we see a sharp reversal, I’d watch for another attempt at all-time highs.

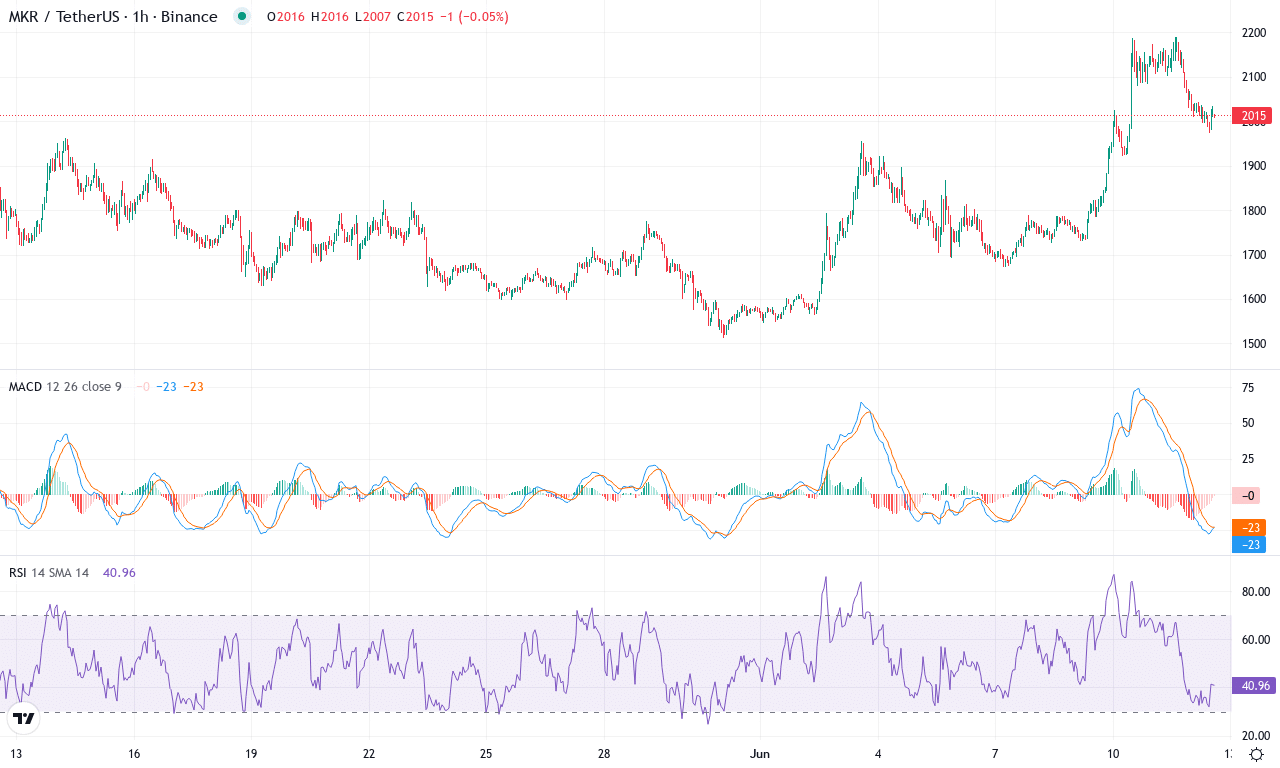

Maker (MKR) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| MAKER(MKR) | $2026.00 | 14.01% | 13.06% | 63.2 | 27.2 | 92.15 | 144.30 |

After a turbulent month punctuated by swift rallies and sharp dips, Maker (MKR) is marching higher, cementing a formidable 13% gain over just the past week and extending its one-month advance to over 13%. Despite negative six- and twelve-month performances casting a long-term shadow, MKR’s recent price action tells a different story: the token surged from a monthly low near $1,511 to touch $2,190 before retreating slightly to trade around $2,026. This move has propelled MKR toward the upper end of its recent range, and it’s now pressing against pivotal resistance levels—notably the $2,190 monthly high and the psychologically-charged $2,200 zone. For anyone riding this wave, the market’s recent energy is both exhilarating and loaded with anticipation—breakout momentum is building, and a volatility surge is hardly out of the question if bulls maintain their grip.

Digging into the technicals, the trend remains robust. MKR’s ADX trend indicator is flashing strong conviction, with positive directional movement handily outpacing the negative, suggesting bulls are firmly in control. The weekly MACD is accelerating higher, underpinned by swelling momentum from other oscillators. Short-term moving averages (the 10, 20, and 30-day EMAs) have all flipped above key price zones, reinforcing upward price action and painting a bullish technical outlook. RSI is knocking on the door of overbought territory, which sometimes hints at profit-taking surges ahead, but the $1,950 area should serve as first-line support should the tide turn. If buyers clear $2,200 with conviction, the next target lies near $2,300—while failure to sustain current levels could prompt a steep correction down to the $1,650 support. As a trader, I’m watching this inflection point closely; all signs point to a breakout, but I’d tread carefully—risks of an extended fall grow if bullish momentum declines sharply.

Can Maker Maintain Its Lead?

Maker’s strong momentum has propelled it past BNB, but now it faces the challenge of sustaining its current pace. Both assets are at critical junctures; Maker shows promising strength, while BNB steadies, awaiting its next directional cue. Traders should watch for stability above recent highs for a potential continuation, but any weakness could herald a breath-taking pause in this rally.