MKR GNO And INJ Hang On Precarious Support As Bears Circle Key Breakdown Triggers

Amid a whirlwind of uncertainty, Maker (MKR), Gnosis (GNO), and Injective (INJ) find themselves on high alert as their precarious supports tremble under heavy bearish scrutiny. MKR’s recent descent toward $1,800 raises alarm after bold monthly gains, leaving traders watching for signs of either a bounce or further retreat. Meanwhile, GNO’s ongoing struggle poses a challenge to bulls grasping for stability, while INJ’s fluctuating performance keeps both sides guessing. As these cryptos hover at critical technical junctures, the pressing question looms: can they hold the line or will bears seize the advantage? Let’s take a closer look at the signals behind the move.

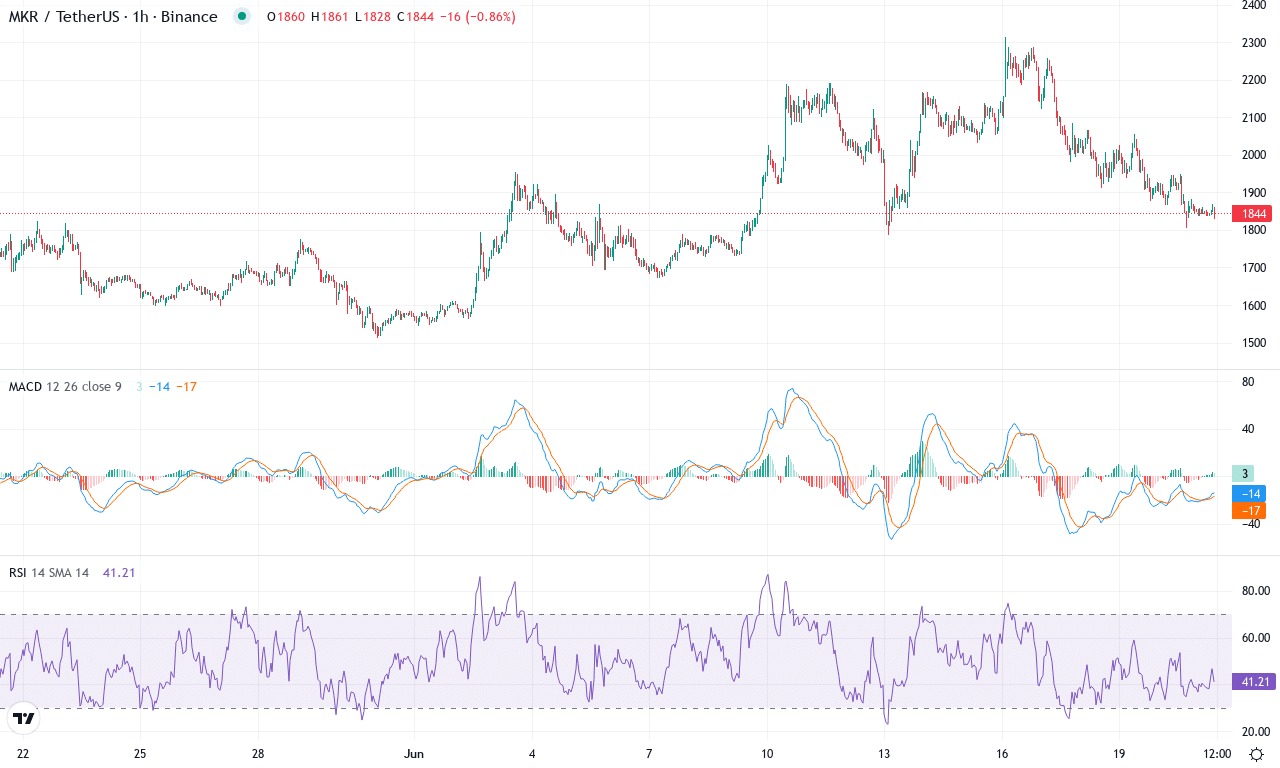

Maker (MKR) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | MAKER(MKR) | $1836.00 | -15.12% | 5.34% | 47.2 | 19.3 | 58.04 | -42.80 |

|---|

After a period of outsized gains and subsequent sideways volatility, Maker (MKR) is now grappling with intensified selling pressure—down more than 15% this week even as its monthly candle stays green. The crypto climbed to a monthly high at $2,314 before profit-taking and a loss of momentum saw it retreat sharply toward the $1,800 region. Despite boasting a robust 48% rally over three months and holding 6-month gains, this week’s dramatic reversal and rising volatility signal a potential inflection point as bulls and bears engage in a fierce tug-of-war near critical support. As headwinds grow, the technical outlook suggests waning bullish momentum—and just between us, I’m keeping stops tight in case the sellers push for an extended fall.

Price action analysis shows MKR teetering just above the $1,800 support level, while key moving averages (EMA10, EMA20, and EMA30) coil closely between $1,950 and $1,870, reflecting compressed volatility and a market at crossroads. Trend indicators—particularly the ADX reading well above 19—highlight trend strength, but with the positive directional movement index losing ground to its negative counterpart, bearish momentum is starting to outpace bulls. Oscillators reinforce this caution: the weekly MACD is rolling over, while the RSI softens after peaking, warning of further downside if selling accelerates. If sellers manage to break below support at $1,750, risks of a steep correction toward $1,650 loom large; conversely, if MKR can reclaim the $1,950–$2,000 zone and ride renewed demand, a move back toward $2,300 is back on the table. One thing’s certain—volatility is far from done here, and whichever side claims victory will set MKR’s trajectory for weeks to come.

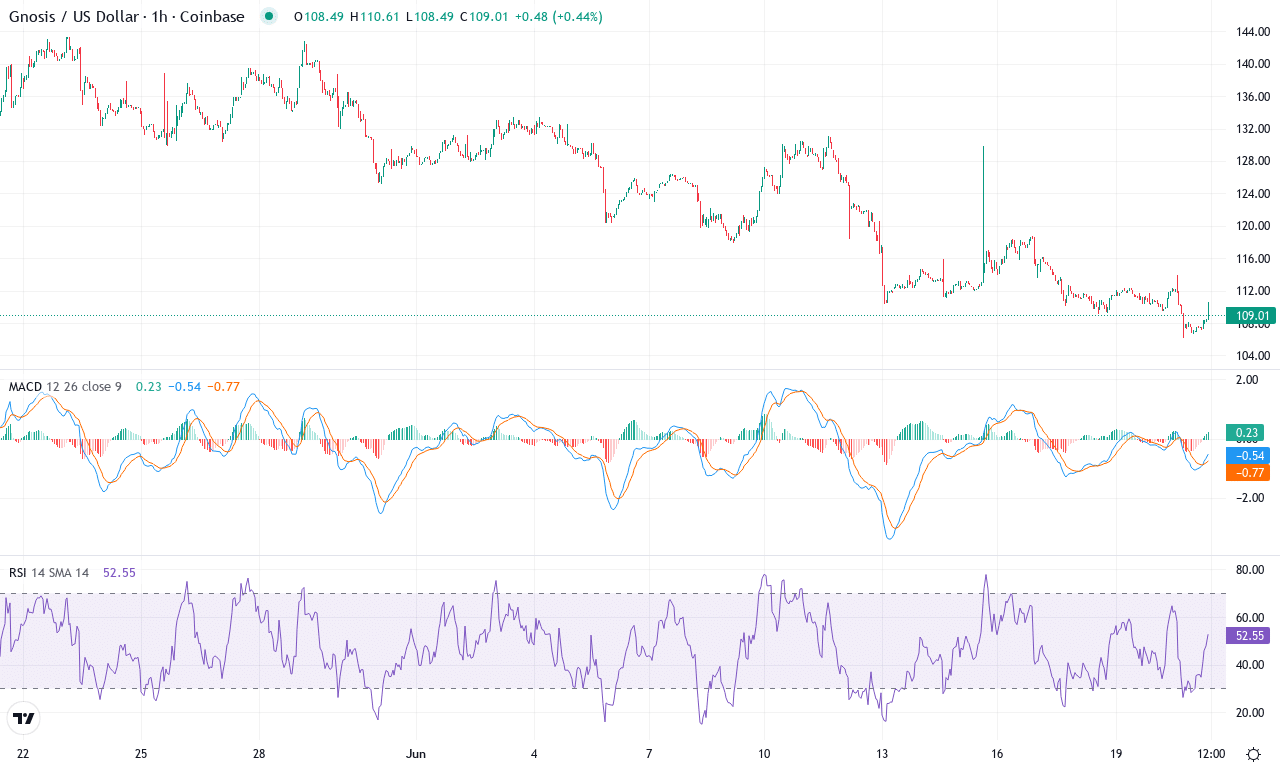

Gnosis (GNO) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | GNOSIS(GNO) | $109.01 | -4.89% | -20.94% | 36.2 | 18.0 | -5.27 | -113.08 |

|---|

After a brutal six months for Gnosis (GNO), the token finds itself down over 57% in that period, recently marking a new monthly low just above $106 before attempting to stabilize near $109. Fresh off a steep -21% drawdown on the month, GNO underperformed the broader market, raising serious questions about sentiment and underlying support. This prolonged decline stands in sharp contrast to the high-flying days of last year, with the yearly chart still buried deep in negative territory at -66%. With price action compressed between local support and the psychological $110 barrier, Gnosis traders are holding their breath—hoping for a catalyst or fearing more pain if the floor gives way. I’ll admit, watching a project with real fundamentals trade like this can be tough, but seasoned traders know markets test conviction right when it feels most uncomfortable.

Diving into the technicals, the trend indicators still point firmly lower. The average directional index, which flashes trend strength, remains elevated, signaling entrenched bearish momentum. The weekly MACD shows no sign of a bullish crossover, and the negative reading on major oscillators confirms sellers continue to dominate. Momentum, while slightly less negative than last week, still languishes far below zero—leaving little hope for a near-term reversal. GNO trades well beneath all its short- to mid-term moving averages, and until price climbs above the $127–$130 zone (with resistance lining up near $128 and a pivotal $132 cluster), hopes for a sustainable bounce will remain faint. If bulls mount a rally and close above these levels, the next target emerges at the $150 range, but a failure to recapture those zones risks an extended fall toward the $107 support and possibly as low as $86 if selling pressure accelerates. For now, the technical outlook suggests caution is warranted: GNO may have to weather more stormy seas before the bulls can even think about regaining control.

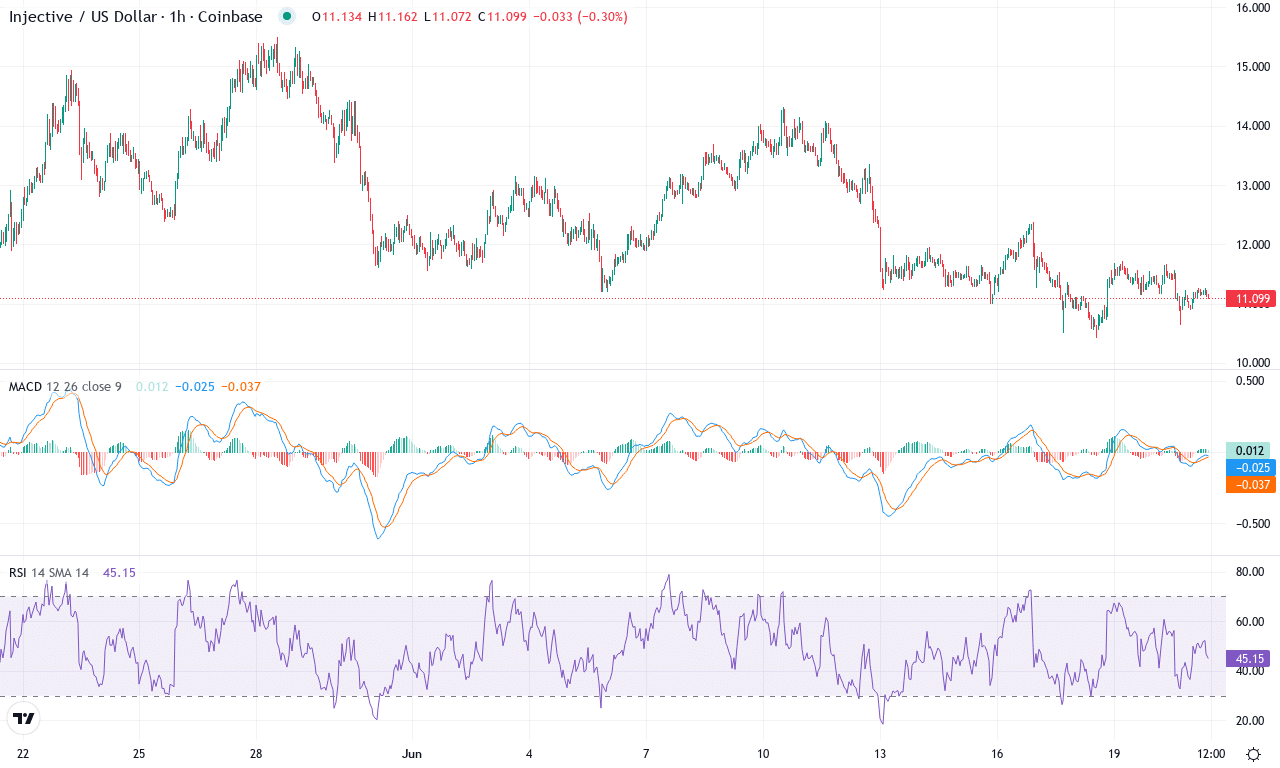

Injective (INJ) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | INJECTIVE(INJ) | $11.08 | -5.90% | -10.67% | 42.2 | 16.4 | -0.36 | -90.00 |

|---|

After a sharp reversal in recent weeks, Injective (INJ) is searching for footing as it trades near $11, close to the monthly low and far removed from its monthly high at $15.50. Sellers have been in control—INJ is down 11% for the month and nearly 6% just this week, compounding a staggering 46% collapse from six months earlier. The relentless downside pressure has flipped the mood from hopeful consolidation to an anxious standoff, with oscillators still reflecting bearish sentiment. Yet, a double-digit three-month bounce—up nearly 12%—proves that short squeezes and technical rebounds still lurk in the backdrop. The big question now: is this the last gasp for bears, or a setup for a relief rally if trend exhaustion sets in?

Delving into the technicals, trend indicators point to a stalemate as ADX hovers in the high teens while directional movement shows both bulls and bears trading blows, with sellers gaining the upper hand. The MACD lines have flattened out, signaling waning momentum after weeks of acceleration on the downside—there’s no outright bullish reversal yet, but the bleeding is slowing. The RSI and other oscillators hover in neutral-to-lower ranges, confirming lingering bearish momentum but stopping short of deep oversold signals. INJ remains pinned beneath all its major moving averages—including the EMA10 and EMA20—not a great look for buyers. Unless bulls reclaim resistance at $12.20, the immediate path of least resistance remains lower, with the $10.40 region offering critical support; break that, and risks of a steep correction surge. Still, if a short-covering rally emerges and $12.20 falls, the next upside target sits near $15.50 and could set off fireworks. I’m not counting out a dramatic reversal if sentiment shifts—but for now, caution is king and aggressive longs should tread lightly.

Can Support Prevail Amidst Bearish Threats?

MKR is balancing teeteringly near $1,800, with the potential for a rebound contingent on stemming bearish pressure. GNO struggles to find a solid footing, echoing market-wide caution, while INJ remains volatile, stuck in a trading limbo. Current support levels are vulnerable, and bears are watching closely. The market’s next moves could set the stage for either stabilization or deeper declines.