MKR, XMR, and QNT Ignite Fresh Uptrends But Will Resistance Unleash the Next Surge—or Reversal?

MKR, XMR, and QNT are turning heads as fresh uptrends breathe new life into these digital assets. Following Maker’s notable 20% climb in the last month, Monero’s impressive six-month gain of over 60%, and Quant’s robust 32% surge, all three are heading toward critical technical junctions. Yet, the big question looms: will this rally break past looming resistances or trigger a reset? Time to sift through the technical indicators and assess the momentum behind these moves.

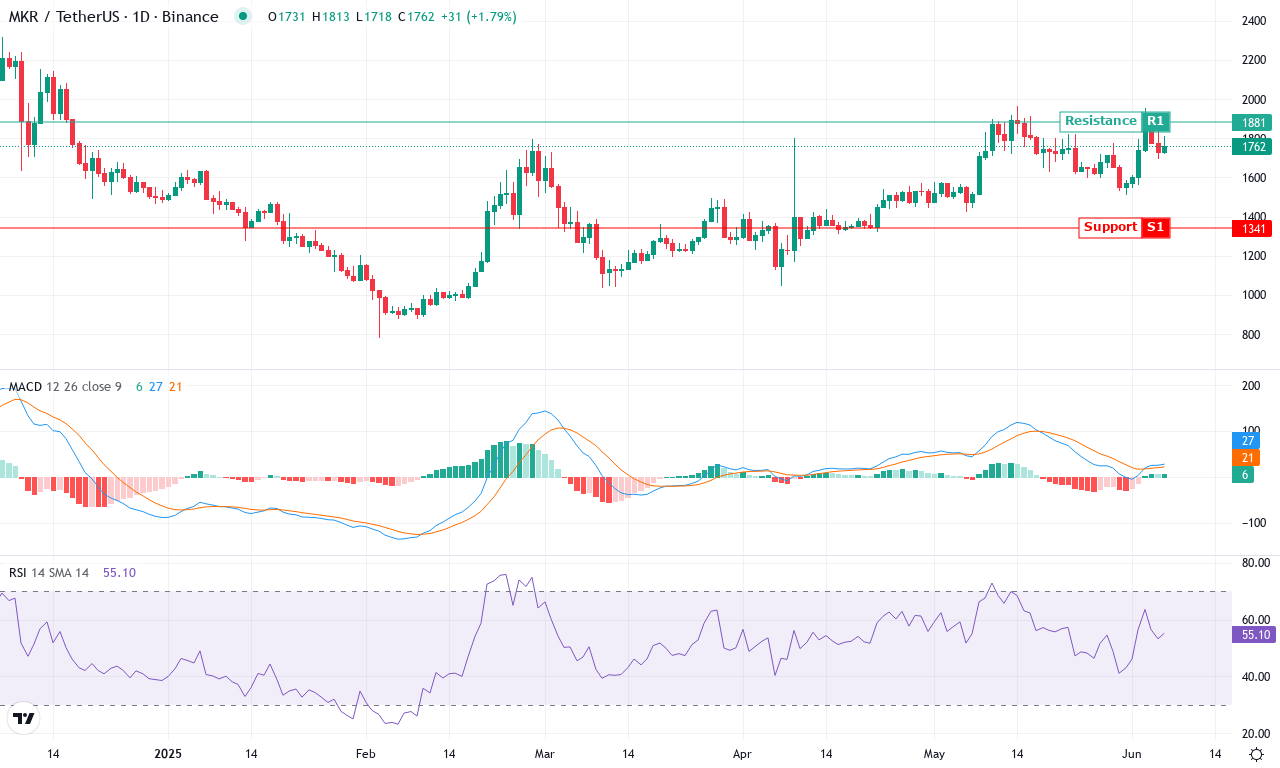

Maker (MKR)

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| MAKER (MKR) | $1763.00 | 6.72% | 19.69% | 55.2 | 20.7 | 27.43 | 74.08 |

After a turbulent spring, Maker (MKR) has staged an impressive rebound, gaining nearly 20% in the past month and recapturing the $1,760 level. Short-term price action has been bullish, with buyers driving the token up over 6% this week alone and erasing much of the steep drawdown seen over the last six months. Momentum has shifted swiftly, and MKR is fast approaching its monthly high of $1,962. With such sharp moves, I’m watching closely—when bulls reclaim ground this quickly, it signals a dramatic shift in sentiment. The broader context is complicated though: on a yearly basis, MKR remains deep in the red, but rising institutional engagement in DeFi and the recent surge in volatility keep the outlook charged with potential.

Drilling down into the technicals, trend indicators are flashing a resumption of bullish momentum, with the average directional index showing strong trend strength and positive directional movement handily outpacing sellers’ pressure. The weekly MACD line is accelerating above its signal, and oscillators like RSI hover in neutral-to-bullish territory—well below overbought, leaving room for further gains. MKR is trading above most of its key moving averages, consolidating just beneath a heavy resistance zone around $1,960. If bulls manage a daily close above that resistance, the next major targets appear near $2,190 and $2,730, both of which represent psychologically significant and technically validated levels. Conversely, should sellers regain control or profit taking surge, watch support around $1,650—breaching that increases risks of a steeper correction toward $1,540. All signs point to a critical inflection; the next breakout or breakdown sets the tone for summer trading. If MKR surges above $2,000, I’ll be watching for a high-volume continuation—this is precisely the moment traders live for.

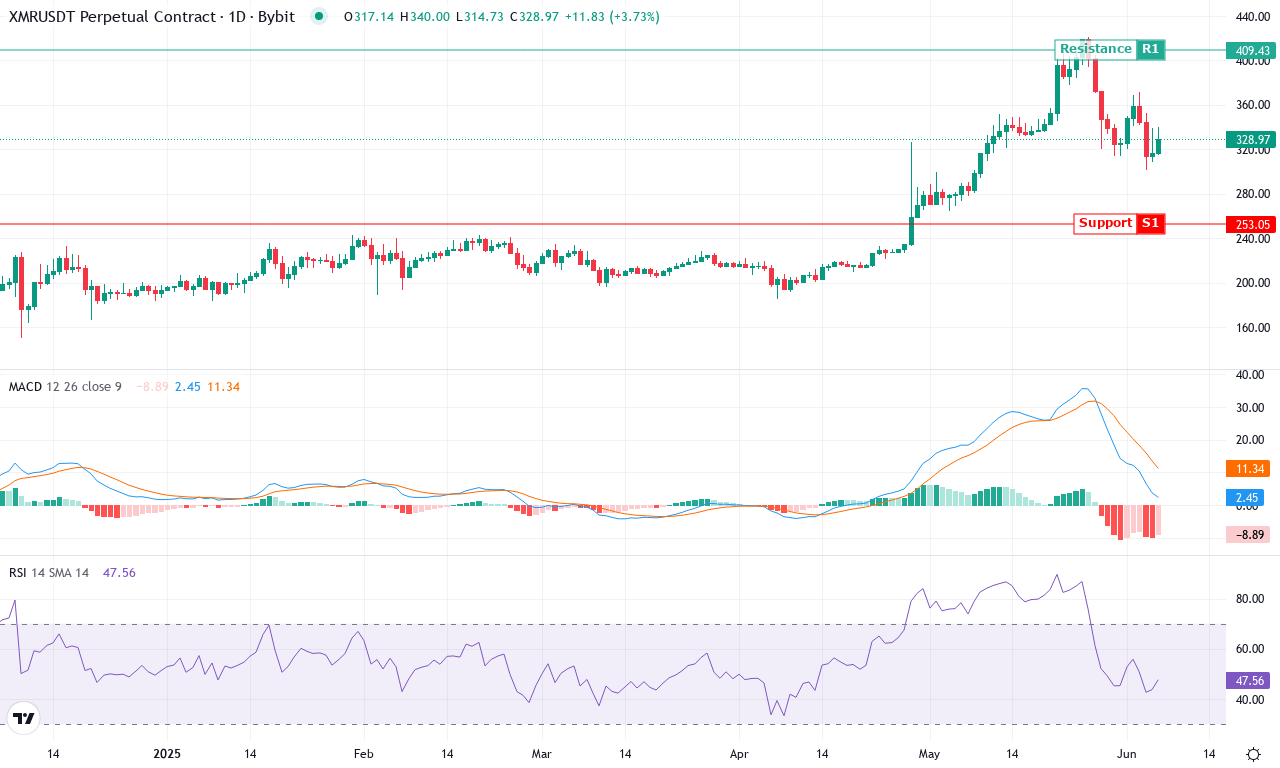

Monero (XMR)

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| MONERO (XMR) | $328.86 | -2.96% | 14.41% | 47.5 | 36.6 | 2.44 | -77.03 |

After a month marked by a sharp 15% rally, Monero (XMR) is showing signs of exhaustion just under the $340 level, following an impressive six-month gain above 60%. The privacy coin has clawed its way back from a low near $280 to post new multi-month highs above $420, only to see some profit taking pull price action back to $331. This recent pullback isn’t surprising after such an explosive move, but the deep retracement from last week’s top does introduce a note of caution. Institutional inflow and growing privacy narratives have underpinned the run, but with the market now digesting heavy upside, traders are right to question whether XMR’s breakout momentum is sustainable heading into June.

Digging deeper, trend indicators remain stubbornly bullish, with the ADX confirming a strong trend in place and MACD lines still firmly above the signal line on weekly timeframes, helping to ward off any immediate bearish reversal fears. Oscillators paint a mixed picture, however: RSI lingers in mid-60s territory, not screaming “overbought,” yet certainly above comfort levels for new longs. XMR is consolidating above all its key moving averages, including the 10-day and 20-day EMAs, reinforcing structural strength—but volatility is swelling, and the next directional move may be dramatic. Traders should watch the resistance at $340–$350; a convincing break would leave the $410–$420 zone vulnerable for a retest, while failure to build momentum here risks an extended fall back to key support near $315, or worst case, $280. I have to admit—I’m rooting for a clean break higher; just don’t forget to keep stops tight as this battle plays out.

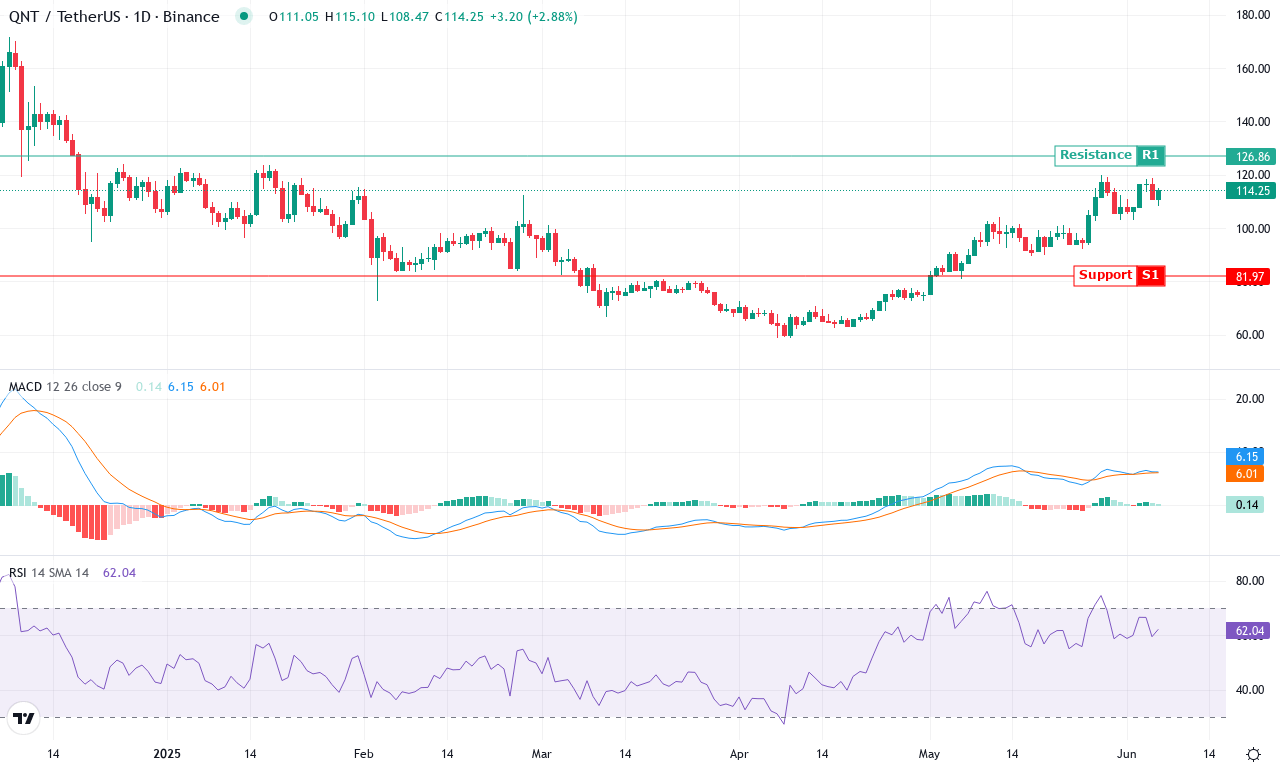

Quant (QNT)

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| QUANT (QNT) | $114.26 | 0.50% | 31.48% | 62.0 | 34.0 | 6.16 | 70.43 |

After several months of steep correction and almost relentless bearish pressure, Quant (QNT) is finally showing a pulse—and what a surge it’s been. With a monthly rally exceeding 32% and a solid 46% gain over the last three months, QNT has rebounded emphatically from its long-term lows around $89.50, now brushing up against $115. This comeback is dramatic, coming after a bruising six months where the token lost nearly a third of its value. The recent volatility surge and decisive move off support suggest institutional inflows or aggressive dip-buying have returned. For investors and traders battered by the previous slide, there’s a palpable sense of hope—especially now that QNT is not only holding above its EMA band but also closing out the week right at its high.

Technically, momentum has meaningfully shifted. The average directional index shows QNT in a strong trend, with bullish momentum swelling and positive trend indicators outpacing their bearish counterparts. The weekly MACD is now accelerating higher, and oscillators—including the relative strength index—indicate a healthy, but not yet overbought, market. Price action analysis confirms QNT is decisively above all critical moving averages—10, 20, 50, even the 200-day—which acts as a bullish greenlight for new entries. The next big resistance level looms near $127, a psychological round number coinciding with a prior pivot. A clear break above this zone would open the gates toward ambitious targets at $145 or even $190. On the flip side, if sellers regain control or profit-taking surges, look to the layered support around $102 and $98; a break below could risk an extended fall back toward the monthly lows. Right now, with conviction building, all signs point to a fresh phase of upside—though I always keep a wary eye out for sudden reversals in this still-volatile market.

Navigating Upcoming Challenges

MKR is within reach of overcoming its recent resistance, while XMR tests stability in its current range. QNT eyes higher levels but first must face short-term hurdles. If these coins can maintain volume and buying pressure, the rallies could extend further — yet, caution is warranted as resistance tests persist. Traders should watch upcoming sessions for confirmation of sustained trends.