Nexo And Injective Test Nerve As Price Compression Nears Breaking Point

Nexo and Injective have recently found themselves trapped in a tightening market squeeze, testing traders’ nerves as they navigate through a web of conflicting signals. With Nexo slipping around 5.5% this month and Injective caught in a downward drift, it’s clear the market’s mood has turned cautious. As both assets hover near pivotal levels, market participants stand at a critical juncture—will the persistent bearish pressure ignite further downside, or can the bulls rally for a reversal? Let’s break down the technical setup across the board.

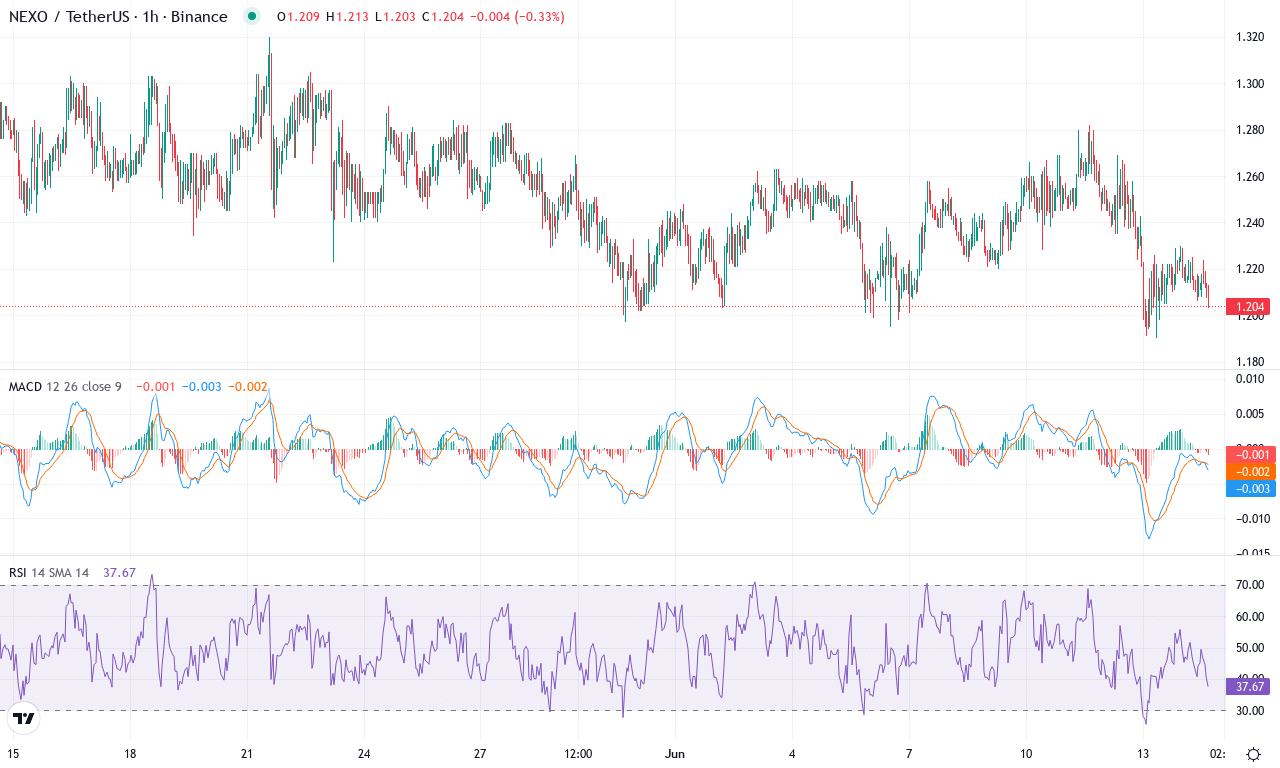

Nexo (NEXO) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | NEXO(NEXO) | $1.21 | -1.15% | -5.56% | 43.2 | 18.9 | 0.00 | -120.98 |

|---|

After an impressive run earlier this quarter, Nexo is now feeling the weight of corrective price action, marking a monthly decline of roughly 5.5% and a tepid trajectory over the past week. Despite some bullish fireworks in previous months, the bears have regained control in the short term, dragging price from this month’s swing high at $1.32 down toward the current close near $1.21. This latest pullback isn’t happening in a vacuum—volatility is quietly swelling and the broader market’s tone has shifted defensively. It’s hard to ignore how quickly bullish sentiment can evaporate; in my own book, this is a textbook pause after exuberant profit taking, but certainly not a full reversal—yet.

Diving deeper, the technical outlook suggests the current consolidation may still have legs. Trend indicators show fading bullish momentum as sellers widen their grip; the ADX registers firm trend strength with negative directionals dominating, while the MACD has slipped into a classic standoff—hovering just above its signal line, suggesting indecision rather than outright panic. Momentum oscillators, including the RSI, have pulled back from overheated territory but aren’t yet oversold, giving bears room to test lower supports. Nexo trades right around its 20- and 30-day moving averages, signaling the battle lines are drawn at this $1.20–$1.25 band. If bulls muster enough conviction to reclaim the $1.32 resistance, the path could open quickly to $1.40 and beyond; otherwise, a break below $1.19 risks an extended fall toward the psychological $1.15 mark and possibly deeper to $1.12. For now, I’m staying nimble—there’s tension in the air, and the next move will likely set the tone for weeks to come.

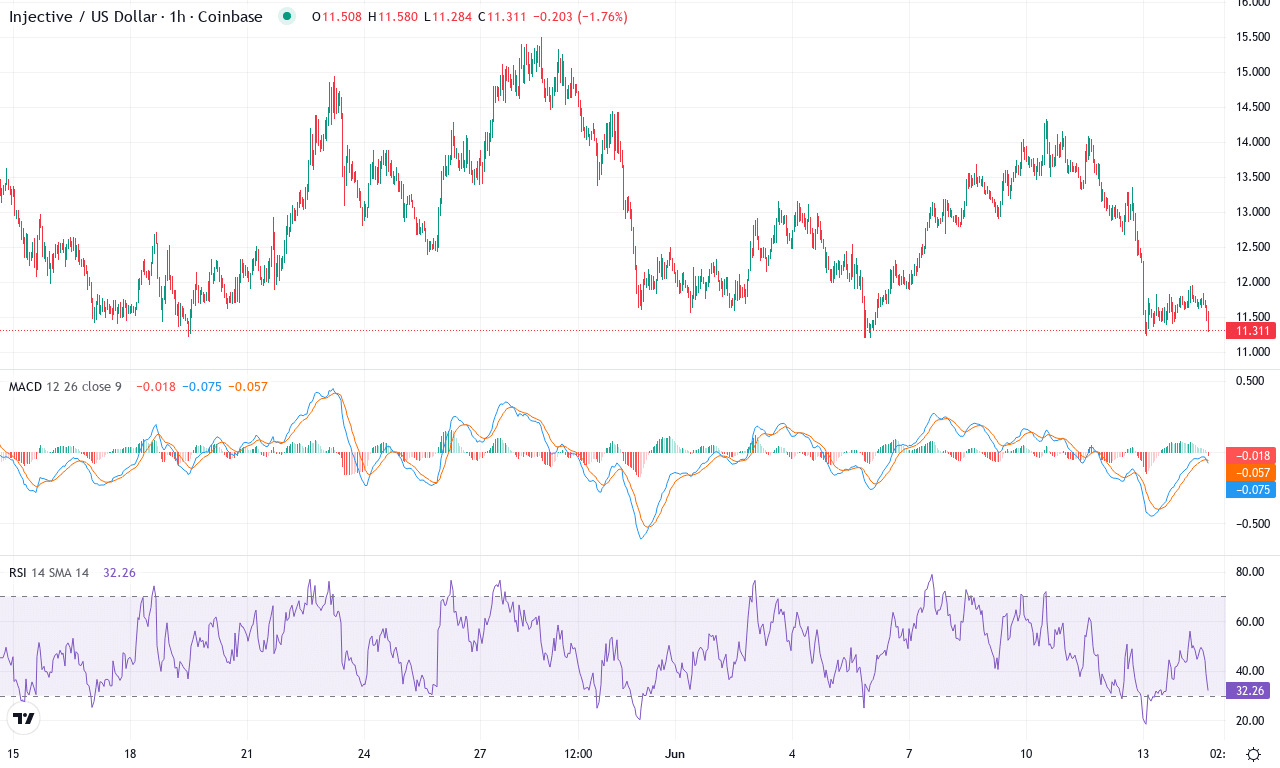

Injective (INJ) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | INJECTIVE(INJ) | $11.36 | -4.55% | -14.13% | 42.4 | 19.8 | 0.02 | -106.09 |

|---|

After a roller-coaster quarter that saw Injective nosedive over 60% from its highs, the token has entered a compressed sideways range, closing this week at $11.36 and sitting close to its monthly lows. Bears have maintained the upper hand—Injective dropped another 14% in the past month and slid nearly 5% this week, slicing through early supports with little sign of buyer resistance. Volatility has cooled, and the market feels like it’s at a crossroads: all eyes are on whether exhausted sellers will drive one last capitulation or if opportunistic bulls can force a decisive reversal from here. The larger trend remains damaged, and after such a punishing drawdown, I still sense plenty of nerves in the market—traders are split between fear of missing a bounce and dread of an extended fall.

Technically, the outlook leans bearish, though signs of stabilization are emerging. Trend indicators remain soft, with positive directional index readings outweighing negative, yet the gap is narrowing and the average trend strength is muted—not the stuff of raging momentum. Zooming in, the MACD has flattened after weeks of downside pressure, with histogram bars wavering around the zero line—a traditional signal that momentum is spent, but not yet convincingly turning up. The price sits below its major moving averages, which cluster near $12–$12.50, forming both resistance and potential battleground for any rebound. Key support holds around $11.20; if this level gives out, risks extend toward $8.80—bears are watching for that breakdown. On the flip side, a forceful push through the $12.20–$12.50 cluster could squeeze short sellers, setting sights on $15.50 as a bullish first target. Oscillators show oversold hints yet lack full confirmation—patience and nimble risk management are the name of the game here. For now, I’m keeping stops tight: until we see bullish momentum or a shift in market mood, the risk of another steep correction remains very real.

Will Price Compression Break?

Nexo remains under bearish hold as it tests critical support levels, while Injective slips, probing new lows with dwindling momentum. A decisive move in either direction could trigger the next trend phase. Traders watch for breakout signals, mindful of potential swift changes in direction as pressure builds.