Pendle And CRV Face Moment Of Truth As Bulls Defend Key Support Amid Bearish Reversal Signals

Pendle and Curve DAO Token (CRV) are at a crucial juncture after both experienced sharp pullbacks from recent highs. Pendle has slipped 13% this month, with CRV also retreating nearly 20%, testing investor nerves and key support levels. The bulls are now staring down pivotal support zones, looking for a bounce that could decisively influence the next trend. Will these assets hold ground or see deeper corrections? Let’s break down the technical setup across the board.

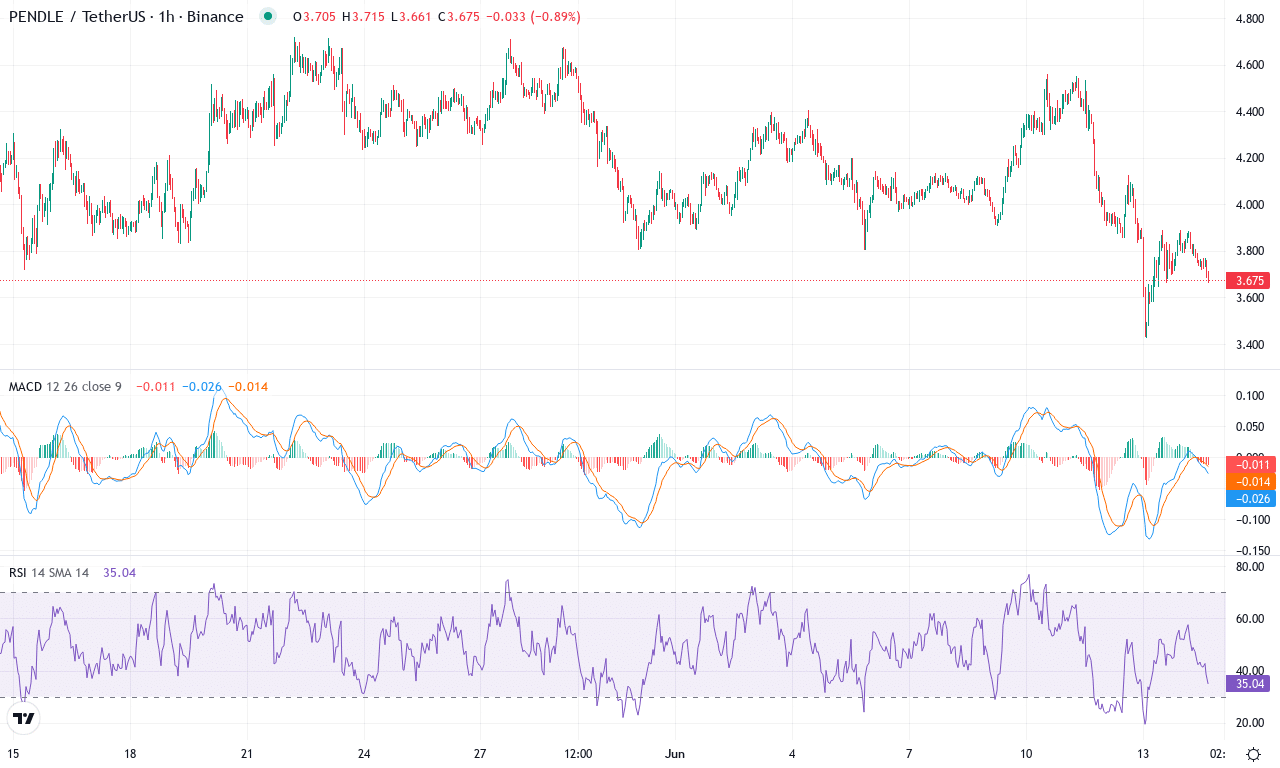

Pendle (PENDLE) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | PENDLE(PENDLE) | $3.67 | -8.29% | -12.76% | 40.5 | 16.1 | -0.04 | -148.67 |

|---|

After a blistering three-month rally that sent Pendle surging over 67%, this month has thrown a wrench into the uptrend: Pendle dropped almost 13% in the past four weeks, including a sharp 8% decline over the last seven days. Sentiment has recently taken a hit as sellers return, pushing Pendle toward the lower end of its recent trading band near $3.40. That steep quarterly ascent clearly attracted profit-taking, and now momentum traders face a crucial test. The bounce potential from these support levels is real, but the technical outlook suggests we’re at an inflection point—a make-or-break zone where bulls absolutely need to step up. If Pendle can reverse here, we could be looking at classic shakeout dynamics before the next move.

Looking deeper, trend indicators are mixed: ADX remains robust, signaling a technically strong trend, but the negative directional component is starting to overtake its positive counterpart—a clear warning that bearish momentum could persist. The weekly MACD just crossed below its signal line, reinforcing the view that sellers are regaining control, while oscillators like RSI and the Ultimate Oscillator sit in neutral to slightly bullish territory but are not flashing oversold yet. Price action has sliced through the short- and mid-term exponential moving averages, now testing heavy support near $3.40, with the bigger psychological floor at $3.00 looming below. If the bears push Pendle below $3.40, risks extend toward a full-blown correction to $3.00 and possibly $2.30 in a worst-case scenario; on the upside, bulls need to reclaim the $4.10–$4.40 zone to regain momentum and validate any fresh breakout thesis. I’m watching for signs of capitulation—a flush that shakes out weak hands—before getting too aggressive; remember, in this market, patience is often your best friend.

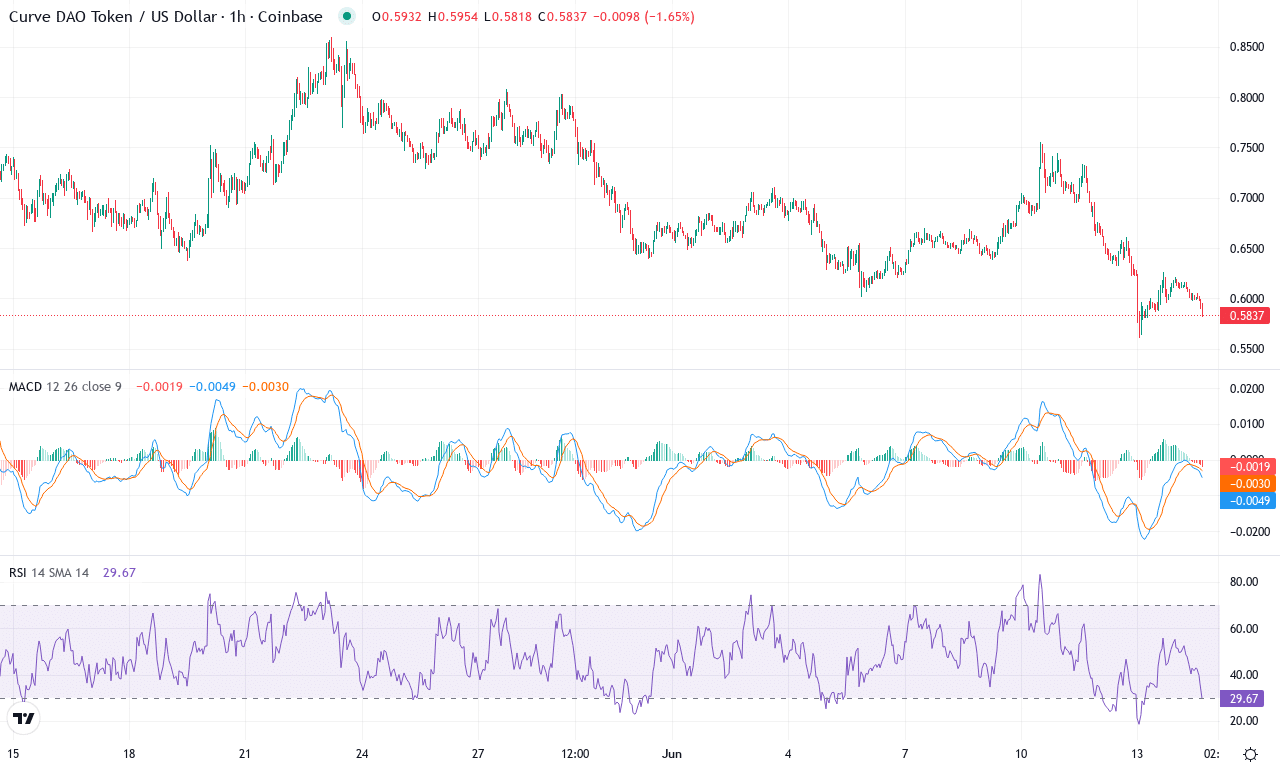

Curve DAO Token (CRV) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | CURVE DAO TOKEN(CRV) | $0.58 | -6.79% | -20.19% | 38.0 | 15.0 | -0.02 | -134.56 |

|---|

After a powerful early-year rally, Curve DAO Token (CRV) is reeling from a sharp monthly decline, with prices slipping nearly 20% to test the lower end of its recent range. This comes on the heels of a staggering 39% Q2 bounce, but also highlights just how volatile the broader DeFi sector has become—especially for heavily shorted assets like CRV. While the token is clinging above key support near $0.56 after dramatic swings within the $0.56–$0.86 band, the latest losses are unnerving. As uncertainty grips the market, I’m watching closely; a reversal could offer a compelling entry for the bold, but risks of an extended fall are real if sellers remain in control.

On the technical front, trend indicators are painting a complex picture—the ADX signals persistent trend strength, but with sellers regaining control as the negative directional component overtakes the positive. The weekly MACD recently flipped bearish, while oscillators are flashing oversold warnings: the RSI is trapped in bear territory below 40, and momentum has turned negative. CRV is trading precariously below its short- and medium-term exponential moving averages, which often paves the way for deeper corrections. Immediate support sits near that crucial $0.56 threshold; a breakdown here could open the floodgates for a steep correction toward historical lows. On the flip side, if the bulls engineer a bounce back above the $0.72–$0.80 resistance cluster—where several moving averages and pivots converge—we could see a fast move back toward monthly highs. Until then, technical outlook suggests caution; only a decisive reclaim of resistance would invalidate the short-term bearish thesis. Hold on tight—CRV’s next big swing is brewing.

Will Bulls Defend Key Support?

Pendle hovers above its critical support, while CRV attempts to stabilize near $0.55. If the bulls can maintain these levels, a rebound could thwart the bearish pressures, yet further declines could open the door for deeper corrections. Traders will closely monitor these support levels in the coming sessions to gauge the strength of the bulls’ defense.