Pendle And ENS Brace For Turbulence As Bulls Defend Last-Ditch Support Amid Volatility Spike

As the crypto markets sizzle with volatility, both Pendle and Ethereum Name Service (ENS) are at a technical crossroads. Following Pendle’s impressive 79% surge, a sharp -10% weekly drop challenges its bullish momentum at a critical support level. Meanwhile, ENS, despite its recent 26% gain, grapples with a steep correction and precarious positioning near pivotal price points. Will these assets find footing or face further turbulence? Let’s break down the signals and uncover what’s next in this volatile landscape.

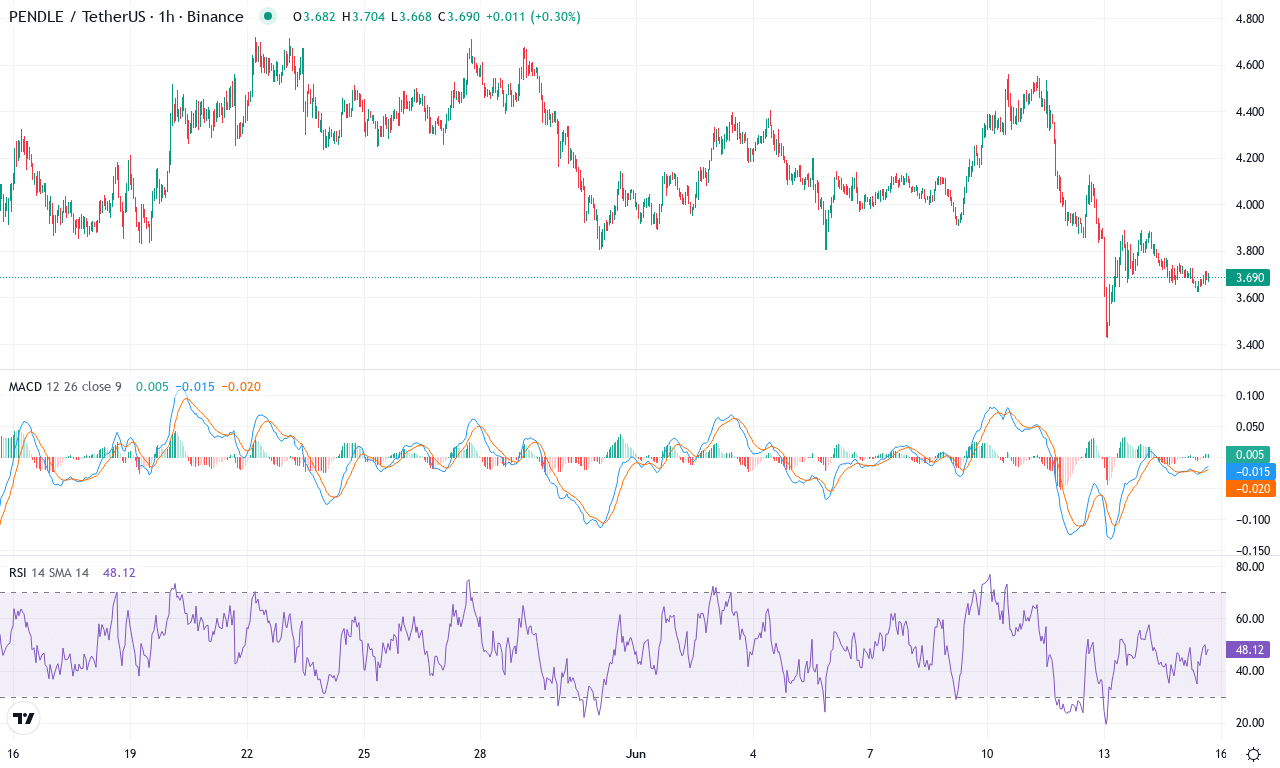

Pendle (PENDLE) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | PENDLE(PENDLE) | $3.69 | -10.25% | -9.83% | 40.7 | 17.1 | -0.06 | -151.96 |

|---|

After a stunning first quarter, Pendle is now feeling the heat as it stumbles through a sharp monthly reversal. The token’s impressive three-month surge of nearly 79% has run headfirst into a -10% weekly drop, echoing risk-off moves across the broader DeFi sector. Price stalled just below $4.72 before capitulating toward the $3.42 monthly low, and with the current close near $3.69, traders are now sizing up the fallout. There’s a palpable sense of caution as Pendle now sits well below its key exponential moving averages, flashing a warning signal that profit-taking and long liquidations may be accelerating. The technical outlook suggests that, after months of bullish momentum, the tide may be turning—or at least pausing for a much-needed reset.

Momentum oscillators are painting a cautionary tale, with RSI failing to reclaim the 50 mark and weekly MACD slipping deeper into negative territory. The directional trend indicator is still positive, but downside pressure is creeping in as negative DI gathers strength. The price action is worrisome, as Pendle has clung to the $3.60–$3.70 zone—a level that now serves as pivotal short-term support. Any decisive breakdown here risks an extended fall toward the psychological $3.50 area, and from there, eyes shift quickly to the $3.15 support below. However, if buyers stage a comeback and bulls clear resistance at $4.07 (the upper band of the monthly moving average cluster), a snapback toward $4.78 isn’t out of the question. With volatility surging and trend indicators flashing mixed signals, I’m watching for a definitive move—either an ugly capitulation or an explosive mean reversion. Stay nimble; this market isn’t for the faint-hearted right now.

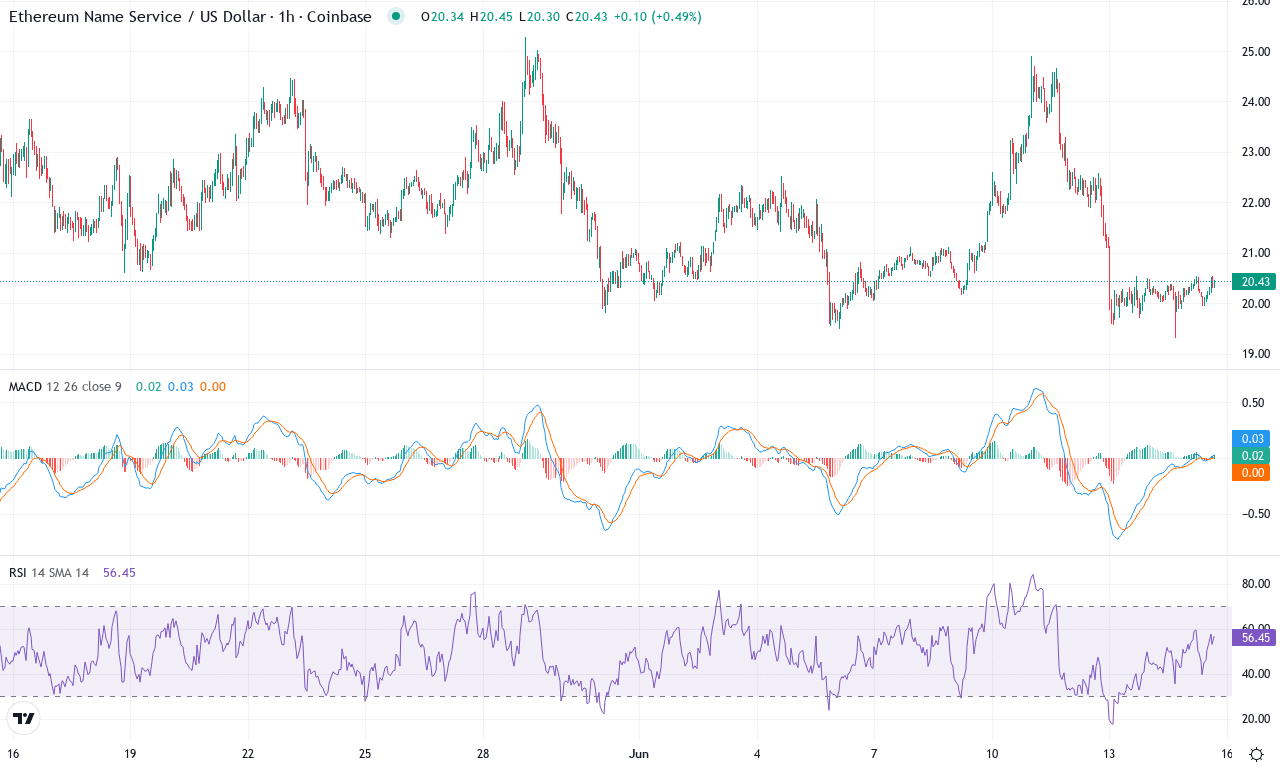

Ethereum Name Service (ENS) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | ETHEREUM NAME SERVICE(ENS) | $20.41 | -2.11% | -9.97% | 45.4 | 13.4 | -0.13 | -82.77 |

|---|

After a stellar multi-month run, Ethereum Name Service (ENS) has sharply reversed course, with the past month posting a steep 10% correction and a slightly negative close for the week. The technical outlook suggests that bullish momentum has fully faded for now, leaving ENS drifting just above a key support zone. Price action analysis shows ENS hovering near $20.41—respectably above this month’s lows, but a far cry from the monthly high at $25.28. What catches my eye here is the broader context: after gaining over 26% in the past three months, the recent -55% six-month performance signals a market that’s both volatile and vulnerable. Sellers have clearly regained control, and unless bulls stage a rapid comeback, risks of an extended fall are mounting.

Diving deeper, trend indicators confirm waning momentum—trend strength is high, but both bullish and bearish directional signals are flatlining, suggesting indecision rather than conviction. The weekly MACD shows continued drift into negative territory and now lags its own signal line, while momentum oscillators flash mixed signals: the RSI rests in neutral territory, far from signaling a bottom, and other oscillators barely register a pulse. ENS trades closely aligned with its short-term moving averages, giving little directional guidance; this flat alignment typically precedes a larger move. The middle pivot near $25.15 looms above as a formidable resistance—if buyers reclaim that level, we could see a fast pivot to the $29.50 range or higher. But if ongoing profit-taking and bearish sentiment persist, watch the $19 support level—it breaks, and we’re likely headed for a volatility surge. As always, volatility is the only constant in crypto—don’t blink.

Navigating the Storm

Pendle holds near its crucial support, aiming to reverse its recent downturn, but sustained pressure could open paths to lower levels. ENS, teetering at essential price thresholds, must stabilize to fend off deeper losses. These assets are on the brink; whether they regain composure or succumb to further volatility will depend on upcoming market cues. Traders should brace for swift movements as the landscape evolves.