QNT Bulls On Edge While Kaia Surge Tests Nerves At Pivotal Resistance

Quant (QNT) has recently showcased an impressive 9% monthly rally, only to hit a crucial resistance zone—pulling back sharply to test the nerves of bulls eyeing continued strength. At the same time, Kaia’s remarkable 33% surge this month adds excitement, yet tension, as it nudges toward key pivot levels. With both assets at pivotal crossroads, traders are left questioning whether momentum will persevere or falter. Let’s take a closer look at the signals behind these moves.

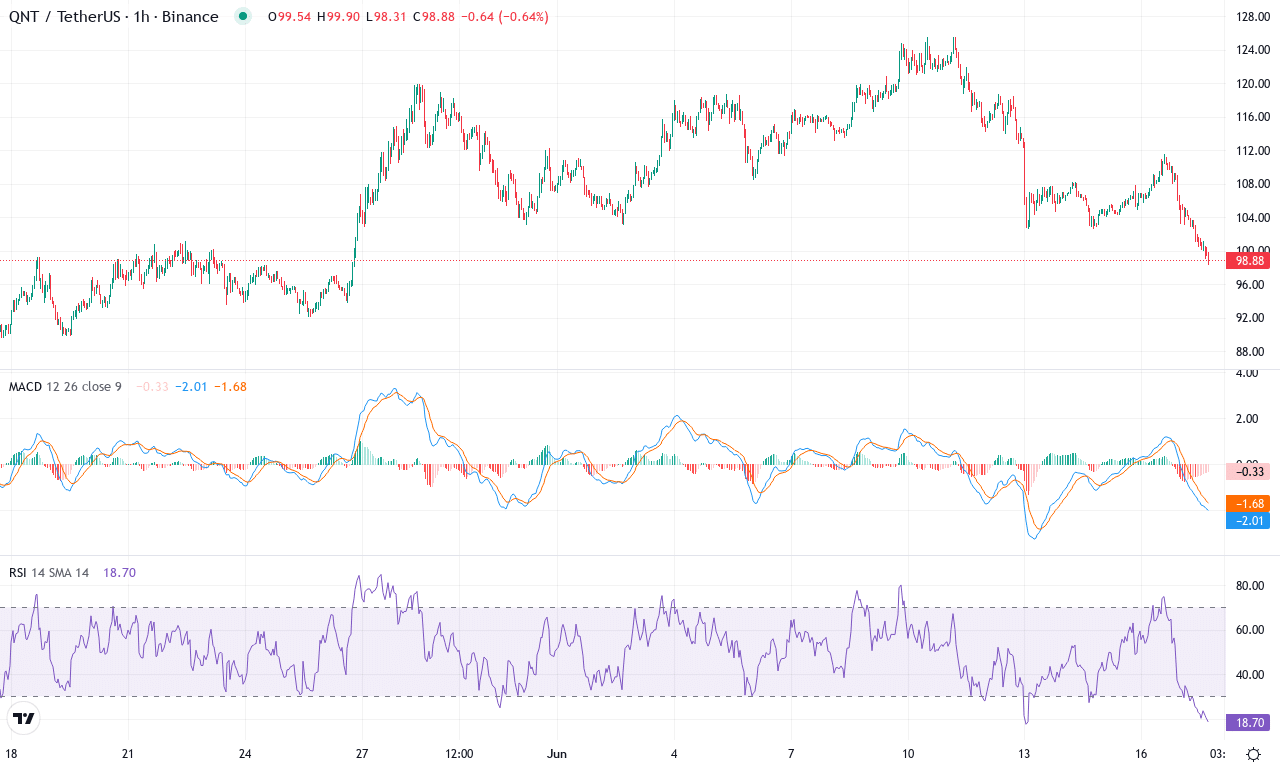

Quant (QNT) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | QUANT(QNT) | $99.78 | -18.67% | 9.37% | 41.7 | 24.2 | 1.34 | -141.01 |

|---|

After a robust 9% rally this month, Quant (QNT) is pivoting at a critical juncture, giving traders a suspenseful blend of volatility and directional ambiguity. The token surged toward $125 in recent sessions—its highest in a month—only to retreat sharply, underscoring the erratic mood gripping mid-cap alts. This latest price action has not been kind in the short term: Quant lost almost 19% over the last week as short-term profit-taking surged and buyers retreated, though the broader trend still leans positive thanks to a 28% gain over the last three months. If you’re in, this is definitely one of those “white-knuckle grip” markets; bullish conviction is being sorely tested as QNT teeters just above main support levels near $101. Should sellers drive the price decisively below this band, risks of an extended fall into the upper $80s escalate sharply, while reclaiming $126 could reignite the recent bullish fervor.

Technically speaking, QNT is in a fragile equilibrium. The average directional index shows trend strength holding firm, yet with negative pressure picking up—trend indicators now hint at increasing bearish momentum. The weekly MACD, having flipped negative, suggests that downside forces are accelerating, while oscillators like RSI—hovering well above oversold territory—don’t yet signal exhaustion among sellers. More worrying for bulls, price now lingers near its cluster of exponential moving averages, struggling to assert dominance above the 10-day and 20-day averages; a sustained close below these would be a classic warning sign. Key support for QNT sits just above $100, with a psychological floor at $90. If bulls can muscle QNT above resistance at $127, all signs would point to a swift move back toward $146 and possibly $190. Otherwise, a failure here likely sets the stage for a steep correction. As always, discipline is the trader’s friend—don’t catch a falling knife, but don’t let nerves shake you out if your thesis still stands.

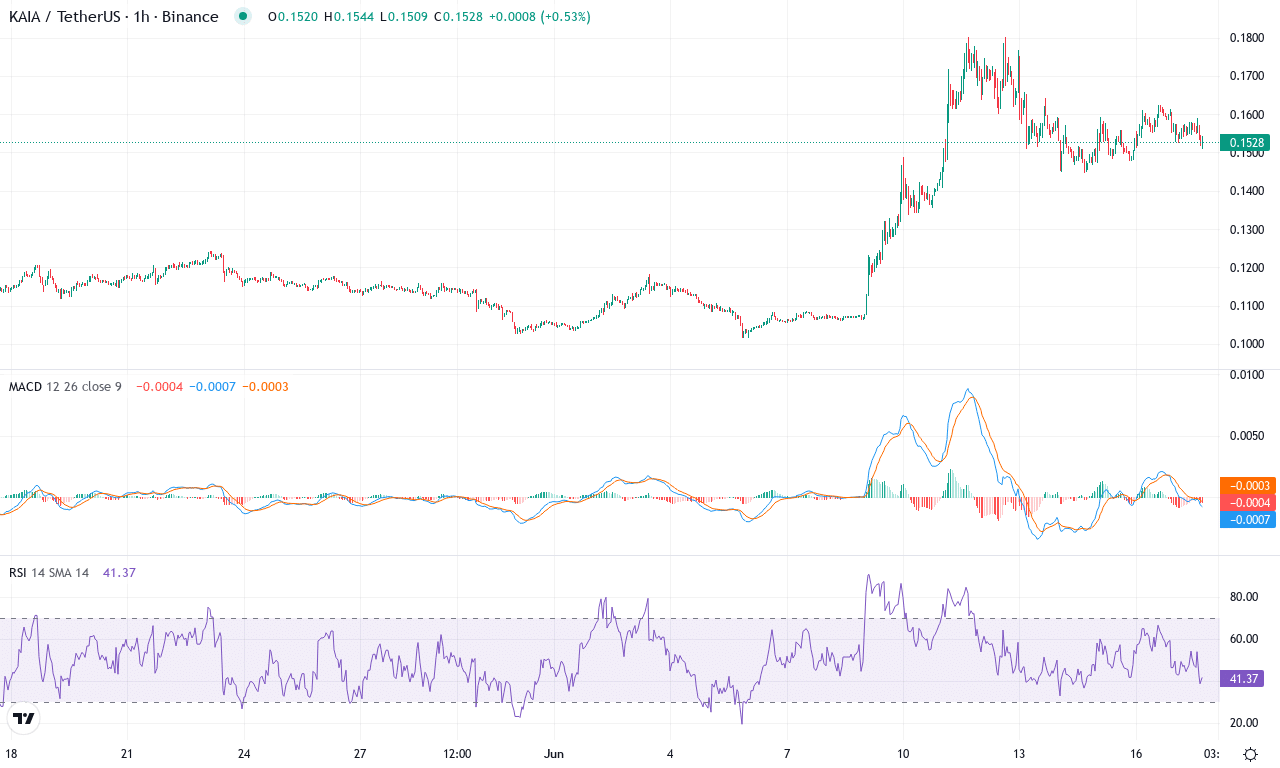

Kaia (KAIA) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | KAIA(KAIA) | $0.15 | 5.95% | 33.71% | 61.6 | 31.0 | 0.01 | 76.38 |

|---|

Kaia has been making waves this month, surging over 33% and clocking in a blistering 44% gain for the quarter, despite a rocky -35% slide over the past six months. The past week has kept bulls energized, with price action pushing near the monthly high and technicals leaning bullish. It’s a comeback story that’s hard to ignore—yearly gains are still robust at 22%, and if you’ve weathered the drawdown, you’re finally seeing some vindication. With the token closing at $0.1531 and consolidating just below the recent $0.18 monthly high, buyers are stepping up exactly where they need to in order to keep this momentum alive. The sudden influx of volume and persistent positive bias across oscillators gives me a shot of adrenaline; if $0.18 breaks, we could be looking at the beginning of a fresh leg higher.

The technical outlook suggests trend strength is building: trend indicators including the ADX are clocking north of 30, which usually signals a strong, directional move—in this case, favoring the bulls. The weekly MACD is accelerating upward, and the histogram’s positive slope reinforces this breakout momentum. Meanwhile, the RSI has climbed past 61; while there’s still room before overbought territory kicks in, bullish momentum is definitely swelling. Price is comfortably above all major exponential moving averages (10, 20, 30, 50, and 100), keeping sellers at bay. The main resistance to watch is the psychological round number at $0.18—if bulls clear this, the next technical target looms near $0.22, a previous pivot high. On the flipside, if this rally fails and aggressive profit-taking emerges, support sits just above $0.14, around the monthly pivot. If that zone gives out, expect a sharper drop toward $0.10. I’m keeping a close eye here; if this breakout holds, it’s the kind of setup that lights up a trader’s week.

Testing the Limits: Can Sustained Growth Prevail?

QNT’s struggle at resistance suggests a pause, while Kaia’s advance to critical thresholds could indicate either a breakout or a reversal ahead. The next trading sessions will be vital in determining sustainability, contingent on volume and market sentiment. Traders should prepare for potential shifts, maintaining a wary eye on confirmation signals.

. 97 ceiling as bulls tighten grip—breakout or bull trap ahead" decoding="async" data-lazy-srcset="https://readblocks.com/wp-content/uploads/2025/06/aerodrome-finance-blasts-toward-0-97-ceiling-as-bulls-tighten-grip-breakout-or-bull-trap-ahead-20250620-768x512.png 768w, https://readblocks.com/wp-content/uploads/2025/06/aerodrome-finance-blasts-toward-0-97-ceiling-as-bulls-tighten-grip-breakout-or-bull-trap-ahead-20250620.png 1536w" data-lazy-sizes="(max-width: 768px) 100vw, 768px" data-lazy-src="https://readblocks.com/wp-content/uploads/2025/06/aerodrome-finance-blasts-toward-0-97-ceiling-as-bulls-tighten-grip-breakout-or-bull-trap-ahead-20250620-768x512.png"/>

. 97 ceiling as bulls tighten grip—breakout or bull trap ahead" decoding="async" data-lazy-srcset="https://readblocks.com/wp-content/uploads/2025/06/aerodrome-finance-blasts-toward-0-97-ceiling-as-bulls-tighten-grip-breakout-or-bull-trap-ahead-20250620-768x512.png 768w, https://readblocks.com/wp-content/uploads/2025/06/aerodrome-finance-blasts-toward-0-97-ceiling-as-bulls-tighten-grip-breakout-or-bull-trap-ahead-20250620.png 1536w" data-lazy-sizes="(max-width: 768px) 100vw, 768px" data-lazy-src="https://readblocks.com/wp-content/uploads/2025/06/aerodrome-finance-blasts-toward-0-97-ceiling-as-bulls-tighten-grip-breakout-or-bull-trap-ahead-20250620-768x512.png"/>