Quant and ENS Hover Near Inflection Point as Bulls and Bears Jockey for Control

Quant and Ethereum Name Service (ENS) are approaching crucial inflection points, with Quant rebounding 18% this month while ENS shows signs of recovery after a bearish dip. Yet, both face pivotal resistance levels that could redefine their short-term trajectories. Will the market’s momentum favor the bulls, or are bears poised to regain command? Let’s take a closer look at the signals behind the move.

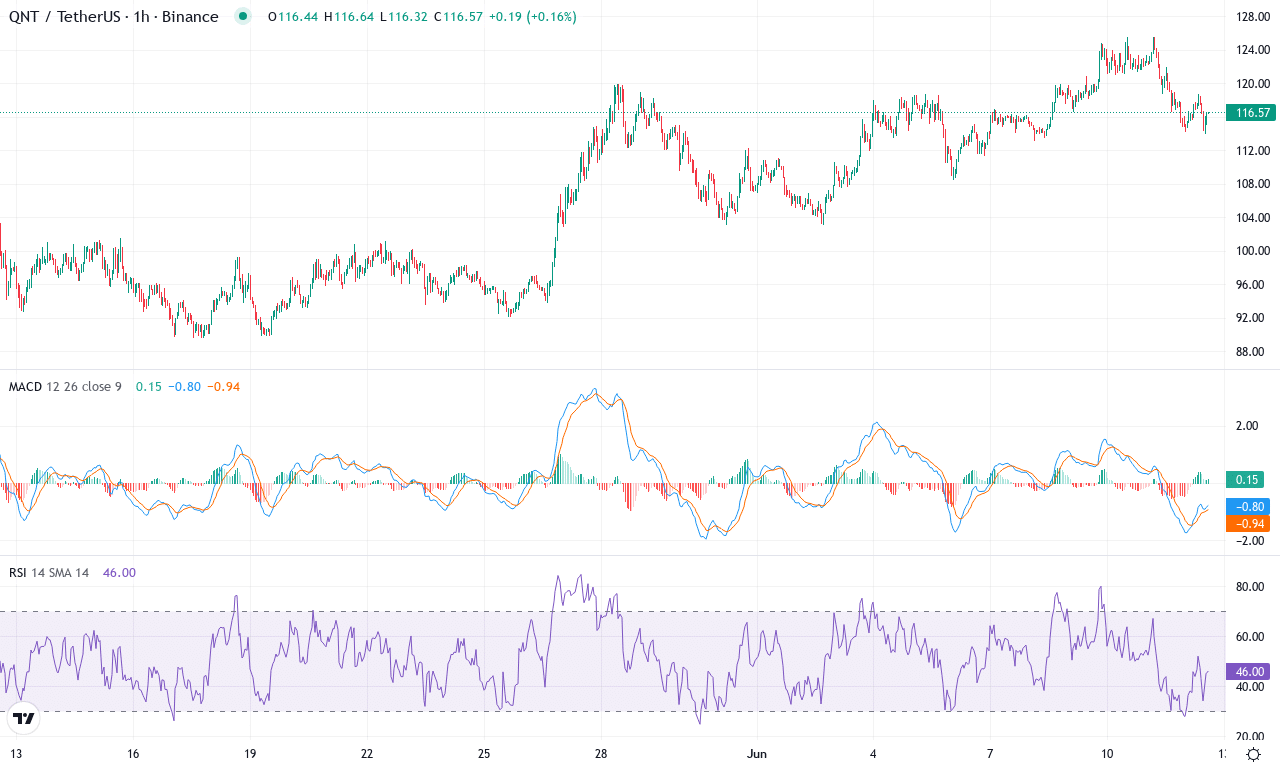

Quant (QNT) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| QUANT(QNT) | $115.89 | -0.54% | 18.01% | 58.5 | 31.9 | 6.07 | 51.52 |

After weathering months of downside and a grueling 6-month drawdown, Quant (QNT) has roared back to life, rallying over 18% in the last month and notching a local high at $125.56. Bulls have recaptured key territory, with the price now stabilizing near $115.89 and not far from this month’s high. The technical outlook suggests a reversal may be taking shape: the monthly surge of over 18% follows a sharp -18% slide in the prior half-year, hinting at early-stage bullish momentum. For traders—myself included—it’s thrilling to see Quant claw out of its rut, but with volatility swelling, discipline remains paramount.

Turning to the indicators, trend signals point decisively higher. The ADX is well above the threshold that marks a strong directional move, while trend-following oscillators lean bullish. The MACD lines are showing healthy separation, and a bullish convergence appears on weekly charts. RSI has pushed into the upper-50s but isn’t yet overbought, leaving room for the rally to run before hitting speculative excess. Notably, Quant is trading above all short- and medium-term exponential moving averages—classic fuel for sustained upside. Immediate resistance looms at $126.86, with a breakout there paving the way for a charge toward $145–$151. If sellers resurface, support lies between $100–$107, where moving averages and psychological anchors converge. In sum, unless Quant plunges back below $107, the recovery thesis stands. All eyes are on $126—if you’re watching this, so am I.

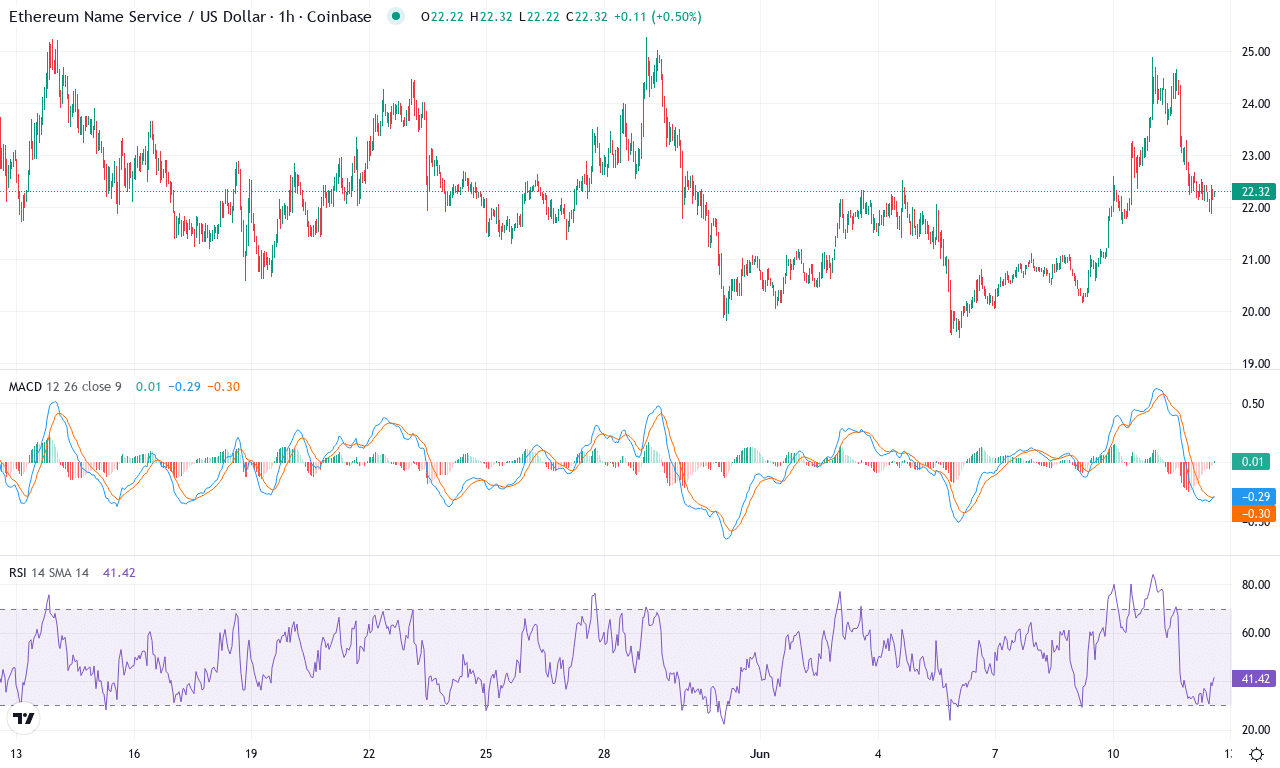

Ethereum Name Service (ENS) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| ETHEREUM NAME SERVICE(ENS) | $22.24 | 3.11% | -3.05% | 53.4 | 17.1 | 0.24 | 38.39 |

After a blistering 35% rally over the past quarter, Ethereum Name Service (ENS) is pausing for breath, slipping 3% on the month despite a modest recovery attempt this week. The token has carved out a volatile range between $19.50 and $25.30, with buyers and sellers fiercely debating ENS’s next directional move. Notably, the past six months have delivered a steep correction—down nearly 50%—but the project’s positive yearly performance confirms there’s still underlying demand. Right now, ENS is hugging $22.20, sandwiched between short-term moving averages and the psychological $20 support zone. With volatility picking up, traders should brace for fireworks as the technical outlook turns increasingly unpredictable.

Drilling into the details, trend indicators continue to suggest bulls have the upper hand. The average directional index is strong, while positive trend components outpace the negative—a sign that upside forces remain in play, but buyers are getting tested. The MACD shows early-stage bullish momentum as it attempts to cross above its signal line on both daily and weekly frames, while oscillators signal waning but persistent momentum. ENS is also trending above its short and medium-term moving averages, hinting at buyers regaining control—though the failure to conquer $25 resistance is notable. RSI and similar measures are elevated but just shy of overbought territory, so some profit-taking wouldn’t surprise me. If bulls break decisively above $25.30, the next target could sit near $28, while a bearish reversal would see ENS revisiting the key $20 support. For now, I’m watching price action closely—any sharp move could spark a volatility surge and reveal ENS’s true trend for the weeks ahead.

What Lies Ahead for Quant and ENS?

Quant continues its upward trajectory, nearing resistance that may test its recent gains, while ENS edges higher, yet remains constrained by a critical ceiling. The bullish momentum holds promise, but resistance levels will determine if the rally has staying power. Traders now wait for a decisive breakout or a shift in trend to anticipate the next move.