Solana and Bitcoin Cash Coil at Key Turning Points as Bulls Eye Breakout or Bull Trap

Solana’s recent rollercoaster, with a notable surge followed by retreat, has set the stage for a crucial test as it hovers just above $163. The technical landscape suggests Solana is coiling, poised for either a breakout or a deeper retracement. Meanwhile, Bitcoin Cash bucks the trend, gaining over 10% this week and pressing towards key resistance at $470. As both coins sit at pivotal technical points, the question remains: will Solana recover its bullish momentum, and can BCH capitalize on its current path upward? Let’s break down the technical setup across the board.

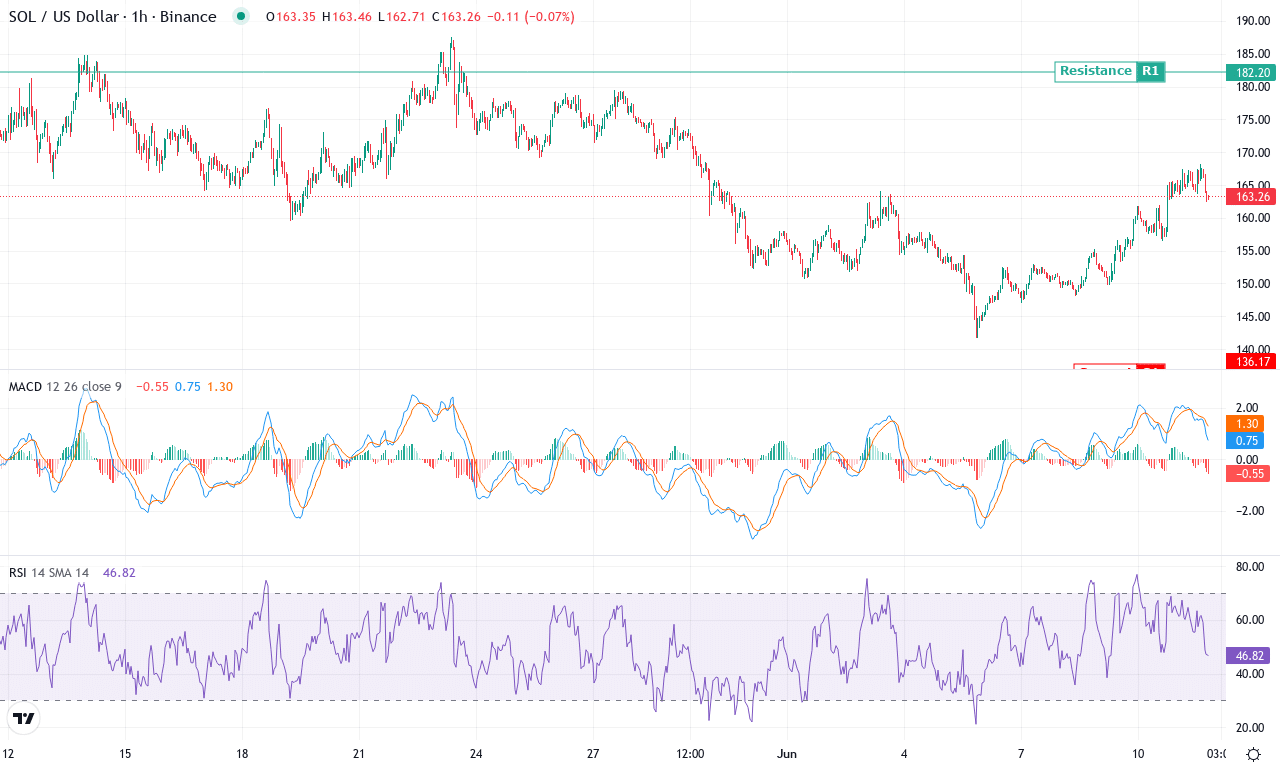

Solana (SOL) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| SOLANA(SOL) | $163.40 | 5.28% | -5.63% | 53.3 | 19.5 | -1.48 | 19.17 |

After a rollercoaster month featuring a steep 28% surge followed by a swift retracement, Solana is now navigating choppy waters—down almost 6% over the past thirty days. The short-term reversal has pulled SOL back from a recent high near $188 to trade just above $163, squeezing volatility and leaving traders on edge. The broader trend, however, remains unbroken: Solana’s technical outlook suggests the long-term bull run is only pausing for breath after an earlier three-month rally that saw gains of nearly 29%. As a trader, I’m watching closely—when wild performers like Solana coil up after exuberant runs, the next major move can be explosive.

Diving into the technical landscape, momentum and trend indicators are showing a market at crossroads. The strong ADX readings signal that the underlying trend is still in play, but with negative signals creeping in: the MACD line hovers below its signal line and the Awesome Oscillator prints persistent red, pointing to dashed bullish momentum. Oscillators like the RSI, still steady near 53, hint there’s room for bulls to regroup before the market risks an extended fall—no overbought warning bells yet. SOL currently holds above key moving averages, and price action is consolidating just above the psychologically-import $160 area, precisely at the classic pivot and the EMA cluster. If buyers can clear immediate resistance around $182, the stage is set for a breakout push toward $207 and beyond; failure here, however, could see profit-taking drive a pullback toward the $136 support zone. I’m itching to see whether Solana’s next act delivers a fireworks show or a prolonged correction—either way, the stage is set for drama.

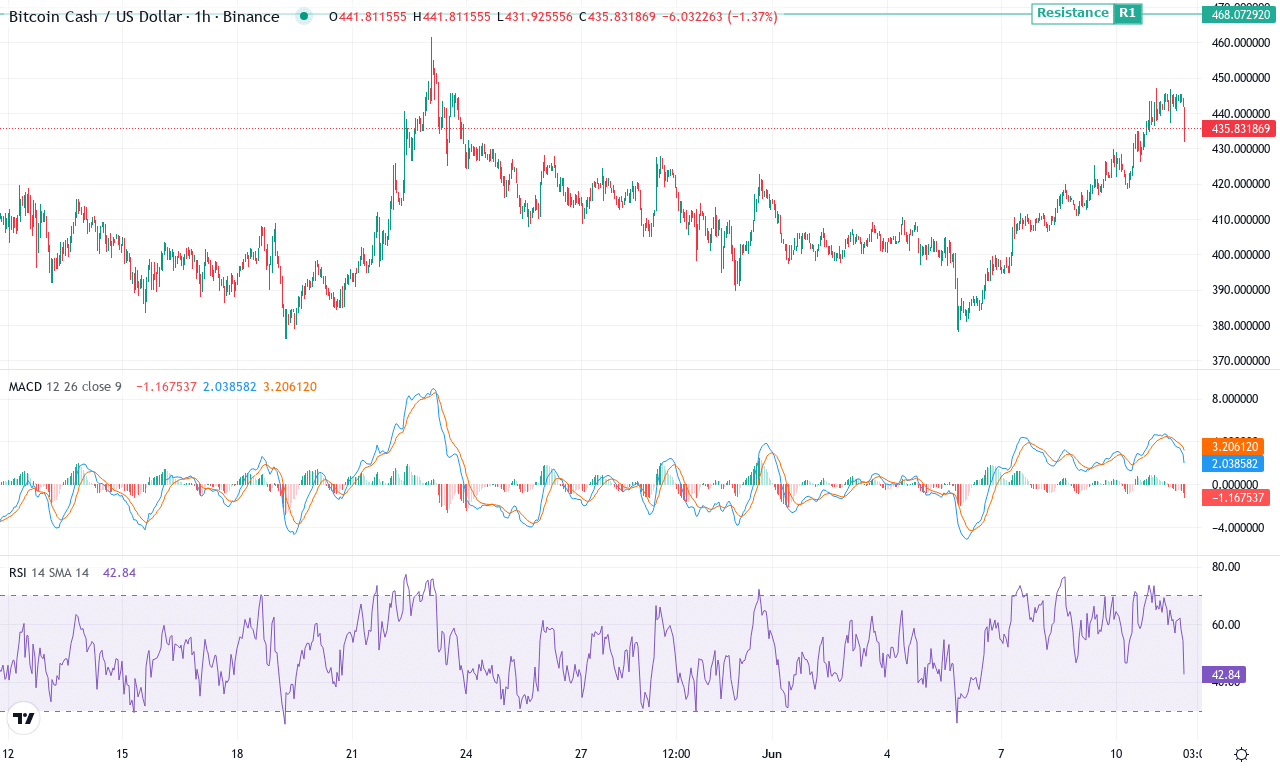

Bitcoin Cash (BCH) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| BITCOIN CASH(BCH) | $441.86 | 10.26% | 8.29% | 63.6 | 21.4 | 7.88 | 170.50 |

After a robust start to the month, Bitcoin Cash (BCH) is pushing higher, leaving its recent sideways chop in the dust. The coin notched a fresh monthly high near $461, with short-term performance firmly in the green—up over 10% on the week and stacking just above 8% gains this month. While the broader crypto market has been torn between breakouts and corrections, BCH’s resilience stands out, especially after last quarter’s steep correction. Price action is now probing major resistance near $470, a level that could unlock serious upside if bulls keep pressing. As institutional inflows start to trickle back, the backdrop for BCH grows more compelling—if we see a decisive breach of that resistance, my gut says this could ignite the next wave.

Diving into the technicals, the trend indicators don’t lie: momentum is swelling. The average directional index is elevated, affirming a strong and maturing trend, while positive directional movement decisively outweighs bears—classic fuel for bullish continuation. The MACD is widening on the weekly, underscoring growing upward force, accompanied by oscillators that are ticking higher but not yet stretched into overbought territory; the RSI flirts just below classic overheating levels. Price is riding well above all short- and long-term moving averages—an unequivocal sign bulls are in control—and the sharp turn north in the Hull Moving Average only sharpens the bullish case. The next challenge is breaking through $470; above that, targets cluster toward $520, with further momentum potentially unlocking a run at last year’s highs. However, if this rally fizzles and sellers regain control, look for a potential pullback toward $408, a zone where support historically stirs dip buyers into action. With BCH perched at this technical crossroads, the coming days could offer explosive opportunity—or a classic bull trap. My advice: stay nimble, and don’t blink.

What Lies Ahead for Solana and Bitcoin Cash?

Solana teeters at $163, potentially setting the stage for a breakout or correction, while Bitcoin Cash approaches critical resistance around $470. Both coins are at crucial junctures; Solana must regain upward momentum to prevent further retracement, and BCH needs to break through resistance to sustain its rally. Close observation of support levels will be key as traders anticipate the next decisive moves.