Sonic and Chia Hover at Make-Or-Break Lows as Bulls Eye Faint Reversal Signal

Bitcoin and Ethereum have both posted impressive monthly gains, but key resistance zones now stand in the way. As price approaches psychological levels, bulls face a decisive test. Will bullish strength continue or give way to short-term exhaustion? Let’s break down what the key indicators are suggesting now.

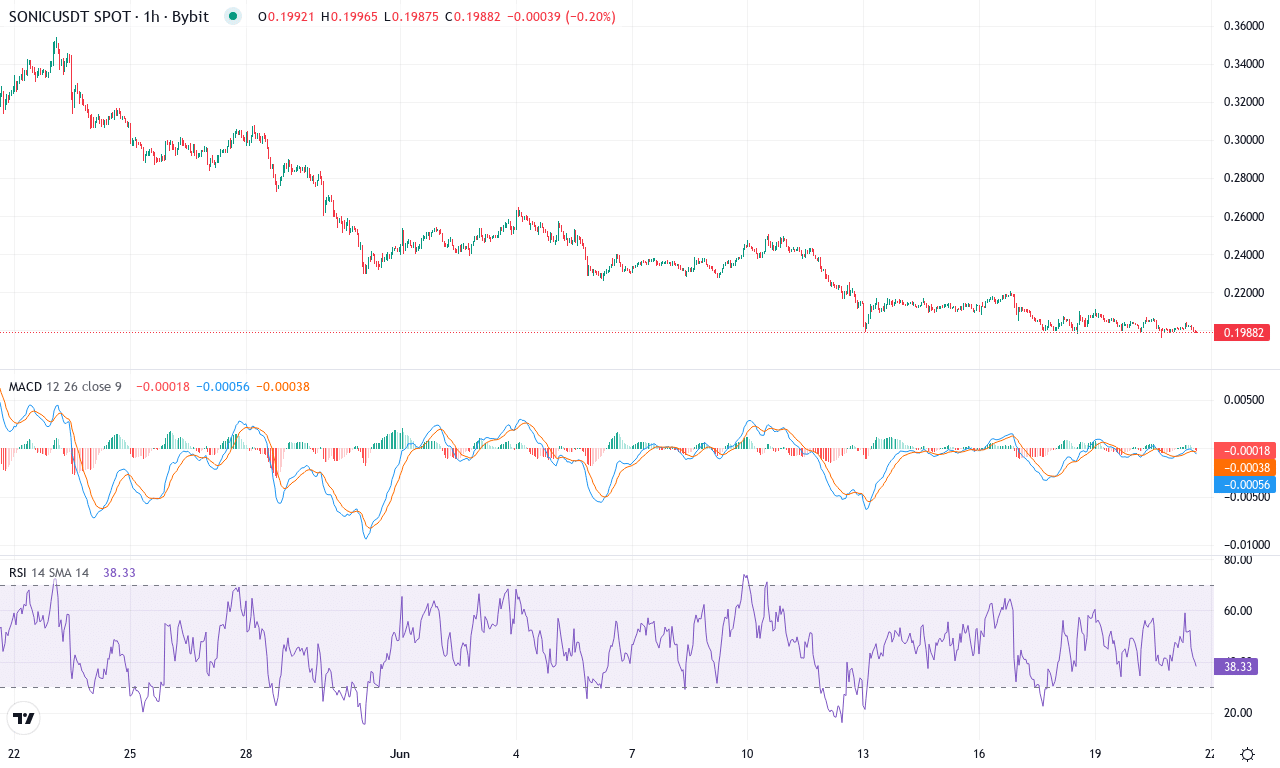

Sonic (S) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | SONIC(S) | $0.20 | -7.74% | -39.28% | 32.3 | 30.8 | -0.02 | -97.60 |

|---|

After an explosive half-year rally that saw Sonic’s price surge nearly 900%, the past month has delivered a stark reversal with a steep 39% correction pulling prices from a high of $0.354 to the current $0.199. This kind of volatility is the market’s way of shaking out weak hands—and perhaps giving patient traders another shot. The weekly performance continues to bleed, though selling appears to be slowing as prices hover stubbornly near a key psychological support. The bigger story is that despite this deep drawdown, Sonic’s longer-term uptrend remains technically valid for now—a classic case where the macro trend collides with fierce profit-taking and short-term pessimism. In all honesty, it’s been a nerve-wracking stretch, but the opportunity to reload at support is hard to ignore if you keep your eye on the broader trend.

Diving into the technicals, trend strength is moderating but not yet collapsing. Oscillators show bearish momentum fading, with a flattening MACD close to a potential bullish crossover—a tell that downside velocity may be losing steam. The ADX sits at modest levels, signaling the current trend isn’t forceful; however, with positive DI keeping above the negative, bulls still have a foothold. Short-term moving averages now threaten to slip below the longer averages, which would confirm bearish momentum and set up a possible retest of support near $0.20. Should sellers lose control and Sonic manage a sustained push above the $0.25–$0.27 band, a fresh rally could ignite—my pulse would be racing if that breakout takes hold. Alternatively, persistent weakness risks an extended fall toward the $0.20 or even the $0.195 monthly low. Keep a tight stop—if this support gives way, the correction could deepen, but if buyers step up, all signs point to a sharp rebound.

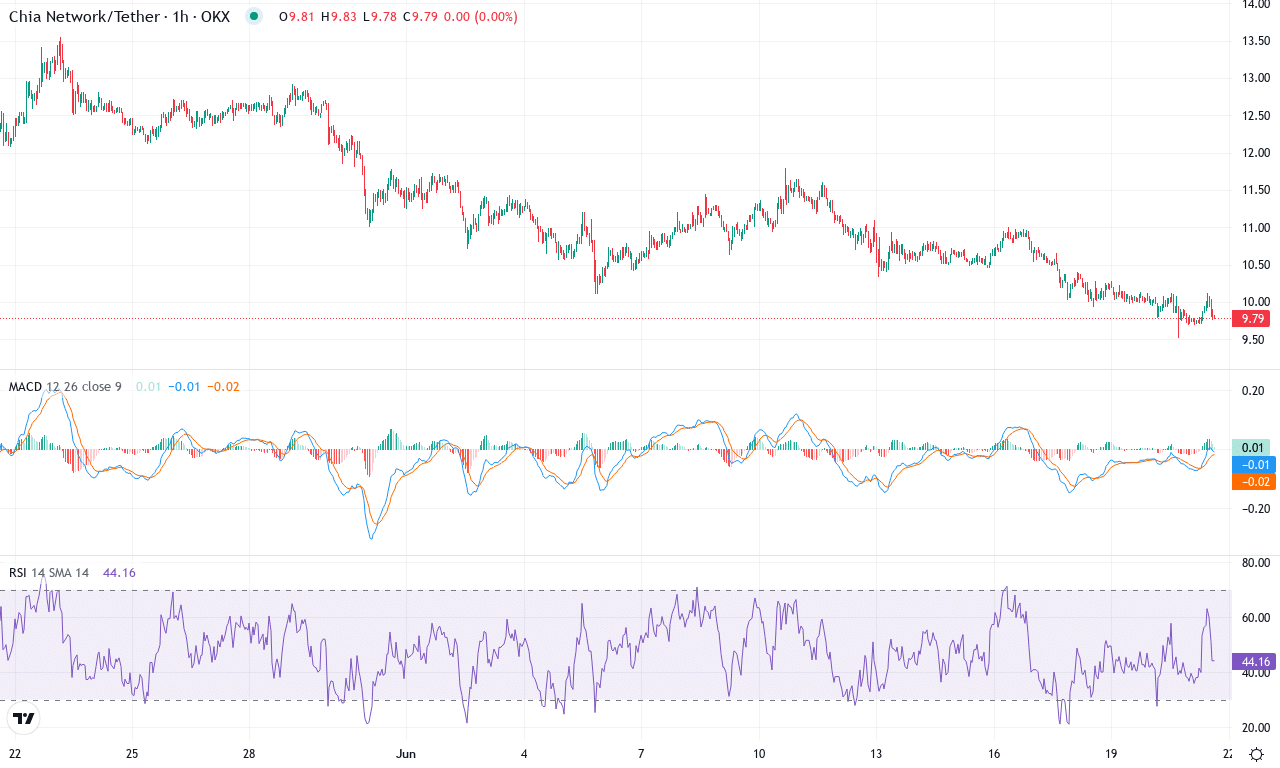

Chia (XCH) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | CHIA(XCH) | $9.82 | -7.88% | -19.64% | 32.5 | 24.0 | -0.50 | -143.91 |

|---|

After a brutal month marked by a sharp 19% retreat, Chia (XCH) is firmly in the bear’s grip. Selling has accelerated over the three- and six-month windows, with XCH collapsing more than 50% since January—a sobering reminder of this token’s volatility. This week alone, bears pressed XCH to fresh lows within the $9.50–$13.50 monthly range, deflating optimism from traders eyeing a turnaround. With short-term price action hugging multi-month support near $9.80, and no reprieve in the fundamental downtrend, the mood here is tense—I’m watching closely for capitulation or a surprise reversal, but I’d be lying if I said I wasn’t worried about further slide.

Technically, the backdrop looks fragile. Trend indicators remain slanted to the downside: the ADX signals robust trending strength, but the negative directional component has taken control, showing sellers remain at the wheel. The MACD lines on both the weekly and daily charts sit in bearish territory, hinting that downward pressure is still building—not a scenario for the faint-hearted. Oscillators, including RSI, linger in subdued territory well below classic overbought zones, signaling sellers are dominating. Price is trading well beneath its short- and long-term exponential moving averages, suggesting persistent bearish momentum and risks of an extended fall if $9.50 breaks. The next real support doesn’t emerge until near the psychological round number at $7.80, while any bounce would first have to retake resistance near $12.50 before a trend reversal could be entertained. Unless bulls stage a rapid recovery, expect more pain ahead—yet if we see a decisive reclaim of $12.50 resistance, that would invalidate the bearish thesis and force quick rethinking from all sides. Stay extra nimble here.

Will the Bulls Push Through?

Sonic and Chia hover at critical support as Bitcoin and Ethereum confront significant resistance barriers. Should current bullish sentiment persist, an upward breach may set the stage for further gains. However, without fresh momentum, the risk of a reversal increases, leaving traders watching for confirmation cues closely in the coming sessions.