XMR, ZEC, And XCH Teeter As Bulls Lose Grip—Will Key Supports Trigger A Fresh Wave

Monero, Zcash, and Chia are navigating turbulent waters, as recent market dynamics test the limits of their latest rallies. Monero, grappling with a 5.5% slide this month after a robust quarterly ascent, is now teasing traders with the possibility of a critical support break. Zcash, meanwhile, faces a precarious moment after a wild ride to recent highs, leaving market sentiment on edge about its next move. With Chia battling deep in oversold territory, the question looming is: can these assets muster a resurgence, or are further declines imminent? Let’s break down what the key indicators are suggesting now.

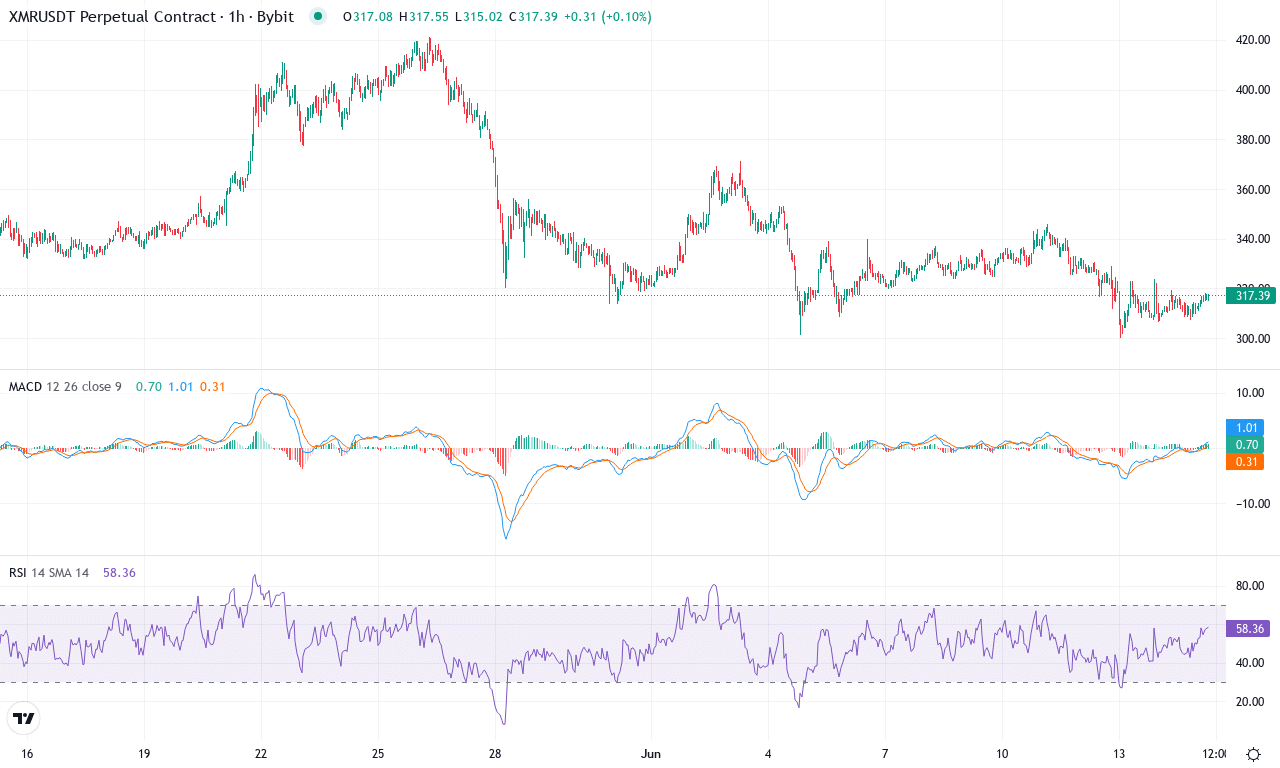

Monero (XMR) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | MONERO(XMR) | $317.24 | -3.26% | -5.48% | 44.4 | 23.8 | -4.68 | -92.44 |

|---|

After a fiery run over the past quarter, Monero (XMR) is downshifting this month, logging a nearly 5.5% slump and cooling off from its recent high just above $420. That pullback comes on the heels of a whopping 52% three-month surge, putting Monero on traders’ radars as a volatility magnet. The fact that it’s still up nearly 50% over six months, despite this latest correction, underscores just how wild the ride has been. As of now, XMR is circling the $317 level, bobbing uneasily after a sharp descent from the monthly peak. The technical outlook suggests a tug-of-war is brewing: after weeks where bulls were firmly in control, the market is once again grappling with directional uncertainty. If you’re sitting on gains, I hope you took some profits up there—these swings don’t come twice.

Diving into the charts, trend indicators show Monero losing bullish momentum. The average directional index remains high, a sign of strong prior trend, but the positive directional line has sharply narrowed and the momentum oscillators are tilting negative. The weekly MACD is rolling over, and that histogram has swung deeply into the red, hinting that sellers are regaining control. On the daily, stochastic indicators and RSI are retreating from overbought territory, and a cluster of moving averages near $320–$330 have flipped from support to resistance. If Monero reclaims $330 with conviction, I’ll be watching the $360–$410 range as the next upside targets. But if this bearish pressure intensifies, watch for a steep correction down toward solid support at $287, with a potential overshoot to the psychologically charged $250 round number. For now, risk is skewed lower—don’t ignore those warning signs, but keep your powder dry for a possible bounce if panic selling erupts.

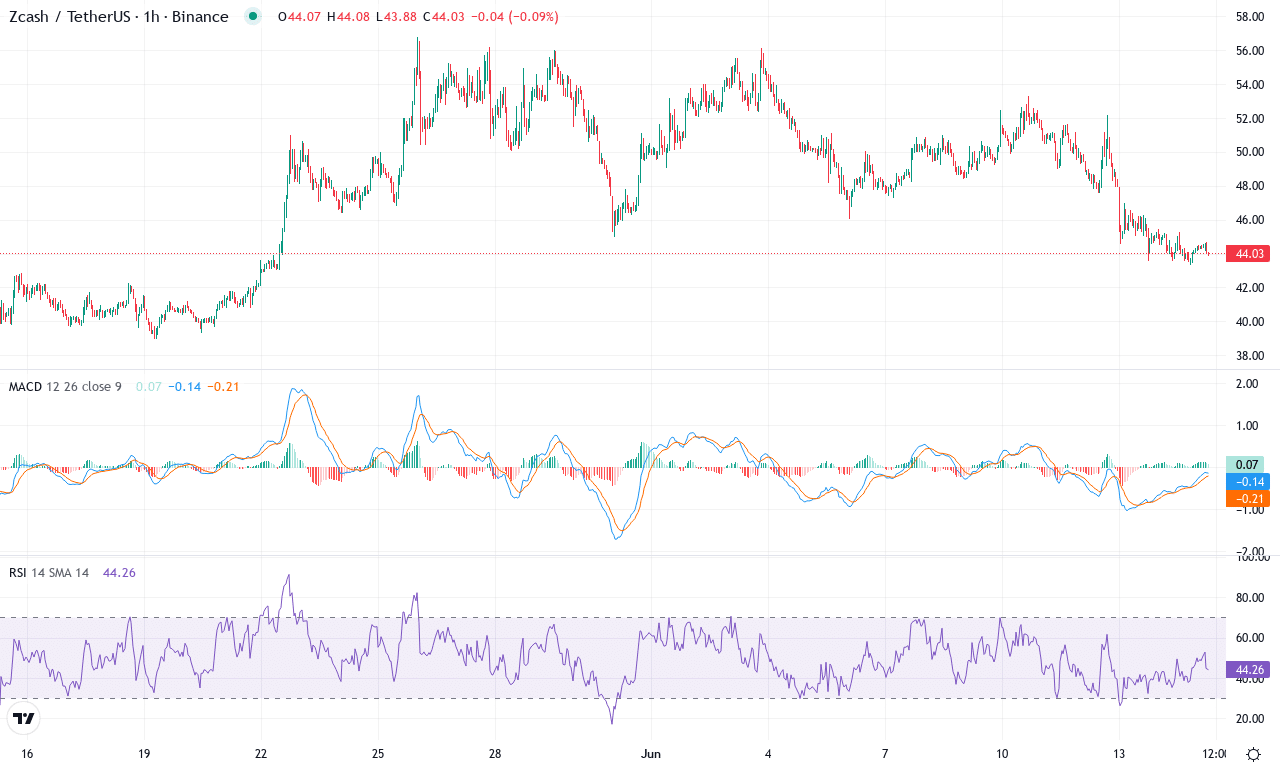

Zcash (ZEC) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | ZCASH(ZEC) | $44.02 | -12.38% | 5.34% | 42.0 | 22.5 | 0.07 | -168.62 |

|---|

After a month of impressive recovery, Zcash finds itself at a crossroads. The coin posted a solid 5% gain in June, following a steep multi-month rally of more than 34% over three months, yet its performance has faltered this past week with a double-digit pullback. Friday’s close at $44.02 leaves ZEC hovering just above monthly support and well below its recent peak at $56.79—raising the stakes for bulls who’ve kept the uptrend alive through choppy markets. The technical outlook suggests that Zcash is still digesting a profit-taking surge, as momentum cools and traders weigh the prospect of a sharp bounce against risks of an extended fall. The year-over-year picture remains vivid—ZEC has nearly doubled—but sideways range action has crept back in, with growing volatility threatening to tip the balance either way. If you’re feeling tense here, trust me—you’re not alone.

Digging into the technical signals, trend indicators are flashing caution. Zcash’s average directional index is at a heightened level, implying the prior rally was aggressive, but the current slide in positive directional indicators hints at fading bullish conviction. The weekly MACD’s flattening slope and loss of upward momentum reinforce this: while the longer-term trend remains constructive, short-term oscillators are showing bearish divergence, with the RSI cooling after flirting with overbought territory. ZEC is now sandwiched between key moving averages, with price action failing to reclaim the 10-day exponential moving average and sitting precariously close to the 50-day. Nearby support holds at $42; if sellers force a close below this zone, watch for a potential steep correction toward $38. On the flip side, if buyers mount a comeback and clear resistance at $48, the next target stands tall near the psychologically critical $60 region. All signs suggest a high-stakes decision point—you don’t want to miss this move.

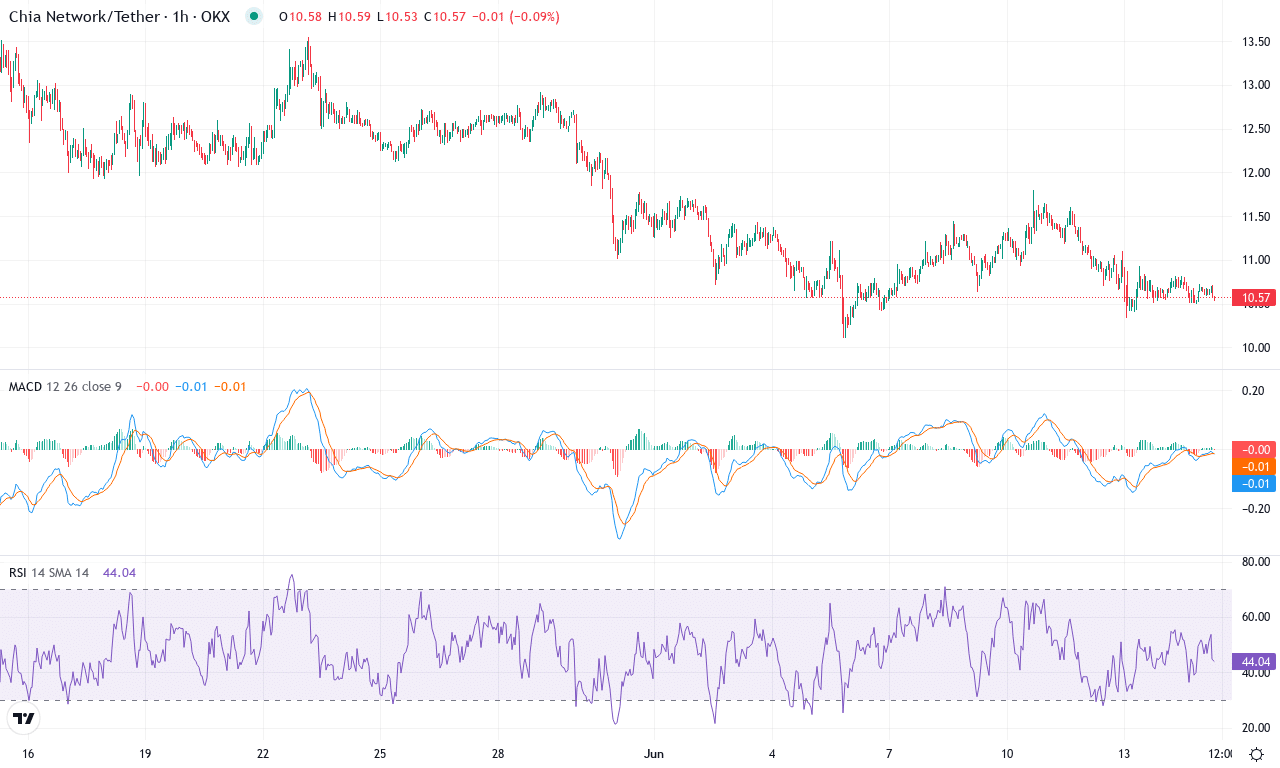

Chia (XCH) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | CHIA(XCH) | $10.59 | -3.38% | -17.33% | 39.4 | 21.5 | -0.37 | -89.82 |

|---|

After months of relentless selling pressure, Chia (XCH) finds itself deep in oversold territory, still reeling from a brutal six-month decline of over 60%. The past month’s slide of 17% speaks volumes about shaken confidence, while the weekly chart shows little respite—XCH is stuck near $10.59, hovering marginally above its monthly low. The market has yet to see a decisive reversal, and honestly, it’s tough to ignore the anxiety in the air. For now, investors are holding out hope that XCH can stabilize before a further downdraft materializes—especially with the next support band looming around the psychologically significant $10.00 mark. Given the steep drawdown and muted recovery attempts, this is a market where caution trumps bravado.

The technical outlook suggests bears are still firmly in control. Trend indicators remain skewed to the downside, evidenced by a stubbornly weak MACD and a strong negative slant in the oscillators. Momentum continues to languish in negative territory, and despite a slight uptick in recent days, RSI is nowhere near an oversold bounce—buyers are simply exhausted. With price action parked below every major moving average, there’s little comfort for the bulls. The next meaningful resistance sits near $12.50, but unless buyers can muster a surprise rally, XCH risks an extended fall toward deeper support at $9.50 or even lower if breakdown momentum builds. If—by some miracle—bulls reclaim $12.50, it could spark a short-covering bounce, but until then, every rally is a potential selling opportunity. Trade carefully: in these conditions, preservation of capital is paramount.

Will Supports Hold Firm?

Monero hovers above its support line, eyeing potential recovery if buying pressure amplifies. Zcash’s recent volatility places it in a limbo, with movements hinging on its ability to bolster near-term support. As Chia languishes in oversold zones, a bounce is plausible if current buyers decisively step in. The upcoming sessions are crucial, with traders closely observing these supports for any crucial shifts.