XRP Bears Test Nerves as LEO Bulls Quietly Advance—Will Range Breakouts Flip Momentum?

As XRP navigates a turbulent market spell with bears challenging support levels, UNUS SED LEO seems to be quietly gathering strength in the peripheries. With XRP experiencing a nearly 8% decline last week, it now teeters near a crucial psychological threshold that could dictate its next move. Meanwhile, LEO’s subtle, yet consistent climb hints at possible bullish momentum building under the radar. Will XRP manage to stage a recovery, or will LEO’s discreet ascent signal a shift in market dynamics? Let’s break down the technical setup across the board.

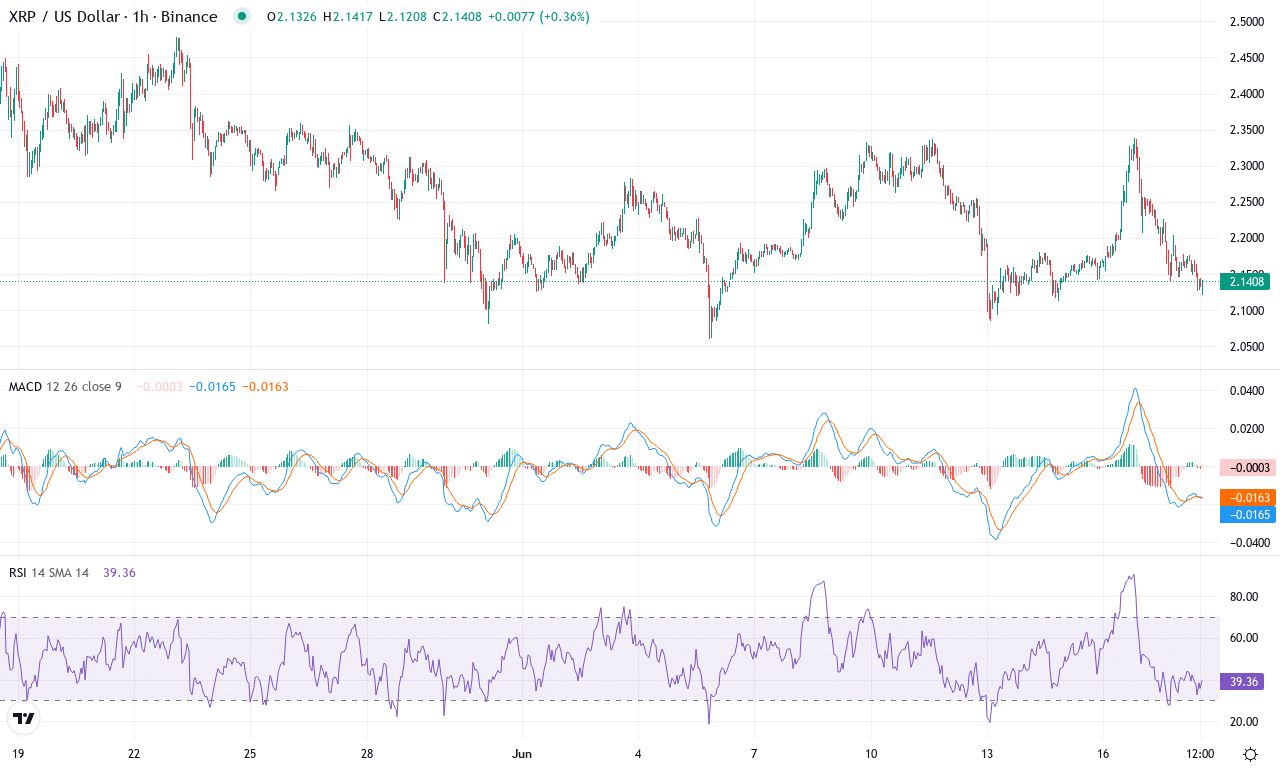

XRP (XRP) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | XRP(XRP) | $2.13 | -7.69% | -12.43% | 42.5 | 14.9 | -0.03 | -77.92 |

|---|

After a bruising week that saw XRP slide nearly 8%, the coin now stands at a crossroads, testing the patience of traders and investors alike. Continued monthly losses and a dismal three-month trajectory—down over 16%—create an unmistakable tone of caution in the air. XRP has recently been locked in a grinding pullback from its monthly high above $2.47 to hover barely above $2.12, lurching dangerously close to a widely-watched support zone. The steep correction has been aggressive, and with year-to-date gains now muted, there’s no question sentiment has tilted bearish for the time being. Still, XRP is trading near some major psychological levels and, if bulls marshal enough conviction, a reversal isn’t entirely off the table.

The technical outlook suggests bearish momentum is still in the driver’s seat: trend indicators remain elevated but are shifting direction, signaling that sellers are regaining control. The MACD is flat to slightly negative, with the signal line still poised above, hinting at continued selling pressure. Oscillators, including the RSI just above 50 and the Ultimate Oscillator cooling off, reinforce the notion that XRP is neither oversold nor ready for a decisive bounce—traders should watch for signs of exhaustion in this downtrend. Price is teetering right at the cluster of short- and medium-term moving averages, which now act as resistance overhead around $2.20 to $2.24. Should bears press prices below the $2.10 support, an extended fall toward the $1.95–$1.72 zone can’t be ruled out. However, if buyers manage to reclaim the $2.30–$2.35 range, upside momentum could accelerate, with monthly pivot resistance emerging near $2.53. Personally, I’m on my toes here: volatility is rising and XRP’s next move will likely be swift and decisive—stay alert, trade tight, and don’t get complacent.

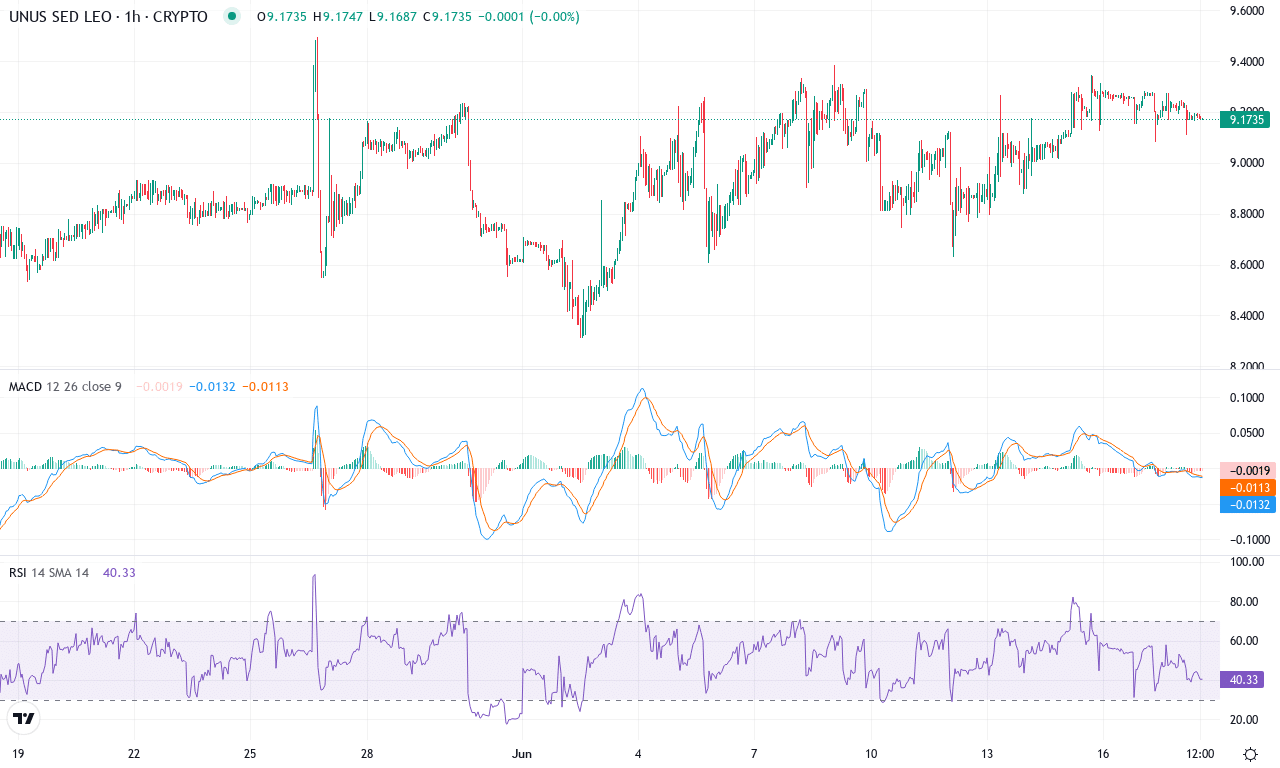

UNUS SED LEO (LEO) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 | UNUS SED LEO(LEO) | $9.17 | 3.33% | 5.66% | 54.4 | 8.6 | 0.09 | 80.78 |

|---|

After weeks of lethargic movement, UNUS SED LEO is beginning to shake off its torpor, posting a 3% weekly gain and notching a steady 5.6% climb for the month. While LEO has trailed among the majors on a three-month horizon, the latest price action hints that bears may be losing their grip. The coin has pushed to $9.17, putting it within striking range of last month’s highs. This mild resurgence comes amidst broader market uncertainty—yet LEO’s ability to dodge deeper corrections and maintain stability above key support levels is starting to catch the eye of more risk-averse traders. At this pace, the uptrend is subtle but undeniably persistent, which makes me wonder if patient bulls are quietly accumulating beneath the surface.

Technically, the trend picture for LEO is nuanced but leans constructive. Trend indicators show a moderate uptrend—directional gauges have positive bias, and while the average directional index isn’t extreme, there’s enough lift to keep momentum on the bulls’ side for now. The weekly MACD remains in positive territory, with a gentle uptick suggesting buying power is outpacing sellers, though the pace isn’t exactly setting hearts racing. Oscillators paint a mixed story: the RSI holds near midline, suggesting neither overbought euphoria nor capitulation pressures, and a modest positive swing in momentum indicators aligns with the slow-and-steady climb in price. LEO is trading snugly above its 10-, 20-, and 50-day exponential moving averages—bullish structure, but not yet explosive. Immediate resistance looms near $9.50; a breakout here could lift targets toward $10 and psychological highs, while failure to hold above $9 risks a retreat back to pivotal support at $8.75. If accumulation continues as quietly as I suspect, there’s a growing case for an upside surprise—but as always, stay nimble: momentum is patient, but reversals can be ruthless.

Testing the Bounds: Next Moves for XRP and LEO

XRP hovers precariously at a critical support, where any further slip could amplify bearish pressure. Conversely, LEO’s gradual ascent suggests a stealthy accumulation phase, possibly poised to breach resistance. The tug-of-war continues; a decisive range breakout will likely chart the course for the weeks ahead, with XRP’s resilience and LEO’s quiet uptick both under scrutiny.