Zcash And Compound Bulls Drive Relentless Rallies As Overhead Resistance Zones Tease A Critical Breakout Test

Zcash and Compound are riding the wave of impressive weekly rallies, but both face a critical test at looming resistance levels. After strong monthly gains, both assets now hover near key psychological zones that could either propel them higher or prompt a short-term reversal. Can Zcash and Compound push through this barrier, or will overhead pressure stall their momentum? Let’s break down the technical setup across the board.

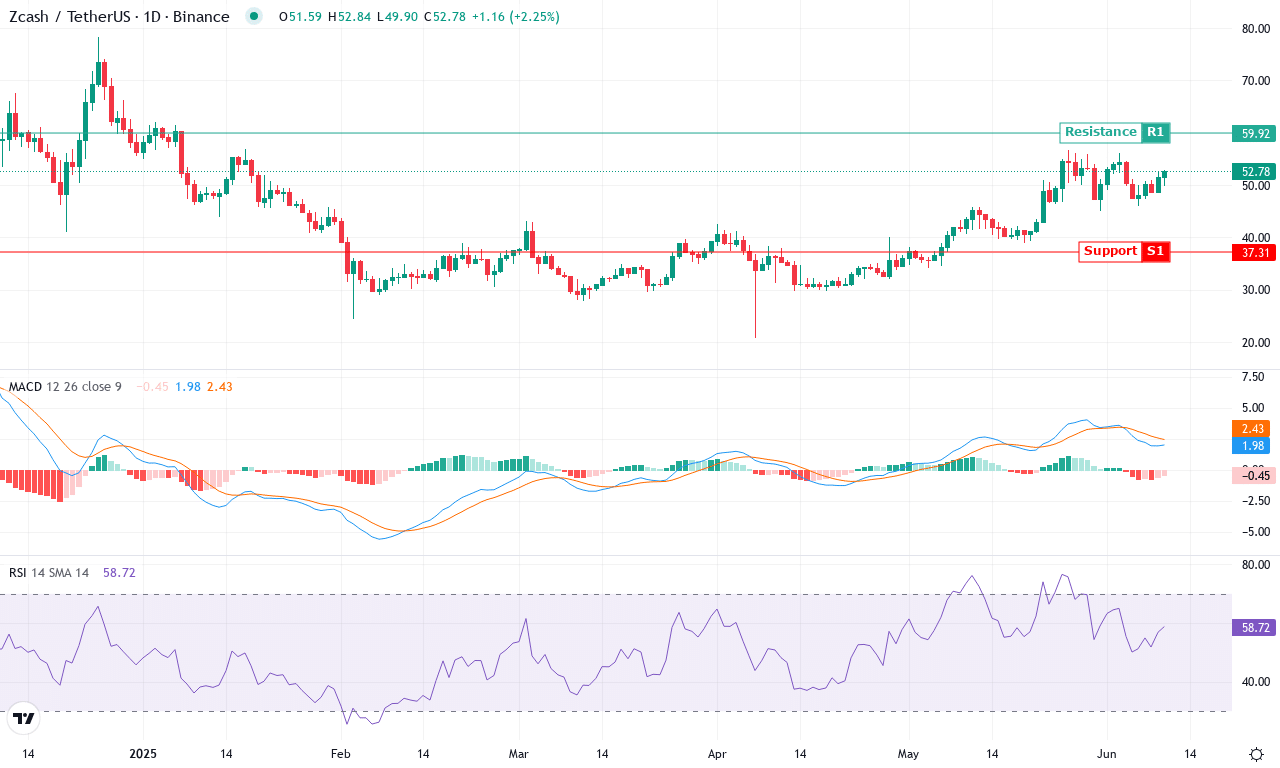

Zcash (ZEC) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| ZCASH (ZEC) | $51.57 | -4.61% | 18.25% | 56.8 | 26.9 | 1.89 | 17.03 |

After a rollercoaster month marked by sharp swings between $56.79 and $38.99, Zcash is regaining impressive ground. The coin posted an eye-popping 18% monthly gain and a jaw-dropping 70% surge in the last quarter, despite taking a mild hit this week. It’s clear that Zcash is shaking off its six-month downtrend, signaling a possible paradigm shift for those tracking longer timeframes. The technical outlook suggests a constructive bias: price is consolidating above key moving averages and holding steady near $51, right at the heart of a high-traffic support zone. If you’re waiting for a volatility surge—this setup is starting to feel electric. If ZEC can stay afloat above $47, bulls may well push toward psychological resistance near $60, with any sustained breach above $56.79 unleashing a fresh round of breakout momentum.

Diving deeper, trend indicators are humming with bullish intent: the ADX is elevated, confirming persistent trend strength, while directional movement shows buyers in control. The weekly MACD shows accelerating upside momentum, with the MACD line staying firmly above its signal. Oscillators, including RSI and the Ultimate Oscillator, are trending higher but haven’t crossed into true overbought territory—suggesting there’s more room to run before traders need to worry about profit-taking surges or bearish reversals. Zcash is trading comfortably atop its suite of EMAs, with the 10, 20, and 30-day averages providing a launchpad just below the current close. Key resistance looms near $60, a crucial litmus test for trend extension. If sellers manage to drag price below $47, look for a deeper pullback toward $43—though I’ll admit, with buyers flexing this much muscle, the bears’ window is rapidly narrowing. All signs point to another dramatic move ahead; stay nimble, because Zcash is primed for action.

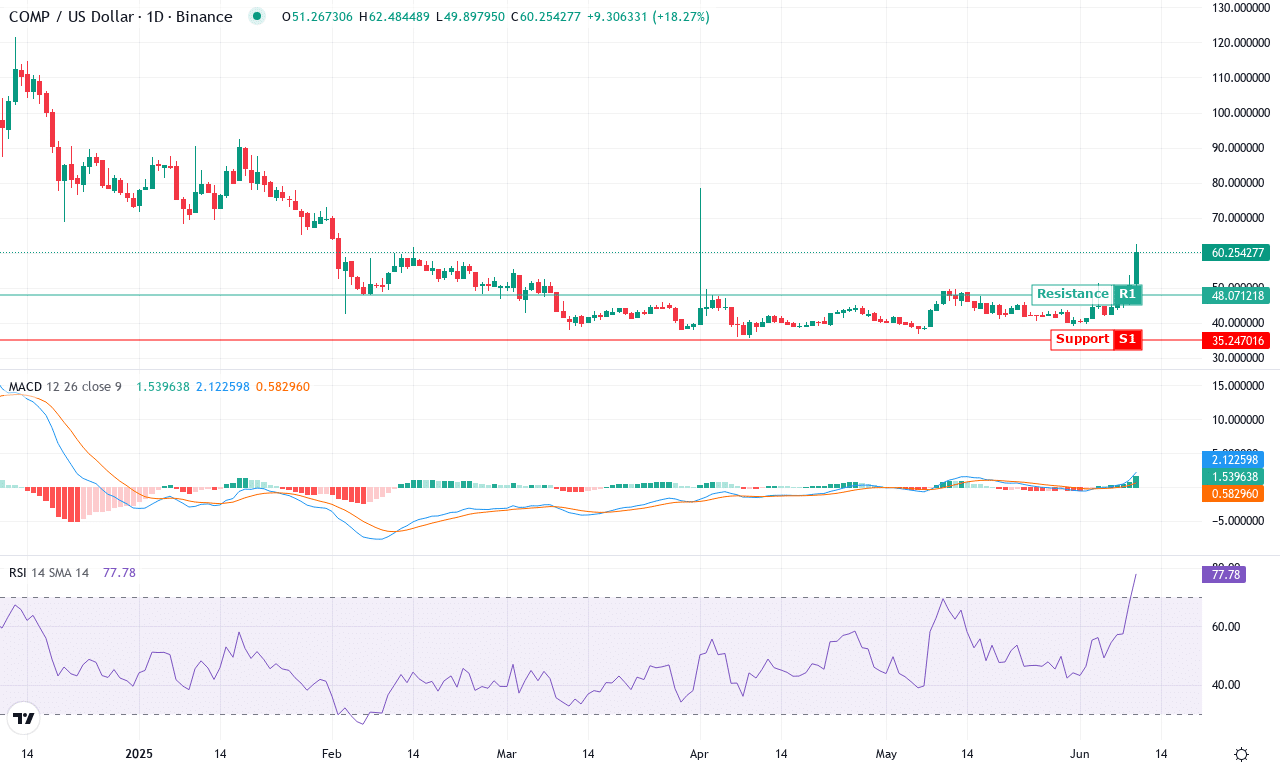

Compound (COMP) Price Analysis

| Crypto | Close | 1W% | 1M% | RSI | ADX | MACD | CCI 20 |

|---|---|---|---|---|---|---|---|

| COMPOUND (COMP) | $60.07 | 45.26% | 22.13% | 77.6 | 27.5 | 2.11 | 330.83 |

After a volatile period that dragged Compound down near the $39 zone, bulls staged a fierce comeback, rallying the token over 22% this month and a staggering 45% in just the past week. That’s the kind of price performance that grabs trader attention—and frankly, I’m not surprised given the recent revival in DeFi sentiment. Momentum is picking up fast: COMP is now testing its monthly high near $62, just below a significant psychological barrier. The 3-month return is an eye-popping 48%, yet keep in mind the longer-term trend: the token is still recovering from a brutal 6-month slide. As things heat up, the technical outlook suggests breakout momentum, but let’s not forget profit-taking could hit hard if excitement cools.

Digging into the indicators, bulls clearly have the upper hand for now. Trend gauges like the ADX highlight solid upward force, with positive signals outweighing negatives—a classic signal of strengthening direction. The weekly MACD shows a sharp acceleration, and momentum oscillators are flashing green, all confirming the recent surge. However, RSI is running hot in overbought territory, hinting that a pullback or at least a cooling-off is not far off; I’d brace for volatility. Price action is comfortably above the short- and medium-term EMAs, underscoring strong buyer conviction. The next big test is resistance around $63; if bulls smash through that ceiling, COMP could charge past $68 before pausing. On the flip side, if sellers regain control, initial support should appear near $55, with stronger footing closer to $50. Anything below there risks an extended fall back toward last month’s lows. All told, this is a textbook high-volatility battleground—trade it with intent and keep those stops tight.

Will Resistance Break?

Zcash has climbed impressively, nearing a crucial resistance near $70, while Compound tests the $50 mark with similar vigor. Both are poised for potential breakout if buy pressure persists, yet any faltering near these thresholds might lead to swift corrections. Traders should watch for volume spikes and price action cues to gauge if these rallies have more to run.